Closed Loop Partners Invests Nearly $15M in Recycling Infrastructure Upgrades Across Several U.S. Municipalities

November 29, 2023

The investments financed new collection carts and recycling technologies, supporting municipalities in their goals to advance a local circular economy for materials

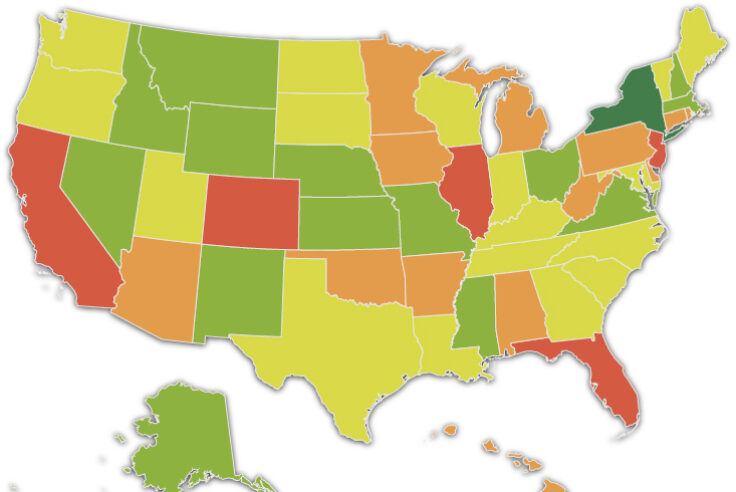

November 29, New York, NY — Over the last year, Closed Loop Partners provided approximately $15 million in catalytic investments to local municipalities across the country, financing projects to upgrade recycling infrastructure and services across the Midwest and Southeast regions of the U.S. Deployed by funds within the firm’s catalytic private credit arm, the Closed Loop Infrastructure Group, these investments help advance the necessary infrastructure to ensure valuable materials are collected, processed and returned to supply chains at their end-of-life.

As the circular economy grows in North America, the diverse group of stakeholders that are critical to its development, including local municipalities, often lack access to the funding needed to improve recycling services––an important step to achieve zero waste goals and advance a circular economy. The Closed Loop Infrastructure Group’s first fund was created nearly 10 years ago to support these public projects and private companies, and since then has grown with market demand, expanding to four different funds that have invested in over 45 different projects to date––from new recycling carts, to recycling facilities upgrades, to innovative recycling technologies and more––keeping over 3 million materials in circulation and avoiding over 6 million tonnes of greenhouse gas emissions. Across all their investments, the funds have collectively been able to catalyze capital inflow from other sources equivalent to three times what has been deployed, significantly amplifying the impact generated.

Alongside innovative companies advancing new recycling solutions, municipalities have played a key role in accelerating recycling infrastructure improvements across the United States. Often a case study in the success of public-private partnerships, local waste authorities have led the way toward building more robust local circular economies. The infrastructure upgrades financed by the Closed Loop Infrastructure Group have resulted in nearly $40 million in direct savings to municipalities to date, through more materials kept in circulation and out of landfills.

Building on its wide range of investments––encompassing both municipal projects and private companies advancing circular solutions from material collection, to processing and remanufacturing––Closed Loop Partners’ Infrastructure Group provided flexible financing to several municipalities over the past year:

The Central Virginia Waste Management Authority

The Central Virginia Waste Management Authority (CVWMA) is a leading public service authority with a strong track record in the recycling and waste management space, representing counties and localities in the Central Virginia (Richmond) area. Only five of the area’s eight counties participating in the Authority’s recycling program had 95-gallon curbside recycling carts, and CVWMA sought a loan from the Closed Loop Infrastructure Fund to help finance the purchase of over 90,000 95-gallon carts for the three remaining jurisdictions. In July 2023, the Closed Loop Infrastructure Fund provided a loan of over $4 million to fund the new 95-gallon carts provided by Rehrig Pacific, upgrading from 24-gallon bins and enabling a 5,000-7,000 incremental increase in tons of materials collected per year, with the potential to increase to ~8,000 tons per year. This was done in collaboration with The Recycling Partnership, who provided grant funding, technical support, as well as education and outreach for the upgraded recycling program.

The Waste Commission of Scott County

Scott County is the third largest county in Iowa, with the Waste Commission of Scott County serving over 25 counties in Iowa and Illinois and over 185,000 total households. The Commission’s relationship with Closed Loop Partners began nearly 10 years ago, when the Commission was first looking to finance upgrades to their recycling infrastructure services. The Closed Loop Infrastructure Fund provided funding to the Commission in 2015 and 2018 to finance new single-stream recycling carts and infrastructure improvements, respectively. The success of these investments resulted in a follow-on multi-million dollar loan in 2022 from the Closed Loop Infrastructure Fund, alongside the Closed Loop Beverage Fund and Closed Loop Circular Plastics Fund, to finance the purchase of new optical sorters to increase and improve the existing facility’s sorting capacity. The new loan will help grow the processing of valuable recyclable materials throughout the region, including polypropylene. When installed, the equipment upgrades will provide more than 3.5 million pounds of additional capacity and allow for the recovery of an additional 900,000 pounds of materials each year.

Kansas City

Building on long-standing commitments to support recycling efforts, the City of Kansas City, Missouri sought a loan to finance the purchase of 162,000 new curbside recycling carts to increase the City’s material collections services, impacting 380,000 residents. In 2023, the Closed Loop Infrastructure Fund and Closed Loop Beverage Fund provided a loan of over $5 million to the City, financing 162,000 65-gallon carts from Rehrig Pacific––an upgrade from the City’s 20-gallon bins. This upgrade helps enable a 2,000-3,000 incremental increase in tons of material collected per year, with the potential to increase to 10,000 incremental tons per year. This initiative to increase collection access in the City was made possible by a collaboration among private and public partners, including Closed Loop Partners, the American Beverage Association’s Every Bottle Back initiative, Missouri Beverage Association, The Recycling Partnership, Dow and Rehrig Pacific.

The need for investments into recycling infrastructure is critical, given a misalignment between the volume of materials produced––from packaging to consumer products––and the infrastructure available to recover them, process them after use and return them to manufacturing supply chains. Over the last decade, the Closed Loop Infrastructure Fund laid the groundwork to solve this challenge. Moving forward, the four funds within the Closed Loop Infrastructure Group continue to deploy capital into projects that help strengthen the infrastructure needed to recover materials at their end-of-life, and increase the volume of quality recycled material to meet a growing demand for these materials and commitments toward a waste-free world.

If you are interested in applying for funding from the Closed Loop Infrastructure Group, learn more about Closed Loop Partners’ catalytic capital strategy here.

About the Closed Loop Infrastructure Fund at Closed Loop Partners

Established in 2014 and funded by some of the world’s largest retailers, corporate foundations, technology and consumer goods companies, the Closed Loop Infrastructure Fund provides below-market rate loans to finance projects that build out circular economy infrastructure in the United States. Investors include 3M, Amazon, Coca-Cola, Colgate-Palmolive, Johnson & Johnson, BlueTriton, Keurig Dr Pepper, Procter & Gamble, PepsiCo, Danone North America, Danone Waters, Starbucks, Unilever and Walmart Foundation. Learn more about the Fund’s investment criteria and apply for funding here.

About the Closed Loop Circular Plastics Fund at Closed Loop Partners

The Closed Loop Circular Plastics Fund provides catalytic financing to build circular economy infrastructure and improve the recovery of polypropylene and polyethylene plastic in the U.S. & Canada, returning plastics to more sustainable manufacturing supply chains for use as feedstock for future products and packaging. Investors include Dow, LyondellBasell, NOVA Chemicals, Charter Next Generation, Chevron Phillips Chemical, SEE, SK geo centric Co. and SMBC. Learn more about the Fund’s investment criteria and apply for funding here.

About the Closed Loop Local Recycling Fund at Closed Loop Partners

The Closed Loop Local Recycling Fund is a circular economy initiative managed by Closed Loop Partners and funded by PepsiCo, aiming to finance and deploy small-scale, modular materials recovery facilities (MRFs) to increase recycling in communities with no or limited access to recycling, reduce waste and unlock a new supply of recycled plastic. Learn more about the Closed Loop Local Recycling Fund and apply for funding here.

About the Closed Loop Beverage Fund at Closed Loop Partners

In partnership with the American Beverage Association, the Closed Loop Beverage Fund seeks to improve the collection of the industry’s valuable plastic bottles so they can be made into new bottles through investments in recycling and circular economy infrastructure in the United States. Learn more about the Closed Loop Beverage Fund here.

Related posts

Press Release

Closed Loop Partners Provides Financing to Olyns, a...

The catalytic loan will help scale production of Olyns’...

Press Release

Does Compostable Packaging Actually Break Down? Composting...

Data in new report reveals that certified food-contact...

Blog Post

10 Years of Building the Circular Economy

10 years into Closed Loop Partners' work to build the...

Blog Post

The Untapped Value of Scrap Metal: How VALIS Insights...

Closed Loop Partners invested in VALIS Insights because...

Press Release

First-of-Its-Kind Study by the Composting Consortium...

Commonly held assumptions about contamination were...

Blog Post

Many Americans Don’t Understand What to Do with Compostable...

As countries and corporations get one year closer to...

Press Release

Closed Loop Partners and the U.S. Plastics Pact Release...

Key findings support the development of more effective...

Press Release

Circular Services Acquires Midwest Fiber Recycling,...

The acquisition of a leading Midwest recycling company...

Press Release

Closed Loop Partners Invests in Circular Manufacturing...

The loan from Closed Loop Partners’ Infrastructure...

Blog Post

What Brands Need to Know to Increase the Recovery of...

Permitting for composting facilities is complex, but...

Blog Post

Why We Invested in Found Energy: The Importance of...

Closed Loop Ventures Group invests in Found Energy,...

Press Release

Closed Loop Partners Acquires Majority Stake in Sage...

Amidst the rapid growth of e-waste, Closed Loop...