Closing the Loop: The Transition to Circularity

Impact Report 2021

2021 was a milestone year for the circular economy.

Amidst COVID-19, global supply chain disruptions, increasingly urgent climate risks, mounting waste and dwindling finite resources, there has never been a more critical time to rethink how we produce, transport and consume goods.

We have reached a critical moment for advancing the circular economy. The value of a waste-free world has come to the forefront of priorities, and many innovators and investors are joining in this critical work, which only continues to strengthen the foundation of our vision. Looking back at 2021, we are thrilled to share the impact and outcomes we have collectively achieved, as we continue to pave the path ahead, working together toward a circular future.

– Ron Gonen, Founder & CEO of Closed Loop Partners

Read Our 2021 Impact Report Here

EXPLORE REPORT HIGHLIGHTS BELOW

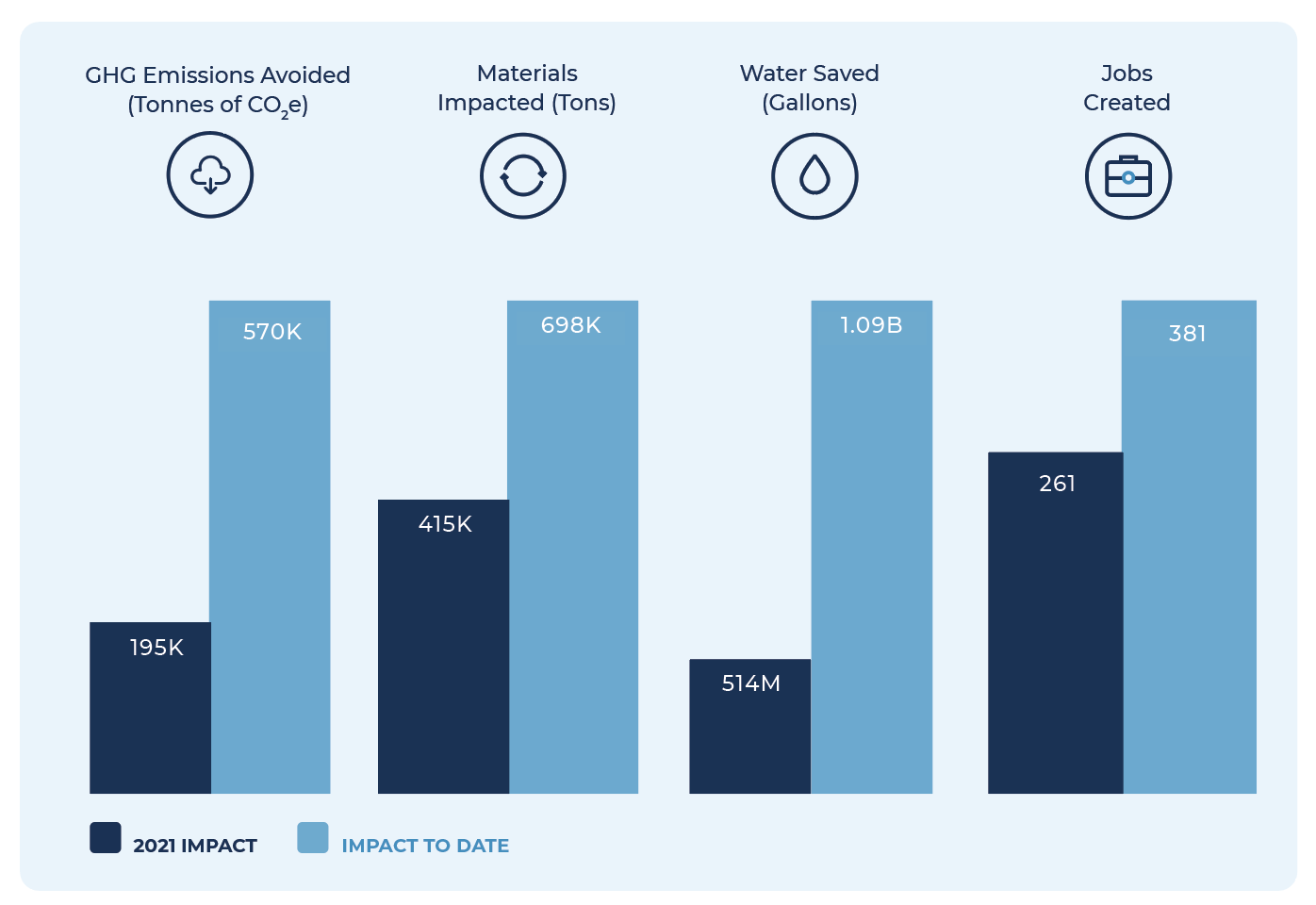

Our Growing Impact

PORTFOLIO COMPANIES IN 4 CONTINENTS, 8 COUNTRIES,

AND 25 U.S. STATES

$400M

Assets Under Management

60+

Portfolio Companies

6.8M

Tonnes of Greenhouse Gas Emissions Avoided

3.6M

Tons of Materials Kept in Circulation

Investment

Investment is a critical driver for accelerating the circular economy, encouraging innovation and enabling transformative companies to bring their solutions to scale.

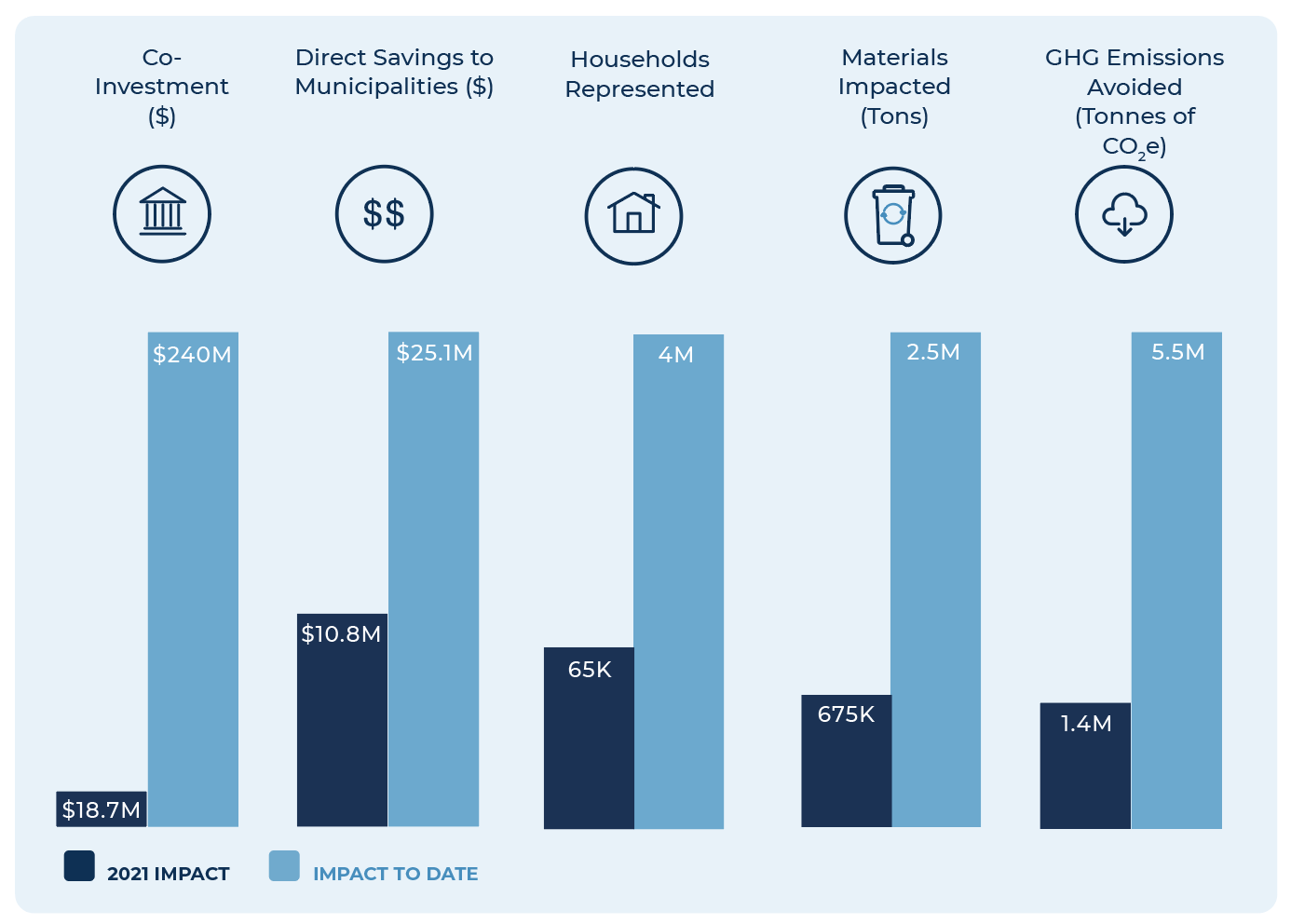

Impact Across Our Funds

Closed Loop Ventures Group

Show moreLaunched in 2017, the Closed Loop Ventures Group deploys early-stage capital into companies developing breakthrough solutions for the circular economy. The Closed Loop Ventures Group invests across the sectors of Plastics & Packaging, Food & Agriculture, Fashion & Beauty, Supply Chain & Optimization and measures the following social and environmental outcomes:

Closed Loop Infrastructure Fund

Show moreEstablished in 2014 and funded by the world’s largest retailers, consumer goods companies and corporate foundations, we finance recycling and circular economy infrastructure. The Closed Loop Infrastructure Fund invests across circular supply chains and measures the following social and environmental outcomes:

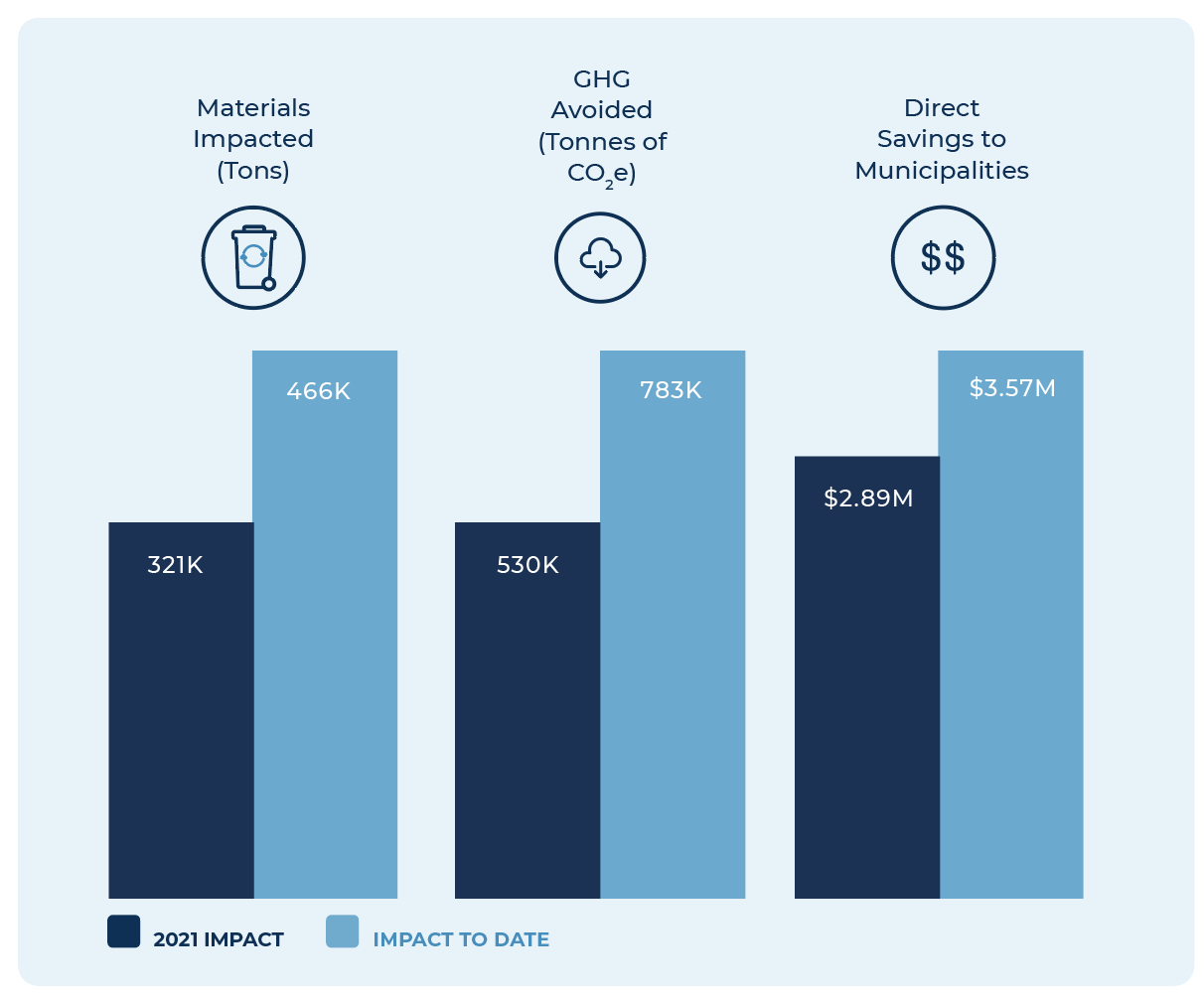

Closed Loop Beverage Fund

Show moreLaunched in 2019, in partnership with the American Beverage Association, the Closed Loop Beverage Fund seeks to improve the collection of the beverage industry’s valuable plastic bottles so they can be made into new bottles.

The Closed Loop Beverage Fund Impact Targets:

- 23 million Americans in 9 million households will be directly impacted in key regions of the country through this Fund’s infrastructure investments

- The Fund is targeting impacts to 300+ million pounds of PET bottles that will be recycled rather than landfilled over the 10-year fund period, equivalent to approximately 10 billion PET bottles

Closed Loop Circular Plastics Fund

Show moreLaunched in 2021, the Closed Loop Circular Plastics Fund invests in scalable recycling technologies, equipment upgrades and infrastructure solutions that advance the recovery and recycling of polyethylene and polypropylene plastics in the U.S. and Canada.

The Closed Loop Circular Plastics Fund Is Designed with Specified Impact Hurdles. Fund Life Targets:

- 500 million pounds of plastics kept in circulation

- 575 million pounds of CO2e emissions avoided

Closed Loop Leadership Fund

Show moreLaunched in 2019, the Closed Loop Leadership Fund invests in and builds circular economy platforms across recycling infrastructure, plastics & packaging, food & agriculture, electronics and logistics to scale vertically-integrated circular supply chains. The Closed Loop Leadership Fund measures the following social and environmental outcomes:

Portfolio Company Highlights

Dive deeper into impact stories of some of our current and former investments, and how they have worked with Closed Loop Partners to catalyze circular outcomes

Dimpora

A portfolio company of our Closed Loop Ventures Group, Dimpora develops sustainable membranes, mostly aimed at the production of outdoor gear.

HomeBiogas

A portfolio company of our Closed Loop Ventures Group, HomeBiogas creates anaerobic digester units that convert organic waste into renewable energy and fertilizer.

Partsimony

A portfolio company of our Closed Loop Ventures Group, Partsimony unifies disparate data to more efficiently manage hardware from prototype through production.

Thrilling

A portfolio company of our Closed Loop Ventures Group, Thrilling is a digital marketplace that brings boutique vintage clothing stores across the U.S. online, increasing access to reusable apparel.

Thrive Lot

A portfolio company of our Closed Loop Ventures Group, Thrive Lot installs and maintains edible, ecological landscaping and more to bring regenerative agriculture to backyards across the U.S.

LRS

A portfolio company of our Closed Loop Infrastructure Fund, LRS is the largest privately-held recycling services company in the Midwest, U.S.

Ripple Glass

A portfolio company of our Closed Loop Infrastructure Fund, Ripple Glass is a glass recycling company that helps keep glass out of landfills and in circulation.

rPlanet Earth

A portfolio company of our Closed Loop Infrastructure Fund, rPlanet Earth transforms post consumer plastics into the highest quality packaging.

Scott County

A portfolio company of our Closed Loop Infrastructure Fund, the Waste Commission of Scott County is a solid waste district in NE Iowa looking to advance recycling rates.

Evergreen

A portfolio company of our Closed Loop Beverage Fund & Infrastructure Fund, Evergreen is a plastics reclaimer and rPET manufacturing facility.

Electronic Recyclers International

A portfolio company of our Closed Loop Leadership Fund, ERI is the nation’s leading electronics recycler.

Balcones Resources

A portfolio company of our Closed Loop Leadership Fund, Balcones Resources is the largest privately held recycling company in Texas.

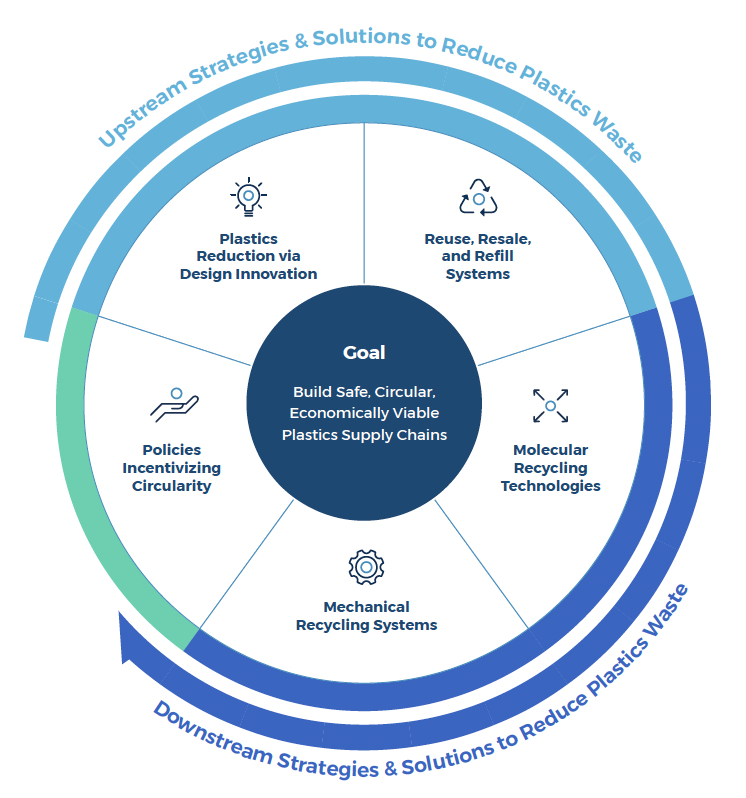

Innovation

As investment flows into circular systems, opportunities for innovation continue to grow. This creativity will shape the future of how consumers shop and how cities move, creating massive shifts that will advance consumer and brand value.

Impact Across the Center for the Circular Economy

Collaboration: NextGen Consortium

Show moreThe NextGen Consortium, managed by our Center for the Circular Economy, is a multi-year, global consortium that aims to address single-use foodservice packaging waste by advancing the design, commercialization and recovery of packaging alternatives. The Consortium works across the value chain––with brands, municipalities, material recovery facilities and manufacturers––to ensure we provide viable market solutions that scale throughout the supply chain and bring value to recovery systems. First on the list: the fiber cup.

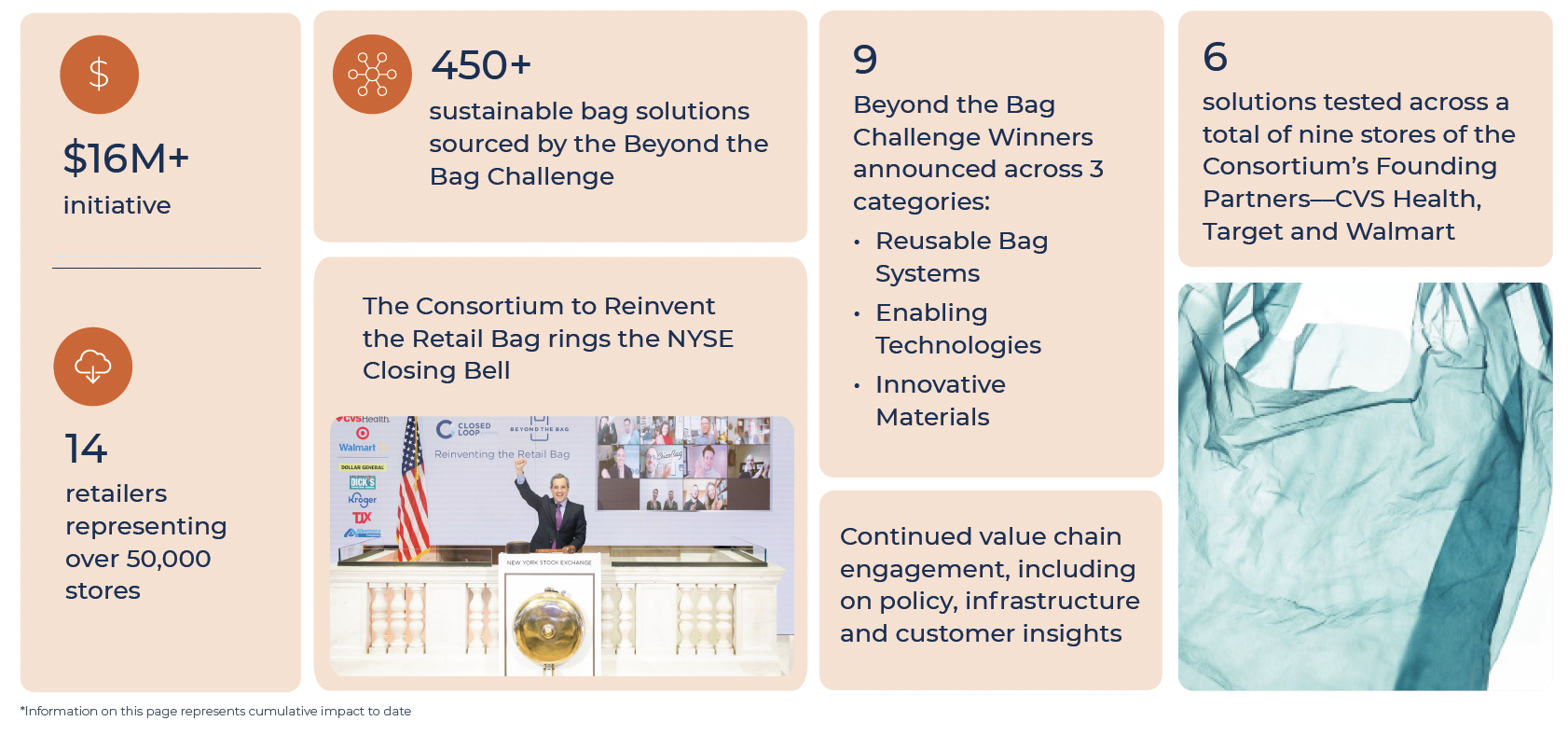

Collaboration: Consortium to Reinvent the Retail Bag

Show moreThe Consortium to Reinvent the Retail Bag, managed by our Center for the Circular Economy, is a multi-year collaboration across retail sectors that aims to identify, test and implement viable design solutions and models that more sustainably serve the purpose of the current retail bag.

Research: Exploring Molecular Recycling

Show moreIn 2021 Closed Loop Partners’ Center for the Circular Economy released its latest report on molecular recycling, Transitioning to a Circular System for Plastics: Assessing Molecular Recycling Technologies in the United States and Canada, examining the potential role of molecular recycling technologies in a circular and safe future for plastics, and the policy, market, and environmental and human health impact conditions needed to achieve this optimal future state.

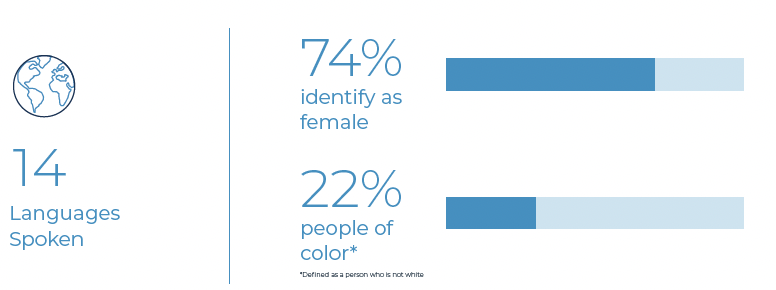

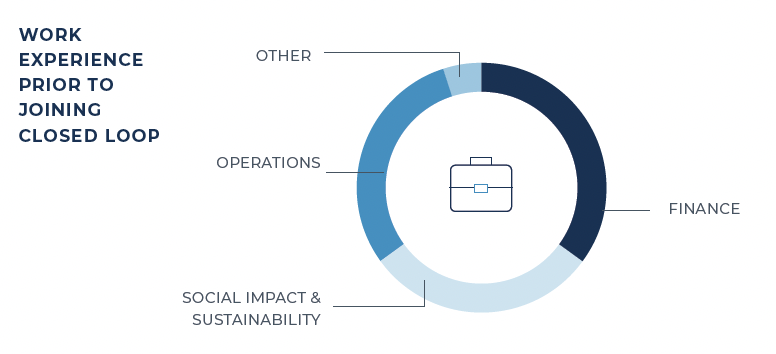

Team

Since Closed Loop Partners’ founding in 2014, our ethos has been to embody an inclusive culture within our firm, attracting smart, dedicated and mission-driven team members. We continue to evolve our policies, procedures and efforts regarding diversity, equity and inclusion (DEI) at the firm, as we work toward being an industry leader in business culture and as investors.

In 2021, we formally established our employee-led DEI committee with a specified mandate to focus on strengthening an action-oriented approach, further developing our short-term, medium-term, and long-term goals. From hiring practices, to educational resources, to investment practices, among many other things, we will continue to work to advance inclusive diversity at the firm, at our portfolio companies and in the communities we service. Most importantly, we expect any statements we make to be accompanied with actions and results.

CLOSED LOOP PARTNERS TEAM HIGHLIGHTS