Climate

Why Water Needs To Be Part of Circular Economy Investments

October 13, 2022

Amidst a climate crisis and high wastewater treatment costs, water reuse technologies are key to keeping one of the most valuable commodities in circulation

The circular economy is the most significant restructuring of global commerce and supply chains since the industrial revolution. The goal? To produce, consume and manage resources so that valuable materials do not go to waste, and damage communities and ecosystems. Since its founding, Closed Loop Partners has made progress to reach this goal across plastics & packaging, organics, textiles and electronics. However, driven by a range of compounding factors, we are at a point where we need to go deeper, and expand this list of materials to include one that is arguably one of the most valuable: water.

Water is fundamental not only in terms of consumption––human beings cannot survive more than three days without drinking water––but clean water is also essential to production. Most of the groundwater we pump is used by farmers to irrigate agricultural land and industries to manufacture the goods we consume. But with the rates of production and consumption fueling today’s linear economy, wastewater treatment is more important than ever. Groundwater is pumped out of aquifers faster than it can be naturally replenished. Increasing frequency and severity of extreme weather events also mean that long periods of drought are exacerbating already diminishing amounts of water, while periods of excessive rainfall are overwhelming the absorption capacity of soil and water treatment infrastructure, causing overflows in sewage and stormwater systems and massive amounts of consequent damage to ecosystems and infrastructure.

Insufficient supplies of water could reduce production capacity for businesses by 44%, disrupting the availability of essential resources like energy, clothing and food and resulting in millions of dollars’ worth of stranded assets. Earlier this year, droughts in Mexico drove a shortage of chili peppers, threatening the production of Sriracha around the world. Sriracha could just be the tip of the iceberg. Droughts are also exacerbating shortages of staple crops like cotton, wheat and corn, which could drive price increases. On the other hand, increasingly frequent deluges of water threaten the systems our societies run on. For example, the recent floods in Pakistan have already resulted in damages reportedly worth over US$10 billion, affecting millions of people and breaking and overwhelming key infrastructure. Overall, according to a CDP report, 69% of publicly listed companies around the world stated that they are exposed to water risks that could generate a substantive change in their business, with the potential value at risk topping out at US$225 billion.

Consumption patterns coupled with climate change are stressing our water sources and systems, threatening the continuity of those very consumption patterns. Amidst this, the diamond-water paradox is glaring––the availability of water directly affects the longevity and quality of our life yet has been one of the most mispriced assets. While water’s historical undervaluation has made investing in it notoriously difficult, we are now seeing market signals that water pricing and value are changing, and this is creating an opportunity for investors.

A sea change in water investing

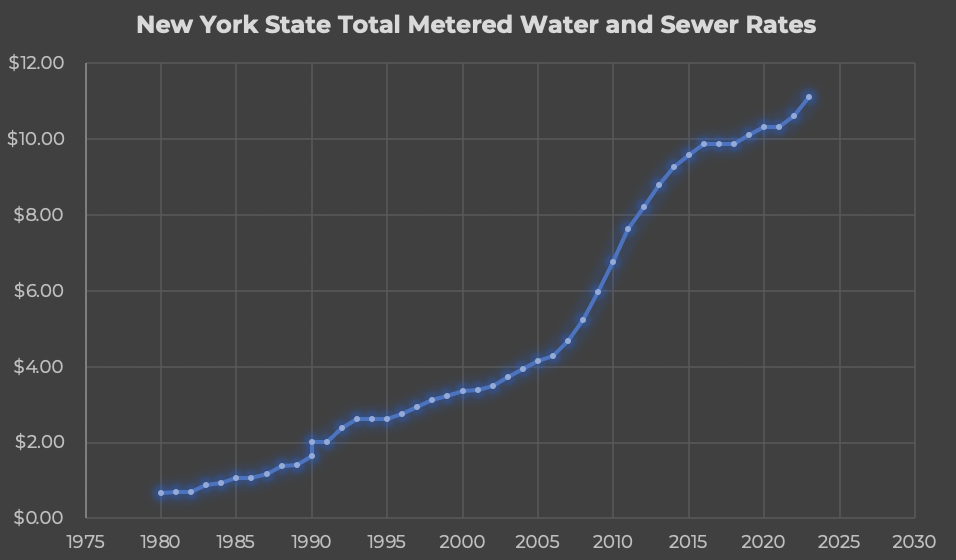

Wastewater treatment has largely improved over the years, driving up water-associated costs in much of the U.S. and Europe. In New York, alone, the price of water and sewer have both increased nearly 5% YoY, and increased over 26% over the last 10 years (over 2x the rate of inflation).

Source: New York City Water Board Rate History Data

The cost to transport heavy wastewater to water treatment facilities, and then transport the leftover sludge to landfill, ensures that operational costs stay high. Sending wastewater sludge to landfills also opens up new environmental and social risks––unleashing a slew of hormones and chemicals from agricultural and industrial waste into the soil. More capacity is needed at treatment plants, but building new water infrastructure requires significant costs: land, new pipes and labor. As it stands, it is more expensive for customers to get rid of water than to buy it. In fact, for anyone hooked up to a municipal water treatment plant, that is often the case. Water disposal in New York City is 159% more expensive than supply (and has been for the last 30 years).

Despite rising costs to treat water, businesses are faced with numerous pressures to keep used water in circulation. Growing policy––including the EPA’s new regulation that holds polluters accountable for cleaning up PFAS contamination, as well as a new plan that reduces water releases from Lake Powell––is raising accountability standards. Industry collaborations––such as Ceres’ Valuing Water Finance Initiative (VWFI), which engages 72 companies with a high water footprint to value and act on water as a financial risk and drive the necessary large-scale change to better protect water systems, and the UN Water Resilience Coalition, a CEO-led initiative committed to reducing water stress by 2050––are driving broader market attention. Water-related public health crises around the U.S.––in Jackson, Las Vegas, Baltimore, Flint and New York––are pushing additional attention onto expanding potable water sources and addressing outdated water infrastructure. With all these forces at play for industries that output water, investing in water management can reduce waste management costs, and provide a consistent and reliable water input stream. If companies can recycle water back into the system and reuse it as an input, they can reduce costs and relieve municipalities of capacity challenges.

A groundswell of new innovations

Across the board, alternative water sources are increasingly interesting––and importantly, increasingly viable from an investment perspective. This includes on-site generation of water, such as SOURCE Water’s technology to produce potable water from sunlight and surrounding air. This also includes on-site filtration technologies that could create potable, grey or functional water, depending on the end user.

Most recently, Closed Loop Partners’ Ventures Group invested in Accelerated Filtration, a water filtration company based in Midland, Michigan that develops industrial water filtration technologies. The company’s technology helps address the pain point of industrial customers, delivering packaged turn-key filtration solutions for the consistent removal of fine suspended solids in variable water streams.

As investable opportunities in the water space continue to grow, Closed Loop Partners’ Ventures Group continues to watch investment opportunities in water filtration technologies that could provide a strong return on investment to commercial and industrial customers, and allow for water reuse. As water becomes increasingly scarce and increasingly valuable, we look forward to seeing the evolution of the space, and championing the integration of water as one of the most important materials to keep within a circular economy.

Interested in learning more about work to keep key materials in circulation? Visit Closed Loop Partners’ website here.

Partsimony Closes $2M Seed Round to Help Organizations Build Intelligent Manufacturing Supply Chains

October 28, 2021

Closed Loop Partners, a circular economy-focused investment firm, leads the round

New York, NY – 8:00 AM EST, October 28, 2021 – Partsimony is pleased to announce the successful close of a $2M Seed round, led by Closed Loop Partners’ Ventures Group with participation from Contour Ventures, Urban Us, and other top institutional and angel investors. Partsimony is a SaaS network that unifies disparate data from multiple sources to more efficiently manage hardware from prototype through production, bringing superior intelligence to manufacturing supply chains.

Today, hardware companies are dealing with a paradigm shift happening in manufacturing supply chains, witnessing:

- Increases in Commodity Volatility. Volatile raw material costs impact the availability of basic component parts. Banks expect commodity prices to rise ~10% in the next year with Copper up 90%+ from 2020 (Bloomberg). The uncertainty of component availability impacts engineering designs, production schedules and costs.

- Increases in Frequency and Severity of Supply Chain Risks. Unknowns are the new norm. 94% of Fortune 1,000 companies are still seeing residual supply chain disruptions from COVID-19 (Accenture). Supply chain disruptions are becoming more frequent with increasing climate-related disasters, too.

- Growing Geopolitical Disruptions. Product costs are driven up by external factors (i.e. reshoring, trade wars, taxes/customs duties, etc.), with additional scope 3 emissions requirements underway.

Executives in the industry recognize that “We’ve been so optimized the last 3 decades on low cost supply that we’ve lost track of resilient supply” (Axios). In this new paradigm, supply chain resilience and speed in decision-making will be an immense competitive advantage for hardware companies. Partsimony is building a cognitive manufacturing supply chain that leverages transactional data to provide deep insights around Manufacturer Discovery, Design Intent, and Supply Chain Resilience.

Similar to a “SaaS hive mind,” Partsimony is building proprietary machine learning models that provide tailored recommendations for both hardware companies and manufacturers, based on their given component design files and manufacturer networks. This enables Partsimony to provide hardware companies with an intelligent manufacturing supply chain infrastructure that is more quickly adaptable to disruptions.

Partsimony has already been tested and adopted by startups and large enterprises alike. Partsimony uniquely works with a hardware company from initial prototypes up through full-scale production. Case studies from closed beta tests show that the results achieved with Partsimony have saved over 96% in cost reductions and months in lead time.

“Sourcing the right parts on complex hardware products is difficult and has never been more important in this global chaotic and disrupted supply chain. Partsimony’s strong value proposition solves difficult and complex requirements by connecting designers and innovators with manufacturers in a collaboration process that creates intended design outcomes in a cost effective, high quality, and repeatable manner.”

— Marty Guay, Vice President of Business Development, STANLEY BLACK & DECKER

“Partsimony is critical for our business; the platform allows us to spend more time focusing on design improvements than on searching and communicating back and forth with prospective manufacturers.”

— Sam Miller, Founder & CEO, PROTEUS MOTION

The Seed funding will help Partsimony capitalize on this unique moment in global supply chain development and enable manufacturing supply chains to be more resilient.

“We are thrilled to bring Closed Loop Partners’ Ventures Group into the Partsimony family as a partner who brings industry connections, guidance and their fundamental thesis of circular economy to the table. Closed Loop Partners shares our vision of digitizing, optimizing and regionalizing supply chains for efficient and sustainable hardware production,” said Partsimony CEO, Rich Mokuolu.

“Closed Loop Ventures Group is pleased to have Partsimony as a part of our portfolio. They are meeting a critical need for hardware companies and manufacturers to design with more recycled materials, with less waste, and for recoverability. Their platform aligns with macrotrends of shorter supply chains, more rapid product turns, and increased responsiveness and resiliency to supply chain disruptions,” said Danielle Joseph, Executive Director, Closed Loop Partners.

This funding round will allow Partsimony to scale their SaaS platform beyond beta and drive value for repeat and new customers. Partsimony is actively working with customers across the automotive, aerospace, robotics, and medical device product segments, and they are open to speaking with all companies building complex hardware products.

About Partsimony

Partsimony is a SaaS network that unifies disparate data from multiple sources to efficiently manage hardware from prototype through production and bring superior intelligence to manufacturing supply chains. Partsimony enables hardware companies and manufacturers to make smart decisions faster, and enhance their supply chain resilience. Learn more at https://www.partsimony.com/

About Closed Loop Partners

Closed Loop Partners is a New York-based investment firm comprised of venture capital, growth equity, private equity, project finance, and an innovation center focused on building the circular economy. Investors include many of the world’s largest consumer goods companies and family offices interested in investments that provide strong financial returns and tangible impact. Learn more at www.closedlooppartners.com.

Press Contact

Rich Mokuolu, Partsimony CEO