The Latest Insights and Analysis from Chris Cui, Director of Asia Programs

November 18, 2019

Chris shares her latest thoughts and takeaways from a recent trip to China where she attended the 14th China International Plastics Recycling Conference & Exhibition and visited a local MRF.

China’s Material Recovery Facilities Are Fast Adapting To A Post National Sword World

We gained valuable market insights from policy makers and market practitioners at the 14th China International Plastics Recycling Conference & Exhibition in September in Shanghai. The discussion focused on how stakeholders across the recycling system should work together to develop a domestic closed-loop ecosystem. This means doubling down on collection, transportation, and reprocessing efforts to enable brands to reach their circularity goals. It became clear that the Chinese government is determined and committed to supporting the development of the circular economy in the coming years by carrying out the following policies:

- Implementing a tax to support the recycling industry

- Creating green standards for recycled plastic and for the production of recycled plastic

We saw firsthand the rationale behind these policies that are being considered. Mr. Wang, the Secretary of CRRA, was also quick to note the number of new faces in the room, including brand owners and capital providers, like Closed Loop Partners and the Alliance to End Plastic Waste. This helped to send a strong signal to the recycling industry around the business case for the circular economy.

Chris promoting the circular economy to brand owners & the recycling industry in China, Shanghai.

Witnessing The Transformation Of A Traditional MRF Into A Tech Enhanced One

It’s been three months since mandatory trash sorting was enforced in Shanghai and other big cities across China. We visited a local MRF to see how the new laws have impacted business. Tianqiang, led by CEO Mrs. Hu, has transformed its business model from a MRF to an all encompassing solutions provider, adding collection, reprocessing and production capacity.

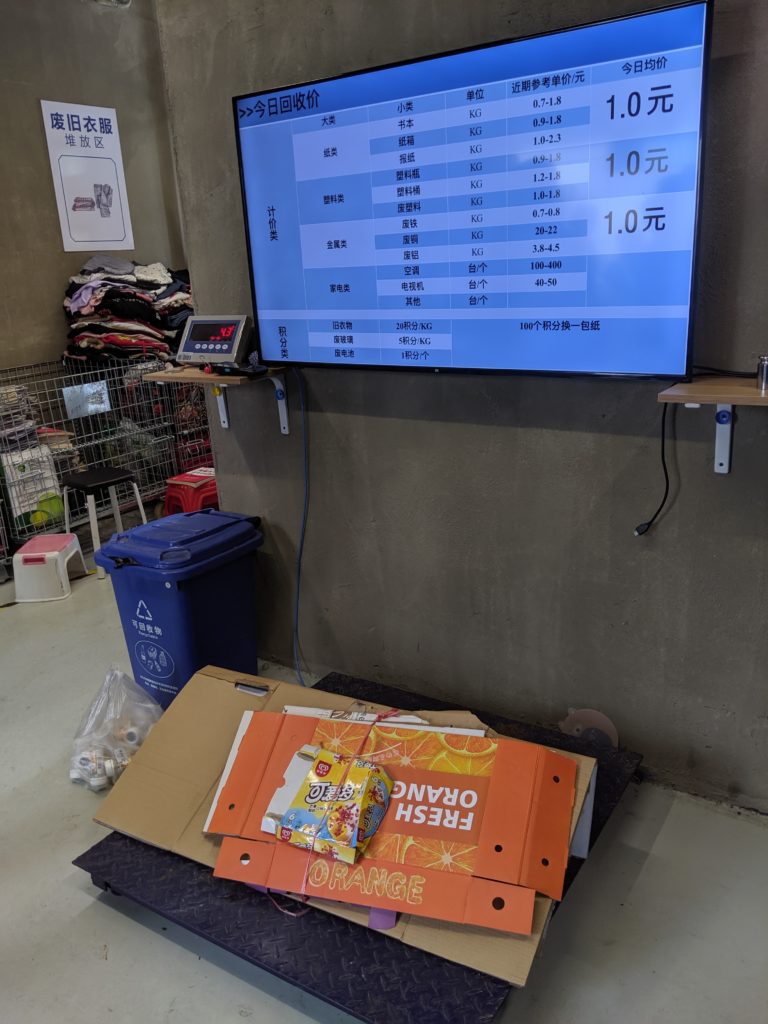

- Tianqiang has implemented technology enabled collection services. They have set up café style smart collection centers with digital scales that are linked to real time commodity prices. Residents get paid immediately by cash or credit according to the commodity price on a given day. Also, operators of the MRF are able to see the exact amount of recyclables collected from each transaction and accumulated at each center on a dashboard. This data helps inform the local government’s waste reduction targets for different communities.

Weighing paper recyclables at Tianqiang.

- Tianqiang is embracing vertical integration. Although their recycled plastic is sold mainly to car and furniture manufacturers, they are also producing their own products such as clothes hangers to sell to retailers. Their recycled paper is being sold directly to the no. 1 and no. 2 paper products manufacturers in China.

- Tianqiang’s collection centers are rent free, strengthening an earlier point that the Chinese government is supporting the development of local recycling infrastructure, for example by providing free land to encourage private sector growth.

Locals separating and sorting recyclables at Tianqiang.

The Latest Insights and Analysis from Chris Cui, Director of Asia Programs

The revision of China’s Solid Waste Management and Pollution Prevention Law could have far reaching impact on brands and recyclers.

A proposed revision to the Solid Waste Management and Pollution Prevention Law in China could affect the operations of brands and recyclers. The revised law entered the review phase at the 13th National Congress on June 25, 2019 and is now seeking public opinion. Below are some key implications of the clauses:

Impact on the packaging industry

Clause 2.13: Companies that produce, use, and store solid waste (SW) should publish their waste management information. Publicly listed companies must also publish their preventive measures against SW pollution.

This represents a significant departure from current protocol. Increased transparency and mandatory reporting requirements for public companies will incentivize companies to invest in SW prevention, potentially providing reputational rewards to those best-in-class. This kind of impact oriented investment fits nicely with the growing interest in ESG investing in China.

Clause 3.20: Producers of SW must pay Environmental Protection Tax.

This would add a new expense for manufacturers that could be passed onto consumers too. The commercial real estate sector in China recently had to adjust to the introduction of this, where previously they did not have to worry about their waste management expenses.

Clause 3.21: The design and production of packaging must follow green production standards that will be set up by the State Market Regulation to reduce waste generation. Producers of materials that fall under mandatory recycling categories must be responsible for the recycling of their materials. The list of mandatory recycling materials will be produced by NDRC (National Development and Reform Committee).

Clause 3.22: The government will encourage R&D institutes and producers to develop and use materials that can be easily recycled, safely stored, and that can decompose in a natural environment. Packaging materials that can’t be easily composted will be banned.

Clause 3.21 and 3.22: It’s encouraging to see that the government is not only promoting recycling, but also the reduction of waste through circular design and materials innovation. This will force brands to adopt circular packaging principles, so there will be a lot of room for innovation in eco-friendly packaging.

Clause 3.42: There will be EPR for electric appliances and other products.

Since 2018, this kind of EPR has been in effect for electric vehicle manufacturers, requiring better lifecycle management across the value chain – from product design and consumption to the recycling and waste management related to electronic vehicles at end-of-use.

Impact on the recycling industry:

Clause 3.28: Permits must be required for the transportation of SW across cities.

Demand for distributed, modular recycling units will grow so that waste can be processed more locally. The need for smart logistics will grow in tandem to optimize for more efficient transportation routes, among other things.

Clause 3.29: There should be a complete solid waste import ban by 2020.

While there has been a lot of speculation in the U.S. regarding whether or not China will implement a total waste import ban by late 2020, as declared in 2017, it is clear that the Chinese government plans to move ahead with this.

Clause 3.57: There will be differential charging schemes for residential waste.

The mandatory sorting of residential waste was introduced in certain pilot cities in China on July 1, 2019. In a district in Shanghai, it now costs $17 USD to dispose of 120 liters of food waste. You can read more about this on our blog on Recycling Rises to Power in China.

Although we do not know how likely it is that all of the proposed revisions will pass or when, the fact that there are so many proposed changes to the current law, which came into force in 1995, and that they’ve gone all the way to the desk of the National Congress, is a signal that waste management is a high priority for the central government. By reviewing the proposed changes, companies in China and abroad can better prepare for what’s coming down the line.

Unlike Europe, where the circular economy is championed by investors, the government, and consumers, in China it’s the government taking the driver’s seat. The proposed revisions to the law illustrate the steps the government is willing to take to develop the circular economy in China. In turn, industries are taking note and are seizing the subsequent business opportunities.

I would encourage brands that consider China as one of their key markets to give serious thought on how they can create a circular advantage to meet the growing demand for sustainable products in China before their competitors do. This will be critical in a context where a country is implementing increasingly strict solid waste management laws.

The reform on plastic pollution in China, the next big thing after National Sword?

At the 10th meeting of the Central Committee for Deepening Overall Reform on September 9th, chaired by the Chinese President, plastic waste reform was listed as a key issue. The following was cited:

“Actively responding to plastic pollution by restricting the production, sale, and use of some plastic products, actively promoting recyclable and biodegradable substitute products, and regulating plastic waste.”

We are still waiting for a detailed reform plan, but this is another huge boost for the development of a circular economy in China, supported by the government. Brands and recyclers in China and overseas should start to prepare for the changes brought by a reform like this.

The Key Takeaways from Fortune’s First Global Sustainability Forum:

This September, in Yunnan, China, I attended Fortune’s first Global Sustainability Forum, speaking on a panel on Waste Not. The Forum dived deep into the business opportunities and challenges that arise from the transition from a linear to circular economy, highlighting the following key points:

- There are three key driving forces behind circularity: increasing shareholder activism and interest in public companies’ ESG commitments; public awareness among consumers on the environmental footprint of products and services; and growing regulation in Europe and Asia to tackle waste issues, especially plastic pollution.

- Finance is slowly but surely reckoning with the economic risks posed by climate change and other environmental threats. ICBC, the world’s largest bank by assets, ran a stress test in 2015 and, we learned, issues higher interest loans to firms that are over-exposed to environmental hazards. The stress tests began in 2015, and have changed the way Chinese banks look at the businesses they fund, now reducing their exposure to coal projects and increasing their exposure to renewable energy.

- Building sustainable supply chains is challenging due to limited transparency around data, a lack of focused financing, and water and waste management typically being too cheap to account for negative externalities. Labor specific issues also often take precedence.

What’s Going on in China: Recycling’s Rise to Power

Chris Cui, Director of China Programs, builds bridges between the U.S. and Asia in order to advance the circular economy. She brings 13 years of cross-sector experience in financial service and philanthropy sectors in Asia, Europe and the U.S., advising Fortune 500’s emerging market strategies to capture growth potential from Asia.

The U.S. as well as other developed countries were taken by surprise when the Chinese government implemented a ban on the importation of recyclables on January 1, 2018. However, the Chinese government had been sending signals for the past decade of their future plans around both the importation of recyclables and the development of domestic recycling infrastructure.

Eight cities in China were selected as pilot cities for pilot recycling programs as far back as 2000 in order to study the most effective programs. Recycling gained significant attention in June 2019 when Chinese President Xi stressed the importance of cultivating the good habit to improve the living environment and to contribute to green and sustainable development.

“Trash classification is related to the people’s living environment and the economical use of resources. It is also an important embodiment of the level of civic-mindedness. Extensive education and guidance should be carried out to make the people realize the importance and necessity of garbage sorting.”

Chinese President Xi

It’s very rare that the top leader, rather than the Ministries in charge of the industry, make such strong statements about recycling.

Importantly, it demonstrates the priority that China has placed on the development of its own domestic recycling programs and infrastructure, as part of its effort to combat environmental issues that threaten the health of its 1.4 billion citizens. It also explains why China carried out the ban in the first place; they are continuing to shift their focus to developing domestic recycling infrastructure to feed their massive manufacturing base. Xi has made clear that the public sector will support the private sector to develop infrastructure to turn “waste” into opportunity.

So, what does this look like?

The Chinese government aims to increase recycling rates to 35% for residences by 2020, they’re building basic trash sortation systems and starting to charge waste management fees for both residential and commercial waste for 46 major cities by the end of 2020. They’re also expanding their trash classification system to all cities by 2025.

The four new trash sortation categories in China.

Image source here.

Case Study: Shanghai

Shanghai is one of the first cities to start responding to the policies from Central Government. Twenty-three million people must learn to sort their trash according to four labels – recyclables, dangerous goods, kitchen waste and other waste – under a mandatory sorting scheme starting on July 1. Misclassification will result in a fine of up to USD 30 for individuals, USD 7,200 for commercial entities and USD 70,000 for recyclers (and the potential revoking of their licenses). How to sort trash correctly is not just in the news, it’s the talk of the town and it’s even included in exam questions for schools.

For individuals who fail to sort their trash, their social credit rating, which not only determines their mortgage rate and insurance premium, but also their eligibility to purchase flight tickets and even send their kids to public schools, will be lowered.

Unsurprisingly, these new developments in recycling bring challenges, particularly around education and infrastructure. The Shanghai government has hired 1,700 instructors, conducted 13,000 training sessions, and created an app to handle enquiries to help citizens meet the requirements.

Meanwhile, the policy highlights the current lack of infrastructure for this kind of scheme. There needs to be significant investment from both the public sector and private sector to sufficiently grow the collection and sortation capabilities of the country. This especially applies to rural regions, which constitute a large proportion of China and lack the necessary infrastructure to deal with trash, especially tricky waste such as fertilizers and pesticides.

Yet all of these shifts have culminated in, and created, a significant business opportunity. Recycling needs investment now. China’s planned economy means that every five years, the central government will create an economic development plan for the country for the next five years. Key sectors that are targeted in the five-year plan will receive support, from specific policies to financial subsidies, that attract significant interest from the private sector. The recent emphasis on the recycling sector is a good example of this and, importantly, sends a positive signal to the market.

Residents in Shanghai search the internet for guidance on how to sort trash correctly.

Image source here.

The Business Opportunity Is Vast and Growing

At Closed Loop Partners, we know that keeping valuable commodities circulating in supply chains is good business. The current developments in China are spurring interest, excitement and investment in the space, which will continue to grow. There is room for both startups and bigger companies, domestic as well as foreign players, traditional players in the recycling industry and new players from other sectors like tech, marketing or consumer goods companies; all of whom are ready to innovate and embrace the change. We’re seeing a new structure of supply and demand around recyclables worldwide. Shanghai is just the beginning; more cities and business opportunities will arise in the coming years as a result of the combination of favorable factors:

The public markets are all in

With preferential policies and hundreds of billions of dollars to support the campaign, stocks have been rising for companies that supply equipment, chemicals and other services related to recycling.

The private sector is paying attention

More and more startups are emerging to solve the waste management problem in China, with some managing to raise money from mainstream VCs such as Alibaba, Baidu and Tencent. Robots for sortation, like AMP Robotics, or mobile apps for smart recycling stations or second hand mobile phones are just some examples of the innovations applicable in the field.

Demand for recycling related equipment and services is growing

As more cities follow the example of Shanghai and start mandatory urban trash recycling, related sales will jump significantly; sales of the smart trash bin on JD.COM soared by 613% between June 1-13 and it’s estimated that Shanghai residents bought 12% of the smart trash bins sold nationwide.

Sustainable packaging will be encouraged

Innovations in sustainable packaging will be welcomed by brands. Policies have been drafted on EPR in China for the packaging industry.

Opportunities for completely new business models are emerging

Challenges in the enforcement of trash classification means there are opportunities for entirely new business models to solve for the new pain points. For example, startups are offering online booking services for on-demand trash pickers and sorters that will come to your home.

If you’re interested in learning more on this topic, get in touch with Chris Cui and join us at these upcoming events:

- 14th China International Plastic Recycling Conference & Exhibition 2019, Sep 25-27, Shanghai, China. Closed Loop Partners is a co-organizer and will give the keynote.

- The Fortune Global Sustainability Forum 2019, Sep 4-6, Yunnan, China. Closed Loop Partners will be speaking on a panel.