Closed Loop Partners Provides Financing to Olyns, a Technology Startup Advancing Collection of Food-Grade Recycled Packaging

April 16, 2024

The catalytic loan will help scale production of Olyns’ reverse vending machines, increasing consumer access to recycling and advancing circular supply chains for consumer packaging.

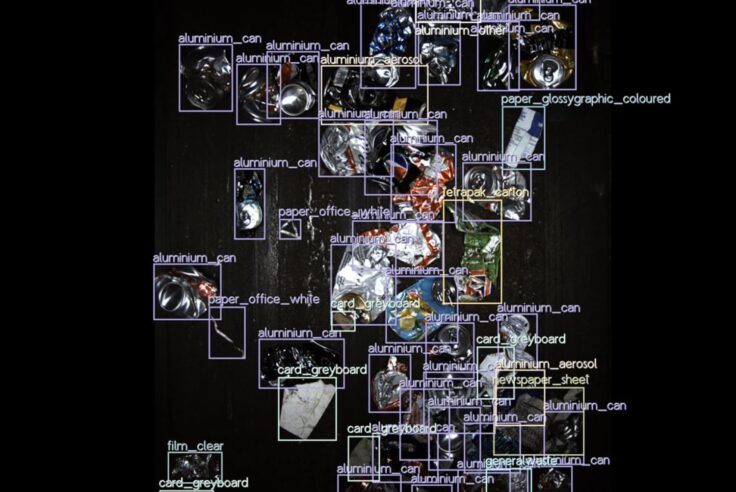

April 17, 2024, New York, NY –– Circular economy-focused investment firm Closed Loop Partners announces the closing of a catalytic loan to Olyns, a technology and media company that engineered a new artificial intelligence (AI)-driven solution to improve the collection, sortation and recycling of consumer packaging. The financing from Closed Loop Partners’ private credit arm, the Closed Loop Infrastructure Group, will support the manufacturing of Olyns’ Cubes––AI-powered reverse vending machines that collect and sort packaging materials, including food-grade plastic, glass and aluminum––and accelerate the expansion of Olyns’ consumer recycling infrastructure across the U.S.

Founded in 2019 in Silicon Valley, Olyns is increasing access to consumer recycling with an innovative technology solution that makes material collection efficient and scalable through a self-sustaining business model. Olyns’ AI-powered Cubes are a new take on reverse vending machines, where people deposit eligible beverage containers and receive cash deposits back electronically. Not only do Olyns’ Cubes provide rewards to incentivize participation and include a screen that can display media, but their machines also leverage AI, enabling them to rapidly learn to recognize new deposited products sold by brands at retailers across the country, as well as track deposit rates by product and brand. This is especially relevant amidst growing policy around materials recovery, such as Extended Producer Responsibility (EPR). Olyns currently partners with top retailers and consumer goods brands to locate their Cubes in high traffic locations such as major supermarkets, big box stores, pharmacies and gas stations, ensuring recycling is convenient and advertisements are effective. By operating as both a consumer recycling network and digital out-of-home media network, Olyns is changing the economics of recycling.

Source: Olyns

Olyns not only has the opportunity to collect millions of containers per year, but also to improve material sortation to maintain the quality of the recycled materials. By using AI to identify and sort containers at the point of deposit into separate bins, Olyns minimizes the co-mingling and contamination common to traditional recycling. This results in industry-leading material recovery rates and bale quality, ensuring that more containers deposited can be made into new containers. The vast majority of the rPET collected in Olyns’ Cubes is food-grade and can be used as material for recycled bottles.

“The material quality of aluminum, PET and glass beverage containers collected by the Olyns reverse vending machines is some of the highest quality material Ming’s facilities receive from our customers,” said Jeff Donlevy, General Manager of Ming’s Recycling Corp, a current processor of Olyns CRV material. “Mixed plastic material collected through co-mingled programs often can’t achieve the same quality standards, and significant amounts end up in landfill. Olyns’ technology minimizes co-mingling, and consistently achieves the food-grade quality material that plastic reclaimers want.”

As the Olyns network scales, it helps unlock a new supply of recyclable post-consumer plastic and aluminum, helping corporations meet their sustainable packaging goals and reducing their dependence on virgin plastic from non-renewable sources. As demand for food-grade rPET is anticipated to outpace supply by about three times by 2030, scaling solutions that can bolster supply of high-quality recycled content is critical. By expanding recycling access to more locations, Olyns’ Cube network collects and processes a growing portion of the estimated 4.6 billion pounds of unrecycled PET that would otherwise end up in landfill every year, closing the loop on food-grade PET and reducing carbon emissions that would result from the production of virgin plastic.

“Greater consumer access to recycling, more efficient material sortation and economically sound recycling systems are critical to recovering high-quality materials,” says Philip Stanger, Co-Founder and CEO of Olyns. “Since we installed our first Cube in California in 2020, user growth has been phenomenal, proving that when people have easy access to recycling, impact is magnified. While we started with collecting PET plastic, aluminum and glass beverage containers, we are looking to build our AI capacity to potentially expand collection for hard-to-recycle materials, such as films and flexibles. Closed Loop Partners’ financing will help us build the circular economy infrastructure that helps make recycling possible for more materials, and accessible to more communities.”

The Closed Loop Infrastructure Group has been providing flexible loans to projects that build out circular economy infrastructure and innovation in the United States for nearly 10 years. This includes robust recycling infrastructure equipment, as well as rapidly growing companies poised to scale circular solutions. The loan to Olyns underscores the potential of new innovative solutions and creates a significant opportunity to increase material collection in underserved areas, including states without deposit return schemes such as bottle bills. By producing a source-separated, clean stream of materials, Olyns also helps bolster the market for high-quality recyclables, looping more material back into the same or similar products.

“We see immense opportunity to finance rapidly growing technology innovations, alongside large-scale recycling infrastructure, to improve materials sortation and accelerate the circular economy in the U.S. Expanding the types of financing available in the market can help meet the distinct needs of innovators developing new circular solutions. Catalytic capital is a powerful tool, providing the foundation needed to accelerate further growth,” says Jennifer Louie, Managing Director and Head of the Closed Loop Infrastructure Group at Closed Loop Partners. “Closed Loop Partners’ Infrastructure Group is proud to finance scalable and replicable solutions and provide access to the Closed Loop Partners ecosystem to support their growth. We are thrilled to partner with Olyns, as they disrupt material collection and advance more circular supply chains for valuable packaging materials.”

Moving forward, Olyns looks to further scale its solution, partnering with key brands to expand to new locations and increase collection and recovery of more materials, reducing reliance on natural resource extraction and driving forward a circular economy.

If you are interested in learning more about Olyns, visit here. If you are interested in applying for funding from the Closed Loop Infrastructure Group, learn more about Closed Loop Partners’ catalytic capital strategy here.

About Olyns

Olyns innovates at the nexus of retail media and recycling, connecting people to recycling and brands to customers. Founded in 2019 in Silicon Valley, Olyns’ pioneering ecosystem includes the Cube, an AI-powered reverse vending machine that provides self-serve beverage container recycling to consumers and includes a 55-inch screen to display advertising. Olyns partners with top retailers and consumer goods brands to locate Cubes in high traffic locations such as major supermarkets, big box stores, pharmacies, and gas stations, ensuring recycling is convenient and advertisements are effective. By operating as both a consumer recycling network and digital out-of-home media network, Olyns is changing the economics of recycling. With its use of artificial intelligence (AI) to identify and sort containers at point of deposit, Olyns minimizes the co-mingling and contamination common to traditional recycling and unlocks a valuable new supply of food-grade recycled plastic.

Olyns is on a mission to inspire people to recycle, stop the depletion of the earth’s resources, and accelerate the shift to a circular packaging economy. Learn more at www.olyns.com

About Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management, managing venture capital, buyout private equity and catalytic private credit investment strategies; its innovation center, the Center for the Circular Economy; and its operating group, Closed Loop Builders.

The firm’s catalytic private credit arm, the Closed Loop Infrastructure Group, provides a mix of flexible financing solutions to support a range of circular economy projects, companies, infrastructure and enabling technologies. The Infrastructure Group deploys catalytic capital, which seeks to accelerate and de-risk the development of high-impact projects and companies. Areas of strategic investment include: providing below-market rate loans to finance circular infrastructure, providing catalytic financing to increase recovery of hard-to-recycle plastics and PET bottles, and financing and deploying small-scale, modular materials recovery facilities (MRFs) to increase recycling in communities with no or limited access to recycling.

Closed Loop Partners is based in New York City and is a registered B Corp. Learn more at closedlooppartners.com.

Disclaimer

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Partners or any company in which Closed Loop Partners or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Information provided reflects Closed Loop Partners’ views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision.

Related posts

Press Release

Closed Loop Partners Adds New Private Equity Managing...

Daniel Phan joins the circular economy-focused firm...

Blog Post

The Hidden Value of Scrap Metal: Why Local Recovery...

VALIS discusses circularity of metal processing, and...

Press Release

Closed Loop Partners’ Composting Consortium Launches...

The grant program for composters and communities comes...

Blog Post

How AI Can Reduce Food Waste at Restaurants

Closed Loop Ventures Group led the seed investment...

Press Release

New Data Reveals High Quantities of Food-Grade Polypropylene...

Closed Loop Partners’ Center for the Circular Economy...

Press Release

Closed Loop Partners and U.S. Plastics Pact Identify...

Packaging types primed for reuse lay the groundwork...

Blog Post

Why We Invested in Mycocycle: Nature-Inspired Circular...

Closed Loop Partners’ Ventures Group saw a key opportunity...

Press Release

Groundbreaking Results From Citywide Petaluma Reuse...

The Petaluma Reusable Cup Project from the NextGen...

Press Release

Closed Loop Partners’ Portfolio Company, Sage Sustainable...

The bolt-on acquisition scales Sage’s end-to-end...

Press Release

Closed Loop Partners Unveils Groundbreaking Findings...

Closed Loop Partners’ Center for the Circular Economy...

Press Release

Capricorn Investment Group Backs Closed Loop Partners...

The partnership signals tailwinds behind the circular...

Blog Post

8 Tips to Navigate Life Cycle Assessments for Circular...

Closed Loop Partners’ Center for the Circular Economy...