Reuse

Making Reuse an Everyday Reality: 3 Things We Must Consider Before Scale

September 06, 2023

Reuse is now at a critical stage of development. A plethora of innovation has expanded the realm of possibilities, but what will it take to get to the point of industry-scale disruption?

Earlier this year, seven winners of the highly anticipated 2023 Reusies were announced on stage at GreenBiz’s Circularity23 Conference in Seattle. The winners encompassed corporate and community initiatives, and B2B and B2C reuse innovations across food & beverage, consumer packaged goods and fashion & apparel. Together, they provided a window into the best and brightest developments in the reuse space. Indeed, hundreds of start-ups and large corporates are working on making reuse an everyday reality for consumers, with applications as far-ranging as closed system solutions for corporate campuses and events, to software companies supporting reuse-as-a-service, and refill applications in retail or in commercial, industrial and event spaces. The potential for reuse to reduce waste has catalyzed much innovation and brought conversations to a fever pitch.

Reuse is now at a critical stage of development. A plethora of innovation has expanded the realm of possibilities, but what will it take to get to the point of industry-scale disruption? Making reuse a far-reaching and everyday reality––where reusable items are consistently and efficiently reused to make a significant difference and reduce environmental impact––requires continued testing, collaboration across the value chain, investment and supportive policy.

At Closed Loop Partners, reuse systems are an integral part of our vision of a transition away from the take-make-waste economy and toward a circular economy. When products that have historically been single-use are able to be used two, five, ten or one hundred times, and the proper recovery infrastructure is in place for their eventual end-of-life, that can make a meaningful difference on reducing valuable materials sent to landfill––and on the embodied carbon, water and materials required to produce the item in the first place.

But to get to this next horizon, a number of factors must be considered to ensure that reuse does not result in unintended consequences and instead serves a truly circular economy:

1. Closed or semi-closed reuse systems are a key starting point, especially at early stages of adoption. On-premise reuse unlocks higher return rates which can make reuse systems profitable––or at least breakeven. In open systems, as consumers use and dispose products away from point of adoption, more complex collection networks and communication strategies are needed to drive returns. For this reason, closed systems can operate with lower upfront capital expenditures and lower recurring operating expenditures until the time at which consumer behavior has shifted to be more amenable to open systems (see #3!).

2. Reuse is a hardware-first business, and requires capital and collaborations to build localized infrastructure––including collection, sorting and washing. There continues to be a shortage of washing infrastructure needed for reuse solutions, and traditional waste management players are not currently set up for the type of collection and sorting needed for reusable products that are intended to stay in circulation for more than one use. Many software-only solutions still require partnerships with washers and logistics providers. There is an opportunity for founders, corporates and municipal governments to build out these partnerships to enable reuse and share in the funding that will be required to build this new infrastructure.

3. Broad consumer adoption starts with meeting customers where they are today. There are still many customers that have yet to be onboarded into the reuse culture. As we’ve seen in our work through the Beyond the Bag Consortium and the NextGen Consortium, we need to design solutions with current behaviors in mind and support customers as they build new habits. Advancing reuse won’t happen overnight; cross-industry and cross-company collaboration, a range of solutions, clear messaging and consistent regulatory frameworks are required to effectively support consumers in adopting reuse within their communities, as the industry addresses complex waste challenges. Importantly, in-market testing plays a key role in unlocking what works effectively in the market and meets customer needs. Today’s market is complex, with diverse customer demographics and shopping habits, different operations across retailers, a range of reuse packaging materials and more that need to be considered.

We see experimentation as a critical precedent to scale. Reuse is no simple feat, and testing market fit and operation alignment is an important step to expand reuse responsibly and mitigate unintended consequences that can happen without a measured examination of new systems. But isolated, small-scale experiments will not get us there. Closed Loop Partners runs multi-brand reuse tests through its Center for the Circular Economy to identify tactics that are proven and ready to scale, as well as models that require further tweaking and iteration to deliver the expected environmental and financial outcomes. While we work to scale proven solutions, we continue to de-risk systems that need refinement. Our in-field deployments intentionally mimic large-scale, cross-brand implementation, but in a controlled manner. The insights and data gleaned from these tests are key stepping stones to new rounds of implementation and scale. Most recently, the Beyond the Bag Consortium’s largest multi-brand reusable bag pilots tested a range of reuse solutions to understand what it will take to effectively drive reduction of single-use plastic bags. Next year, the NextGen Consortium will go back into market to test the viability of reusable cup systems across multiple brands. These tests unlock important insights on what it will take to build a culture of reuse and will serve as the foundation for identifying scalable initiatives.

With all these developments, we believe we’ll get there. There are tremendous tailwinds supporting the development of reuse and a multitude of communities, innovators and corporations committed to seeing the shift through. To do so, the next five years are critical to pivot from bespoke solutions to shared frameworks, from ad hoc consumer engagement to a consistent drumbeat, and from in market tests to truly scaled solutions. We are excited to be working to advance the transition from innovation to scaled solutions that can replace single-use. Join us!

This article represents perspectives from across Closed Loop Partners, including the Center for the Circular Economy and Closed Loop Capital Management. Special thanks to Kate Daly, Carol Lobel, Danielle Joseph, Aly Bryan and Anne-Marie Kaluz for sharing their thoughts for this piece.

How Closed Loop Partners’ Multi-Million Dollar Investment in LRS Is Expanding Recycling Infrastructure and Access in Chicago

August 16, 2023

This is Closed Loop Partners’ third loan to LRS, which will support the Exchange, its newly constructed materials recovery facility, accelerating materials circularity in the third largest city in the U.S.

When Closed Loop Partners provided its first loan to LRS almost 10 years ago, the leading recycling company was already making waves to advance materials circularity in the Chicagoland area. Operating in the third largest city in the U.S., home to 2.7 million people, LRS has faced significant opportunity to recover valuable materials and expand recycling access at scale, and has been at the forefront of this work, strengthening the recycling infrastructure needed to advance the circular economy. Over the last several years, LRS made critical advancements in its growth, supported by catalytic capital from circular economy investment firm, Closed Loop Partners. Today, LRS, the largest recycling company in the Chicagoland area, has reached another pivotal moment of growth: a newly constructed materials recovery facility (MRF) in the heart of Chicago, the Exchange. Supporting the newly constructed MRF, and the innovative technology housed within it, is a multi-million dollar loan from Closed Loop Partners’ Infrastructure Group.

The Closed Loop Partners team at LRS’s ribbon cutting ceremony; photo credit: Closed Loop Partners

Pictured left to right: Jennifer Louie (CLP), Kate Krebs (CLP), Ray Hugel (CLP)

The state-of-the art MRF is now operational and expected to divert 224 million pounds of recycled material per year. It will house cutting-edge system components, including new artificial intelligence (AI)-powered equipment and other technologies to advance efficient materials sortation and recovery in the Chicagoland area. The loan is closing at a critical time, as infrastructure upgrades and innovative technologies are needed to handle an increasingly mixed stream of collected materials, including plastics & packaging, textiles and food scraps. AI and automation play an important role in improving material sortation and reducing contamination across different material streams, enabling the recovery of clean, high-quality materials. The AI-powered sortation technology to be integrated at the Exchange will enable LRS to sort polypropylene (PP) plastic for the first time in the Chicagoland area, including cold to go cups and yogurt containers. The new automated technology is also expected to mitigate labor risks at the facility, as well as add new jobs to manage the new equipment––increasing job quality and safety.

LRS Exchange Facility – LRS employees celebrate the grand opening of The Exchange materials recovery facility, which created 50 new full-time jobs in the city; photo credit: Sean Kennedy/LRS

This is Closed Loop Partners’ third loan to LRS, building on a robust track record between the two entities. The investment firm’s first and second loans to the recycling company contributed to the growth of their operations at a critical moment, helping enable them to win the collection rights of recyclable materials in three additional Chicago Blue Cart recycling zones. This new loan, provided by three catalytic funds within Closed Loop Partners’ Infrastructure Group––the Closed Loop Infrastructure Fund, Closed Loop Circular Plastics Fund and Closed Loop Beverage Fund––helps expand LRS’s capacity, as the Exchange will process recyclable material collected from all six of Chicago’s Blue Cart zones, sorting material for approximately 430,000 households, encompassing over one million people. The Exchange’s expanded capacity will also enable LRS to collect material from other areas surrounding the city, reducing landfilling and providing recycling access for more communities.

“This is a key moment of our expansion, as we extend our reach and impact across the Chicagoland area,” says John Larsen, chief operating officer, LRS. “This loan to support our new facility helps us serve even more households in the area, and sort and process more valuable materials––including polypropylene, for the first time in the region. Closed Loop Partners has been a key part of LRS’s meaningful growth over the years and we are proud to work with their team again in this work to recycle even more valuable materials and reduce waste.”

Ribbon cutting ceremony for LRS’ new $50 million materials recovery facility (MRF) in Chicago, IL; photo credit: Sean Kennedy/LRS

Pictured left to right: Emily Olsen-Torch (LRS), David Fass (Macquarie), Department of Streets and Sanitation Commissioner Cole Stallard, Rich Golf (LRS), Chief Operating Officer John Larsen (LRS), Cook County Commissioner John Daley, Executive Vice President John Silwicki (LRS)

Over the last nearly 10 years, Closed Loop Partners’ Infrastructure Group––the investment firm’s catalytic capital group––has played a key role in identifying and advancing novel technologies and infrastructure development to help private companies and municipalities keep more materials in circulation and out of landfills. Funded by many of the largest consumer goods, technology and material science companies, the catalytic strategy aims to accelerate further investment into materials circularity and drive net positive environmental and social outcomes. To date, the Closed Loop Infrastructure Group has helped keep approximately three million tons of material in circulation across 30 private loans and 15 municipal loans.

The loan to LRS is a milestone for Closed Loop Partners’ catalytic capital funds participating in the financing:

Aligned with the Closed Loop Infrastructure Fund’s goal to improve efficiencies in circular economy infrastructure, the loan to LRS will significantly expand processing capacity in the Chicagoland area;

Further aligned with the Closed Loop Circular Plastics Fund’s goal to advance the recovery and recycling of plastics, the new equipment at the Exchange will capture and separate PP from the stream, with an expected rate of 650 tons of PP collected per year;

Finally, as the Closed Loop Beverage Fund, in partnership with the American Beverage Association, aims to improve the circularity of PET, a critical plastic to the beverage industry, the loan will help reduce LRS’s residue rate in the Chicagoland area, which will enable an increase in other salable commodities annually, including PET for bottle-to-bottle applications. This investment is part of the beverage industry’s Every Bottle Back initiatve, an integrated and comprehensive partnership between America’s leading beverage companies––The Coca-Cola Company, Keurig Dr Pepper and PepsiCo––to reduce the industry’s use of new plastic. The loan is expected to unlock at minimum an additional 150 tons of PET per year.

“One of our industry’s highest priorities is to create a circular economy for our bottles and cans. We are taking action at every step to make sure they are remade as intended,” said Kevin Keane, interim president and chief executive officer of American Beverage. “Chicago is a great and innovative American city. It is exciting to partner on a significant project that will serve to enhance its beauty, environment and quality of life. America’s leading beverage companies are carefully designing our bottles to be 100% recyclable and investing in modern recycling systems to reduce our plastic footprint and keep plastic out of nature. We are excited to continue that work here in Chicago and thank everyone who made this investment a reality.”

“As the circular economy grows across North America, companies that are vital to its development require access to financing to upgrade technology and expand capacity. Closed Loop Partners’ Infrastructure Group is proud to support leading private and public organizations advancing material circularity through upgraded infrastructure and innovative technologies,” says Jennifer Louie, Managing Director of the Closed Loop Infrastructure Group at Closed Loop Partners. “LRS has been a leader in developing the infrastructure needed to accelerate materials circularity in the Chicagoland region. We are thrilled to be working with their team to advance circularity in one of the largest cities in the U.S., keeping more materials in circulation and serving more communities.”

As LRS enters its next phase of growth, Closed Loop Partners will work closely with the LRS team to integrate new technologies into the facility and bolster potential end markets for materials recycled by the facility, helping establish more robust circular systems in the region.

Learn more about Closed Loop Partners’ catalytic capital strategy here.

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

The testimonials provided are from current clients and Limited Partners of Closed Loop Partners. No compensation was provided for the statements, and the statements do not present any material conflicts of interests.

Molecular Recycling

What Is Chemical Recycling, Why Does It Have So Many Different Names, and Why Does It Matter?

August 15, 2023

Closed Loop Partners spent 18 months investigating the environmental impacts and financial viability of several types of molecular recycling technologies (sometimes also called advanced recycling or chemical recycling) to understand how and if these diverse technologies can fit into a circular future for plastics. Here’s what we found.

- Molecular recycling is a diverse sector that can be categorized into three distinct technology categories: purification, depolymerization and conversion.

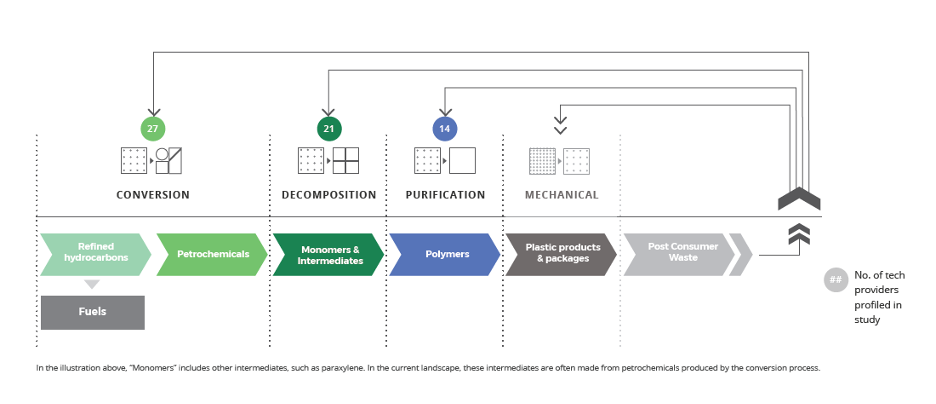

Figure 1: Molecular Recycling Technology Categories and Their Outputs

Molecular recycling is a broad umbrella term – also referred to as chemical recycling or advanced recycling – that encompasses dozens of technologies that use solvents, heat, enzymes, and even sound waves to purify or break down a wide range of plastic feedstocks to create polymers, monomers, oligomers or hydrocarbon products so that they can re-enter manufacturing supply chains, instead of going to landfill.

In other words, molecular recycling technologies can break down plastic waste into its constituent building blocks, which can then be used to create new plastic products. These technologies are only circular when their supply chains produce a final product. Converting plastics to fuel is not recycling or circular. Molecular recycling is a group of technologies that can complement mechanical recycling and help widen the aperture of plastic waste that we can recycle today.

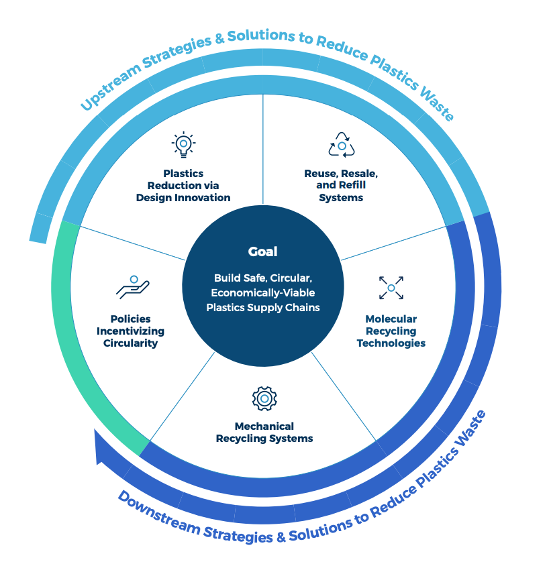

- Molecular recycling is only one part of a suite of solutions to address plastic waste; both upstream and downstream solutions are needed, including design and reuse, as well as mechanical and molecular recycling, and policy.

Figure 2. The suite of solutions needed to reduce plastic waste

Molecular recycling is part of a suite of solutions needed for a circular plastics economy. It is not a silver bullet but plays an important role in creating a waste-free future for our hardest-to-recycle plastics which include the 41 million metric tons of textiles and approximately 2,000 wind turbine blades expected to go to landfill in the U.S. every year.

- Expanding the scope of plastics that we recycle is important given the diversity of plastics in our economy. We will not achieve a waste-free future unless we scale solutions that address all plastics.

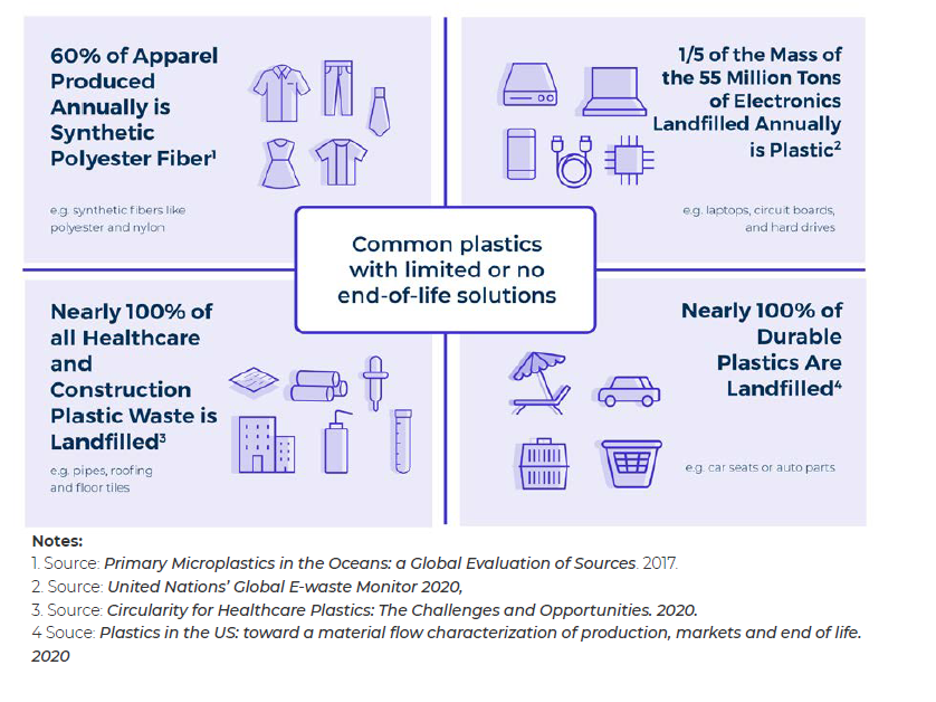

Figure 3. Common Plastics Without Commercial Recovery Solutions, Typically Sent to Landfill every year

The “plastics waste crisis” has been defined in the public and policy discourse as created by single-use plastics. Yet, two-thirds of plastics put into use in the U.S. today are used for purposes other than single-use packaging. These types of plastics are equally visible and challenging to recover and reuse.

- Molecular recycling can expand the scope of plastic waste we can recycle, helping to preserve the value of resources in our economy.

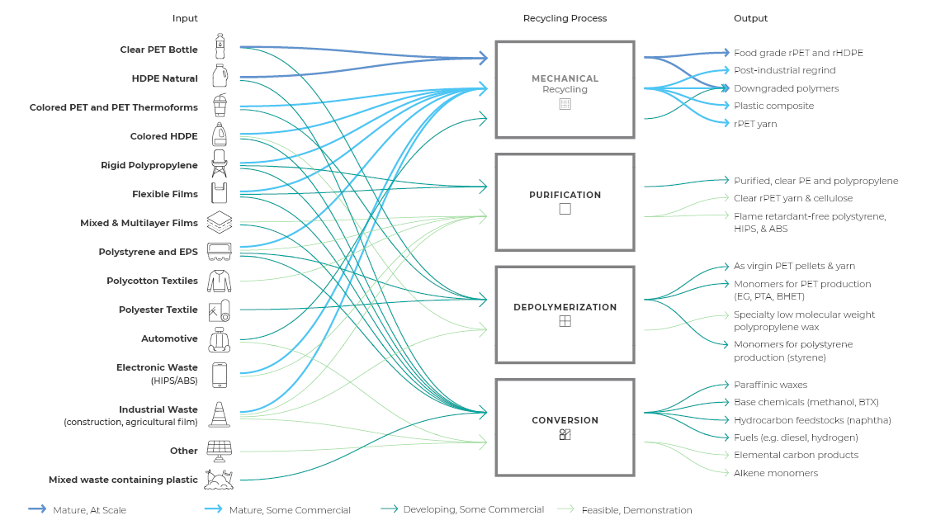

Figure 4: Inputs and outputs for mechanical, purification, depolymerization and conversion technologies from input to output.

Plastic is as ubiquitous as it is diverse. Our current mechanical recycling system is designed to address only a small fraction of plastics in the market – namely, plastic water bottles (PET), milk jugs (HDPE), and in some markets, yogurt cups (rigid polypropylene). Plastic packaging, like plastic film (LDPE) and clear boxy packaging that many salad mixes are sold in (PET thermoforms) are sometimes downcycled into plastic lumber. Textiles and durable plastics are recycled in lower quantities or not at all because there is less consistent demand for these recycled plastics. As a consequence, most plastic waste ends up in landfill.

Molecular recycling technologies can widen the aperture of plastic waste that we can recycle today beyond packaging. Purification technologies can process electronic waste and films. Depolymerization technologies, which largely focus on PET and polyesters, are a critical recycling solution for synthetic textiles including carpets and athletic clothing. Conversion technologies like gasification can even take mixed waste, breaking down feedstock to basic carbon and hydrogen atoms.

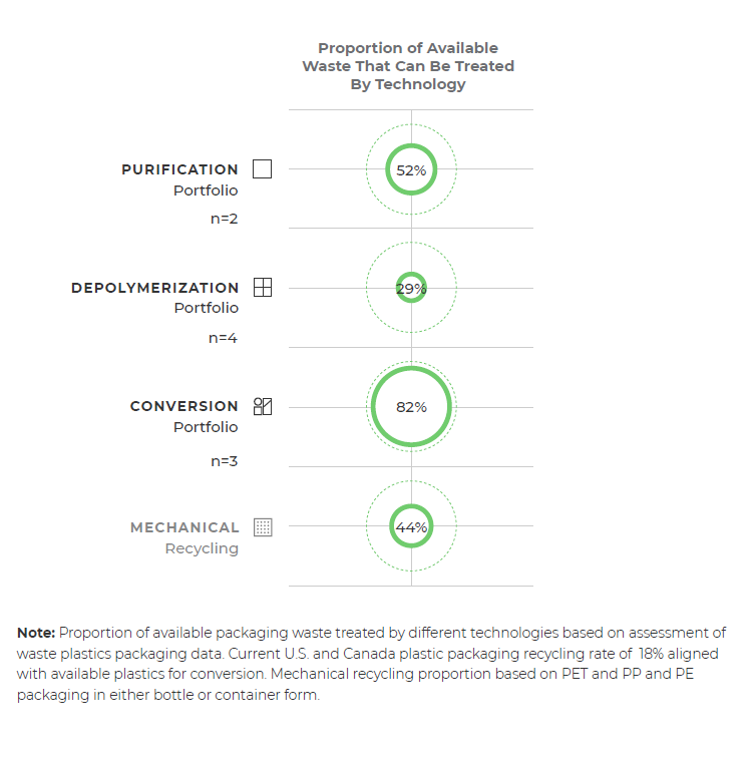

- Conversion technologies like pyrolysis and gasification can process the highest volume of plastic packaging and can accept mixed plastic packaging feedstock.

Closed Loop Partners evaluated nine different technology processes across the three technology categories. When evaluating the total packaging volumes across the United States and Canada, we found that the conversion technologies could accept 82% of all plastic packaging produced, which is more than mechanical, purification, or depolymerization technologies could address alone. These types of technologies also can process mixed plastic waste, while purification and depolymerization requires a sorted and single-resin feedstock. Because feedstock can be mixed, conversion technology companies are often paid to take feedstock rather than paying for feedstock.

Figure 5. Percent of US and Canadian Plastic Packaging that Closed Loop Partner’s Cohort of Molecular recycling Technologies could Address

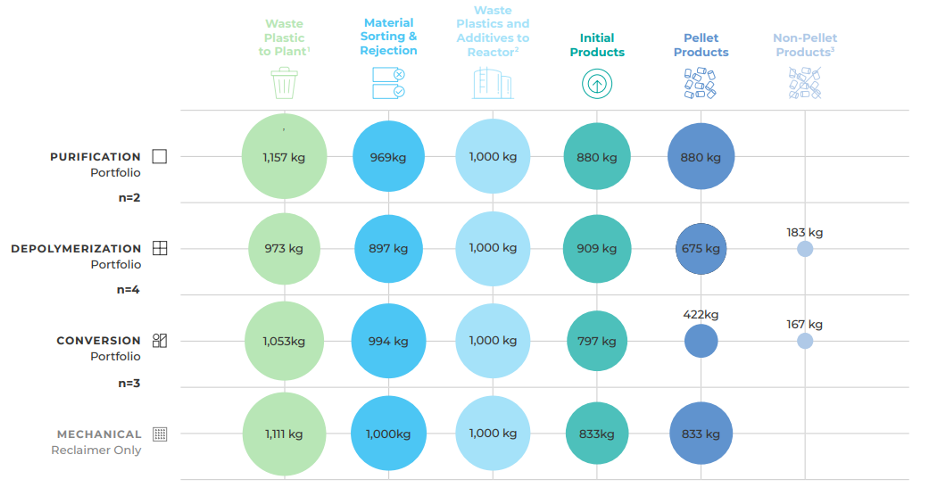

- When considering downstream solutions, a critical metric of success is the amount of recycled plastic (PCR) that each technology solution can produce. The less a polymer is broken down through molecular recycling process, the more recycled plastic will be produced.

Each molecular recycling technology category has a distinct supply chain. For example, purification technologies produce finished recycled plastic. Depolymerization technologies produce monomers which would be sent downstream to be easily repolymerized back into plastic. Conversion technologies have the longest route back to becoming plastic. A pyrolysis technology company will produce pyrolysis oil which would be sent and processed by a steam cracker to produce monomers, which are then sent downstream to make plastic again.

Closed Loop Partners calculated how much plastic resin would be produced by each of the three main molecular recycling technologies discussed in this series (e.g., purification, depolymerization and conversion) if we were to put 1,000 kilograms of plastic feedstock into the technology reactor. Purification yielded the highest amount at 88% of material processing efficiency. Conversion technologies yielded the lowest amount of recycled plastic with a 42% processing efficiency. The capacity to move away from virgin plastics requires the recycling sector to be as efficient as possible.

Figure 6: Average mass yield when 1,000kg of plastic waste is put into each technology process

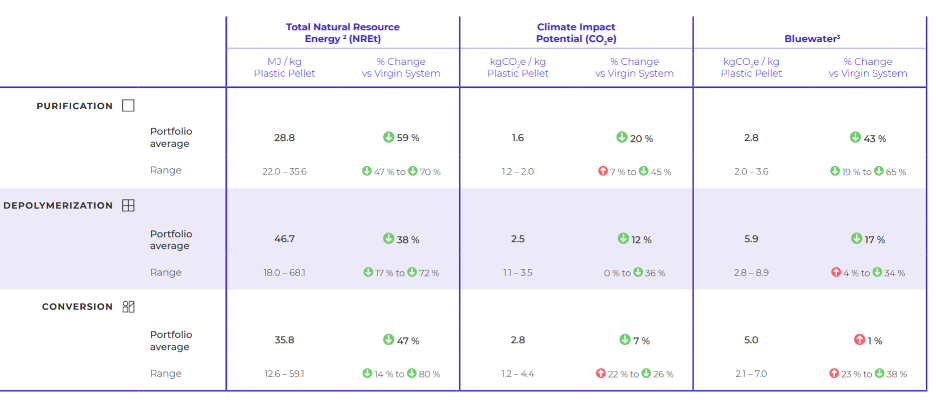

- From an environmental perspective, purification and depolymerization technologies have a smaller environmental footprint, on average, compared to conversion technologies.

Closed Loop Partners also analyzed the energy, greenhouse gases and water impacts of individual technology processes, and the systems-level impact of producing different polymers via purification, depolymerization and conversion technologies. On average, purification was the best performing category across all environmental measures, yielding 20% reduction in greenhouse gas emissions compared to the virgin plastics supply chain. Depolymerization had an average greenhouse gas reduction of 12%, while conversion technologies reduced carbon emissions by 7%, on average. Decarbonizing the plastics supply chain requires prioritizing the solutions that help to meaningfully improve the status quo.

Figure 7: Summary of environmental impacts to produce recycled plastic by technology category

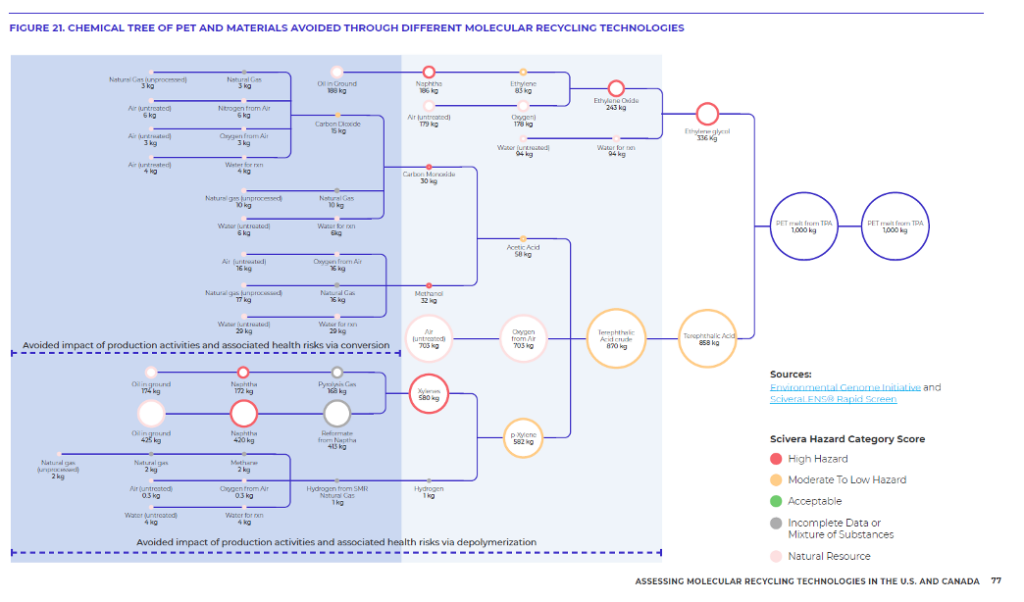

- The less a polymer is broken down through molecular recycling process, the fewer virgin petrochemical inputs are needed to make plastic again – which can reduce the human health impacts of plastic production compared to virgin plastic production.

Several chemical inputs are used to produce plastic. We’ve pictured the chemical tree to make PET which is the plastic used in water bottles. Because plastic can be recycled by many types of molecular recycle technologies, our team wanted to understand the potential human health impacts of different technologies. While qualitative in nature, our findings strongly suggest that the less a polymer is broken down through a molecular recycling process, the lower the human health risk because fewer chemicals and processing are

required to build back the polymer. In the illustration below, depolymerization technologies have an advantage over conversion technologies that can also process PET because depolymerization displaces more of the virgin supply chain to create an equivalent amount of plastic.

Figure 8: Summary of environmental impacts to produce recycled plastic by technology category

- The economic viability of molecular recycling technologies varies depending on several factors, such as the cost and accessibility of feedstocks and the market demand for the recycled products.

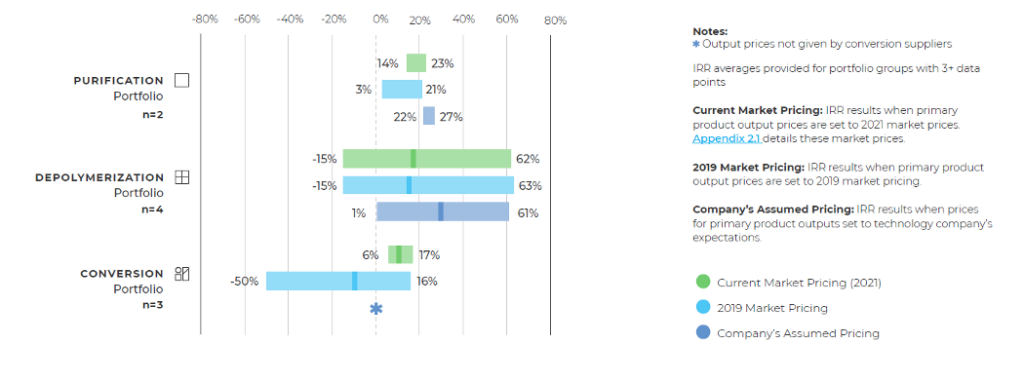

Analyses conducted by Closed Loop Partners over the course of 18 months across nine technology companies found that at least one technology company was financially viable in each category. Specifically, seven of the nine technology companies evaluated had a positive internal rate of return (IRR) ranging from 6% to 62% in the 2021 base case. It is also noteworthy that two-thirds of the technology companies in our study had positive IRRs, given that our base case assumes that these technologies are expected to sell their outputs at market commodity prices without a premium. Figure 5 above summarizes the expected rate of return across three scenarios: 2021 market pricing, 2019 market pricing, and the expected output pricing cited by the technology companies themselves.

Figure 5: Expected Internal Rate of Return (%) Ranges for Each of the Three Molecular Recycling Technologies

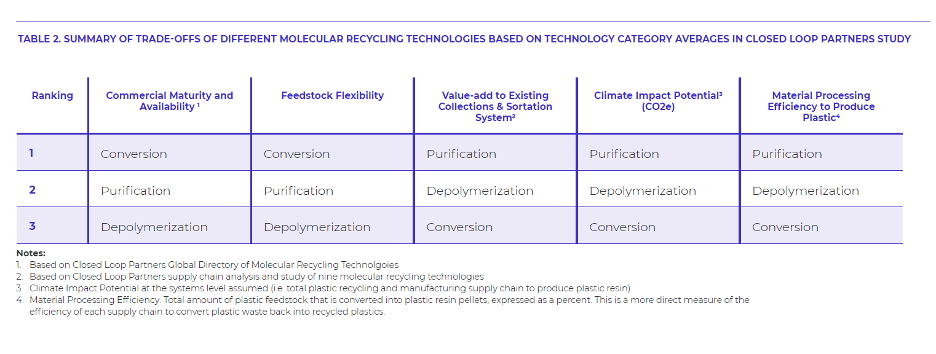

- There are tradeoffs to each molecular recycling technology category and type. The viability of one solution depends on those metrics that matter most to a brand, investor, or community.

The molecular recycling sector is incredibly nuanced and diverse. Not all technology groups are at the same level of development. Their tolerance for mixed plastics or other contamination varies company to company, just like their performance across environmental impact metrics like energy, water and greenhouse gas emissions. Due diligence prior to investing in strong performing technologies is critical. Closed Loop Partners has summarized the results when observing the category averages between purification, depolymerization, and conversion in the table below. This summary is based on our review of nine technology companies between 2020-2021 and should only serve as a point of data, not a definitive source on the state of the sector at large. The opportunity for consumer brands, policymakers, and investors is to collaborate to develop a vision of success for this sector.

To read our full report on molecular recycling technologies, including a list of more than 100 questions that investors and brands should ask when considering investing in this sector, visit Closed Loop Partner’s website.

The Most Sustainable Bag Is Likely the One You Already Own: 5 Things YOU Can Do to Reduce the Need for Single-Use Plastic Bags

July 19, 2023

How often do you get to the checkout counter only to realize you’ve left your reusable bags at home or in the car? It’s happened to all of us, including me.

Don’t be that person stashing plastic bags until your drawer begins to overflow. In addition to going bagless for quick shopping trips, here are 5 tips for remembering to bring your own bag, so YOU can reduce the need for single-use-plastic bags:

- Make it visible. Write “bring bags” at the top of your grocery list and leave bags in a basket near your front door or hanging on the doorknob, so you don’t forget them as you are leaving the house.

- Make it available. Always keep a few bags in your car for spontaneous shopping trips.

- Make it essential. Place an important item in the bag, like your phone, keys or wallet, so you won’t forget it.

4. Make it personal. Purchase reusable bags you actually like, so you’ll be more inclined to carry them with you.

Why is this so important? Every year, 100 billion single-use plastic bags are used annually in the U.S., and its estimated fewer than 10% of them are recycled.

While the convenience of the single-use plastic retail bag can’t be disputed, the negative impact — considering its short use (12 minutes, on average) and long estimated lifespan — has created an untenable situation that is contributing to a mounting global waste crisis. Plastics can now be found in the deepest depth of the ocean, the top of Mount Everest, and on both polar ice caps.

Reducing the number of single-use plastic bags retailers use across their stores can make a tremendous difference. Even a 1% bag reduction would have a substantial impact on our global waste footprint – equivalent to 1 billion fewer bags used and discarded across the U.S.

If you’re already regularly using reusable bags, you are not alone! Learn more about our pilots in Denver and Tucson where 150+ retailers are working together to help all of us reinforce the habit of bringing our bags. Additionally, check out our new playbook full of solutions retailers can implement today to get teams and customers on board with reducing single-use plastic bags and encourage shoppers to reuse their own bags.

While there’s a lot retailers can do; remember, we’re all in this together and YOU can make a difference by reducing the need for single-use plastic bags.

Why We Invested in Molg: Supporting the Circular Economy for Critical Minerals Through Electronics Recovery

May 31, 2023

This blog is part of our “Why We Invested” series, which offers a deep dive into our most recent investments and the growing circularity trends in the space.

Over the past few months, the dialogue around sourcing critical minerals for the clean energy transition has reached a fever pitch. In March, we highlighted the three pain points to critical mineral recovery that have been largely absent from discussions: (1) valuable streams of recoverable domestic materials are currently overlooked; (2) existing processing techniques are leaving value on the table; and (3) geographic silos are disadvantaging both suppliers of recovered materials and manufacturers. Today, we’re excited to share how one of the newest portfolio companies of Closed Loop Partners’ Ventures Group, Molg Inc., is moving the needle on critical mineral recovery through advancing design-for-disassembly and deconstruction.

Molg uses robotics and design software to ensure one product’s end is another’s new beginning––enabling a circular manufacturing process. Led by Co-Founders Rob Lawson-Shanks and Mark Lyons, Molg provides a full suite of solutions to improve the disassembly of existing electronic products––from servers to laptops to handheld electronics. We invested in Molg because circularity is at the core of why and how this team operates. They think outside the box of traditional, linear systems, understanding that just because products have always been designed one way, doesn’t mean that process should continue. They are also committed to recapturing as much material as possible––including those previously designed in non-recoverable ways––recognizing that even products lacking optimized designs can be recovered profitably at scale. That’s a circular economy.

- Molg is targeting a historically overlooked source of critical materials in the U.S.: end-of-life electronics. Much of the unused critical materials needed for advancing the clean energy transition are not domestically available at scale in the U.S. and may be sourced from regions challenged with human rights breaches, water scarcity or geopolitics. However, much of the minerals needed already exist in our end-of-life electronics in the U.S.––both in commercial and individual use cases. Molg is committed to capturing and recovering the materials from these sources and, through direct CAD integrations, has a pathway to do so for a diverse variety of products.

- Molg’s robotic disassembly processes maximize the value from recovered materials. Traditional recovery processes prioritize shredding materials and then using chemicals to deconstruct those materials down to monomers, capturing only those worth the highest value, and losing value in the process. By starting with disassembly, Molg can close a tighter loop––keeping still usable materials in their original form factor––and accelerating reuse while ensuring feedstock that can be recycled.

- Molg’s micro-factory approach allows for localized recovery where the materials are most needed––minimizing transport costs that may otherwise challenge recovery economics. End-of-life electronics are heavy and transporting them costs money. By advancing pathways to disassemble electronics on-site through their micro-factories, Molg allows processors to get to single source feedstocks sooner, removing the need for sortation and processing that may have required transport before recycling could take place.

What the Molg team is building is just one part of the broader recovery ecosystem. The involvement of the entire value chain is needed––from aggregators, sorting and recertification infrastructure, metal processors and manufacturers who are prepared to use recycled feedstocks in their processes. This also includes designers prepared to take on the challenge of designing for disassembly, and regulators who view these waste products as a primary source of materials and worthy of being prioritized. There is a promising opportunity ahead for critical minerals, and at Closed Loop Partners, we’ll continue to invest in companies that strive to push circularity for these materials forward.

Interested in learning more about Molg? Tune in to Circularity23 where the team will be pitching for Accelerate for Circularity!

About Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments. Closed Loop Capital Management manages venture capital, growth equity, buyout and catalytic private credit investment strategies on behalf of global corporations, financial institutions and family offices. The Center for the Circular Economy unites competitors and partners to tackle complex material challenges and implement systemic change to advance circularity. Circular Services employs innovative technology within reuse, recycling, remanufacturing and re-commerce solutions to improve regional economic and environmental outcomes, and build resilient systems that keep food & organics, textiles, electronics, packaging and more, in circulation and out of landfill or the natural environment. Closed Loop Partners is based in New York City and is a registered B Corp. For more information, please visit www.closedlooppartners.com.

About Closed Loop Ventures Group

Closed Loop Partners’ venture capital arm launched in 2017 with one of the first venture funds dedicated solely to investing in early-stage companies developing breakthrough solutions for the circular economy. The Closed Loop Ventures Group targets leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy.

The Closed Loop Venture Fund II builds on the venture capital group’s first fund’s strategy, supported by an existing portfolio with strong financial performance, coupled with robust environmental and social impact. HomeBiogas, one of the early investments of the Closed Loop Venture Fund I is a leader in developing biogas systems that transform organic waste into clean energy and bio-fertilizer. They announced their $94 million initial public offering (IPO) in Israel in 2021, accelerating the company’s growth into additional markets, including North America. To date, the company has sold over 10,000 systems in more than 100 countries. Algramo, another investment of Fund I, developed a reuse system powered by vending machines that dispense household products into smart reusable packaging. With the investment and support of Closed Loop Partners, the Chile-based company expanded into North America, now piloting their reuse systems in New York City, while also having piloted with leading brands such as Walmart and Unilever in other geographies.

About Molg Inc.

Molg tackles the growing e-waste problem by making manufacturing circular. The company’s robotic microfactory can autonomously disassemble and reassemble complex electronic products like laptop PCs, servers, and handheld electronics, helping keep more valuable materials within supply chains. Molg partners with leading electronics manufacturers to design the next generation of products with reuse in mind, ensuring that one product’s end is another’s beginning. To learn more, visit molg.ai.

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Reuse

How Today’s Single-Use Habits Can Inform the Direction of Reuse Systems of the Future

April 24, 2023

To build successful reuse systems, we need to make reuse a natural choice for customers.

With around 250 billion single-use cups used globally each year, contributing to greenhouse gas emissions and lost resources, there is a significant opportunity to reduce our waste by learning from the journey of everyday materials, like cups, that are part of many people’s daily routine. Understanding customer motivation, preference, and behavior is a critical step in advancing a circular economy, where materials are kept in circulation and designed with their next life and use in mind.

Over the past two years, our NextGen Consortium has surveyed thousands of customers on how they buy and consume beverages on the go, and what they do with their cups after they are done. We examined survey results* across three types of cups for: 1) hot coffee, 2) iced coffee, and 3) fountain soda. These findings inform not only how to improve recycling and composting outcomes for cups today, but also how to optimize for reusable cup systems in the future.

What we learned:

1) Lives are busy, and people sip on the go.

- Most customers purchase drinks in single-use cups during busy, on-the-go moments, and drink them in their car

- Most people finish drinking within 30 mins to one hour, but hold on to their cup for an hour or more––except for hot coffee drinkers, who generally dispose of their cups in less than one hour

2) Nearly half of all cups finish their journey at home.

- The most common cup journey starts in a drive-thru, is consumed in a vehicle, and then is placed in the trash at home

- Few customers dispose of their cup at a coffee shop/restaurant, including in the parking lot

- Most cups end up in waste streams at home, work or school

3) Reusing a cup is more common than it may appear.

- This is especially true for convenience/gas station purchases and among customers with lower income

- Customers are significantly more likely to bring their reusable coffee cups to convenience/gas station vs. other restaurant/coffee shop settings

4) Once customers embrace reuse, they tend to stick to it.

- Of customers who typically reuse their cup, half say they “almost always” bring a refillable cup with them

5) There is a desire to cut down on waste if it is convenient.

- Customers express an interest in different disposal methods, but don’t want to go out of their way to do so

- While the majority of customers prefer to reuse or recycle their cups, the say-do gap is real, and the process to recycle or reuse needs to be seamless for people

- Given the choice, customers say they would rather recycle their cup than throw it in the trash

Gaining a better understanding of how customers use and dispose of single-use cups today helps to inform the optimal design of reusable cups and cup sharing systems. As we test these new systems and think through what it will take for reusable cups to become part of our cultural norms and daily habits, these survey findings can help us meet customers where they are instead of expecting new behaviors. These findings also prompt important questions, such as:

- How can we make it easy for customers to borrow reusable cups in drive thrus and return the cups on the go and/or from their homes or place of work?

- How do we continue to strengthen multi-brand partnerships to build dense networks of restaurants and coffee shops participating in collaborative returnable cup programs?

- If customers are still not clear on where to dispose their single-use cups, how do we educate them when a fourth bin of reusable cups is added to the equation? And how do we design reusable cups for recoverability when they do end up in a recycling bin?

- For beverages consumed in the car, how might we encourage the use of more durable and insulated reusable options that replicate the performance benefits of styrofoam, a much less sustainable option?

- Since the overwhelming number of cups are disposed of at home, the office or at school, can we explore residential or commercial reusable cup collection services that make participation as easy as disposing a cup in the trash or recycle bin?

Bottom line: To build successful reuse systems, we need to make reuse a natural choice for customers. If we make it easy for customers, as part of their busy daily routine, we can make reuse the top option for millions of people.

Our customer research findings are critical inputs to the NextGen Consortium’s broader strategy to accelerate the transition to reuse. We’ve been researching and testing reusable cups since 2018 and will continue to iterate and advance in 2023 and beyond with in-market tests and other studies, such as financial modeling and environmental impact analyses on reuse. If you would like to be a part of our upcoming studies and pilots, get in touch with us at [email protected].

* To explore customer behavior related to single-use cups, the NextGen Consortium conducted three, quantitative surveys with 2,500 U.S. respondents each focused on 1) hot coffee cups, 2) iced coffee cups, and 3) fountain soda cups over a period ranging from two to three weeks in 2021 and 2022. We examined how customers buy and consume beverages in single-use cups as well as what happens to the cup after purchase. In these studies, “customer” refers to respondents who purchase hot coffee, iced coffee, or fountain soda out of the home regularly, at least once per week.

Reuse

How Personalized Home Delivery Models Could Spur Successful Reuse Systems

March 23, 2023

Georgia Sherwin, Senior Director at Closed Loop Partners’ Center for the Circular Economy interviews Bruno Ballester, ROYAL CANIN Individualization Senior Product Owner. ROYAL CANIN® offers customized pet food and home delivery in reusable packaging to meet the diverse needs of pet owners and in the process has generated interesting learnings about reuse adoption.

- In a nutshell, can you describe the reusable packaging system implemented by ROYAL CANIN and how it works?

Since June 2022, ROYAL CANIN®, a brand of Mars, Inc, has been partnering with reusable packaging innovator RePack to offer a sustainable solution for home deliveries of ROYAL CANIN IndividualisTM pet food refill orders in France, representing thousands of orders per month. ROYAL CANIN® IndividualisTM is an on-demand, individualized nutritional program created to answer every pet’s unique health needs. Pet owners receive their ROYAL CANIN order in returnable RePack delivery packaging. Once empty, the RePack packaging can be returned through the postal system for free, after which it is cleaned and reused. The packaging can go through this process up to 20 times. The reuse delivery packaging guarantees intact quality of our products at delivery.

After 20 cycles, analysis shows that RePack packaging results in only 0.1kg of waste and 0.9kg of CO2 emitted, compared to 3kg of waste and 4.4kg of CO2 for a cardboard box. The process represents a reduction of 80% of CO2 when comparing the lifecycle of a RePack bag to disposable packaging. We are now exploring potential opportunities to expand this project to the rest of Europe and North America.

- Why did you decide to implement a reuse model for ROYAL CANIN®? What factors contributed to it?

ROYAL CANIN® is committed to furthering sustainability across all our operations, knowing that reuse, recycling and upcycling packaging are key contributions in alleviating the impact of our activity and helping create a healthy future for pets, people and the planet. We also signed the Ellen MacArthur Foundation’s New Plastics Economy Global Commitment, which encourages responsible behavior and calls for collective engagement to ensure a common vision of a circular economy for plastic, in which it never becomes waste or pollution.

We feel that reuse habits have been lost to today’s dominant single-use, disposable culture, but we think reuse is a trend that is coming back and could become the norm.

This opt-out model for reuse has helped ensure momentum.

- How has customer adoption evolved over time since the launch of the program?

Customer adoption of the reusable RePack packaging program has been a great success. Importantly, while we leave the choice to our customers to ask if they prefer to switch back to the previous packaging approach, after several thousand orders, no customer has asked to change. This opt-out model for reuse has helped ensure momentum. We also inserted a QR code to collect feedback after each order and the overwhelming feedback from customers was positive. The program received a Net Promoter Score of 76, which indicates that the majority of customers are satisfied and would recommend the approach. In fact, a lot of customers noted they were surprised this type of solution isn’t being deployed more widely and becoming the norm.

A couple of great customer quotes about the reusable packaging system worth highlighting include, “I think it’s an excellent idea, congratulations to the inventor”, “I love it”, “a perfect solution”, “it is a very good initiative. I hope that many companies will follow this”, and “I find this idea great and very practical.” This kind of feedback is really encouraging for us to continue to push the bounds of sustainability initiatives. Beyond our net promoter score increasing, which indicates positive customer satisfaction, we’ve also saved time from an operations perspective by packing parcels with RePack vs. cardboard boxes.

- What’s been the biggest challenge for the program?

There are many different considerations when it comes to reuse. We usually ship our premium pet food in protective cardboard boxes to preserve the quality and the health benefits of the finished product up to the point of final consumption. Therefore, we had to ensure RePack packaging was strong enough to guarantee intact quality at delivery. It was also important for us to monitor and measure the feasibility of the program: how can we offer reusable packaging for each customer each month without increasing the costs? Should this solution cover several countries, or should we select one single country? And we kept a constant eye on customer satisfaction––are customers willing to return the packaging each month?

- What did it take to get the program off the ground? What key stakeholders and resources were involved?

ROYAL CANIN® ran a test over two months with 15 pet owners and sent them their refill order in a RePack packaging. They agreed to share their experience during individual interviews. This first test was very successful and received, on average, a rating of 4.8/5. Customers reported that RePack was: 1) Easy to use 2) Sustainable 3) A good solution for e-commerce. This valuable feedback helped us scale the reusable packaging project, whilst also recognizing what information was most relevant to French customers.

We also organized a workshop in our warehouse in France where all ROYAL CANIN® Individualis™ orders are prepared, packed and shipped. We met with the RePack team to review the order preparation as we were kicking off the first orders for the small pilot.

The product packaging size can vary significantly depending on if it is for a cat or a large dog for example, and therefore we usually need three sizes of cardboard boxes. The three sizes of RePack allowed us to meet our packaging needs perfectly. We tried RePack’s different sealing methods to find the most efficient and secure one for us. We tested the solidity of the packaging with a test and validated an International Safe Transit Association (ISTA) certification certifying that RePack packaging protected the pet food during transport.

Putting Recovery at the Center of the Critical Minerals Sourcing Debate

March 22, 2023

Over the past few months, sourcing critical minerals has been at the forefront of conversations about how to support the renewable energy transition.

The chip shortages in 2020-21 increased awareness that, from steel and aluminum to rare earth minerals, the U.S. market has far fewer processed materials available than we need to meet the growing demand for electric vehicles, battery storage and transmission lines needed to maintain a 1.5-degree future. And the push to secure access to a finite, price-competitive global materials supply was only heightened by the Inflation Reduction Act’s domestic sourcing requirements for assets like electric vehicle batteries.

This growing need has prompted efforts to fund new extraction domestically and to secure feedstock from international regions––often with challenging environmental and human rights records but higher volumes of available supply. Onshoring and near-shoring of key aspects of manufacturing––once seen as cost prohibitive––are now seen as cost-of-doing-business to access the U.S. market. Less prevalent is the consideration of how to create more sustainable domestic sourcing channels for the critical minerals needed to support the manufacturing being announced in the U.S.

That is not to say that “recycling” is absent from the conversation. Indeed, a handful of large battery recycling companies have garnered significant attention and capital––the most recent being a $2B conditional loan commitment from the Department of Energy Loan Programs Office to Redwood Materials. However, much of what is being invested in today relies upon energy- or chemical-intensive processes that prioritize recovery of the highest-value-by-dollar-amount materials. The result is that other materials––steel, aluminum, copper––can be left behind in the process. Those materials that are recovered––like lithium, cobalt, nickel––may end up requiring significant re-processing to be re-usable in a new battery.

It is important to advance the “large loop” circularity narrative of recycling materials all the way back to their base, raw material form; however, enabling smaller, cost-competitive loops alongside this can move the needle on material availability in the near-term. These include optimally leveraging used materials and minimizing processing costs to get these materials back to the manufacturing lines where they are needed. This is essential as we redefine our hierarchy of mineral recovery––from one that leads with extraction to one that leads with recovery as the primary source for materials.

At Closed Loop Partners, we see significant opportunity to elevate recovery as a core part of the critical minerals conversation. Namely that (1) valuable streams of recoverable domestic materials are currently overlooked; (2) existing processing techniques are leaving value on the table; and (3) geographic silos are disadvantaging both suppliers of recovered materials and manufacturers.

- Valuable streams of recoverable domestic materials are being overlooked

It is no secret that there are major concerns about the near-term availability of end-of-life batteries to feed existing recycling lines. At the same time, sourcing newly mined materials for electric vehicles has become a challenge for many automakers, and recent announcements demonstrate a push toward net new, domestic extraction for materials like cobalt.

There are diverse used material streams that can serve as the feedstock needed by new battery manufacturers. This includes everything from scrap created during the initial battery manufacturing process to end-of-life electronic waste and, even, recovery from seawater, clay or waste streams from other manufacturing processes.

Innovation that takes the country’s natural endowments into account is better positioned to move the needle on critical minerals access. These include not just minerals under the ground, but also those above it––being scrapped off the line, waiting in line at an end-of-life electronics processor, or even in our junk drawers at home. And there is an investment opportunity in recovery technologies that view those waste streams not as liabilities but as feedstocks for the energy transition.

- Existing processing techniques are leaving value on the table

While current methods for battery recycling, such as pyro and hydrometallurgy, are well suited to recover cathode materials––lithium, cobalt, nickel and manganese––there is still opportunity to innovate and improve recovery mechanisms, ideally that preserve and catalyze reuse of anode materials or casings––graphite, iron, copper, steel, aluminum––many of which may not be fully recaptured in processing.

We know it is possible to extract more value from existing waste streams to loop materials back into supply chains––and de-manufacturing is a core enabler of that. Instead of starting a recovery process by shredding the existing product, we can prioritize deconstruction. This allows for the preservation of materials in a usable form rather than a return to the base elements (for example, direct cathode-to-cathode recovery, versus a reversal to lithium carbonate that needs to be reprocessed to be usable in a battery again). Not only does this require fewer steps for reintegration, but it may also be less energy intensive––and still gets domestic materials back to the manufacturers who need them most.

Similarly, existing operations in traditional industries, such as mining and oil and gas, have room for incremental recovery of materials that are currently viewed as waste products. Mine tailings, for example, are a natural waste product of the mining process and there are thousands of tailing dams––both active and inactive––around the world. There is an opportunity for innovation that focuses on reprocessing and recovering the critical minerals still present in those tailing dams. These “waste” streams from traditional extraction processes can become valuable sources for materials needed in battery manufacturing. They can also have secondary benefits, such as improved water quality, revitalization of biodiversity loss and more.

- Geographic silos are disadvantaging both suppliers of recovered materials and manufacturers

North American electric vehicle battery manufacturing has continued to accelerate, with nearly 1,000 GWh/year of manufacturing capacity expected to be online by 2030. The manufacturing footprint is broad––stretching from California to Eastern Canada, Texas to Florida to Massachusetts. Unfortunately, the planned capacity for critical minerals recovery is less distributed.

As operators of the largest private recycling company in North America, Closed Loop Partners knows well that the most important aspect of profitability in waste recovery is the ability to optimize the full ecosystem processing cost––and transportation is a significant part of that equation especially when an end-of-life product is heavy. There may be opportunities for more proximate, localized or modular processing, as well as more structured recovery infrastructure.

Putting Recovery at the Center of the Debate

We have the opportunity today to build the new supply chain for electric vehicle battery manufacturing with circular economy and recovery principles embedded from the beginning. Prioritizing recovery over additional mineral extraction allows us to localize supply chains and feed new capacity for domestic manufacturing of semiconductors and batteries for electric vehicles. It hedges over-exposure to finite supplies of raw materials that have, historically, only been accessible in specific, higher risk geographies around the world and, in doing so, creates a hedge against pricing volatility in those markets. If done well, it does all of that at a lower cost than full lifecycle mineral extraction and with a lower emissions footprint than legacy recycling infrastructure while diverting high value waste from landfill. It builds long-term resilience––all while driving transparency, connectivity and agility into our domestic processing capacity for critical minerals.

Core to our investment approach at Closed Loop Partners is a belief in the power of the ecosystem. The circular economy, by definition, requires collaboration across stakeholders. It requires a shared understanding of fully loaded costs to get something back in circulation and a commitment to make it work in the least emissions-intensive, most cost-efficient way possible––not just for a single entity in the value chain but for all of them. Sourcing critical minerals is no different. Now is the time for a new wave of collaborative innovation that puts novel recovery front and center in our journey toward sustainable, cost competitive, low carbon and low waste materials for the energy transition.

Special thanks to the GreenBiz23 team and my fellow panelists from the Future Proofing Critical Minerals Supply panel, to my Closed Loop Partners team––especially Jessica Long, Danielle Joseph, Andrew McColm, and Anne-Marie Kaluz––and to the countless corporate partners, investors, and start-ups innovating across this ecosystem that have already pushed my thinking here. I look forward to many more discussions on the topic!

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Reuse

Four Key Needs for the Growth of Reuse in 2023

February 13, 2023

Many large consumer–facing brands are making sustainable packaging commitments that go beyond recycling and into the world of reuse. That’s an important step that must be supported by other ecosystem-wide advances that make reuse an easy choice for customers.

Looking back at 2022

Last year, most reuse success stories for foodware and packaging happened in closed or semi-closed environments, where logistics management and returns are simpler to handle. Think of the cups and food containers used in venues such as restaurants, college campuses, stadiums, or office buildings. While reuse models in these closed or semi-closed spaces suffered during the height of COVID-19, due to increased sanitation concerns and venue shutdowns, 2022 saw them rebound, with significant momentum among reuse innovators in this space. Some examples include:

- r.Cup continued their partnership with AEG and NIVA, expanding past Denver to launch wash hubs in Seattle, Los Angeles and San Francisco, bringing reusable foodware to venues, movie studios, museums, sports arenas, universities and corporate campuses.

- TURN, a long-time partner of Live Nation and C3 group, continues to roll out reusable cups across their US venues, stadiums, and music festivals. Programs with Oak View Group and Delta Airlines went live last month. TURN also announced building two new US-based wash hubs, supporting growth in Atlanta and Los Angeles.

- Re:Dish worked with corporations, cultural institutions, and K-12 schools across the New York DMA to replace their single use disposable packaging with reusable containers, plates and cups. In 2022, Re:Dish expanded their Brooklyn-based industrial washing hub to enable the washing and delivery of 75,000 units daily per line.

- Bold Reuse now offers reusable food trays for the Portland Trail Blazers at the Rose Quarter and partnered with Park City, Utah to collect reusable takeout containers from local restaurants.

Closed or semi-closed environments are a key starting point for the transition from single-use to reuse. They offer optimal conditions to introduce customers to reuse systems, and pave the way for expanding reuse into open environments and moving the needle on eliminating single-use plastic packaging waste. In 2022, we saw progress here too, with companies launching open environment pilots throughout the U.S. and beyond. In these pilots, customers could “borrow” reusable packaging on-the-go––whether a bag, cup or foodware––and later take it back to a return bin (instead of a trash bin) in stores or select drop off points in transit hubs or public spaces once the packaging was no longer needed. Some examples include:

- Starbucks launched multiple reusable cup pilots globally, building upon the learnings from its 2021 Seattle pilot.

- Coca-Cola and Burger King partnered with Loop to test reusable cups and containers in the U.S.

- Loop also worked with major brands to launch reuse pilots at Kroger in Portland, Giant in Washington, DC, and Walmart in Arkansas.

- DeliverZero, in New York and Colorado, and Dispatch Goods, in the Bay Area, continued to expand their offerings of returnable takeout containers.

- The Rounds, a zero-waste refill and delivery service that launched in 2020 in Philadelphia, expanded its offering of home delivery of everyday goods in reusable containers to three more cities, DC, Atlanta and Miami, in ’21 and 2022. They partnered with Topanga, a software company, to track its reusable containers throughout their lifecycle.

- Topanga also partnered with Grubhub to pilot zero-waste dining on campuses nationwide, and is continuing to build track-and-trace technology to power reuse systems at scale.

- Returnity continued to grow reuse programs for major brands across diverse industries such as New Balance, Rent the Runway, and Estee Lauder while expanding into food delivery with The Rounds and others.

- Goatote launched their borrow-a-bag program at select CVS Health, Target, and Stop & Shop stores in New Jersey, expanded their program in Colorado, and launched in Ontario, Canada.

- In Canada, Muuse partnered with DreamZero and the Government of Toronto to launch a Neighbourhood Zero Waste Zone for Muuse Reusables in Toronto East, and integrated its first pizza box for takeaway customers.

- In Vancouver, Tim Hortons launched a reusable cup pilot operated by ShareWares and Return-It launched a multi-brand reusable and single-use cup collection pilot.

Getting these open environment pilots off the ground is a huge step in introducing reusable packaging to customers and operators in the field. To accelerate uptake and scale of these solutions, continued collaboration and experimentation are more important than ever.

So, what will it take in 2023 and beyond to enable uptake of reusables in open environments?

1. Legislative policies need to evolve to incorporate more explicit language around reuse and lessons learned from single-use plastic bans to avoid potential unintended consequences

In 2022, we saw regulatory pressures from single-use plastic bans growing, with many cities and states either passing or considering single-use plastic bans utilizing California, New Jersey, and Massachusetts ordinances and legislation as leading examples. Public policy plays a critical role in driving meaningful impact and oftentimes is the first step to inspire broader change. For example, in New Jersey, single-use bags were banned from grocery and super stores to help enable reuse, resulting in a significant decrease in purchase of single-use plastic bags. However, our customer research found that 87% of customers in New Jersey said they have enough, more than enough or too many reusable bags. While the policy has resulted in a significant decrease in the use of single-use plastics bags, we need to ensure complementary interventions, incentives and tactics are implemented that support customers to bring their own bags back into store so that reusable bags achieve their intended reuse. Looking ahead, policy will be a key enabler to promote a cultural shift towards reusables. Policymakers, advocacy groups and industry players will need to work together to pass regulations that advance reuse models that are measured and tracked and learn from existing examples of where policy has or hasn’t worked.

2. Widespread consistency in messaging and education for customers around reuse systems will make the difference in adoption rates

Asking customers to return packaging can be challenging. In 2022, we saw engagement growing slowly, but it will take consistent messaging over time and across industry players to create a cultural shift. Besides messaging and education, most reuse programs are still refining their business models to make their systems more convenient for customers. While many programs started with technology requirements (account creation, app download, sign-up process and more), we are seeing a shift towards solutions that, despite being tech-enabled, do not require additional digital steps from customers.

3. Identifying opportunities for shared reuse infrastructure, for example washing or transportation partners, and shared collection points will help create economies of scale

It will take more than one company to create a sustained and scalable system to collect and prepare reusable packaging for its next life cycle. Low volumes within reuse systems create challenges for financial viability, whereas shared infrastructure could drive efficiencies in the system. Ways to build shared infrastructure can include aggregating washing vendors for multiple reuse products and leveraging empty trucks on their way back from delivering goods (known as “milkruns”), among other things.

4. Data transparency and measurement will be critical in ensuring new reuse systems achieve their intended environmental, social and economic impact

Packaging material choices and end-of-life considerations are foundational to ensuring that a reuse system is better for the environment. For example, a stainless-steel cup with a return rate lower than 95% could be worse for the environment than a single-use cup given the high carbon footprint for steel production. In 2022, many brands identified polypropylene plastic as their go-to material for food-service containers. In 2023 and beyond, continuous exploration and careful evaluation of materials based on their intended use and actual (not aspirational) rates of reuse will continue to be critical. Important considerations around end-of-life recovery pathways, how energy intensive the material is to extract, cost and customer happiness need to be weighed before scaled production begins.

What’s ahead

There is a lot to look forward to in 2023 when it comes to reuse. The landscape is rapidly evolving and growing, and the continuous learning and experimentation yields new insights and upends assumptions. At Closed Loop Partners’ Center for the Circular Economy, within our NextGen Consortium and Consortium to Reinvent the Retail Bag, we continue to deploy reuse solutions in the field, measuring the impacts of different policy, material selection choices, customer engagement strategies and reverse logistics mechanisms. The insights and data gleaned directly informs our strategy ahead, as we continue our focus on reuse as a critical means to addressing single-use plastic waste.

That’s the Circular Economy: How A Logistics Company Uses Empty Retail Spaces to Fix Supply Chains and Reduce Waste

December 20, 2022

A full logistics center inside a shopping mall––this is how Fillogic infuses agility into supply chains.

The company is at the center of one of today’s most pressing opportunities, as supply chain bottlenecks and logistics challenges elevate the need for streamlined, efficient movement of goods into and out of our homes and businesses. Today’s complex logistics system is coupled with a manufacturing system weighed down by overproduction, opacity and waste. The fashion industry alone has an average 40%[1] overproduction rate. This overloads production facilities and raises costs for brands as they hold unsold inventory for long periods. Eventually, most surplus products are landfilled or destroyed, wasting valuable resources. While legacy supply chains went unquestioned for many decades, their inefficiency has been apparent amidst the bottlenecks of the last two years.

The COVID pandemic accelerated the growth of e-commerce, and in its wake, return rates soared to over 20%[2]. Brittle retail supply chains bogged down by overproduction were unable to handle the spike. Today, if a garment is returned at all, it takes weeks or months until it is available for sale again––if it ever makes it back on shelf at all. This means that unsold and returned inventory can sit in a box for half of the apparel markdown cycle, and when it finally goes back to the retailer for sale, it is often already shopworn and damaged. This says nothing for the excess carbon emissions associated with the transport of that good through the network as returns make their way back to central distribution hubs.

The retail system operates as an omni-channel network and its weakness lies in its silos. If 100 pairs of jeans are shipped, they travel in one direction before branching into different sales channels: wholesale, retailer and e-commerce. These silos are often disconnected and managed by different parties. When items across these three channels are unsold or returned, they end up in consolidation centers mixed with different products. Brands have little to no data on that inventory. Without the backend infrastructure to connect these three channels and consolidate information, a holistic view of managed inventory is impossible––making it similarly challenging to reallocate products into the optimal sales channels. Inventory ends up in holding patterns instead of getting where it needs to go.

Networks, technology and infrastructure need to change quickly, but it’s never been more expensive to do so. Industry is looking for ways to use existing infrastructure more efficiently. That’s where Fillogic comes in.

Breaking Down Silos

Fillogic recognizes that if the same product (for example, a pair of jeans) is allocated across a brand’s wholesale, retail and e-commerce channels, then the three channels should be connected on the backend. That way, outbound, unsold, returned or lightly worn inventory can be reallocated to a channel where it will most likely sell, helping brands reach business goals and meet customers where they are while minimizing inventory idling in warehouses or backed up in transit.

Their technology intercepts unsold garments at the middle mile and redirects them across the appropriate channel. This reduces the need for retailers to markdown in stores to move inventory. Instead, they can resell these products––which are often part of the nearly 40% of inventory that’s sold at discount––at full price or at a slight markup, through a different channel or in a different store, and more quickly than should these items have languished in the existing logistics infrastructure.

To add speed and efficiency, Fillogic operates within existing spaces close to retailers and customers. They repurpose shopping malls and under-utilized retail spaces into local market logistics hubs that connect the retail network. They see opportunity in forgotten spaces: the truck tunnels and elbow joints––bringing value back into overlooked assets rather than building more infrastructure. They optimize existing inventory, both outgoing and returning, to unlock new revenue streams for brands, enable better margins on the sale of unsold items and the resale of returned goods, advancing reuse and meeting customer demand in the process. Ultimately, this keeps valuable products that otherwise could have gone to landfill in the hands of consumers.

Paving the Path for Growth

Closed Loop Partners’ Ventures Group invested in Fillogic in early 2022, recognizing the need for supply chain transparency to increase utilization of goods and keep those materials in circulation. According to the Circularity Gap report, 70% of greenhouse gas emissions are related to material production and use, bringing the circular economy, and increasing utilization rates of manufactured products to the center of climate conversations. Advancing more circular supply chains plays a key role in increasing resource efficiency and resiliency to bring products to market while limiting waste.