Closed Loop Partners Provides Financing to Olyns, a Technology Startup Advancing Collection of Food-Grade Recycled Packaging

April 16, 2024

The catalytic loan will help scale production of Olyns’ reverse vending machines, increasing consumer access to recycling and advancing circular supply chains for consumer packaging.

April 17, 2024, New York, NY –– Circular economy-focused investment firm Closed Loop Partners announces the closing of a catalytic loan to Olyns, a technology and media company that engineered a new artificial intelligence (AI)-driven solution to improve the collection, sortation and recycling of consumer packaging. The financing from Closed Loop Partners’ private credit arm, the Closed Loop Infrastructure Group, will support the manufacturing of Olyns’ Cubes––AI-powered reverse vending machines that collect and sort packaging materials, including food-grade plastic, glass and aluminum––and accelerate the expansion of Olyns’ consumer recycling infrastructure across the U.S.

Founded in 2019 in Silicon Valley, Olyns is increasing access to consumer recycling with an innovative technology solution that makes material collection efficient and scalable through a self-sustaining business model. Olyns’ AI-powered Cubes are a new take on reverse vending machines, where people deposit eligible beverage containers and receive cash deposits back electronically. Not only do Olyns’ Cubes provide rewards to incentivize participation and include a screen that can display media, but their machines also leverage AI, enabling them to rapidly learn to recognize new deposited products sold by brands at retailers across the country, as well as track deposit rates by product and brand. This is especially relevant amidst growing policy around materials recovery, such as Extended Producer Responsibility (EPR). Olyns currently partners with top retailers and consumer goods brands to locate their Cubes in high traffic locations such as major supermarkets, big box stores, pharmacies and gas stations, ensuring recycling is convenient and advertisements are effective. By operating as both a consumer recycling network and digital out-of-home media network, Olyns is changing the economics of recycling.

Source: Olyns

Olyns not only has the opportunity to collect millions of containers per year, but also to improve material sortation to maintain the quality of the recycled materials. By using AI to identify and sort containers at the point of deposit into separate bins, Olyns minimizes the co-mingling and contamination common to traditional recycling. This results in industry-leading material recovery rates and bale quality, ensuring that more containers deposited can be made into new containers. The vast majority of the rPET collected in Olyns’ Cubes is food-grade and can be used as material for recycled bottles.

“The material quality of aluminum, PET and glass beverage containers collected by the Olyns reverse vending machines is some of the highest quality material Ming’s facilities receive from our customers,” said Jeff Donlevy, General Manager of Ming’s Recycling Corp, a current processor of Olyns CRV material. “Mixed plastic material collected through co-mingled programs often can’t achieve the same quality standards, and significant amounts end up in landfill. Olyns’ technology minimizes co-mingling, and consistently achieves the food-grade quality material that plastic reclaimers want.”

As the Olyns network scales, it helps unlock a new supply of recyclable post-consumer plastic and aluminum, helping corporations meet their sustainable packaging goals and reducing their dependence on virgin plastic from non-renewable sources. As demand for food-grade rPET is anticipated to outpace supply by about three times by 2030, scaling solutions that can bolster supply of high-quality recycled content is critical. By expanding recycling access to more locations, Olyns’ Cube network collects and processes a growing portion of the estimated 4.6 billion pounds of unrecycled PET that would otherwise end up in landfill every year, closing the loop on food-grade PET and reducing carbon emissions that would result from the production of virgin plastic.

“Greater consumer access to recycling, more efficient material sortation and economically sound recycling systems are critical to recovering high-quality materials,” says Philip Stanger, Co-Founder and CEO of Olyns. “Since we installed our first Cube in California in 2020, user growth has been phenomenal, proving that when people have easy access to recycling, impact is magnified. While we started with collecting PET plastic, aluminum and glass beverage containers, we are looking to build our AI capacity to potentially expand collection for hard-to-recycle materials, such as films and flexibles. Closed Loop Partners’ financing will help us build the circular economy infrastructure that helps make recycling possible for more materials, and accessible to more communities.”

The Closed Loop Infrastructure Group has been providing flexible loans to projects that build out circular economy infrastructure and innovation in the United States for nearly 10 years. This includes robust recycling infrastructure equipment, as well as rapidly growing companies poised to scale circular solutions. The loan to Olyns underscores the potential of new innovative solutions and creates a significant opportunity to increase material collection in underserved areas, including states without deposit return schemes such as bottle bills. By producing a source-separated, clean stream of materials, Olyns also helps bolster the market for high-quality recyclables, looping more material back into the same or similar products.

“We see immense opportunity to finance rapidly growing technology innovations, alongside large-scale recycling infrastructure, to improve materials sortation and accelerate the circular economy in the U.S. Expanding the types of financing available in the market can help meet the distinct needs of innovators developing new circular solutions. Catalytic capital is a powerful tool, providing the foundation needed to accelerate further growth,” says Jennifer Louie, Managing Director and Head of the Closed Loop Infrastructure Group at Closed Loop Partners. “Closed Loop Partners’ Infrastructure Group is proud to finance scalable and replicable solutions and provide access to the Closed Loop Partners ecosystem to support their growth. We are thrilled to partner with Olyns, as they disrupt material collection and advance more circular supply chains for valuable packaging materials.”

Moving forward, Olyns looks to further scale its solution, partnering with key brands to expand to new locations and increase collection and recovery of more materials, reducing reliance on natural resource extraction and driving forward a circular economy.

If you are interested in learning more about Olyns, visit here. If you are interested in applying for funding from the Closed Loop Infrastructure Group, learn more about Closed Loop Partners’ catalytic capital strategy here.

About Olyns

Olyns innovates at the nexus of retail media and recycling, connecting people to recycling and brands to customers. Founded in 2019 in Silicon Valley, Olyns’ pioneering ecosystem includes the Cube, an AI-powered reverse vending machine that provides self-serve beverage container recycling to consumers and includes a 55-inch screen to display advertising. Olyns partners with top retailers and consumer goods brands to locate Cubes in high traffic locations such as major supermarkets, big box stores, pharmacies, and gas stations, ensuring recycling is convenient and advertisements are effective. By operating as both a consumer recycling network and digital out-of-home media network, Olyns is changing the economics of recycling. With its use of artificial intelligence (AI) to identify and sort containers at point of deposit, Olyns minimizes the co-mingling and contamination common to traditional recycling and unlocks a valuable new supply of food-grade recycled plastic.

Olyns is on a mission to inspire people to recycle, stop the depletion of the earth’s resources, and accelerate the shift to a circular packaging economy. Learn more at www.olyns.com

About Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management, managing venture capital, buyout private equity and catalytic private credit investment strategies; its innovation center, the Center for the Circular Economy; and its operating group, Closed Loop Builders.

The firm’s catalytic private credit arm, the Closed Loop Infrastructure Group, provides a mix of flexible financing solutions to support a range of circular economy projects, companies, infrastructure and enabling technologies. The Infrastructure Group deploys catalytic capital, which seeks to accelerate and de-risk the development of high-impact projects and companies. Areas of strategic investment include: providing below-market rate loans to finance circular infrastructure, providing catalytic financing to increase recovery of hard-to-recycle plastics and PET bottles, and financing and deploying small-scale, modular materials recovery facilities (MRFs) to increase recycling in communities with no or limited access to recycling.

Closed Loop Partners is based in New York City and is a registered B Corp. Learn more at closedlooppartners.com.

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Partners or any company in which Closed Loop Partners or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Information provided reflects Closed Loop Partners’ views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision.

Does Compostable Packaging Actually Break Down? Composting Consortium Reveals Groundbreaking Findings from Largest Field Test in North America

Data in new report reveals that certified food-contact compostable packaging breaks down successfully at commercial composting facilities that meet reasonable operating parameters.

NEW YORK, April 16, 2024 /PRNewswire/ — Today, the Composting Consortium, an industry collaboration led by the Center for the Circular Economy at Closed Loop Partners, released a groundbreaking report that fills a critical data gap for the U.S. composting industry: how well does certified, food-contact compostable packaging actually break down in real-world composting facilities? The report, Breaking It Down: The Realities of Compostable Packaging Disintegration in Composting Systems, shares findings from an 18-month study––the largest known field test of certified, food-contact compostable packaging conducted in North America––revealing the realities of compostable plastic and fiber disintegration in diverse in-field composting conditions.

In total, the study tested over 23,000 units of certified food-contact compostable packaging within large-scale industrial composting environments. This encompassed 31 types of fiber packaging & products and compostable plastic packaging & products––such as PLA and PHA––across 10 diverse composting facilities across the U.S.

The data is released at a critical time, as compostable packaging grows as an alternative to conventional plastics amidst an urgent waste crisis. Roughly one-third of the world’s food is wasted each year––a loss estimated at $230 billion. Nearly 60% of the uncontrolled methane emissions from municipal landfills are caused by discarded food, highlighting its significant impact on the environment. To address the urgent food waste and climate challenge, demand for organics circularity is rising, and with it, the volume of food-contact compostable packaging––a market poised to grow 16% annually in the U.S. until 2032, 4x faster than traditional plastic packaging. Today, the U.S. composting industry is in an early stage of transformation to accept and process more food waste; approximately 70% of the composters who process food also accept and process some format of food-contact compostable packaging, with the understanding that accepting these materials helps bring in more food waste to their facilities.

For compostable packaging to reach its full potential as a circular packaging solution, disintegration at end-of-life is critical, in tandem with consistent labeling and design that differentiates compostable and non-compostable packaging further upstream, as well as policies that incentivize robust composting infrastructure to process these materials. In this new study, the Composting Consortium focuses on how compostable packaging breaks down. Previously, scant information was publicly available on the disintegration of compostable packaging, particularly on the compost environments in which they disintegrate.

This groundbreaking study found that overall, compostable packaging breaks down successfully at composting facilities that meet reasonable operational parameters (e.g., compost pile temperatures, moisture, oxygen, pH, etc., defined in The Composting Handbook). While the Consortium’s study did not assess disintegration with the intention to “pass” or “fail” any specific compostable packaging or product, notably, the average compostable plastic and fiber packaging in-field performance in this study met disintegration thresholds used by industry groups:

- Compostable plastic packaging and products broke down successfully across five composting methods, and all 10 facilities’ varying processing timeframes and operating conditions, achieving 98% disintegration on average by surface area, which exceeds industry thresholds to achieve a 90% or higher disintegration.

- Compostable fiber packaging and products achieved 83% disintegration on average by surface area, meeting industry thresholds to achieve an 80% or higher disintegration. Findings showed that certain operating conditions, like turning, agitation and consistent moisture levels above 50%, support increased disintegration of fiber packaging and products.

The findings point to the viability of certified food-contact compostable packaging as an alternative packaging solution to single-use conventional plastic packaging. It also highlights the importance of ensuring that these materials align with available recovery infrastructure, and the importance of expanding robust recovery pathways to divert compostable packaging, and the food scraps they carry, from landfill––that is at the core of the Composting Consortium’s mission.

The Composting Consortium, in collaboration with its brand and industry partners, the US Composting Council, the Compost Research and Education Foundation and other groups, will leverage these findings to help inform policymaking around compostable packaging, update best management practices for composting facilities and shape a field test standard for evaluating compostable packaging disintegration at composting facilities. Data from this study will be donated to the Compostable Field Testing Program (CFTP), which will later launch an open-source database on the disintegration of compostable packaging. Additionally, ASTM International is currently developing an in-field test method for assessing disintegration of compostable items at composting facilities, and the data from this study will be used to inform the draft field testing method. As the Consortium moves into its next phase of work, the results of this study will shape its engagement and education efforts with composters, municipalities, regulators, brands and packaging manufacturers.

“Field testing for disintegration has been ongoing for three decades, and the Composting Consortium’s work across the value chain has significantly advanced insights for the industry,” says Diane Hazard, Executive Director of the Compost Research and Education Foundation. “The collaborative approach and open-source data from this project both advances field testing methods and equips compost manufacturers and brands with the knowledge to better understand the variability of disintegration across different systems, all major steps towards successfully processing compostable packaging.”

“Brands and manufacturers must prioritize material selection and design and labeling for compostable packaging to achieve optimal performance in composting environments, which can then incentivize composters to accept food-contact compostable packaging materials at their facilities,” says Frank Franciosi, Executive Director of the US Composting Council, an industry partner of the Composting Consortium. “As feedstock for composters becomes diversified and more complex, it’s important for all entities within the supply chain to support consumer education on source separation of organics and reevaluate best management practices to support those composters who choose to accept compostable packaging, and this study is another tool for our industry to be able to start that process.”

“Alongside design and reduction as well as reuse and recycling, composting is an important solution for waste mitigation. Through this research, the Composting Consortium sheds light on what is needed for compostable packaging to have the greatest positive impact. Informed by this robust data, we can together ensure the responsible growth of compostable packaging and composting infrastructure, and drive toward circular outcomes, including increased diversion of food scraps and compostable packaging from landfills,” says Kate Daly, Managing Director and Head of the Center for the Circular Economy at Closed Loop Partners.

The study brought together the Consortium’s corporate brand partners, including PepsiCo, the NextGen Consortium, Colgate-Palmolive, Community Impact at Danaher, Eastman, The Kraft Heinz Company, Mars, Incorporated and Target Corporation; technical partners including the US Composting Council, Resource Recycling Systems (RRS), the Compostable Field Testing Program (CFTP) and the Biodegradable Products Institute (BPI); and a cohort of compost partners including Atlas Organics, Napa Recycling & Waste Services, Specialized Environmental Technologies, Windham Solid Waste Management, Black Earth Compost, Ag Choice Organics Recycling, Happy Trash Can Compost, Veteran Compost and Dayton Foodbank. Advisory partners include 5 Gyres, Foodservice Packaging Institute (FPI), ReFED, the Compost Research and Education Foundation (CREF), the Sustainable Packaging Coalition (SPC), Compost Manufacturing Alliance (CMA), Eco-Cycle, University College London (UCL), Western Michigan University (WMU), University of Wisconsin-Stevens Point and World Wildlife Fund (WWF).

About the Composting Consortium

The Composting Consortium is a multi-year collaboration to pilot industry-wide solutions and build a roadmap for investment in technologies and infrastructure that enable the recovery of compostable food packaging and food scraps. The Composting Consortium is managed by Closed Loop Partners’ Center for the Circular Economy. Learn more about the Consortium at closedlooppartners.com/composting-consortium/

About the Center for the Circular Economy at Closed Loop Partners

The Center for the Circular Economy is the innovation arm of Closed Loop Partners, a firm at the forefront of building the circular economy. The Center executes research and analytics, unites organizations to tackle complex material challenges and implements systemic change that advances the circular economy. The Center for the Circular Economy’s expertise spans circularity across the full lifecycle of materials, connecting upstream innovation to downstream recovery infrastructure and end markets. Learn more about the Center for the Circular Economy at closedlooppartners.com/the-center/

10 Years of Building the Circular Economy

April 11, 2024

Closed Loop Partners is proud to celebrate 10 years of building the circular economy. This is part of a series of insights to mark this milestone, highlighting key advancements over the last decade––and the continued work needed over the next decades to accelerate the transition to the circular economy.

In January 2014, Doug McMillon, the CEO of Walmart, invited the CEOs and leadership of Unilever, P&G, PepsiCo, The Coca-Cola Company, Kenvue (formerly Johnson & Johnson Consumer Health) and Keurig Dr Pepper to join him on stage at the annual meeting of Walmart’s suppliers. It was a groundbreaking moment. Some of the world’s largest corporations announced that they had joined together as the founding investors in the Closed Loop Fund, the inaugural fund of Closed Loop Partners, and one of the first investment funds focused on financing the development of the circular economy.

It was a monumental first step toward changing the trajectory of how we use our planet’s resources––away from a ‘take-make-waste’ economy and toward a waste-free world designed around resource efficiency, driving economic growth. This is the beginning of our story at Closed Loop Partners.

Several key factors led to that moment on stage. My journey before Closed Loop Partners had given me a clear view into the economic opportunity of rebuilding antiquated and inefficient supply chains into efficient and circular supply chains that continually reused materials in local markets. An urgent waste crisis, an increase in environmental regulation and growth in consumer demand for environmental responsibility, coupled with the emergence of circular innovations, made developing the circular economy so important to the future of business that it brought competitors together to form the Closed Loop Fund. This collaboration by industry leaders helped lay the foundational infrastructure for the circular economy in the U.S.

A few years later, as the circular economy gained momentum, our original Closed Loop Fund attracted additional corporate investors, including 3M, Amazon, BlueTriton, Colgate-Palmolive, Danone and Starbucks, catalyzing more capital into circular economy infrastructure. As our ecosystem grew, adding more strategies and asset classes, it attracted capital from financial institutions, including funds and accounts managed by BlackRock, leading family offices and foundation endowments. To meet the growing interest in the circular economy, the vision of Closed Loop Fund was expanded into other strategies, now comprising Closed Loop Partners.

What started with one fund a decade ago has grown into three businesses that form the Closed Loop Partners ecosystem, focused on three key development areas of the circular economy: our investment arm, Closed Loop Capital Management, invests in circular solutions across venture capital, catalytic private debt and buyout private equity strategies; our innovation and advisory group, the Center for the Circular Economy, advances critical research and manages unprecedented pre-competitive industry collaborations; and our operating group, Closed Loop Builders, houses our first operating company, Circular Services, the largest privately held recycling company in the U.S.

As I look back, some of Closed Loop Partners’ earliest catalytic investments demonstrate our founding vision and the foundation of the circular economy:

- A decade ago, as changes in global policy highlighted the need for local circular economy infrastructure in the U.S., investments in recycling capacity expansion became critical. Eureka Recycling, a recycling company servicing Minneapolis and St. Paul, Minnesota, was a first mover in elevating U.S. recycling, leveraging their operational experience and engaging with policymakers, industry leaders and community advocates to influence systems change. Financing from Closed Loop Partners over the past 10 years supported a three-fold increase in Eureka’s polypropylene plastic recovery. Since then, they continue to be a leader in setting the standard for best-in-class recycling operations and infrastructure.

- As the circular economy grew in the U.S., upgrades to municipal recycling systems were needed to keep pace with a growing volume of recovered materials. When aging recycling equipment needed replacing, the Waste Commission of Scott County pursued the change from dual- to single-stream recycling to improve material collection. Closed Loop Partners’ first loan nearly 10 years ago enabled the purchase of larger carts for curbside recycling and a redesigned single-stream MRF. The success of our first municipal loan catalyzed follow-on loans in 2018 and 2022, now enabling the county to serve 185,000+ households and process over 40,000 tons of paper, metal, glass and plastic per year.

- The onset of corporate waste reduction goals also meant a rise in demand for alternative packaging. TemperPack was one of our first investments to advance new sustainable materials. TemperPack developed the first high performance, curbside recyclable thermal packaging for shipments of perishable goods such as food and pharmaceuticals. Today, they continue to be a leader in packaging innovation, with a range of solutions that protect products, strengthen brands, and keep waste out of supply chains.

- Innovative circular solutions include new technologies that can work alongside material reduction, reuse and mechanical recycling to recover hard-to-recycle materials. One of our first investments was in PureCycle Technologies––its patented recycling process, developed by P&G and licensed to PureCycle Technologies, separates color, odor and any other contaminants from plastic waste feedstock to transform it into virgin-like resin. PureCycle closes the loop on the reuse of recycled plastics while making recycled plastics more accessible to companies looking to use a sustainable, recycled resin.*

Since these catalytic investments were first made, the market has matured and Closed Loop Partners’ work has expanded to include venture capital and buyout private equity, as well as innovation advancement, infrastructure development and circular materials management. These early investments were a market signal, and our work today is a foundation upon which we will invest in and build the circular economy over the coming decades––as profitability attracts more investment and as supportive policy accelerates tailwinds for incumbent supply chains to transition to circularity.

Closed Loop Partners now supports over 1,000 jobs across its ecosystem, all dedicated to advancing the circular economy. We are proud to work with leading organizations, cutting-edge innovators and over 50 of the world’s largest corporations committed to reducing waste across multiple areas––including plastics & packaging, organics, textiles and electronics. Closed Loop Capital Management manages over $500 million and has invested in over 80 companies, municipalities and organizations accelerating circular solutions. Together, our investments have kept 4.8 million tons of material in circulation and avoided 10.1 million tonnes of greenhouse gas emissions to date. The Center for the Circular Economy has led groundbreaking industry-leading pre-competitive collaborations that are focused on solving some of the most complex supply chain and manufacturing challenges, including reduction, reuse and recovery solutions for foodservice packaging and retail bags. And most recently, with over $700m in commitments from Brookfield, Microsoft, Nestlé, PepsiCo, SK Group, Starbucks and Unilever, we launched Circular Services, which is now the largest privately held recycling company in the U.S. It operates 20 recycling facilities and serves some of the largest municipal contracts in the nation including New York City, Palm Beach County, Austin, San Antonio and Phoenix.

Closed Loop Partners has evolved as the circular economy has advanced. Today, the circular economy is recognized as a core solution to climate change mitigation as we all as a template for more efficient business operations. As more stakeholders recognize the financial and environmental opportunity of the circular economy, billions of dollars are beginning to move toward circular systems. More industry leaders are collaborating around shared waste reduction goals, leaders of countries are working together on a global plastics treaty, U.S. states are proposing and passing bipartisan Extended Producer Responsibility (EPR) legislation to fund recycling programs, and C-suites of Fortune 100 companies are pushing to achieve ambitious publicly stated circular economy and climate goals.

Transforming entire supply chains across multiple industries is the work of generations, but the world is changing faster today than it was 10 years ago. As Closed Loop Partners enters a new decade of action and impact, we see a future ripe with opportunity. We are now at a pivotal point, and the next decade will be critical to delivering outcomes and building transparent, circular systems. There is much more work to be done in the next phase of this systemic shift, but together with strategic partners, and across our platform, we are focused on expanding our impact and rebuilding industries to follow nature’s lead––grounded in resource regeneration and positioned for a resilient future.

As we celebrate this milestone in 2024, we will be sharing key insights on our impact over the last 10 years, and what is to come in the next decades of building the circular economy.

We invite you to join us in the transition to the circular economy.

—

*In October 2020, PureCycle Technologies fully paid off its loan from Closed Loop Partners, thus exiting the Closed Loop Infrastructure portfolio as a borrower. The Closed Loop Partners team, however, continues to engage with the PureCycle Technologies team as they continue growing their operations.

*This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Partners or any company in which Closed Loop Partners or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Information provided reflects Closed Loop Partners’ views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision.

First-of-Its-Kind Study by the Composting Consortium Analyzes Contamination Rates Across U.S. Composting Facilities

February 28, 2024

Commonly held assumptions about contamination were put to the test, revealing new data on the realities of contamination at composting facilities.

February 28, 2024, New York, NY — Today, the Composting Consortium, an industry collaboration led by the Center for the Circular Economy at Closed Loop Partners, released an unprecedented report on compost contamination, Don’t Spoil the Soil: The Challenge of Contamination at Composting Sites. The report reveals first-of-its-kind data on the amount of contamination at U.S. composting facilities, and the significant cost to manage it. Working with composters across the U.S., the Consortium’s in-field study quantifies contamination rates in feedstock and finished compost, highlighting a need for policy, innovation and packaging design to help composters improve contamination mitigation and strengthen organics recovery processes.

The report is released at a critical time for the composting industry, as pressure increases around the growing food waste crisis in the U.S. Today, nearly 40% of food is wasted and sent to landfill in the U.S.––at a loss of $430 billion––and only about 4% of all post-consumer food waste generated by Americans is sent to composters. Organics collection and infrastructure is one key solution to the crisis. To meet growing demand, the U.S. composting industry is shifting. While most composting facilities in the U.S. still only process yard trimmings, curbside organics collection has surged by 49% since 2021. Composter feedstock acceptance policies are also slowly shifting to match demand, with approximately 145 full-scale compost facilities in the U.S. now accepting food waste and some forms of food-contact compostable packaging—that packaging can be a key vessel for diverting food waste to compost, if recovered at composting facilities.

There is eagerness among compost manufacturers to be a part of the food waste solution, but concerns about contamination risks in the organics stream continue to be the one of biggest barriers to greater acceptance of food waste and food-contact compostable packaging. Concerns are increasing amidst the growing volume of compostable packaging in the U.S., largely due to look-alike, non-compostable packaging inadvertently entering the composting stream due to unclear labeling and confusion among consumers. This creates operational and financial challenges for haulers and composters, hindering further acceptance of food waste across the country.

Before the Composting Consortium released this report, there was little to no publicly available data on the amount and types of contamination in feedstock or finished compost products, or the time and money spent by composters to manage contamination at their facilities. To support the composting industry in its transition to accept food waste and food-contact compostable packaging, the Composting Consortium set out to address this data gap by conducting a first-of-its-kind study with 10 leading composters of varying sizes across the continental U.S., capturing a geographically and operationally diverse dataset on contamination volumes and decontamination practices.

The study measures and characterizes contamination across different points of the composters’ processes––and analyzes the financial cost to composters to handle contamination. The study examines five commonly held assumptions about contamination and compostable packaging, and breaks down in-field realities in a data-backed and easy-to-follow format. Key findings include:

- Conventional plastic is the most common contaminant received by composters, making up an average of 85% of the contamination that composters receive, by volume;

- Despite diligent efforts to combat contamination, conventional plastic can persist in the finished compost; 4 out of 10 composters in the study had trace amounts of conventional flexible plastic in their finished compost;

- Contamination has a significant impact on the bottom line; on average, 21% of composter operating costs are spent on contamination removal;

- Most composters had contamination, irrespective of whether or not they accept compostable packaging; several factors contribute to the levels of contamination that a facility receives;

- Eight out of nine composters who accept compostable products in the study had no detectable amounts of compostable packaging in their finished compost.

The data confirms the pervasiveness of plastic contamination, and the need to further mitigate this challenge, both upstream and downstream in the composting value chain. It also highlights that more consistent and standardized compostable packaging design and labeling is needed to ensure that certified, food-contact packaging is properly sorted and recovered at end of life. In the same vein, non-compostable packaging should be distinct in its design and labeling to reduce the risk of conventional plastic packaging making its way into the organics stream. Composters must be supported and incentivized to accept food and certified food-contact compostable packaging, to ensure these materials drive value and circular outcomes to the composting industry.

“Addressing contamination is critical to paving the way for broader organics recovery as a key solution to the food waste crisis in the U.S.,” says Kate Daly, Managing Director of the Center for the Circular Economy at Closed Loop Partners. “The Composting Consortium’s findings shed light on the significant opportunities––and challenging realities––of composting in the U.S. today. This study lays the groundwork for future research and investment to scale end-of-life solutions for food and food-contact compostable packaging to drive circular outcomes.”

This study is an important snapshot of a pervasive challenge that affects the compost industry. This work represents the Composting Consortium’s continued efforts to break siloes and bring together the key stakeholders––upstream, midstream and downstream––to remove barriers and advance a circular economy for organics and compostable packaging. Addressing contamination requires enhancing transparency, intensifying educational efforts and championing innovation. Additional research and collaboration across the entire composting and compostable packaging ecosystem can help pave the way for a circular future, turning food waste into a valuable resource and relieving composters from the burden of contamination.

About the Composting Consortium

The Composting Consortium is a multi-year collaboration to pilot industry-wide solutions and build a roadmap for investment in technologies and infrastructure that enable the recovery of compostable food packaging and food scraps. The Composting Consortium is managed by Closed Loop Partners’ Center for the Circular Economy. PepsiCo and the NextGen Consortium are founding partners of the Consortium. Colgate-Palmolive; Community Impact at Danaher; Eastman; The Kraft Heinz Company; Mars, Incorporated; and Target Corporation joined as supporting partners, and the Biodegradable Products Institute, the US Composting Council and the U.S. Plastics Pact joined as industry partners. Our compost partners for the Contamination Pilot include Ag Choice, Atlas Organics, Black Earth Compost, Dirt Hugger, The Food Bank at Dayton, Happy Trash Can Compost, Napa Recycling, Specialized Environmental Technologies (SET), Veteran Compost, and Windham Solid Waste Management District. Our advisory partners include 5 Gyres, Foodservice Packaging Institute (FPI), ReFED, Compost Research and Education Foundation (CREF), the Sustainable Packaging Coalition (SPC), Compost Manufacturers Alliance (CMA), Eco-Cycle, University College London (UCL), Western Michigan University (WMU), University of Wisconsin-Stevens Point and World Wildlife Fund (WWF). Learn more about the Consortium at closedlooppartners.com/composting-consortium/

About the Center for the Circular Economy at Closed Loop Partners

The Center for the Circular Economy (‘the Center’) is the innovation arm of Closed Loop Partners, a leading circular economy-focused investment firm in the U.S. The Center executes research and analytics, unites organizations to tackle complex material challenges and implement systemic change that advances the circular economy. The Center for the Circular Economy’s expertise spans circularity across the full lifecycle of materials, connecting upstream innovation to downstream recovery infrastructure and end markets.

Many Americans Don’t Understand What to Do with Compostable Packaging. Here’s a Solution.

February 20, 2024

As countries and corporations get one year closer to their own deadlines for meeting major climate targets, there are some important pathways to emissions reduction that cannot be ignored. Food waste mitigation is one of them.

Roughly one-third of the world’s food is wasted each year––a loss estimated at $230 billion. Nearly 60% of the uncontrolled methane emissions from municipal landfills are caused by discarded food, highlighting its significant impact on the environment. To address the urgent food waste and climate challenge, demand for organics circularity is rising, and with it, the volume of food-contact compostable packaging––a market poised to grow 16% annually in the U.S. until 2032, 4x faster than traditional plastic packaging.

Certified, food-contact compostable packaging can enable the diversion of food waste from landfill and support a circular economy. If food packaging filled with food scraps is properly recovered and sent to composting facilities, then this food wouldn’t end up emitting greenhouse gases in landfills. The food and packaging would also be converted into nutrient-rich compost. But if certified compostable packaging is not appropriately collected and processed into compost after it’s used, more waste is created.

We often hear that there is a lack of recovery infrastructure for compostable materials. The reality is, U.S. composting infrastructure is in the middle of transitioning from processing just yard waste to accepting more types of inputs, including post-consumer food waste and food-contact compostable packaging. Today, 70% of the 200 full-scale composting facilities that process food waste already accept and process some forms of compostable packaging. Plus, 15 million Americans have access to organics collection, a dramatic 49% increase in access since BioCycle’s last survey in 2021.

For food-contact compostable packaging to be successful in the market today, labeling and design need to be aligned so that consumers throw packaging in the right bin, and composters can easily process these materials. Yet, data shows that some labels confuse consumers, who mistake packaging as compostable when it’s not, or misunderstand where to dispose of that packaging at the end of its use.

Without policies that drive clear, standardized labels and instructions on where compostable packaging needs to go after it’s used, a lot of it ends up in landfills or contaminating recycling streams. Conversely, non-compostable look-alike products and packaging can make their way to compost facilities where they end up contaminating the soil. These look-alikes are the primary contamination challenge in the organics stream.

To address this challenge, the Composting Consortium, led by the Center for the Circular Economy at Closed Loop Partners, and the Biodegradable Products Institute (BPI) embarked on a joint study to test different packaging label and design approaches, and how these inform consumers’ assumptions on what to do with compostable packaging after it’s been used. The findings can inform policies that better support labeling practices and standards for both compostable and non-compostable packaging. In the U.S. today, five states have compostable packaging labeling laws, including Washington, California, Colorado, Minnesota and Maryland. Other states, like Virginia and New Jersey, recently introduced laws that would establish recycling labeling requirements.

Until this study, this information on American consumers had not been publicly available. The Composting Consortium and BPI released the findings in a first-of-its-kind industry report. Here’s a snapshot of what the data reveals:

- Nearly 1/3 of respondents say they would place compostable packaging in the recycling bin

Compostable packaging is not designed to be recycled at a material recovery facility (MRF) and can contaminate the recycling stream if intermixed with fossil fuel-based plastics. Compostable packaging that mistakenly ends up in recycling streams loses a significant portion of its value and creates a contamination challenge that impedes the recovery of valuable recyclable materials. Cross-contamination of the recycling and composting streams is an expensive operational challenge and would pose significant risk to both industries. Brands that have set ambitious sustainable packaging goals are also impacted by inadequate collection and processing of these materials.

Our recommendation: Brands and municipalities should work together on educational campaigns and clear, on-pack messaging.

- Up to 50% of respondents say they would place packaging labeled as “made from plants” in the composting bin

“Made from plants” describes the materials used to make the packaging, not where the package should go at the end of its use. In fact, “made from plants” claims are commonly found on plastic packaging that should be recycled (i.e. PET made from ethanol derived from corn). Our study found that American consumers are especially confused by products and packaging that are not actually compostable yet have green or natural coloring, green tinting, or make claims such as “made from plants” without any context or disclaimer language. These plastic, non-compostable materials are virtually indistinguishable from their compostable counterparts.

Our recommendation: Brands and policymakers should support labeling policies that standardize clear, consistent consumer communications, design and labeling.

Source: Alamy

- Adding a trusted certification logo and larger “compostable” call out increases consumers’ ability to identify packaging as compostable by up to 22%

Our study finds that using at least two to three design elements that call out compostability on food-contact compostable packaging, such as the BPI certification mark, the intentional use of tinting and coloring, and a more prominent “compostable” call out, is most effective for consumer understanding.

Our recommendation: Brands and manufacturers should refer to the Composting Consortium’s latest report and BPI’s Industry Labeling Guidelines for specific examples of packaging design strategies that improve consumer identification, increase recovery of compostable materials and mitigate contamination at facilities.

Coming this month: A new report from the Composting Consortium on contamination rates at different composting facilities! Sign up for a webinar to learn about our findings here!

Without standardized labeling, misleading designs and claims will continue to cause consumer confusion. This research provides insights to brands, manufacturers, consumers, policymakers, municipalities, composters and other stakeholders on effective design and labeling techniques that could improve the diversion of food-contact compostable packaging to the right material stream. While these new findings shed light on the issue, this is just the beginning. As the composting space rapidly evolves, complementary studies will be critical to advancing the recovery of compostable packaging––a critical path to reducing food waste and greenhouse gas emissions.

Learn more about these findings in the latest report from the Composting Consortium and BPI here: https://www.closedlooppartners.com/research/us-consumer-perception-of-compostable-packaging/.

Circular Services Acquires Midwest Fiber Recycling, Expanding Services for Communities in the U.S.

December 18, 2023

The acquisition of a leading Midwest recycling company expands Circular Services’ holistic materials management services to support more communities and companies across the U.S.

December 18, 2023, New York, NY – Circular Services, a leading developer and operator of circular economy infrastructure in the U.S., announced its acquisition of Midwest Fiber Recycling, growing the portfolio of materials recovery facilities under Circular Services’ recycling arm, Balcones Recycling. This marks Circular Services’ expansion into the Midwest of the U.S., to support existing recycling infrastructure and services in the region and increase the recovery of valuable materials into domestic supply chains.

Midwest Fiber began in 1990 when founders Ron and Linda Shumaker purchased the Decatur Recycle Paper Company. Since then, with sons Mike and Todd Shumaker, they have grown the company into one of the largest recycling operations in the Midwest, with facilities in Decatur, Normal, Urbana and Peroria, IL and Terre Haute, IN. Today, Midwest Fiber services residential single-stream and commercial properties via a dedicated collection fleet. In addition, Midwest Fiber provides document destruction and recycling services and has a recycled material brokerage arm that helps generators maximize value by marketing directly to end-users. Following the acquisition, Midwest Fiber’s management team will continue to run the company, partnering with the Circular Services team and leveraging its broader platform to continue its growth trajectory.

“Todd and I waited to find the right partner,” said Mike Shumaker, CEO of Midwest Fiber Recycling. “The singular focus of Circular Services and Balcones Recycling on advancing robust circular materials management, as well as their longstanding experience operating recycling infrastructure, made them a great fit. We look forward to working alongside their team, and leading our family business into the next chapter.”

The acquisition is taking place at a critical time as more cities across the U.S. prioritize zero-waste goals, due to the combined urgency of climate risks and increasing landfill costs. Similarly, many leading corporations in the U.S. are committing to keep more materials in circulation and incorporate more recycled content in their packaging, as part of their larger sustainability and net zero goals. According to the Circularity Gap Reporting Initiative, 70% of all global greenhouse gas (GHG) emissions are related to material handling and use, making circular economy infrastructure a critical part of the solution to the climate crisis. Expanding access to recycling and reuse services will enable cities and businesses to avoid the costs and emissions of landfilling products and packaging and achieve their sustainability goals.

Circular Services operates several companies to offer holistic circular materials management services, helping municipalities and businesses close the loop on valuable materials, including paper, metal, glass, plastics, organics, textiles and electronics. Among these companies is Balcones Recycling, Circular Services’ recycling company. Prior to this acquisiton, Balcones Recycling was already one of the largest independent recycling companies in the country, handling more than 1 million tons of recyclables each year through its operations in New York, New Jersey, Florida, Texas, Arizona and Arkansas. Following this acquisition, Balcones Recycling will operate 18 materials recovery facilities across the U.S., including five from Midwest Fiber.

“The Shumakers have built and led a great company with an excellent reputation as they served their surrounding communities for over 30 years,” said Tom Outerbridge, CEO of Balcones Recycling. “We are proud to join forces with Mike, Todd and their management team and leverage our collective expertise and growing portfolio of facilities to offer custom, effective recycling solutions to more municipalities, counties and small-to-large businesses.”

“We are excited to expand Circular Services and have Midwest Fiber Recycling be a part of our larger portfolio of infrastructure and services keeping materials in circulation—from paper, to plastic, organics, electronics, textiles and more,” said Amy Wagner, CFO & EVP of Business Development & Operations, Circular Services. “We look forward to expanding our services to the Midwest region of the U.S., and into commercial and brokerage services, providing more communities and companies with the infrastructure needed to reduce dependence on extraction and landfill, and advance a circular economy.”

About Balcones Recycling

Balcones Recycling is a Circular Services company. As a pure-play recycling company, Balcones is on a mission to recover all recyclables from the waste stream. As such, we design custom recycling programs focused on keeping resources away from landfills. We are known for building state-of-the-art facilities and fostering great partnerships with small-to-large businesses, counties and municipalities. We don’t stop at processing – we are active in key industry initiatives to increase the circularity of our materials and economy. We prioritize education and outreach initiatives to improve recycling participation. We love what we do and look forward to partnering with you to build a circular economy, one bale at a time. Learn more about Balcones Recycling at https://www.balconesrecycling.com/about/

About Circular Services

Circular Services is the operating group of Closed Loop Partners, a leading investment firm focused on advancing the circular economy. Circular Services provides holistic, circular materials management to close the loop on valuable materials for municipalities and businesses throughout the United States. Employing innovative technology within reuse, recycling, remanufacturing and re-commerce solutions, Circular Services improves regional economic and environmental outcomes by building resilient systems to keep food & organics, textiles, electronics, packaging and more, in circulation and out of landfill or the natural environment. For more information, please visit https://www.closedlooppartners.com/circular-services/

Closed Loop Partners Invests in Circular Manufacturing Company, Minus Works, Accelerating Sustainable Solutions for Cold Chain

December 06, 2023

The loan from Closed Loop Partners’ Infrastructure Group will help the company scale production of sustainable gel packs, reducing waste in the shipping of perishables

December 6, 2023, New York, NY –– Circular economy-focused investment firm Closed Loop Partners announces the closing of its loan to Minus Works, a manufacturing and technology company developing circular solutions for the cold chain. Minus Works builds products to reduce waste in the shipping of perishable products, primarily through sustainable gel packs and freezing process innovations. Financing was deployed through Closed Loop Partners’ catalytic private credit arm, the Closed Loop Infrastructure Group, to support the company’s expansion to meet growing demand for environmentally friendly alternatives to single-use plastic encased gel packs, and create a new end market for recycled paper.

Founded in 2020 and based in Farmingdale, New York, Minus Works is disrupting the cold chain with their BRiQ smarter coolant, a sustainable, high-performance gel pack and freezing process for the shipping of perishables, which aims to reduce single-use plastic waste and avoid greenhouse gas emissions in the supply chain. Made with recycled content paper, as well as a compostable gel interior, BRiQ serves as a non-toxic, circular alternative to single-use plastic wrapped gel packs. With freezing co-located at the gel manufacturing site, Minus Works also reduces required production space by 80%, and reduces costs and emissions associated with transportation.

Today’s standard gel packs are the biggest source of waste in the last mile cold chain, with the vast majority discarded into landfill, or contaminating the recycling stream. Most gel packs are made with single-use, non-curbside recyclable low-density polyethylene (LDPE), and use a petroleum derivative for the gel. Demand for less wasteful alternatives continues to increase as industries that are dependent on the cold chain––such as meal kit delivery services––continue to grow, and perishable packaging materials are expected to shift amidst upcoming Extended Producer Responsibility and “Truth in Labeling” regulations.

The Closed Loop Infrastructure Group has been providing flexible loans to projects that build out circular economy infrastructure and innovation in the United States for nearly 10 years. The loan to Minus Works builds on previous investments in circular economy infrastructure and technologies, including investments in the packaging manufacturing space, such as TemperPack, a leading developer and manufacturer of sustainable packaging materials. The Closed Loop Infrastructure Group aims to advance projects and solutions that keep valuable recyclable materials in circulation for longer, upgrade recycling infrastructure and strengthen end markets for recyclable material.

“Minus Works is accelerating circularity for an industry that has remained largely unchanged for half a century. We are excited about their growth potential, as well as the role that we expect the company to play as a new end market for recycled fiber markets, while reducing waste, emissions and fresh water use in the cold chain industry,” says Jennifer Louie, Managing Director and Head of the Closed Loop Infrastructure Group at Closed Loop Partners. “Closed Loop Partners’ Infrastructure Group is thrilled to partner with Minus Works and to have them as a portfolio company. The company’s values mirror that of other mission-aligned organizations that we have invested in who are committed to advancing innovations and infrastructure to support a circular economy.”

“We at Minus Works see immense opportunity for building new products and introducing new processes that will disrupt the resource-intensive cold chain industry and create more circular supply chains,” says Ben Shore, Founder and CEO of Minus Works. “Since our founding, we have been working on sustainable innovations and have seen demand grow across industries, from the perishable food and meal kit delivery space to life sciences. Our partnership with Closed Loop Partners is a milestone in our continued growth. We look forward to working alongside experts in the circular economy who share our vision for less waste and a positive future for the planet.”

If you are interested in applying for funding from the Closed Loop Infrastructure Group, learn more about Closed Loop Partners’ catalytic capital strategy here.

About Minus Works

Minus Works is an American manufacturing and technology company focused on bringing innovative products to the cold chain industry, including sustainable, high-performance coolant for the shipping of perishables. Learn more about Minus Works here https://minusworks.com/

About Closed Loop Partners

Closed Loop Partners is a leading investment firm advancing the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management; its innovation center, the Center for the Circular Economy; and its operating group, Circular Services. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies. Closed Loop Partners’ catalytic private credit arm, the Closed Loop Infrastructure Group, provides a flexible mix of financing solutions to support a range of circular economy projects, companies, infrastructure and enabling technologies. The Closed Loop Infrastructure Group deploys catalytic capital, which seeks to accelerate and de-risk the development of high-impact projects and companies. Areas of strategic investment include: providing below-market rate loans to finance circular infrastructure, providing catalytic financing to increase recovery of hard-to-recycle plastics and PET bottles, and financing and deploying small-scale, modular materials recovery facilities (MRFs) to increase recycling in communities with no or limited access to recycling. Closed Loop Partners is based in New York City and is a registered B Corp. closedlooppartners.com.

What Brands Need to Know to Increase the Recovery of Compostable Packaging

November 28, 2023

Permitting for composting facilities is complex, but critical. The Composting Consortium breaks it down.

Over the last few years, demand for compostable packaging has grown quickly, as more brands explore alternatives to single-use conventional plastic. Whether in the form of a bowl, fork or a chip bag, compostable packaging is becoming more prevalent each year. At its best, compostable packaging could play an important role in reducing food and packaging waste by helping deliver food scraps within packaging to composting infrastructure, avoiding the greenhouse gases emitted if food were to end up in landfill.

But the reality is that the U.S. composting infrastructure in existence today was predominantly designed to process only yard trimmings––leaves, grass clippings and woody debris––because of a policy trend in the late 80s and early 90s that banned yard waste from landfill in dozens of states. As climate change mitigation and zero-waste goals have emerged, the composting industry is modernizing, diversifying feedstock inputs to include post-consumer food waste and certified compostable packaging. But it is only at the beginning stages of that transition.

The Composting Consortium, a multi-year collaboration across the entire compostable packaging value chain, has been studying composting infrastructure for several years. In the U.S., about 70% of the 200 full-scale composting facilities that process food waste also process some form of compostable packaging. Most of these facilities are located in urban areas. The rest of the over 2,500 composting facilities in the U.S. only process yard waste, meaning most Americans lack convenient options to compost food waste, including food-contact compostable packaging. Creating circular outcomes for compostable packaging hinges on scaling the recovery of food scraps, and brands, packaging manufacturers, industry groups, composters and investors all need to be involved.

What needs to happen so that compostable packaging doesn’t end up as waste?

Several things need to be in place for compostable packaging to operate within a truly circular, waste-free system. Consumer education, supportive policy, and clear and consistent packaging design and labeling all play important roles––and recovery infrastructure is a critical piece to the puzzle.

When envisioning a future system where composting facilities accept not just yard waste, but also food scraps, and the compostable food packaging those scraps often arrive with, the first step is to consider what must be true for facilities to upgrade from yard waste-only composting infrastructure to also recover food.

Only when more food waste is recoverable at composting facilities will it be possible to also see more recovery of food-contact compostable packaging. This infrastructure upgrade is a key steppingstone to reducing packaging waste.

Why do permitting requirements matter?

While there is opportunity to upgrade existing yard trimmings composting facilities to recover food waste––and potentially, also food-contact compostable packaging––it is often difficult to get the necessary permits to do so. In many cases, yard trimmings-only composting facilities are permitted to compost only yard trimmings. To obtain a permit to also compost food waste and make all the necessary upgrades, these facilities would need to go through a lengthy and expensive permitting process.

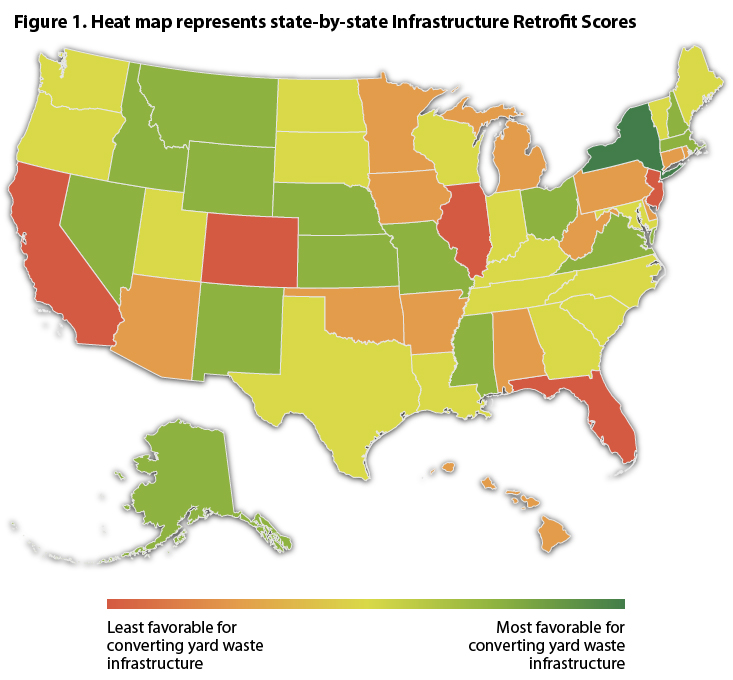

The Composting Consortium and BioCycle evaluated each of the 50 states’ permitting requirements across five factors to produce a “Composting Infrastructure Retrofit Score” that measures how easy or difficult upgrading existing yard trimmings-only composting facilities would be across different states.

The final Composting Infrastructure Retrofit Score looked across five factors:

- Ease of permitting process: The difficulty of obtaining a permit to compost food waste in a particular state.

- Presence of permitting tier: Whether a state has rules for composting facilities depending on how much and what types of food waste they accept. Some states have stricter rules for facilities that accept large amounts of food waste or food waste that may be contaminated with pathogens.

- Cost to upgrade: The cost of upgrading a yard trimmings-only composting facility to process food waste.

- Time needed to upgrade: The amount of time it takes to upgrade a yard trimmings-only composting facility to process food waste.

- State food waste disposal ban: Whether a state has a ban or mandate that restricts disposal of food waste.

The findings uncovered a patchwork landscape of permitting conditions across the county as shown in BioCycle’s heatmap below. New York state stood out among the 50 states as having a comparatively straightforward process to obtain permits required for infrastructure retrofit, while most states including South Carolina, Rhode Island and California make navigating permitting requirements significantly more costly and time-intensive.

Original Source: BioCycle

In many states, permitting requirements for food waste composting are one of the major factors standing between compostable packaging and the recovery pathways needed to ensure they are a circular alternative to single-use plastic packaging.

What role do brands play in navigating permitting requirements?

CPG brands have a unique opportunity to play a leading role in scaling up a more circular system for food-contact compostable packaging in the U.S.––by investing in recovery solutions for food-contact compostable packaging, advancing consumer education, designing packaging that is compatible with food waste composting infrastructure, and advocating for policies––like extended producer responsibility––that can support the development of food waste composting infrastructure.

To advance the necessary upgrades to composting facilities, brands can be supportive of efforts of composting industry groups like the US Composting Council, who advocates for standardized state regulations for composting. Permitting requirements are a determining factor in creating more opportunities for compostable packaging circularity and navigating them requires the engagement of stakeholders across the value chain.

In 2024 and 2025, the Composting Consortium will continue to connect the dots and work with the compost industry, policymakers, and packaging manufacturers and brands to lower the barriers to scaling food-waste composting infrastructure and unlock value to all stakeholders across the composting value chain. Through this unprecedented collaborative work, the Composting Consortium aims to build a more circular composting system, one that drives values to all stakeholders.

Learn more about the work the Consortium is doing to scale circular outcomes for compostable packaging.

About the Composting Consortium

The Composting Consortium is a multi-year collaboration to pilot industry-wide solutions and build a roadmap for investment in technologies and infrastructure that enable the recovery of compostable food packaging and food scraps. The Composting Consortium is managed by Closed Loop Partners’ Center for the Circular Economy. PepsiCo and the NextGen Consortium are founding partners of the Consortium. Hill’s Pet Nutrition parent company Colgate-Palmolive, Danaher Foundation, Eastman, The Kraft Heinz Company, Mars, Incorporated, and Target Corporation joined as supporting partners, and the Biodegradable Products Institute, the US Composting Council and the U.S. Plastics Pact joined as industry partners. Our advisory partners include 5 Gyres, Foodservice Packaging Institute (FPI), Google, ReFED, Compost Research and Education Foundation (CREF), the Sustainable Packaging Coalition (SPC), TIPA, University College London (UCL), Western Michigan University (WMU), University of Wisconsin-Stevens Point, and World Wildlife Fund (WWF). Learn more about the Consortium at closedlooppartners.com/composting-consortium/

Reuse Series

Debunking Durability: How Durable Does Reusable Packaging Need to Be?

October 24, 2023

When reuse started regaining popularity in the United States, it was hard to imagine how any version of reuse could be worse for the environment than single-use equivalents. Today, there’s growing awareness of potential unintended consequences of reuse if return rates, and associated packaging use cycles, are not high enough to justify the added durability (and material) that comes with reusable packaging.

With the newest wave of reuse policy discussions and renewed efforts to integrate reuse models into reduction requirements of Extended Producer Responsibility (EPR) bills, there is growing confusion on what defines a “good” reuse system. Although many metrics are cited, use cycles or return rates paint the most robust picture of how well a reuse system is operating in practice. As we build the reuse systems of tomorrow, a universal understanding of such metrics is essential. So, what is a high enough return rate?

The reality of today’s reuse rates

Across different sources, the number of reuses required to offset the added durability and materials needed for reusable packaging (also known as the breakeven point) is said to range from about five to 800 uses. But in today’s reality, reusable packaging is often reused less than five times, based on the results of past and ongoing open-system reuse pilots. For containers to have five uses on average in their lifetime, return rates need to be 80%. For a 90% return rate––which we have yet to see in open systems at scale––containers are used only 10 times on average*.

Achieving five to 10 uses is still a dream state for most open-environment reuse systems, yet we see packaging designers choosing and testing packaging materials to withstand dozens, and sometimes hundreds, of uses. Brands and manufacturers designing reusable containers are often reacting to regulations that set up unreasonably high use targets for open-system models. CalRecycle suggests washable as something that lasts 780 cycles. The Choose2Reuse drafted regulation cited a requirement of about 1,000 cycles. These types of requirements force the industry to design packaging for aspirational return rates, making breakeven points even higher.

Why designing for current state matters

To mitigate the environmental impact of reuse, reusable packaging needs to be designed for current return rates. Otherwise, you limit the environmental benefits by potentially generating a higher volume of materials, that are less likely to be recovered.

Additionally, durability will naturally be a function of usage environment; reusables must be appropriately designed for their expected use case. Items made for more closed environments, such as dine-in at a restaurant or for a drink at a venue, may have higher use cycles than open environments, such as takeaway or delivery.

The bottom line: as we transition toward more widespread reuse, we need to design with actual return rates and uses cases in mind. We must also ensure that containers that are not returned for reuse are recycled at their end-of-life (learn more about designing for end-of-life here).

While we work towards building the convenience and incentives needed to increase return rates, we must ask: what’s the least amount of material that we can put in a returnable packaging solution today to make it durable enough to survive five to 10 uses? Will it look sufficiently like a durable reusable to signal returnability? And ultimately, how many cycles does a container need to survive to beat its single-use equivalent? For open reuse systems today, when the answer is less than five or so cycles, the packaging design is going in the right direction.

Reusable packaging is at an important inflection point. New innovations are expanding what is possible, but to ensure that reuse does not generate unintended environmental consequences, reusable packaging needs to be thoughtfully designed with today’s reality in mind. Designing reusable packaging with current return rates, use cases and eventual end-of-life in mind are all critical steps to building a reuse system that truly advances a circular economy and a waste-free future.

How a South Carolina Paper Mill Started Recycling Your Paper Coffee Cups

September 26, 2023

A spotlight on Sonoco and its recycling tests with the NextGen Consortium

In July 2022, Sonoco announced it would accept paper cups in bales of mixed paper at its paper mill in Hartsville, South Carolina. The NextGen Consortium supported cup trials with Sonoco. Below, we discuss with Scott Byrne, Director, Global Sustainability Services at Sonoco how the organization made this decision and what considerations companies might want to take when exploring the recyclability of different types of packaging.

This work represents part of a forthcoming report on paper cup recovery in the United States intended for release in late fall.

Scott Byrne, Director, Global Sustainability Services at Sonoco

1. Who is Sonoco and what are you focused on?

Sonoco is a South Carolina-based global packaging company with more than 20 mills worldwide. Among our packaging products, we manufacture rigid paper cans, steel cans, thermoformed plastics and other packaging formats. Sonoco is uniquely positioned as a leading recycler, paper mill operator and paper packaging converter, in addition to other formats, to help push the industry to look towards future innovations and grow end-of-life solutions across the entire paper value chain.

2. How do you typically approach recycling of new products at your mills?

After validating that our mills could recycle rigid paper cans in residential mixed paper, we decided to further demonstrate the ability to recycle other similar polycoated fiber-based containers through the post-consumer mixed paper stream.

3. Where do you currently accept paper cups?

Hartsville, South Carolina. and we are exploring other Sonoco mills as well that use residential mixed paper.

4. What are some of the steps you took to determine that accepting cups wouldn’t create new challenges for your mill?

With support from the NextGen Consortium, we conducted two main activities to assess how cups might behave. First, we conducted lab-based testing of both single- and double-sided poly-coated fiber cups. Second, and after we were confident that the cups would not pose any issues to our equipment, we ran a large-scale trial whereby we dosed in nearly 20 tons of cupstock and cups into our pulper alongside other mixed paper, increasing the volume relative to other materials to test the system and upper bounds of materials we’d anticipate receiving if we accepted cups. Based on those results we felt confident that cups could be included in our accepted materials list and we were thrilled to have the mill listed alongside others on Foodservice Packaging Institute’s end market map of mills that accept cups.

5. What about your other paper mills?

Before we broadly accept cups at more of our mills, we’d want to distill our findings from the Hartsville location and consider any additional steps those mills would need to take to feel confident in accepting cups. This might include additional lab-and mill-based trials.

6. Any advice you’d give to other mills considering including cups?

Every mill is slightly different, from their equipment to operating conditions to inbound material mix. Testing to those conditions is a key proof point in determining what might work best in that location.

7. What’s next for Sonoco in its efforts to improve polycoated paper recycling?

Sonoco is a founding member of the Polycoated Paper Alliance that kicked-off in March 2023, which aims to increase widespread end-market acceptance of polycoated paper packaging products. We are collaborating with like-minded member brands and industry leaders on developing improved and harmonized data, updated design guidelines, expanded end market acceptance and upgraded mill specifications, among other initiatives.