Why We Invested in Neutreeno: Engineering Circular Supply Chains with the Right Data

October 29, 2024

You can’t manage what you can’t measure.

This has been the mantra around carbon emissions measurement and management for the last decade. Over that time, we have seen several companies attempting to properly measure Scope 1, Scope 2 and Scope 3 carbon emissions––with various levels of (in)accuracy and friction. However, most importantly, none that are actionable across entire value chains.

To properly measure and address emissions across complex value chains, you need (1) primary data from suppliers, (2) deep knowledge of various processes, energy intensity and embodied emissions in materials, (3) scientific models that make this collection and calculation easy, and (4) actionable insights for businesses and asset owners to lower their carbon footprints.

The growth of the carbon measurement and management market is partially driven by regulatory scrutiny, but for Closed Loop Partners’ Ventures Group, we think the biggest opportunity is in helping asset owners reduce costs, risks and waste in their supply chain, made possible through studying resource flows and emissions simultaneously.

Today, up to 70% of greenhouse gas emissions are linked to the extraction, processing and manufacturing of materials within our current linear production and consumption model. Measuring and managing carbon emissions uncovers opportunities for increased circularity within supply chains––a key driver of supply chain resilience and greenhouse gas avoidance. After reviewing hundreds of companies in this space, we believe Neutreeno is best positioned to help address these embedded emissions and move industry towards circular models, given the team’s scientific credentials.

Through collaboration with University of Cambridge researchers, Neutreeno has developed industry-leading emission models that solve the fundamental challenges of data collection, accuracy and actionability across the major industrial sectors.

Dr. Spencer Brennan, CEO and Founder of Neutreeno combined his Physics PhD research in high-resolution measurement systems with his chemical engineering background to build models that require 10x less data to generate precision emissions reports, and provide actionable insights about how a given supplier can decarbonize. Neutreeno’s advanced product material and energy flow analysis builds on University of Cambridge Professor, Jonathan Cullen’s, 15 years of research to decode manufacturing processes, drive efficiency, integrate circularity and decarbonization across multiple tiers of the value chain, and deliver critical emissions insights and visualizations.

Neutreeno offers a game-changing solution that seamlessly integrates into existing workflows. Built on rigorous, science-based foundations for calculating emissions, their model delivers precise, actionable insights for immediate decarbonization across the value chain. Plus, with ROI analysis, businesses can confidently prioritize the most impactful levers, driving faster and smarter decisions to advance more circular, decarbonized supply chains.

About Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management; its innovation center, the Center for the Circular Economy; and its operating group, Closed Loop Builders. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies. The firm’s venture capital group, the Closed Loop Ventures Group, has been investing early-stage capital into companies developing breakthrough solutions for the circular economy since 2016. The Closed Loop Ventures Group’s portfolio includes companies developing leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy. Closed Loop Partners is based in New York City and is a registered B Corp. To learn more, visit closedlooppartners.com

About Neutreeno

Utilizing proprietary process networks and engineering models, Neutreeno identifies and eliminates emissions at source. Neutreeno partners with leading businesses wanting to move beyond carbon accounting and take decisive action to decarbonize Scope 3 emissions. Learn more here.

Disclosure

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

How the Apparel Industry Is Challenging Us to Think Again on Circularity

September 17, 2024

In crowded retail stores, it’s easy to believe that all products on shelves eventually find their forever home in someone’s closet, or at least get re-sold at an off-price retailer at some point. But today’s retail experience––as convenient and on-trend as it is––does not indicate the complexities of operations behind the scenes.

Behind the rapid and improbably simple exchange of products in stores, from cashier to customer (and back, as clothes are often returned), are legacy supply chains struggling to keep up with the speed required of retail today.

The rapid pace of trends and increasing volume of returns are up against slow supply chain timelines and complex logistics. This translates to a lot of excess clothing––most of it ending up in landfill. Textile recycling and recovery systems are also not yet scaled to recover all these items; often, the best case scenario is items like jeans turning into home insulation. They don’t become new jeans again.

The high cost of waste, to both retailers and consumers, has sparked the need for change, but the apparel industry has ebbed and flowed in its transition to circularity. Yet, in the past six months, the tides have been turning. What makes the next decade the time for the industry to rise to the challenge of an urgent waste crisis?

Retailers are hurting––and change is the only option.

The proliferation of style requirements, and long timelines between a brand placing their order and receiving it, have made it increasingly difficult for retailers to purchase only what they need––and to design in ways that minimize overstock and oversupply. The result is anywhere from 12-40% of clothing is unsold at the end of the season[1]. These are clothes that the brands have already paid their manufacturers for and are now taking losses on through liquidation channels. Even when a product does make it to a consumer, it will likely be worn fewer than seven to 10 times before being discarded,[2] a result of increasing consumer demand for the new and novel and manufacturers’ decisions to prioritize lower cost, lower quality construction to bring products to market quicker.

In parallel, return rates are soaring––up to 20-30% of all products purchased.[3] This costs retailers up to $30 per returned item––or even 2/3 the cost of an item––regardless of whether they’re going to be able to sell that product again.[4] This is made more challenging because a large percentage of returns are damaged on their way back to shelves[5]. Those never make it back on shelf to begin with, even if they were efficiently processed and listed for resale. Every year, more than 9 billion pounds of material end up in landfill from consumer returns.[6] It’s no surprise that historically lenient policies for returns are beginning to fade away[7] as retailers wrestle with finding a balance between top quality customer service and operating a profitable business.

As retailers struggle to right the wrongs of legacy business models, circularity could create opportunities to reduce cost and waste together.

Consumers are aware––and want to see change.

The average consumer purchases 53 new items per person per year––U.S. consumers throw away more than 80 pounds of clothes in the same timeframe.[8] Consumers are increasingly engaging with “returnless refund” models, where retailers offer to refund a consumer a purchase and allow them to keep the product to save shipping and processing costs on returns[9] (which make very clear that the ultimate destination should they have returned the product is landfill), and are asked to engage directly with the disposal themselves. Legacy donation-led systems have also come under increased scrutiny, and it’s become clear just how much business-as-usual results in products being shipped overseas or ultimately landfilled.

In parallel, large retailers are promoting resale and takeback channels at unprecedented levels (see Trashie’s recent announcement with Steve Madden for their takeback recycling program), not to mention the mainstreaming of resale through models like ThredUp, The RealReal and others. Rental is also on the rise again, and it’s creating a sense of community, as our portfolio company, By Rotation, has demonstrated.

In other words, consumers want to be a part of the solution.

High profile “failures” are encouraging all of us to think again

Earlier this year, early innovator in textile recycling, Renew:cell, declared bankruptcy[10]––a sobering moment for all of us who work in this industry. The reality is that less than 1% of textiles are recycled into new fibers annually,[11] and while the necessity of textile recovery is widely recognized, it’s been seen as a Sisyphean task by the industry.

The cost to purchase end-of-life materials is often high. This is driven up by competition with cheaper downcycling options that do not require the same level of stringent sorting as more complex molecular processing technologies. Most of those technologies are currently operating sub-scale, with significant upfront capital requirements to grow to a point where they can produce at parity to virgin fibers.

Where is the opportunity? Necessity is the mother of invention and we’ve seen a remarkable evolution in the willingness of brands and institutional investors to support first-of-a-kind facilities supporting next life textile collection, sorting, processing and recycling in the past twelve months. An evolving capital stack is positioning us to help emerging technologies achieve scale more quickly, as more innovators come into the market to focus on lower cost solutions.

More sophisticated capital partners, and a new crop of innovators––let’s do this!

We’re (finally) all in this together.

In short, if you’ve been an innovator working to advance textile circularity, or a brand responsible for reducing waste in your supply chain, the past decade has been challenging. But in the past two years, the narrative has shifted, and we believe the momentum has returned. Brands, consumers and innovators are coming together with urgency––because the problem of textile waste is not just one for the planet. It is an existential threat––and opportunity––for the industry itself.

At Closed Loop Partners, we’re excited to be on the front lines of this transition. We hope you’ll join us.

If you are interested in continuing to engage on this topic, Closed Loop Ventures will be co-hosting a session during New York Climate Week with the Los Angeles Cleantech Incubator. Please reach out if interested in attending at [email protected].

Note from the Author:

I am lucky to have gotten to evolve my thinking on the apparel industry in real time with a host of industry experts over the past few months. Many thanks to the Circularity24 team from Trellis––and my co-panelists from Eileen Fisher, Fillogic, Debrand and Loop, the team at Home Delivery World, innovators in textile design, reverse logistics, and recycling––including CLVG portfolio companies Browzwear, Hyran, Fillogic and so many others for helping to push my thinking.

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

[1] Source: https://www.theguardian.com/fashion/2024/jan/18/its-the-industrys-dirty-secret-why-fashions-oversupply-problem-is-an-environmental-disaster

[2] https://stateofmatterapparel.com/blogs/som-blog/10-scary-statistics-about-fast-fashion-the-environment

[3] Source: https://3dlook.ai/content-hub/apparel-return-rates-the-stats-retailers-cannot-ignore/; https://coresight.com/research/the-true-cost-of-apparel-returns-alarming-return-rates-require-loss-minimization-solutions/; https://medium.com/@shaku.tech/the-challenge-of-high-return-rates-in-the-fashion-industry-ab51878d0073

[4] Source: https://www.modernretail.co/operations/the-case-for-and-against-return-fees/; Source: https://www.modernretail.co/operations/the-case-for-and-against-return-fees/; https://www.letsbloom.com/blog/true-cost-of-ecommerce-returns/

[5] Source: https://www.cnn.com/2021/01/30/business/online-shopping-returns-liquidators/index.html; https://www.newyorker.com/magazine/2023/08/21/the-hidden-cost-of-free-returns

[6] Source: https://www.fastcompany.com/90756025/product-returns-are-wasteful-for-companies-and-the-planet-heres-how-to-change-that; https://earth911.com/business-policy/rescuing-product-returns/

[7] Source: https://www.cbsnews.com/sacramento/news/more-retailers-doing-away-with-free-returns/; https://retailwire.com/free-returns-are-starting-to-disappear/

[8] Source: https://fashionunited.com/global-fashion-industry-statistics

[9] Source: https://www.cbsnews.com/news/returnless-refunds-retailers/; https://www.gotrg.com/company/news-events/news/this-is-everything-to-know-about-returnless-refunds-and-keep-it-options

[10] Source: https://www.renewcell.com/en/renewcell-decides-to-file-for-bankruptcy/

[11] Source: https://www.mckinsey.com/industries/retail/our-insights/closing-the-loop-increasing-fashion-circularity-in-california

Why We Invested in Aerflo: Making Reuse an Everyday Norm

September 12, 2024

Photo Credit: Fast Company

At this point, we know that reuse is a critical part of the circular economy. It keeps valuable materials in circulation longer, and is part of an essential suite of solutions that also includes upstream material reduction and downstream recovery solutions.

Over the last decade, the use of reusable water bottles in particular has grown––many of us are familiar with the ubiquitous airport water fountains––but broader options for refill remain somewhat underwhelming. It’s, in a word, still.

Many circular reuse models today are appealing to environmentally driven consumers. While this is a growing demographic, it is still not scaled. The question remains: how do we get reuse into the mainstream? How do we get it to, in a word, sparkle?

To gain mainstream traction and drive a shift, solutions need to be better without compromise. Along with environmental benefits, they need to be more delightful and cost less to the end consumer.

Enter Aerflo. John Thorp and Buzz Wiggins, co-founders of Aerflo, started on this journey as outdoor adventurers frustrated that the beverages they wanted to drink only came in single-use, disposable packaging. Together, they embarked on building a solution that would make it possible to enjoy these beverages without waste and create a user experience that catered to the on-the-go lifestyle––all driven by a circular model.

Demand for sparkling water is on the rise in the U.S., with the market anticipated to grow at a compound annual growth rate of over 12% from 2023 to 2032. Today, we are not only seeing a diversity of options on retail shelves, but also a wave of innovations making it possible for consumers to make their own sparkling water. We have seen the growth of at-home countertop devices, such as Soda Stream and Aarke, and in-office spaces with Bevi, introducing a shift away from single-use packaging. But for consumers who want sparkling water on the go, single use has been the only option.

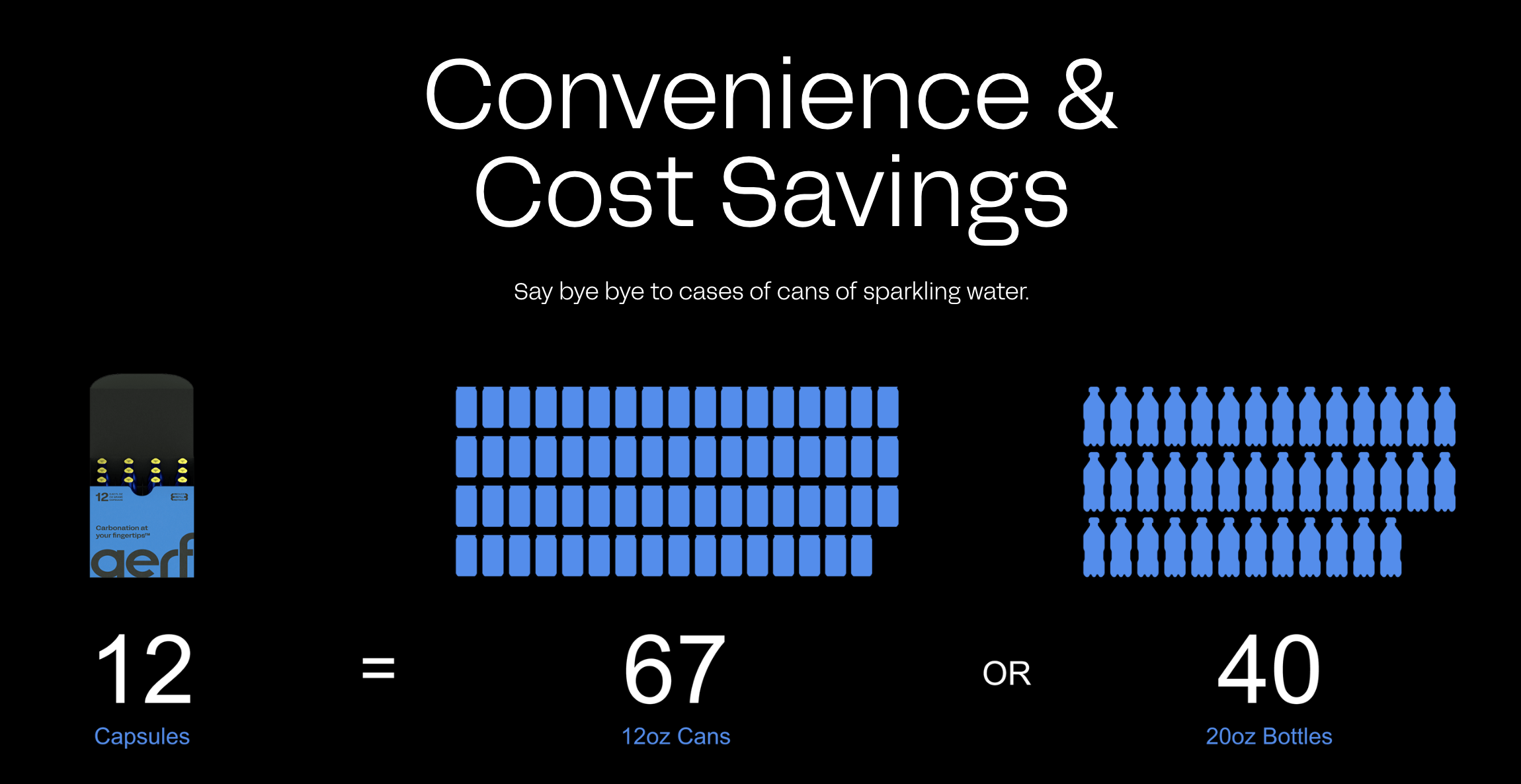

After years of building, John and Buzz launched Aerflo with the first-of-its-kind portable Aerflo Aer1 System that can turn any drinkable water source into refreshing sparkling water with the press of a button. The bottle houses a carbon capsule that can carbonate four full bottles of water. It is designed so that users can see carbonation happen, to gauge how much sparkle to add. The small bubbles mimic those in sparkling water sold in stores, bringing sparkling water to consumers without the need to ship glass bottles or cans filled with water thousands of miles. By inspiring and enabling reuse, Aerflo helps reduce waste and greenhouse gas emissions.

John and Buzz started with the concept of bubbles-on-the-go. How delightful would it be to add bubbles to beverages anywhere in the world, elevating the experience of drinking water, whether someone was on top of a mountain or running through New York City?

Every detail was carefully considered and crafted, ensuring that convenience and taste were not compromised for circularity––a critical factor to the success of reuse.

When capsules are empty, customers ship them back to Aerflo (in the same packaging, and with a return label pre-affixed). This immediately triggers the customer’s next order to be sent––so no subscription is needed. In the company’s fully automated, circular refill facility in New Jersey, the returned Aerflo capsules are cleaned, inspected and refilled before being shipped out to the next customer.

The model is entirely circular. Aside from the clear environmental benefits (each capsule can prevent the need for 330+ cans in its lifetime) this system drives cost savings for customers (60%+ less than single use) and gives the option of still or sparkling at any moment.

Over the past decade, Closed Loop Partners has reviewed hundreds of reuse models through our Closed Loop Ventures Group; we have also tested reuse models in-field and conducted reuse research through our Center for the Circular Economy. And now, Closed Loop Ventures Group is thrilled to announce our investment in Aerflo, a company offering what we believe is a natural choice for on-the-go consumers looking for an elevated experience. Aerflo drinkers don’t need a subscription or commitment and the company offers better value: it is less expensive on a per liter basis than buying carbonated bottled water and offers a more delightful experience to aerate water anywhere, helping make reuse an everyday habit.

About Closed Loop Ventures Group at Closed Loop Partners

Closed Loop Partners has been a leader in the reuse movement for almost a decade. Today, we are actively catalyzing the shift to reuse through our investments and in-market tests––unlocking critical insights and supporting reuse solutions in the field to prepare them for scale. From years of in-field testing and deep research, we have proven that to build successful reuse systems, we need to make reuse a natural choice.

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management; its innovation center, the Center for the Circular Economy; and its operating group, Closed Loop Builders. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies. The firm’s venture capital group, the Closed Loop Ventures Group, has been investing early-stage capital into companies developing breakthrough solutions for the circular economy since 2016. The Closed Loop Ventures Group’s portfolio includes companies developing leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy. Closed Loop Partners is based in New York City and is a registered B Corp.

About Aerflo

To learn more, visit https://aerflo.co/.

Disclaimer

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

How Businesses Can Spark a Cultural Shift Towards Reduction and Reuse in Foodservice Packaging

June 25, 2024

9% of Americans report bringing their own refillable cup when purchasing their coffee on the go. What needs to be true for that number to increase?

The Center for the Circular Economy at Closed Loop Partners shares insights on how businesses can align with customers in reducing cup waste, drawing on lessons learned from 90 Bring-Your-Own-Cup (BYOC) initiatives in cafés and restaurants across the U.S.

Read more to learn about our insights.

The Opportunity of Catalytic Capital

May 14, 2024

Closed Loop Partners is proud to celebrate 10 years of building the circular economy. This blog is part of a series of insights to mark this milestone, highlighting key advancements over the last decade––and the continued work needed over the next decades to accelerate the transition to the circular economy.

For 10 years, our thesis at Closed Loop Partners has remained consistent. The linear economy of materials management––characterized by extraction, single use and disposal––is inefficient. A more effective system exists: a circular economy, whereby people and businesses are custodians of materials over perpetual life cycles. The circular economy creates new value––a fundamental shift in the way society has managed resources over the last 75 years. But to sustain itself well into the future, circularity must be more profitable than the linear system.

Closed Loop Partners saw the economic, environmental and social opportunity in circularity. It was one of the first investment firms to bring together incumbent and emerging players to collectively accelerate this transition. As the firm enters its tenth year, cross-industry stakeholder participation continues to prove its effectiveness in advancing systemic change. Today, markets are experiencing the momentum driving the acceptance and understanding of circularity. Tailwinds including technological innovation, consumer sentiment, regulatory incentives, net-zero commitments and the need for supply chain resiliency propel the current transition. As the circular economy disrupts the status quo, it also presents investment opportunities, inviting collaboration across unexpected corporate, financial, government and community stakeholders.

The opportunity of the circular economy goes far beyond recycling. It represents full systems change, revamping each point in the supply chain: product design, logistics technology, collection capacity reprocessing and remanufacturing. Industries from consumer package goods (CPG) to food & agriculture, retail, technology, energy and the built environment stand to benefit from more efficient management of materials such as plastics & packaging, organics, textiles and critical minerals. To advance systems change across the product life cycle of different materials, different forms of financing are needed.

Today, Closed Loop Partners manages three primary investment strategies: early-stage venture capital, buyout private equity and private credit and catalytic capital. But 10 years ago, our work started with catalytic capital, to amplify the opportunity of circularity and to crowd traditional investment into the capital gap for the transition. 10 years later, it continues to be a critical piece of the puzzle.

Alongside traditional equity and debt solutions, catalytic capital––defined as flexible financing that prioritizes specific outcomes over prevailing market returns––can send a market signal to direct capital flows. This accelerates the uptake and scale of private businesses, municipal projects and infrastructure that are key contributors to durable, circular operations. For a decade, our catalytic investments, provided by Closed Loop Partners’s Infrastructure Group, have been connecting profit incentives with urgent environmental and social impact outcomes. Backed by global retailers, consumer package goods, technology and material science corporations and foundations such as Walmart, Unilever, Starbucks, PepsiCo, P&G, Microsoft, Keurig Dr Pepper, Kenvue (formerly Johnson & Johnson Consumer Health), Danone, Colgate-Palmolive, The Coca-Cola Company, BlueTriton, Amazon and 3M, these private credit and hybrid investments support innovations, private businesses, municipal projects, equipment upgrades and facility development.

By deploying below-market rate and more flexible financing than would otherwise be available, the Closed Loop Infrastructure Group aims to:

- attract follow-on capital from traditional capital markets

- increase the quality and quantity of recycled material kept in the system

- mitigate greenhouse gas emissions

- create more jobs across communities

- advance corporate strategic goals of integrating circularity into their operations.

As early champions of catalytic capital, Closed Loop Partners has worked with an array of municipalities and private companies to accelerate the transition to a profitable and more sustainable system. 10 years in, we have seen the ability of this financing to catalyze the market, in more ways than one.

- Catalyzing More Capital: rPlanet Earth was founded to provide high-quality recycled PET (rPET) packaging and containers to food, beverage and other CPG companies. Operating under a single roof, it is the world’s first completely vertically integrated manufacturer of multiple high rPET content products (up to 100% rPET), creating a much-needed market for the PET packaging collected from curbside recycling programs across California. rPlanet Earth is committed to providing the lowest carbon footprint packaging and products in the marketplace. In 2018, Closed Loop Partners identified the opportunity to bridge a near term capital gap and send a market signal. Our catalytic group provided a $1.5 million loan. Grants and loans from California’s Department of Resources Recycling and Recovery (CalRecycle), CAEATFA and private debt financing sources also provided alternative financing solutions. Also, one of the four largest banks in the U.S. provided a multi-million-dollar loan to finance the construction of their first facility. Together, this capital, along with substantial equity investments from two prominent funds financed rPlanet Earth’s first plant in Vernon, CA.

- Catalyzing Growth: By 2019, Phoenix, Arizona had risen to the fifth largest metropolis in the United States, resulting in a higher volume of recyclable materials. With a $3 million investment from the Closed Loop Infrastructure Group, the City of Phoenix upgraded its North Gateway materials recovery facility (MRF) to enable greater diversion of plastics from landfill and to improve the quality of baled paper produced. The upgrade also helped to increase the overall tonnage of residential recycled materials processed and recovered by the City’s MRF by over 25% within the two years after investment. The city has established a strong reputation for its commitment to the circular economy and its zero waste plan.

- Catalyzing Scale: In 2022, the Closed Loop Infrastructure Group invested in Greyparrot, a leading AI waste analytics platform for the circular economy. Their AI Waste Recognition System is deployed on moving conveyor belts in sorting facilities globally, with the mission of using AI to significantly improve recycling efficiency and increase resource recovery. Supported by funding, Greyparrot has grown to now identify over 25 billion waste objects each year, with 100+ of its Greyparrot Analyzer Units spread across more than 17 countries, and is working with three of the top eight global waste management companies.

Our future requires an increase in material circularity and urgent climate action. Our work at Closed Loop Partners advances efficient materials management and optimized supply chains in a more profitable, more resilient circular system. There is significant opportunity to transition the over $100 trillion global economy from the incumbent linear economic system characterized by wasted resources and profit leakage, to a more efficient circular economy. The Circularity Gap Report estimates that as of 2023, just 7% of the global economy was circular. There is over 90% of the economy yet to transition across materials including paper, metal, plastic, organics, water, critical minerals and carbon itself, and across industries from CPG to fashion, from technology to transportation, energy to real estate.

The transition to circularity presents trillions of dollars of opportunity. Catalytic capital can spark capital flows and accelerate scale, making the innovations, businesses, municipal projects and infrastructure that are critical to a profitable circular system move faster than they otherwise would. For potential collaborators––corporate, foundation, municipal finance or other institutional capital––that would like to learn more, please get in touch with our team. Join us in accelerating the transition to a market-driven circular economy and, in doing so, build a climate-positive future.

—

*This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Partners or any company in which Closed Loop Partners or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Information provided reflects Closed Loop Partners’ views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision.

Why We Invested in Capra Biosciences: How Microbes Are Changing Manufacturing

April 29, 2024

Today, we are witness to a rapidly changing manufacturing landscape, driven by demand for low cost, resilient (localized and more distributed) manufacturing and processing, with less reliance on feedstocks from complex global supply chains. In addition to AI, robotics and other advances in manufacturing, we see immense opportunity in the efficiency of the smallest of organisms: the microbe.

Microbes are behind well-known industrial processes: from yeast for leavening bread or producing ethanol to acetic acid bacteria for vinegar production. These processes typically start with some sort of carbohydrate or sugar-rich feedstock, in which the living organisms are added and allowed to eat their way through the feedstock in a process known as fermentation. Closed Loop Partners has long been exploring the prospect of using microbes to advance circularity, such as creating energy from food waste––as seen through the work of one of our earliest portfolio companies, HomeBiogas. Today, we are seeing even more opportunities for microbes to change the way we produce, and this drove our investment in Capra Biosciences.

Capra sits at the confluence of synthetic biology, resilient supply chains for national defensive strategies, and sustainable consumption. Capra leverages a unique microbe to consume organic feedstocks (like food waste) and convert those materials into high value molecules that are direct replacements for petrochemical-derived products. This can range from molecules used in cosmetics to high value lubricants.

In taking these waste feedstocks and upcycling them into some of the highest value end products, Capra demonstrates how synthetic biology sits at the heart of the circular economy:

- Reducing reliance on extractive industries: Capra is displacing petroleum-based feedstocks for hydrophobic chemicals. This eliminates the need for extractive mining processes and instead leverages waste feedstock to produce high value commodity products at a price point that is competitive with market incumbents.

- Leveraging waste feedstock: Synthetic biology is often reliant on sugars as feedstock for the microbes, which come from net new agricultural production. Capra is starting with food-waste derivatives that are widely available. By giving these materials another life, Capra diverts food waste from landfill and offers a more sustainable product.

- Process-flow material recovery: An ideal system is one in which the microbes and solvents can be recovered after one pass through the system, leaving a close to zero waste process and positively impacting unit economics.

- Distributed, on-site generation: Capra’s technology design allows for continuous flow and modularity, meaning they can convert waste carbon sources such as food waste into high value chemistries onsite. By keeping production and distribution local and integrated, their process helps reduce emissions associated with transportation.

Given the promise of synthetic biology, we are proud to be backing the expert team of Liz Onderko, PhD and Andrew Magyar, PhD, co-founders of Capra Biosciences. We have compiled a diverse syndicate of support, including SOSV, GS Futures, First Bight, E14 and others to support Capra in their work to make high performance and affordable renewable chemicals for the circular economy. Learn more about Capra Biosciences here or reach out to [email protected].

About Capra

Capra Biosciences is venture-backed startup company focused on sustainable production of petrochemical replacements from waste carbon using their proprietary bioreactor platform. Capra Biosciences is located in Sterling, VA. To learn more about the company, visit www.CapraBiosciences.com

About the Closed Loop Ventures Group at Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management; its innovation center, the Center for the Circular Economy; and its operating group, Circular Services. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies. The firm’s venture capital group, the Closed Loop Ventures Group, has been investing early-stage capital into companies developing breakthrough solutions for the circular economy since 2016. The Closed Loop Ventures Group’s portfolio includes companies developing leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy. Closed Loop Partners is based in New York City and is a registered B Corp. Closedlooppartners.com.

—

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Partners or any company in which Closed Loop Partners or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Information provided reflects Closed Loop Partners’ views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision.

10 Years of Building the Circular Economy

April 11, 2024

Closed Loop Partners is proud to celebrate 10 years of building the circular economy. This is part of a series of insights to mark this milestone, highlighting key advancements over the last decade––and the continued work needed over the next decades to accelerate the transition to the circular economy.

In January 2014, Doug McMillon, the CEO of Walmart, invited the CEOs and leadership of Unilever, P&G, PepsiCo, The Coca-Cola Company, Kenvue (formerly Johnson & Johnson Consumer Health) and Keurig Dr Pepper to join him on stage at the annual meeting of Walmart’s suppliers. It was a groundbreaking moment. Some of the world’s largest corporations announced that they had joined together as the founding investors in the Closed Loop Fund, the inaugural fund of Closed Loop Partners, and one of the first investment funds focused on financing the development of the circular economy.

It was a monumental first step toward changing the trajectory of how we use our planet’s resources––away from a ‘take-make-waste’ economy and toward a waste-free world designed around resource efficiency, driving economic growth. This is the beginning of our story at Closed Loop Partners.

Several key factors led to that moment on stage. My journey before Closed Loop Partners had given me a clear view into the economic opportunity of rebuilding antiquated and inefficient supply chains into efficient and circular supply chains that continually reused materials in local markets. An urgent waste crisis, an increase in environmental regulation and growth in consumer demand for environmental responsibility, coupled with the emergence of circular innovations, made developing the circular economy so important to the future of business that it brought competitors together to form the Closed Loop Fund. This collaboration by industry leaders helped lay the foundational infrastructure for the circular economy in the U.S.

A few years later, as the circular economy gained momentum, our original Closed Loop Fund attracted additional corporate investors, including 3M, Amazon, BlueTriton, Colgate-Palmolive, Danone and Starbucks, catalyzing more capital into circular economy infrastructure. As our ecosystem grew, adding more strategies and asset classes, it attracted capital from financial institutions, including funds and accounts managed by BlackRock, leading family offices and foundation endowments. To meet the growing interest in the circular economy, the vision of Closed Loop Fund was expanded into other strategies, now comprising Closed Loop Partners.

What started with one fund a decade ago has grown into three businesses that form the Closed Loop Partners ecosystem, focused on three key development areas of the circular economy: our investment arm, Closed Loop Capital Management, invests in circular solutions across venture capital, catalytic private debt and buyout private equity strategies; our innovation and advisory group, the Center for the Circular Economy, advances critical research and manages unprecedented pre-competitive industry collaborations; and our operating group, Closed Loop Builders, houses our first operating company, Circular Services, the largest privately held recycling company in the U.S.

As I look back, some of Closed Loop Partners’ earliest catalytic investments demonstrate our founding vision and the foundation of the circular economy:

- A decade ago, as changes in global policy highlighted the need for local circular economy infrastructure in the U.S., investments in recycling capacity expansion became critical. Eureka Recycling, a recycling company servicing Minneapolis and St. Paul, Minnesota, was a first mover in elevating U.S. recycling, leveraging their operational experience and engaging with policymakers, industry leaders and community advocates to influence systems change. Financing from Closed Loop Partners over the past 10 years supported a three-fold increase in Eureka’s polypropylene plastic recovery. Since then, they continue to be a leader in setting the standard for best-in-class recycling operations and infrastructure.

- As the circular economy grew in the U.S., upgrades to municipal recycling systems were needed to keep pace with a growing volume of recovered materials. When aging recycling equipment needed replacing, the Waste Commission of Scott County pursued the change from dual- to single-stream recycling to improve material collection. Closed Loop Partners’ first loan nearly 10 years ago enabled the purchase of larger carts for curbside recycling and a redesigned single-stream MRF. The success of our first municipal loan catalyzed follow-on loans in 2018 and 2022, now enabling the county to serve 185,000+ households and process over 40,000 tons of paper, metal, glass and plastic per year.

- The onset of corporate waste reduction goals also meant a rise in demand for alternative packaging. TemperPack was one of our first investments to advance new sustainable materials. TemperPack developed the first high performance, curbside recyclable thermal packaging for shipments of perishable goods such as food and pharmaceuticals. Today, they continue to be a leader in packaging innovation, with a range of solutions that protect products, strengthen brands, and keep waste out of supply chains.

- Innovative circular solutions include new technologies that can work alongside material reduction, reuse and mechanical recycling to recover hard-to-recycle materials. One of our first investments was in PureCycle Technologies––its patented recycling process, developed by P&G and licensed to PureCycle Technologies, separates color, odor and any other contaminants from plastic waste feedstock to transform it into virgin-like resin. PureCycle closes the loop on the reuse of recycled plastics while making recycled plastics more accessible to companies looking to use a sustainable, recycled resin.*

Since these catalytic investments were first made, the market has matured and Closed Loop Partners’ work has expanded to include venture capital and buyout private equity, as well as innovation advancement, infrastructure development and circular materials management. These early investments were a market signal, and our work today is a foundation upon which we will invest in and build the circular economy over the coming decades––as profitability attracts more investment and as supportive policy accelerates tailwinds for incumbent supply chains to transition to circularity.

Closed Loop Partners now supports over 1,000 jobs across its ecosystem, all dedicated to advancing the circular economy. We are proud to work with leading organizations, cutting-edge innovators and over 50 of the world’s largest corporations committed to reducing waste across multiple areas––including plastics & packaging, organics, textiles and electronics. Closed Loop Capital Management manages over $500 million and has invested in over 80 companies, municipalities and organizations accelerating circular solutions. Together, our investments have kept 6 million tons of material in circulation and avoided 17.5 million tonnes of greenhouse gas emissions to date. The Center for the Circular Economy has led groundbreaking industry-leading pre-competitive collaborations that are focused on solving some of the most complex supply chain and manufacturing challenges, including reduction, reuse and recovery solutions for foodservice packaging and retail bags. And most recently, with over $700m in commitments from Brookfield, Microsoft, Nestlé, PepsiCo, SK Group, Starbucks and Unilever, we launched Circular Services, which is now the largest privately held recycling company in the U.S. It operates 20 recycling facilities and serves some of the largest municipal contracts in the nation including New York City, Palm Beach County, Austin, San Antonio and Phoenix.

Closed Loop Partners has evolved as the circular economy has advanced. Today, the circular economy is recognized as a core solution to climate change mitigation as we all as a template for more efficient business operations. As more stakeholders recognize the financial and environmental opportunity of the circular economy, billions of dollars are beginning to move toward circular systems. More industry leaders are collaborating around shared waste reduction goals, leaders of countries are working together on a global plastics treaty, U.S. states are proposing and passing bipartisan Extended Producer Responsibility (EPR) legislation to fund recycling programs, and C-suites of Fortune 100 companies are pushing to achieve ambitious publicly stated circular economy and climate goals.

Transforming entire supply chains across multiple industries is the work of generations, but the world is changing faster today than it was 10 years ago. As Closed Loop Partners enters a new decade of action and impact, we see a future ripe with opportunity. We are now at a pivotal point, and the next decade will be critical to delivering outcomes and building transparent, circular systems. There is much more work to be done in the next phase of this systemic shift, but together with strategic partners, and across our platform, we are focused on expanding our impact and rebuilding industries to follow nature’s lead––grounded in resource regeneration and positioned for a resilient future.

As we celebrate this milestone in 2024, we will be sharing key insights on our impact over the last 10 years, and what is to come in the next decades of building the circular economy.

We invite you to join us in the transition to the circular economy.

—

*In October 2020, PureCycle Technologies fully paid off its loan from Closed Loop Partners, thus exiting the Closed Loop Infrastructure portfolio as a borrower. The Closed Loop Partners team, however, continues to engage with the PureCycle Technologies team as they continue growing their operations.

*This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Partners or any company in which Closed Loop Partners or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Information provided reflects Closed Loop Partners’ views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision.

Why We Invested in VALIS Insights: Bringing Circularity to the Metals Processing Industry

March 18, 2024

This blog is part of our “Why We Invested” series, which offers a deep dive into our most recent investments and the growing circularity trends in the space.

The way scrap metal is processed today is a mystery to most outside the industry. When a car or an appliance reaches the end of its useful life, most of us often rely on a junk removal service––or hope that the retailer selling the new equipment will take the old one with them on the way out. What happens after that?

Emily Molstad, Caleb Ralphs and their team at VALIS Insights have spent the past five years getting to know these markets in minute detail. Imagine spending days and nights captivated by how metals are processed in the U.S. after they’re done being used. Imagine coming face-to-face with the information asymmetries in the system that result in mixed metals being shipped overseas instead of recovered for local use. Imagine having hundreds of conversations with processors, metals refiners and customers of virgin and recycled metals to better understand why the system is built the way it is and where there are opportunities to improve it. That’s what this team has done so comprehensively over the past few years, driving toward the creation of their AI-powered software that is closing the loop on a circular economy for metal fabrication.

Today, used metals are still dramatically under-recovered in the U.S. Recycling rates for many non-ferrous and ferrous metals lag below 60%, despite the high resale value of these materials. As of the latest data from the EPA, only 27.8% of ferrous metals (those containing iron) were recycled in 2018––and nearly 7.2% of all municipal solid waste landfilled in 2018 was from steel––equivalent to 10.5M tons. The reality is often worse for non-ferrous metals (such as aluminum, copper, nickel) which may only be sorted for recycling after their heavier ferrous counterparts are removed.

These insufficient recycling rates for metals can be attributed to losses during material processing. Current recycling technology and processing capabilities struggle to address the growing complexity of mixed metal products, leading to contaminated and downgraded metal recovery. Scrap processors have historically recovered only certain metal commodities that were perceived to have higher resale value, leaving out other various mixed metals from the sorting process and shipping them overseas. As a result, significant volumes of aluminum, copper, nickel and cobalt are lost from our domestic supply. However, increasing domestic demand in the U.S. is driving up value for these types of materials, and tools like VALIS’s solution help scrap processors understand the monetary value of the metals they are currently selling overseas.

Closed Loop Partners has long understood the complexities of end-of-life commodity markets––we’ve been investing in the space for a decade and recognize that challenges exist at every stage in the value chain––collection, sorting, resale and ultimately recovery into the next life. For large format composite metals––such as automotive, appliances and heavy machinery––collection has rarely been a problem. These products are bulky enough that they typically end up in processing facilities around the country. The challenge is what happens after that.

We invested in VALIS because their software improves the sorting process of mixed metals and allows domestic processors to maximize the resale value of the outputs, keeping more metals in local circulation. By capturing data on commodity prices and input materials and delivering high-value insights on material and processing trends, they help optimize sortation processes to capture the most valuable metals that might otherwise be overlooked. With more optimized and predictable sortation, processors can command higher prices for higher quality outputs.

As the U.S. faces an extreme shortage of critical metals that are required for the renewable energy transition, solutions like this are increasingly important. Copper, nickel, aluminum, graphite and steel among others are seen as critical and are expected to be in . Many companies have now mandated chain-of-custody and fair labor validation of the minerals and metals used within their supply chains. VALIS helps create lower cost, resilient and transparent supply chains for these metals domestically––and focuses on metal recovery from current waste streams rather than incremental extraction. This provides multiple benefits including reducing waste, enhancing local economies and lowering the emissions footprint of the recycled metals.

Overall, VALIS helps recover more pure metals from our existing waste streams, reduces the complexity of the end products that are being sold for the next stage of processing and can help get metals back in circulation faster. They do all of this, while providing the traceability that’s so essential in today’s critical mineral supply chains. VALIS is improving the business case for scrap processors today, while creating new opportunities for greater material recovery from the urban mine. It makes economic sense. It makes emissions sense. And yes, it makes material sense. That’s the circular economy.

About Closed Loop Ventures Group at Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management; its innovation center, the Center for the Circular Economy; and its operating group, Circular Services. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies. The firm’s venture capital group, the Closed Loop Ventures Group, has been investing early-stage capital into companies developing breakthrough solutions for the circular economy since 2016. The Closed Loop Ventures Group’s portfolio includes companies developing leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy. Closed Loop Partners is based in New York City and is a registered B Corp. Closedlooppartners.com.

About VALIS Insights

VALIS Insights is building AI-powered software that makes recycling more profitable, material supply chains more sustainable and closes the loop on a circular economy for metal fabrication. With VALIS technology metal recyclers gain visibility into their material quality and make data-driven process decisions to extract more value. Founded in 2022 by experts in metal recycling and data science, VALIS is dedicated to delivering the software and data solutions needed across the recycling value chain to ensure the materials of yesterday are properly recovered for the manufacturing of tomorrow. For more information visit https://www.valisinsights.com/.

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Partners or any company in which Closed Loop Partners or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Information provided reflects Closed Loop Partners’ views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision.

Many Americans Don’t Understand What to Do with Compostable Packaging. Here’s a Solution.

February 20, 2024

As countries and corporations get one year closer to their own deadlines for meeting major climate targets, there are some important pathways to emissions reduction that cannot be ignored. Food waste mitigation is one of them.

Roughly one-third of the world’s food is wasted each year––a loss estimated at $230 billion. Nearly 60% of the uncontrolled methane emissions from municipal landfills are caused by discarded food, highlighting its significant impact on the environment. To address the urgent food waste and climate challenge, demand for organics circularity is rising, and with it, the volume of food-contact compostable packaging––a market poised to grow 16% annually in the U.S. until 2032, 4x faster than traditional plastic packaging.

Certified, food-contact compostable packaging can enable the diversion of food waste from landfill and support a circular economy. If food packaging filled with food scraps is properly recovered and sent to composting facilities, then this food wouldn’t end up emitting greenhouse gases in landfills. The food and packaging would also be converted into nutrient-rich compost. But if certified compostable packaging is not appropriately collected and processed into compost after it’s used, more waste is created.

We often hear that there is a lack of recovery infrastructure for compostable materials. The reality is, U.S. composting infrastructure is in the middle of transitioning from processing just yard waste to accepting more types of inputs, including post-consumer food waste and food-contact compostable packaging. Today, 70% of the 200 full-scale composting facilities that process food waste already accept and process some forms of compostable packaging. Plus, 15 million Americans have access to organics collection, a dramatic 49% increase in access since BioCycle’s last survey in 2021.

For food-contact compostable packaging to be successful in the market today, labeling and design need to be aligned so that consumers throw packaging in the right bin, and composters can easily process these materials. Yet, data shows that some labels confuse consumers, who mistake packaging as compostable when it’s not, or misunderstand where to dispose of that packaging at the end of its use.

Without policies that drive clear, standardized labels and instructions on where compostable packaging needs to go after it’s used, a lot of it ends up in landfills or contaminating recycling streams. Conversely, non-compostable look-alike products and packaging can make their way to compost facilities where they end up contaminating the soil. These look-alikes are the primary contamination challenge in the organics stream.

To address this challenge, the Composting Consortium, led by the Center for the Circular Economy at Closed Loop Partners, and the Biodegradable Products Institute (BPI) embarked on a joint study to test different packaging label and design approaches, and how these inform consumers’ assumptions on what to do with compostable packaging after it’s been used. The findings can inform policies that better support labeling practices and standards for both compostable and non-compostable packaging. In the U.S. today, five states have compostable packaging labeling laws, including Washington, California, Colorado, Minnesota and Maryland. Other states, like Virginia and New Jersey, recently introduced laws that would establish recycling labeling requirements.

Until this study, this information on American consumers had not been publicly available. The Composting Consortium and BPI released the findings in a first-of-its-kind industry report. Here’s a snapshot of what the data reveals:

- Nearly 1/3 of respondents say they would place compostable packaging in the recycling bin

Compostable packaging is not designed to be recycled at a material recovery facility (MRF) and can contaminate the recycling stream if intermixed with fossil fuel-based plastics. Compostable packaging that mistakenly ends up in recycling streams loses a significant portion of its value and creates a contamination challenge that impedes the recovery of valuable recyclable materials. Cross-contamination of the recycling and composting streams is an expensive operational challenge and would pose significant risk to both industries. Brands that have set ambitious sustainable packaging goals are also impacted by inadequate collection and processing of these materials.

Our recommendation: Brands and municipalities should work together on educational campaigns and clear, on-pack messaging.

- Up to 50% of respondents say they would place packaging labeled as “made from plants” in the composting bin

“Made from plants” describes the materials used to make the packaging, not where the package should go at the end of its use. In fact, “made from plants” claims are commonly found on plastic packaging that should be recycled (i.e. PET made from ethanol derived from corn). Our study found that American consumers are especially confused by products and packaging that are not actually compostable yet have green or natural coloring, green tinting, or make claims such as “made from plants” without any context or disclaimer language. These plastic, non-compostable materials are virtually indistinguishable from their compostable counterparts.

Our recommendation: Brands and policymakers should support labeling policies that standardize clear, consistent consumer communications, design and labeling.

Source: Alamy

- Adding a trusted certification logo and larger “compostable” call out increases consumers’ ability to identify packaging as compostable by up to 22%

Our study finds that using at least two to three design elements that call out compostability on food-contact compostable packaging, such as the BPI certification mark, the intentional use of tinting and coloring, and a more prominent “compostable” call out, is most effective for consumer understanding.

Our recommendation: Brands and manufacturers should refer to the Composting Consortium’s latest report and BPI’s Industry Labeling Guidelines for specific examples of packaging design strategies that improve consumer identification, increase recovery of compostable materials and mitigate contamination at facilities.

Coming this month: A new report from the Composting Consortium on contamination rates at different composting facilities! Sign up for a webinar to learn about our findings here!

Without standardized labeling, misleading designs and claims will continue to cause consumer confusion. This research provides insights to brands, manufacturers, consumers, policymakers, municipalities, composters and other stakeholders on effective design and labeling techniques that could improve the diversion of food-contact compostable packaging to the right material stream. While these new findings shed light on the issue, this is just the beginning. As the composting space rapidly evolves, complementary studies will be critical to advancing the recovery of compostable packaging––a critical path to reducing food waste and greenhouse gas emissions.

Learn more about these findings in the latest report from the Composting Consortium and BPI here: https://www.closedlooppartners.com/research/us-consumer-perception-of-compostable-packaging/.

What Brands Need to Know to Increase the Recovery of Compostable Packaging

November 28, 2023

Permitting for composting facilities is complex, but critical. The Composting Consortium breaks it down.

Over the last few years, demand for compostable packaging has grown quickly, as more brands explore alternatives to single-use conventional plastic. Whether in the form of a bowl, fork or a chip bag, compostable packaging is becoming more prevalent each year. At its best, compostable packaging could play an important role in reducing food and packaging waste by helping deliver food scraps within packaging to composting infrastructure, avoiding the greenhouse gases emitted if food were to end up in landfill.

But the reality is that the U.S. composting infrastructure in existence today was predominantly designed to process only yard trimmings––leaves, grass clippings and woody debris––because of a policy trend in the late 80s and early 90s that banned yard waste from landfill in dozens of states. As climate change mitigation and zero-waste goals have emerged, the composting industry is modernizing, diversifying feedstock inputs to include post-consumer food waste and certified compostable packaging. But it is only at the beginning stages of that transition.

The Composting Consortium, a multi-year collaboration across the entire compostable packaging value chain, has been studying composting infrastructure for several years. In the U.S., about 70% of the 200 full-scale composting facilities that process food waste also process some form of compostable packaging. Most of these facilities are located in urban areas. The rest of the over 2,500 composting facilities in the U.S. only process yard waste, meaning most Americans lack convenient options to compost food waste, including food-contact compostable packaging. Creating circular outcomes for compostable packaging hinges on scaling the recovery of food scraps, and brands, packaging manufacturers, industry groups, composters and investors all need to be involved.

What needs to happen so that compostable packaging doesn’t end up as waste?

Several things need to be in place for compostable packaging to operate within a truly circular, waste-free system. Consumer education, supportive policy, and clear and consistent packaging design and labeling all play important roles––and recovery infrastructure is a critical piece to the puzzle.

When envisioning a future system where composting facilities accept not just yard waste, but also food scraps, and the compostable food packaging those scraps often arrive with, the first step is to consider what must be true for facilities to upgrade from yard waste-only composting infrastructure to also recover food.

Only when more food waste is recoverable at composting facilities will it be possible to also see more recovery of food-contact compostable packaging. This infrastructure upgrade is a key steppingstone to reducing packaging waste.

Why do permitting requirements matter?

While there is opportunity to upgrade existing yard trimmings composting facilities to recover food waste––and potentially, also food-contact compostable packaging––it is often difficult to get the necessary permits to do so. In many cases, yard trimmings-only composting facilities are permitted to compost only yard trimmings. To obtain a permit to also compost food waste and make all the necessary upgrades, these facilities would need to go through a lengthy and expensive permitting process.

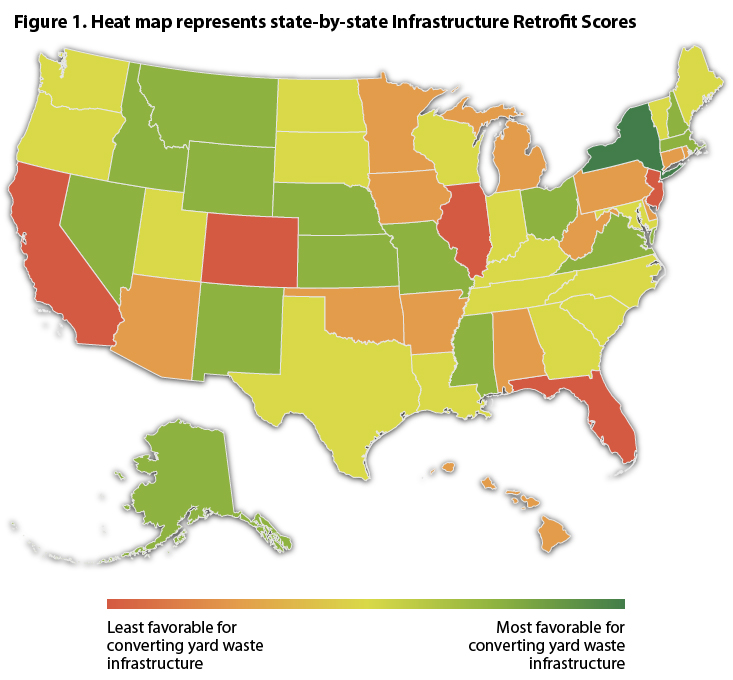

The Composting Consortium, BioCycle and Craig Croker evaluated each of the 50 states’ permitting requirements across five factors to produce a “Composting Infrastructure Retrofit Score” that measures how easy or difficult upgrading existing yard trimmings-only composting facilities would be across different states.

The final Composting Infrastructure Retrofit Score looked across five factors:

- Ease of permitting process: The difficulty of obtaining a permit to compost food waste in a particular state.

- Presence of permitting tier: Whether a state has rules for composting facilities depending on how much and what types of food waste they accept. Some states have stricter rules for facilities that accept large amounts of food waste or food waste that may be contaminated with pathogens.

- Cost to upgrade: The cost of upgrading a yard trimmings-only composting facility to process food waste.

- Time needed to upgrade: The amount of time it takes to upgrade a yard trimmings-only composting facility to process food waste.

- State food waste disposal ban: Whether a state has a ban or mandate that restricts disposal of food waste.

The findings uncovered a patchwork landscape of permitting conditions across the county as shown in BioCycle’s heatmap below. New York state stood out among the 50 states as having a comparatively straightforward process to obtain permits required for infrastructure retrofit, while most states including South Carolina, Rhode Island and California make navigating permitting requirements significantly more costly and time-intensive.

Original Source: BioCycle

In many states, permitting requirements for food waste composting are one of the major factors standing between compostable packaging and the recovery pathways needed to ensure they are a circular alternative to single-use plastic packaging.

What role do brands play in navigating permitting requirements?

CPG brands have a unique opportunity to play a leading role in scaling up a more circular system for food-contact compostable packaging in the U.S.––by investing in recovery solutions for food-contact compostable packaging, advancing consumer education, designing packaging that is compatible with food waste composting infrastructure, and advocating for policies––like extended producer responsibility––that can support the development of food waste composting infrastructure.

To advance the necessary upgrades to composting facilities, brands can be supportive of efforts of composting industry groups like the US Composting Council, who advocates for standardized state regulations for composting. Permitting requirements are a determining factor in creating more opportunities for compostable packaging circularity and navigating them requires the engagement of stakeholders across the value chain.

In 2024 and 2025, the Composting Consortium will continue to connect the dots and work with the compost industry, policymakers, and packaging manufacturers and brands to lower the barriers to scaling food-waste composting infrastructure and unlock value to all stakeholders across the composting value chain. Through this unprecedented collaborative work, the Composting Consortium aims to build a more circular composting system, one that drives values to all stakeholders.

Learn more about the work the Consortium is doing to scale circular outcomes for compostable packaging.

About the Composting Consortium

The Composting Consortium is a multi-year collaboration to pilot industry-wide solutions and build a roadmap for investment in technologies and infrastructure that enable the recovery of compostable food packaging and food scraps. The Composting Consortium is managed by Closed Loop Partners’ Center for the Circular Economy. PepsiCo and the NextGen Consortium are founding partners of the Consortium. Hill’s Pet Nutrition parent company Colgate-Palmolive, Danaher Foundation, Eastman, The Kraft Heinz Company, Mars, Incorporated, and Target Corporation joined as supporting partners, and the Biodegradable Products Institute, the US Composting Council and the U.S. Plastics Pact joined as industry partners. Our advisory partners include 5 Gyres, Foodservice Packaging Institute (FPI), Google, ReFED, Compost Research and Education Foundation (CREF), the Sustainable Packaging Coalition (SPC), TIPA, University College London (UCL), Western Michigan University (WMU), University of Wisconsin-Stevens Point, and World Wildlife Fund (WWF). Learn more about the Consortium at closedlooppartners.com/composting-consortium/