Industry Case Study

Insights on companies on-the-ground

The Opportunities and Challenges in Developing Distributed Molecular Recycling Systems in a Circular Economy

In November 2021, Closed Loop Partners released its latest report on molecular recycling, Transitioning to a Circular System for Plastics: Assessing Molecular Recycling Technologies in the United States and Canada. As part of this study, our team released a series of case studies meant to highlight best practices and lessons learned from molecular recycling companies advancing these technologies on-the-ground.

Background

Between 2020 and 2021, Closed Loop Partners and its Center for the Circular Economy conducted an 18-month study of molecular recycling technologies and their role in a circular plastics economy. The summary of the financial, supply chain, environmental, and human health impact analyses is detailed in the report, Transitioning to a Circular System for Plastics: Assessing Molecular Recycling Technologies in the United States and Canada.

As part of this study, our team also sought to evaluate the potential of modular and small-scale recycling technologies. Plastic waste is a distributed challenge so we wanted to evaluate the role that distributed, modular solutions could play.

With increasing disruptions and delays experienced across global supply chains, made worse by the pandemic and extreme weather events, our team also sought to explore the important role of local manufacturing networks in building resilience. Our goal was to summarize key financial metrics related to modular, molecular recycling solutions in order to share with investors and plastic recycling stakeholders to help evaluate their role in a circular plastics future.

Overview of the Technologies

For this case study, small-scale molecular recycling is defined as those technology processes whose design allows for annual throughput capacity of less than 12,000 metric tons (1). A modular system is defined as one which allows for “pre-designed” components that can be manufactured to a single design and combined together to make larger units vs projects that must be designed to a specific scale for each effort. These molecular recycling technology processes leverage chemical solvents, thermal heat, or enzymes to purify or break down plastic waste into polymer, oligomers, monomers, or hydrocarbon products that can be sold in the market.

While our main study focused on a broader set of molecular recycling technologies, including purification, depolymerization, and conversion technologies, all the technology companies evaluated for the small-scale modular case study that fit the criteria above are classified as conversion technologies (i.e. pyrolysis, gasification and pyrolysis-to-gas). A primary reason for this is because purification and depolymerization commercial facility sizes typically fall between 15,000 and 40,000 metric tons per year; units smaller than this are typically for demonstration purposes only and/or not economically viable. In contrast, conversion technologies have the capability to operate at a smaller scale, profitably, and usually serve a specific use case for local waste management (i.e. local fuel production, localized energy production, local processing of ocean plastics, private and safe processing of waste for a corporate entity or government, etc.).

About the companies in this case study

Recycling Technologies: Recycling Technologies Ltd, a UK-based company founded in 2011, developed a proprietary, patented technology to recycle mixed plastic waste. The RT7000 is a pyrolysis technology that transforms plastic waste into Plaxx®, a chemical feedstock for plastic production. The RT7000 is a modular technology that can process most types of plastics that are not routinely recycled, such as soft and flexible packaging (e.g., films), multi-layered and laminated plastics (e.g., crisp packets), complex or even contaminated plastic (e.g., food trays). In 2020, Recycling Technologies secured an important investment with two strategic industry investors, Neste and Mirova, leaders in renewable products and sustainable investments––forming valuable collaborations between the recycling industry and financial services to enable strategic and profitable circular solutions for plastic waste.

Renew One (formerly Renewlogy): Founded at MIT, Renew One aims to be a technology leader in developing solutions for landfill-bound waste. The company operates a research & demonstration facility in Salt Lake City, Utah, which converts low-value plastics into petrochemical products, and demonstrates innovative pre-processing for mixed plastic waste. The company’s proprietary molecular recycling process allows the company to reverse plastic back into its basic molecular structure, converting non-recycled plastic waste into new valuable products such as high-value petrochemical feedstocks. Their process is continuous, automated and able to accept contaminated, mixed streams of plastics.

Synova: Founded in California in 2012, Synova is headquartered in the Netherlands with teams in the USA and Bangkok. Synova’s technology is a spin-out and partnership with the Netherlands Organization for Applied Scientific Research (TNO). Synova’s patented process converts plastics and biomass in a single step, into a gas rich in plastic feedstocks (i.e. ethylene, propylene, benzene, C4 olefins.). At ~750°C, the process has wide feedstock tolerance, accepting mixed and multi-material plastics with contaminants (i.e. paper, cloth, food, moisture, wood, sand, cardboard, rubber) in commercially available refuse-derived fuel (RDF) which is plentiful and cheap. Modular design allows scaling from (150+ tons per day) to smaller prefabricated units (~30 tons per day). Synova is engaged with petro-chemical leaders to produce “green” plastics feedstocks and fuels, including its recent strategic partnership with Technip energies, a leader in building plastic production infrastructure.

3 Key Takeaways

Small-scale molecular recycling technologies have lower CapEx setup costs on an absolute and normalized basis compared to larger-scale molecular recycling facilities. However, an absence of subsidies and policy mandates to encourage plastics recycling, in markets like the United States, creates variable rates of return among the technologies we evaluated.

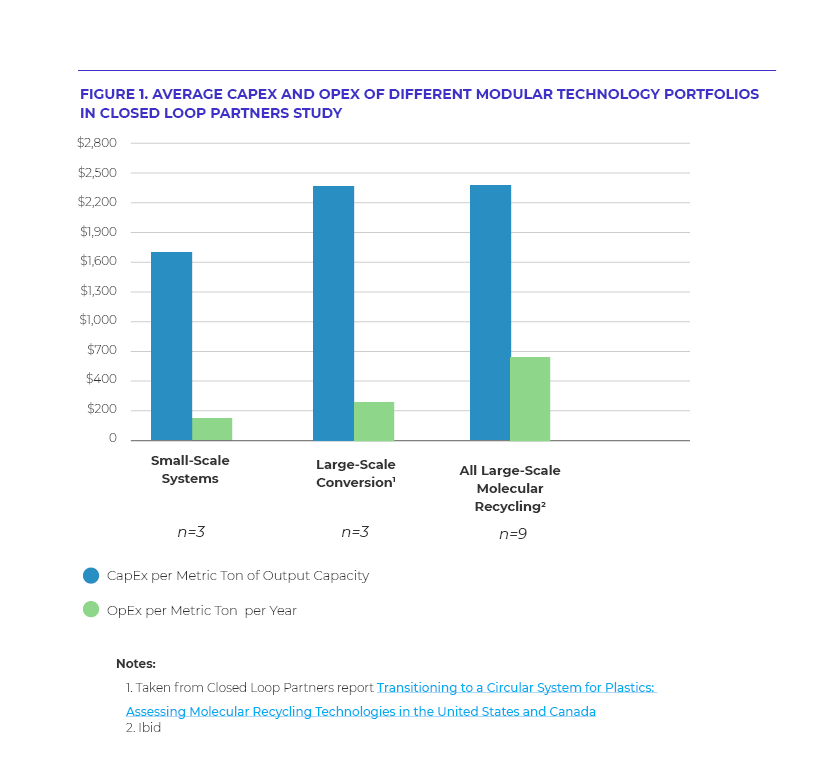

The average throughput capacity of all three small-scale conversion processes is 6,300 metric tons per year; the average CapEx set up costs is $11.1 million dollars (USD). Compared to the larger scale conversion processes in our main study, which had an average annual throughput of approximately 150,000 metric tons per year and required, on average, $275 million dollars to be built (i.e. total CapEx average in Year 0), small-scale molecular recycling units are a fraction of the cost. These smaller units also appear to be more capital efficient on a normalized basis. The CapEx needed per metric ton of feedstock processed is only $1,700 for small-scale units compared to an average CapEx per metric ton of $2,400 for larger-scale conversion technology processes, possibly due to feedstock constraints and additional processing costs that are passed downstream. Figure 1 shows the average CapEx costs for small-scale molecular recycling units compared to the cost of a conversion facility on a normalized basis.

The key of these small-scale units is the speed at which they can be set up and the size of real-estate required which can be a benefit in many densely populated locations where plastics waste concentration is high. In our interviews, most of the molecular recycling companies commented that their technology could be pre-fabricated and shipped around the world in shipping containers. Contrast that to the often multi-year process spent raising capital to finance building a large-scale molecular recycling facility; small-scale solutions could be developed more quickly and serve hyper-local wastesheds (2).

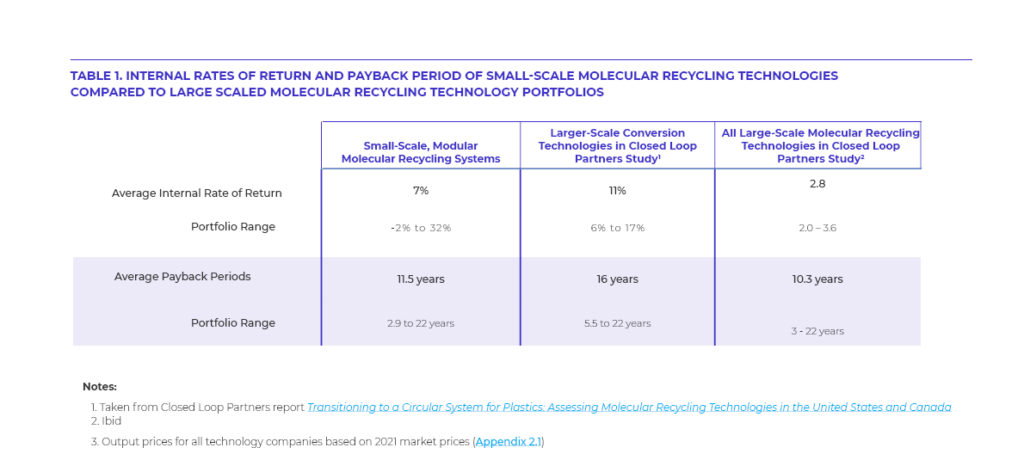

Our case study looked at the projected internal rate of return and payback periods of small-scale systems and compared that to larger-scale technology processes. In order to model how these small-scale distributed processes could integrate into a U.S. market, where to-date, there are no subsidies or tax credits provided for processing plastic waste, we modeled all technologies on the same set of assumptions for tipping fees and output pricing, in line with our main study (see Appendix 2.1). The average IRR observed in the small-scale cohort was 7%, which is in line with the lower-end of the conversion internal rate of return that we observed in our study. The payback periods of small-scale technology processes, however, were among the shortest that we evaluated; this is due to the low CapEx setup costs for these technology processes. The shortest payback period in the small-scale molecular recycling cohort was 2.9 years. Technology processes with the longest payback period had higher CapEx costs amongst the small-scale cohort and would rely on subsidies in markets that they operate in. Table 1 summarizes the internal rate of return observed in this case study and compares that to the average IRRs and payback periods of the larger-scale conversion technologies.

The key of these small-scale units is the speed at which they can be set up and the size of real-estate required which can be a benefit in many densely populated locations where plastics waste concentration is high. In our interviews, most of the molecular recycling companies commented that their technology could be pre-fabricated and shipped around the world in shipping containers. Contrast that to the often multi-year process spent raising capital to finance building a large-scale molecular recycling facility; small-scale solutions could be developed more quickly and serve hyper-local wastesheds.

Our case study looked at the projected internal rate of return and payback periods of small-scale systems and compared that to larger-scale technology processes. In order to model how these small-scale distributed processes could integrate into a U.S. market, where to-date, there are no subsidies or tax credits provided for processing plastic waste, we modeled all technologies on the same set of assumptions for tipping fees and output pricing, in line with our main study (see Appendix 2.1). The average IRR observed in the small-scale cohort was 7%, which is in line with the lower-end of the conversion internal rate of return that we observed in our study. The payback periods of small-scale technology processes, however, were among the shortest that we evaluated; this is due to the low CapEx setup costs for these technology processes. The shortest payback period in the small-scale molecular recycling cohort was 2.9 years. Technology processes with the longest payback period had higher CapEx costs amongst the small-scale cohort and would rely on subsidies in markets that they operate in. Table 1 summarizes the internal rate of return observed in this case study and compares that to the average IRRs and payback periods of the larger-scale conversion technologies.

Small-scale molecular recycling solutions can help create additional revenue streams for materials recovery facilities by paying for their “residues” and transforming them into something of value, in doing so diverting material from landfill. Larger-scale molecular recycling solutions have business models that economically incentivize upstream stakeholders to support their operations.

All nine molecular recycling technology companies that we evaluated in our main study required some level of feedstock preprocessing. For the larger-scaled processes, including some conversion companies, this meant that these companies were paying for feedstock, going as far as economically incentivizing their feedstock suppliers (i.e. material recovery facilities (MRFs)) to limit contamination to ensure the quality of their own outputs. Some companies were receiving nominal tipping fees for accepting plastic waste, but this made up less than 5% of their total revenue.

Small-scale conversion processes took one of two feedstock procurement approaches which directly correlated to the technology process’ feedstock constraints. The first approach was to co-locate or contract with MRFs to process residual plastic waste at no-cost or a low-cost which was less than landfilling. The second approach was to bypass the MRF altogether and charge a tipping fee to process mixed waste (i.e. polycotton blends, refuse derived fuel) from customers. All three of the small-scale molecular recycling companies in our study generated 10 to 20% of their total annual revenue from tipping fees.

The United States has some of the lowest landfill tipping fees among the world’s developed countries, which challenges any business model that competes for material that is currently sent to landfill. We observed that small-scale molecular recycling companies were able to reduce their customers’ operating costs (i.e. residue/disposal costs). However, these same companies can not support paying for feedstock and may be at risk of feedstock dislocations in an absence of policy or long-term contracts with suppliers.

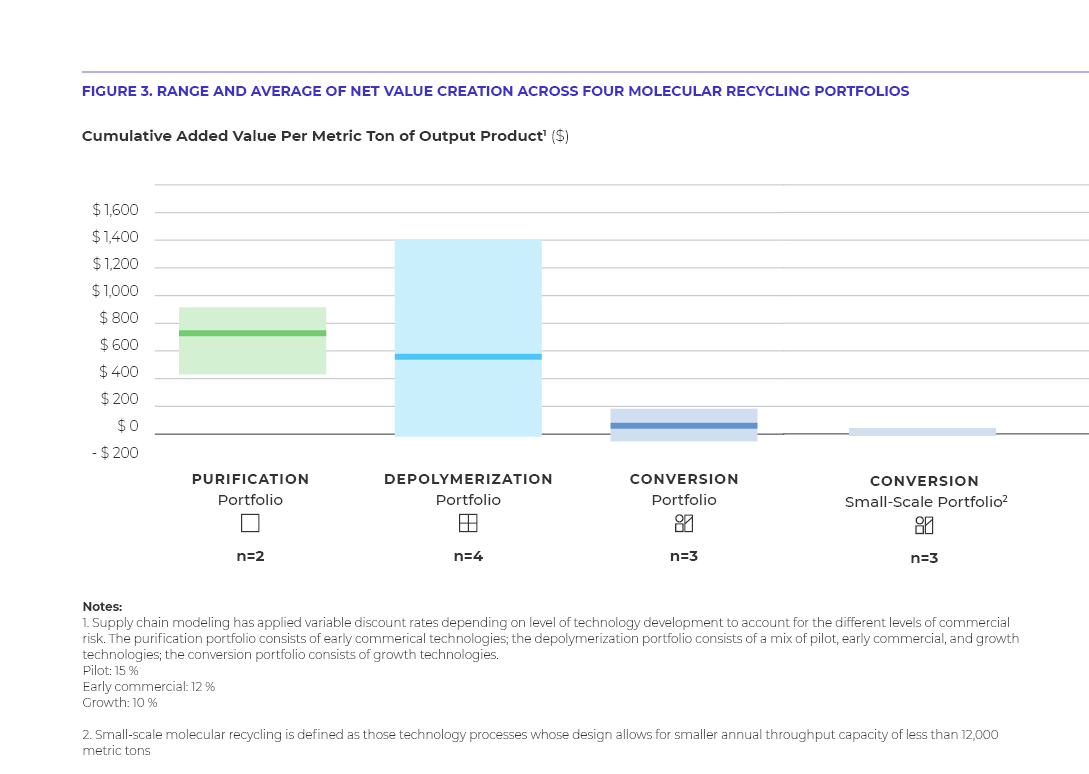

At this time, small-scale molecular recycling technologies are producing energy or a pyrolysis oil that requires upgrading to looped back into the plastics supply chain. Their customers are not looking to extract the maximum value out of waste, rather they are entities who benefit from receiving carbon credits from diverting waste from landfill (in markets that offer this) or campus operations wanting on-site waste management solutions (e.g. hospital). Based on the data we’ve gathered across our study, it appears that larger-scale processes are able to deliver more economic value to the existing value chain today. Figure 3 summarizes the value delivered by each technology process and where modular companies fall in that range.

Continued innovation and collaboration is required to scale a distributed molecular recycling system.

There is strong interest to integrate distributed molecular recycling technologies into the circular plastics economy, but technology and system barriers persist. All three small-scale molecular recycling companies are marketed as solutions to support the circular plastics economy; this represents a goal to-date, and this segment of the molecular recycling sector is early in its development.

There are opportunities to align technology to the needs and end markets in the circular plastics economy. For example, one technology company in the small-scale cohort mentioned that their output needs to be upgraded (i.e. hydrotreated) in order to integrate into downstream plastics manufacturing supply chains, a common but nonetheless extra cost and step that can become a barrier to incentivize using outputs from molecular recycling in plastics production. Such upgrading may need to be performed at a central location close to the off-take since transportation may cause chemical degradation.

Other companies in our study that offer multiple technology units, both large-scale and small, noted that their small scale units had been optimized for energy production with its existing distributed offtake network, while their larger units were more ideal for plastics-to-plastics recycling due to the size of existing offtake customers for plastics feedstocks. Petrochemical companies, for now, seem focused on large-scale molecular recycling processes, since these can more easily integrate with their centralized plastics infrastructure, and leverage common downstream investments (e.g. steam cracker, cleaning, production). In comparison to the petrochemical industry’s scale, large-scale molecular recycling solutions are considered small-scale. Also, as fuel costs have increased, transportation costs have also increased. This influences the total transportation costs of off takers to aggregate outputs like recycled naphtha to make plastics which is a highly centralized industry.

For now, small-scale molecular recycling facilities appear positioned to be more quickly deployed to divert plastic waste from landfill, but in order to ensure plastics-to-plastics outcomes and derisk distributed supply chains that has yet to materialize in this sector, more R&D is needed to improve integration to downstream supply chains and demonstrate that small-scale modular solutions can enable large scale businesses based on their outputs.

- This choice was informed by analyzing the commercial size capacities of other technologies in our study which ranged from 18,000 to over 250,000 metric tons per year.

- Wasteshed – geographic area that serves as supply of post-consumer and post-industrial plastics for recycling technologies