Bringing the NextGen Cup to Life

November 18, 2019

From 480 innovative ideas, to live prototyping, to preparing for pilot readiness and beyond, these next generation cups are paving the way for a waste-free future.

The NextGen Consortium is a global initiative convened by Closed Loop Partners’ Center for the Circular Economy. Starbucks and McDonald’s are founding partners of the Consortium, together with supporting partners The Coca-Cola Company, Yum! Brands, Nestlé and Wendy’s, as well as WWF as an advisory partner. OpenIDEO is the Consortium’s innovation partner.

The NextGen Consortium is working to change the future of beverage consumption. Together, brands, industry experts, and innovators are aiming to bring a waste-free to-go cup to market. With 250 billion fiber to-go cups produced annually, the majority of which end up in landfills today, this is not a small task that one stakeholder can solve alone. And that is the spirit in which the multi-brand NextGen Consortium was formed, launched by Closed Loop Partners in 2018 to advance the design, commercialization, and recovery of sustainable food packaging alternatives.

NextGen Cup is the Consortium’s first initiative, which began with an open call for solutions from around the world to redesign the fiber cup so that it’s fully recoverable at a global scale. Twelve winning teams were selected from the 480 submissions, and six of those teams recently completed an accelerator focused on getting their solutions ready to go to market. The accelerator led to significant progress for each of the teams, as they move along the journey from concept to tangible solution—Accelerator teams have now tested their solutions in a live environment, developed scalable manufacturing plans with 1-3 year rollouts, and have made improvements to their cup design to meet specific circular design criteria.

As we reflect on the learnings of brands, innovators, experts, and designers coming together to tangibly move the needle on a global issue, there are three conditions that have continuously contributed to measurable progress.

One: Collective brand investment

Why was this a collective effort, rather than one spearheaded by a single brand alone? Creating and scaling the next generation fiber cup for global recovery or reuse brings a host of challenges throughout the value chain.

From material choice, to cup design, to barista and customer experience, to integration with waste recovery streams (and much, much more), each component must be carefully designed, tested, and prototyped prior to piloting to ensure the solution can perform to the necessary quality and standards.

The NextGen Consortium was intentionally designed to be collaborative, both across the NextGen Consortium brands, and with the solutions themselves. The strategy behind this was two-fold:

- It’s faster together: Pre-competitive collaboration allows these brands to come together and share insights, learnings, and resources, making for a richer knowledge ecosystem overall. Similarly, cross-brand partnerships can send a unified signal to the market; for example, incentivizing wider adoption of sustainable materials or encouraging recovery systems to collect cups. By looking at multiple concepts at once, all stakeholders can move forward faster, including the teams themselves. Shared feedback mechanisms lead to enhanced learning for all involved.

- It’s less risky together: As partners and innovators learn, experiment, and work together across a number of concepts and concept types, all participants receive a clearer picture of what works through shared learnings and aggregated needs. With time and cup solutions iterations, the Consortium can work to mitigate any risks around introducing new concepts to market.

Two: Controlled prototyping experiences

In June 2019, the NextGen Circular Business Accelerator teams conducted live in-context prototyping at three different Google campus cafes in the South San Francisco Bay Area.

The goals of which were to:

- Accelerate learning: Prototyping helps teams learn faster and identify areas in need of development by testing solutions in an environment that is as close to a real market as possible.

- Test the whole system or a single hypothesis: Product and service systems can have a lot of interdependent moving parts. Prototyping is a low-risk way of testing how all of those parts work (or don’t work) together. It’s also useful for testing out a new feature or hypothesis that a team might have.

- Learn from users: Seeing first hand how users (coffee drinkers, restaurant workers, etc.) interact with and react to the solution is invaluable. The ability to hear their comments, answer and ask questions in real time is an important part of the process.

- Decrease risk: If a part of a solution does not work, it’s useful for teams to learn this early while the stakes are lower and while they still have the opportunity to incorporate what they learn into the next iteration of the product.

Choosing Google campuses as the prototyping location was a specific design choice. The closed environment of a campus approximates a high traffic retail cafe while offering the benefits of being able to control for key variables.

Cup teams had the opportunity to learn from a highly engaged group of users, and leverage Google’s network of micro-kitchens to explore multiple iterations of their solutions at the same time. Maintaining control across key variables provided teams with the opportunity to develop a prototyping plan that focused on the needs unique to their specific cup solution. For instance:

- Footprint was testing lid use and performance.

- Colombier was looking to compare different coating applications on their cups.

- CupClub wanted users to try out the UI/UX of their mobile application.

Three: A niche and specialized accelerator

Cup design is incredibly technical. From the integrity and safety of the cup itself, to the ability for baristas and users to handle them with ease, to becoming truly waste-free, constant attention to each and every one of these details (plus many more) required the development of a set of specialized metrics and tracking specific to this ecosystem.

For example, during the Google prototyping, teams were specifically evaluating:

- User experience: Teams explored first-hand how beverage drinkers interact with and react to their solutions. Testing was conducted in a variety of ways including design research interviews, surveys, observations and comments, and deep-dive question sessions.

- Barista experience: Many teams had yet to see and understand how their cups do or do not work within the barista context. This was a key initial exploration to determine how well the cup is nesting / de-nesting, holding up to certain types of drinks being made, as well as overall impressions from baristas on each cup.

- Performance: Teams measured general performance of each cup solution, including: how long cups must hold liquid at this location based on user habits, how well the cup regulated temperature either with / without a sleeve, how well the cup stacked, stored, nested and de-nested within the space, overall lid performance, etc.

- Disposal: Teams tracked where the cups ended up in bins across campuses in order to better understand what signifiers (written, visual, verbal, etc.) helped to inform consumers of the proper disposal method.

Top row: CupClub, ReCup, Muuse. Bottom row: Colombier, Footprint, SoluBlue.

Where cups end up after-use is a critical part of the journey and a key focus of the NextGen Consortium’s work. By connecting upstream cup innovation to downstream recovery infrastructure, and focusing on understanding and integrating new cup solutions within existing recovery systems, the NextGen Consortium aims to keep the valuable materials in cups in circulation. During the accelerator, teams visited and ran their new cup solutions through materials recovery facilities (MRFs) to see first-hand what happens to their cups at end-of-use. They examined the value of their cup materials post-processing to better understand the market incentives for recycling or composting, which are ultimately driven by end markets.

The benefits of focusing on this very specific world of sustainable cups continued to ring clear as teams graduated from the accelerator and pitched their solutions live to NextGen Consortium Partners and a group of investors during Climate Week NYC, in September 2019. When it comes to storytelling and understanding the breadth of solutions available within the fiber to-go cup ecosystems, seeing each of the solutions side by side helped investors, partners, and teams understand the value of each of their approaches. The cup solutions included:

Reusable cups and cup systems solutions:

- CupClub: A returnable cup ecosystem, providing a service for drinks. Think bike sharing, but for cups.

- ReCup: A deposit system for reusable cups. Rent a cup and return it to any participating partner shop. No cleaning of the cup or carrying around required.

- Muuse: A deposit-based platform for smart, reusable beverage packaging, connecting their cups–and third party products–to Internet of Things technologies. (Formerly Revolv)

Single-use fiber cups and liners solutions:

- Colombier: A recyclable and compostable barrier for paperboard cups.

- Footprint: Cups, lids and straws that are fully formed fiber-based solutions, with an aqueous-based coating that is recyclable and compostable.

Innovative new materials:

• Solublue: Plant-based, food grade and non-toxic products that biodegrade after use.

What’s next for the NextGen Cup?

As each of the six teams stepped off the stage during the final accelerator pitch event, the NextGen Consortium entered the next phase of this work: pilot readiness testing.

After the initial prototyping at Google campuses, select teams will now work to increase the size and complexity of their testing locations, looking at universities and offices, among other locations. Additionally, these teams will now begin to prototype alongside select teams from the NextGen Consortium’s “Advanced Solutions Program,” later-stage teams from the NextGen Cup Challenge that did not require the initial accelerator programming. As these teams work to reach market readiness, their greatest need is additional data points that will prove their concept’s ability to operate at scale.

The pilot readiness tests aim to provide much of that data and help setup teams for next steps around scalability. In parallel, the NextGen Consortium will continue its work convening experts and identifying opportunities to align new cup designs and materials with the infrastructure like MRFs, paper mills, and other recyclers that would process them at end-of-use.

From 480 innovative ideas to live prototyping to preparing for pilot readiness and beyond, these next generation cups are paving the way for a waste-free future. These are not solutions that will be ready overnight and require multiple layers of testing and iteration. That’s why NextGen Cup has a multi-stage, multi-year approach to identifying, testing, and scaling sustainable cup solutions to integrate into the global supply chain.

NextGen Cup is designed to both acknowledge the complex journey of the cup, from design through to cup recovery after-use, and accelerate it by de-risking the process in its collective efforts and creating methods for effective prototyping and pilot readiness.

The Latest Insights and Analysis from Chris Cui, Director of Asia Programs

Chris shares her latest thoughts and takeaways from a recent trip to China where she attended the 14th China International Plastics Recycling Conference & Exhibition and visited a local MRF.

China’s Material Recovery Facilities Are Fast Adapting To A Post National Sword World

We gained valuable market insights from policy makers and market practitioners at the 14th China International Plastics Recycling Conference & Exhibition in September in Shanghai. The discussion focused on how stakeholders across the recycling system should work together to develop a domestic closed-loop ecosystem. This means doubling down on collection, transportation, and reprocessing efforts to enable brands to reach their circularity goals. It became clear that the Chinese government is determined and committed to supporting the development of the circular economy in the coming years by carrying out the following policies:

- Implementing a tax to support the recycling industry

- Creating green standards for recycled plastic and for the production of recycled plastic

We saw firsthand the rationale behind these policies that are being considered. Mr. Wang, the Secretary of CRRA, was also quick to note the number of new faces in the room, including brand owners and capital providers, like Closed Loop Partners and the Alliance to End Plastic Waste. This helped to send a strong signal to the recycling industry around the business case for the circular economy.

Chris promoting the circular economy to brand owners & the recycling industry in China, Shanghai.

Witnessing The Transformation Of A Traditional MRF Into A Tech Enhanced One

It’s been three months since mandatory trash sorting was enforced in Shanghai and other big cities across China. We visited a local MRF to see how the new laws have impacted business. Tianqiang, led by CEO Mrs. Hu, has transformed its business model from a MRF to an all encompassing solutions provider, adding collection, reprocessing and production capacity.

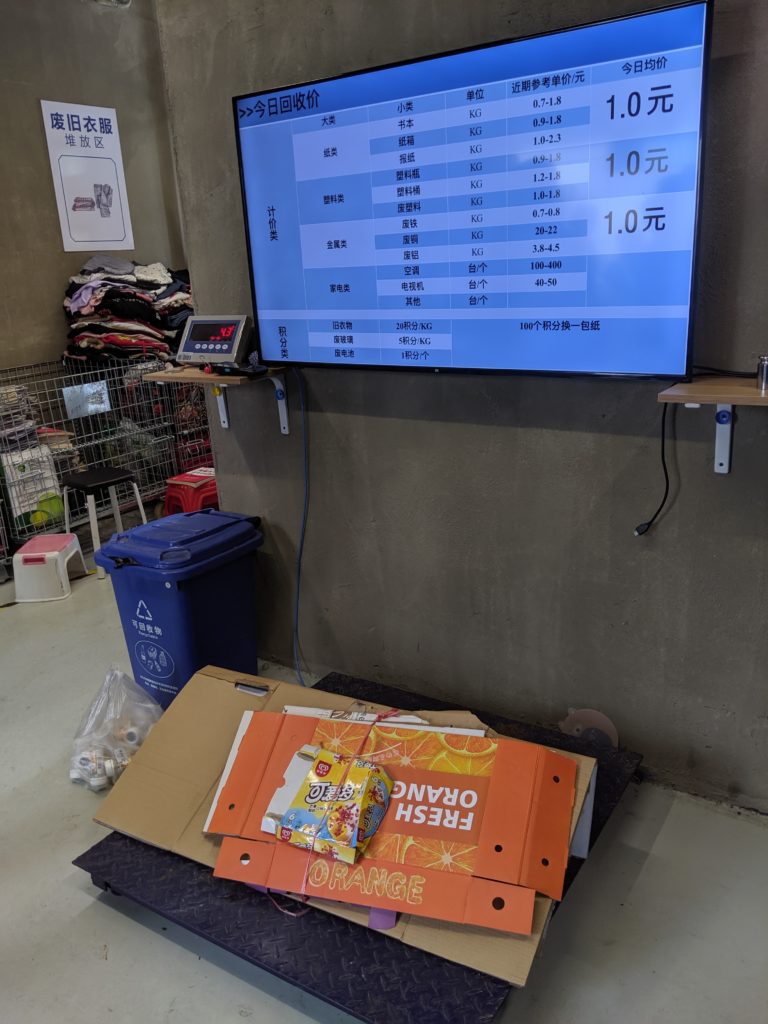

- Tianqiang has implemented technology enabled collection services. They have set up café style smart collection centers with digital scales that are linked to real time commodity prices. Residents get paid immediately by cash or credit according to the commodity price on a given day. Also, operators of the MRF are able to see the exact amount of recyclables collected from each transaction and accumulated at each center on a dashboard. This data helps inform the local government’s waste reduction targets for different communities.

Weighing paper recyclables at Tianqiang.

- Tianqiang is embracing vertical integration. Although their recycled plastic is sold mainly to car and furniture manufacturers, they are also producing their own products such as clothes hangers to sell to retailers. Their recycled paper is being sold directly to the no. 1 and no. 2 paper products manufacturers in China.

- Tianqiang’s collection centers are rent free, strengthening an earlier point that the Chinese government is supporting the development of local recycling infrastructure, for example by providing free land to encourage private sector growth.

Locals separating and sorting recyclables at Tianqiang.

A Linear Take-Make-Waste Economy Has Prevailed For The Last 50 Years, But The Circular Economy Is Where Value Will Be Created In The 21st Century

We have reached an expiration date on the current linear economic system that throws valuable resources away.

When did we stray so far from the common sense value of not wasting? Until the 1950s, people designed products to be proud of their quality and durability. Repair services were a given; a tailor would risk reputational ruin if their clothes had to be tossed after one wear. During the first and second World Wars, recycling was viewed as a patriotic duty. Recycling and reuse were championed. Rubber, metals, textiles, and cooking fats, among other things, were essential to the war effort. And so Americans rallied.

Today, rather than continue to evolve towards conservation and resource efficiency, we seem to devolve into a world of waste and pollution. Approximately 50% of all food produced in the U.S. is thrown out, and food waste is the biggest occupant in American landfills, costing taxpayers billions in landfill disposal fees. Americans throw out 80 pounds of clothing each year. And about 90% of plastic waste ultimately ends up in a landfill or incinerated. The statistics go on, but the loss of these resources has a double sting: there’s a hefty price tag attached to all this waste and dire implications for our health.

A throw “away” culture, while financially beneficial to companies that extract natural resources like oil and mining companies and landfill operators, causes a massive financial hardship to municipal budgets. Landfill tipping fees per metric ton can exceed $100 in the United States and landfills are the third largest source of methane emissions in the world. Ultimately, these costs are paid by taxpayers and municipalities.

The materials we pay to landfill are often valued commodities. Plastics, paper, textiles, and metals can be reused, repurposed, and can re-enter manufacturing supply chains. The recycling industry is a powerful engine in the economy; in 2018, the industry created over $110 billion in economic activity, 534,000 jobs, and $13.2 billion in tax revenues for governments across the country. Only 30% of what can be recycled in the United States is recycled due to a lack of recycling and circular economy infrastructure in many parts of the United States. That means that there is an opportunity to 3x the already substantive jobs and economic value created by the recycling industry.

Given all of this, why are we still following a linear economic model that culminates in wasted resources? Over time, a number of different forces have contributed to the current state of play. In the 1950s, there was a marked shift away from the “waste not, want not” approach to life, replaced instead by a feverish post-war consumption boom where status came to be defined by the quantity of products consumed as opposed to the quality of products produced.

By 1960, the prevailing indicator of the health and success of a country was its gross domestic product – the total value of goods and services provided – rather than attributes like quality of education, air, water, and green spaces, among other things. In the 1970s, economist Milton Friedman declared that the only responsibility of business is to increase profits, establishing the precedent of shareholder primacy which ignores and discounts other stakeholders like local communities and the environment.

While consumers, taxpayers, and the environment lose out in this current take-make-waste economy, extractive industries, like oil & gas and landfill owners win. But we can reimagine this system and an alternative does exist: it is the circular economy, and it’s gaining traction.

The circular economy represents the most significant restructuring of global commerce since the industrial revolution. It is an overhaul of how products are designed, manufactured, sold, consumed, refurbished and recycled, eliminating the concept of waste and keeping materials in circulation at their best and highest use. This new economic model reduces the need for the extraction of finite raw materials and the costly disposal of waste at landfills.

Today is the perfect opportunity to reflect on this shift, since recycling is a key enabler of the circular economy. On America Recycles Day, Closed Loop Partners is celebrating the potential of the circular economy to reimagine capitalism in order to reduce costs, increase efficiency, and protect the environment we share.

The circular economy is estimated to be worth $4.5 trillion globally by 2030. Large consumer goods companies are increasingly recognizing that the development of circular supply chains will reduce manufacturing costs and provide consumers with more sustainable products. Similarly, governments are seeing how local recycling and circular economy infrastructure reduce municipal disposal budgets, generate revenue and drive local job creation. The transition to circularity will rely on collaboration across the entire value chain, including product designers, recyclers, manufacturers and brands. In doing so, we will align the interests of citizens, municipalities, industry and the environment we all share.

Team Spotlight: Allison Shapiro, Executive Director

Allison joined the Closed Loop Partners team this year and is responsible for strategic partnerships, capital formation, and fund structuring at the firm. We sat down with her to hear more about her journey into the circular economy world where profitability and sustainability meet.

I was ready to transition to a role where I could enable systemic change in a work environment where risk-taking was encouraged. I had already decided the circular economy was the right next sector — it was a matter of finding an exciting role that would blend investing, industry influence, and a triple-bottom-line ‘systems thinking’ manner of evaluating problems.

Tell us a little bit about your previous life and what brought you to Closed Loop Partners?

As a college student, I became excited by the possibility of capital markets enabling social and environmental change across national borders. I was a student at Georgetown University’s Foreign Service School studying Science & Technology Policy. I loved everything involved with social and environmental finance: from measuring impacts, to pricing them, to setting up schemes to finance and trade them, all with the goal of finding the most most efficient ways to protect and enable them.

After graduating, I became a carbon markets analyst at a D.C.-based non-profit, studying and reporting on voluntary carbon market trading regimes around the world. At the time, the economy was booming; there were several cap and trade bills in the U.S. Congress; and a carbon price seemed imminent — we could finally decouple greenhouse gas intensity from economic growth! Alas, the financial crisis happened the following year — and with it, so did the near term prospects for a national carbon price.

So, I returned to school in 2009 to study finance and the business of sustainability at the University of Michigan’s Erb Institute, receiving an MBA and an MS in sustainable systems science. After graduating in 2012, I joined JPMorgan in a rotational management training program. Following the program, I became a structured finance banker to alternative investment funds, creating custom financing solutions for alternative investment funds. I enjoyed the product development and also the sophistication of my clients. Most interesting of all, I was seconded to JPM’s Sustainable Finance team for part of my last year at JPM to set up two social impact funds.

After these secondments, it became clear that I was ready to transition to a role where I could enable systemic change in a work environment where risk-taking was encouraged. I had already decided the circular economy was the right next sector — it was a matter of finding an exciting role that would blend investing, industry influence, and a triple-bottom-line ‘systems thinking’ manner of evaluating problems. Having become aware of Closed Loop Partners (CLP) through friends in impact investing two years earlier, the decision to join was an easy one. We’re at a tremendously exciting phase in our platform growth, and I am thrilled to be a part of it.

What excites you most about the circular economy?

Two things: the urgency of the waste / conservation problem, and the fact that circular economy solutions make so much sense! Also, I’ve been obsessed with recycling since college. I even went ‘dumpster diving’ for a month on Georgetown’s campus to try to figure out the right combination of bin siting and labeling that would encourage people to recycle. Yeah, I was cool.

What are you most looking forward to in your role at Closed Loop Partners?

Being able to apply my finance and systems analysis experience to helping Closed Loop Partners grow. The impact, network, and respect that CLP has built in the recycling, sustainability, and impact investing industries is impressive.

LOLIWARE: The Seaweed Straw of the Future

We caught up with Chelsea Briganti, founder and CEO of LOLIWARE, while onboard the National Geographic’s ship, SeaBird, for the first week of the Sustainable Ocean Alliance’s (SOA) Accelerator at Sea this September. LOLIWARE was part of the inaugural cohort of SOA’s ocean-tech focused accelerator in 2018.

Chelsea Briganti, Founder & CEO of Loliware

LOLIWARE is a Closed Loop Ventures’ portfolio company that is pioneering biomaterials derived from seaweed to replace plastics; healing the planet by making single-use plastics obsolete.

Born in Hawaii, Chelsea grew up feeling a strong connection to the ocean, where she was baptized, nourished, and calmed by the waves throughout her childhood. This, along with her industrial design background and desire to use her skills to create a better planet, have helped propel LOLIWARE forward. The company is now working with several Fortune 500 companies and partnering with Marriott and Pernod Ricard to disseminate millions of plastic-free straws.

We sat down with Chelsea to catch up on the latest news. This interview has been condensed and edited for clarity.

With the help of a team of material scientists, food technologists, seaweed biologists, and biopolymerists, LOLIWARE wants to replace the 360 billion plastic straws used globally every year. How far along on this journey are you?

We’re currently underway with a massive scaling effort. This is where most startups completely drop the ball. They have a great idea, it could be world-changing, but they struggle to take it from the lab to mass scale.

Fortunately, I learned a lot from our initial work at LOLIWARE on the cup. We were creating a cup that you could eat rather than throw away. It was an interesting idea and helped put us on the map, but we dropped the ball on the manufacturing side. I learned that LOLIWARE’s strength and core competency, our real sizzle as a company, is our material technology and innovation pipeline, it’s not that we’re manufacturing geniuses.

What we are is a leading materials innovation technology company. This means that we continue to pioneer biomaterials derived from seaweed to replace plastics at scale. We’re doing this by inventing new materials and inventing the process to scale these new materials. We can then take these two blueprints to a plastic manufacturer, for example, and license them. Plastic manufacturers will be dinosaurs unless they evolve with current regulatory and market forces. There are tons of bans on plastics and millennials don’t want plastic anymore. We’re pitching a new technology to help manufacturers evolve with the times.

LOLIWARE’s straw feels just like a traditional plastic straw, but it’s 100% plant-based, hyper-compostable, and marine degradable. What’s the significance of seaweed in your mission to heal the ocean?

The reason seaweed is so special is because it sequesters carbon as it grows and has a fast, renewable lifecycle of four to six weeks. What comprises the seaweed is cellulose, naturally occurring polymers, and proteins. All of these represent opportunity. They can be used for other packaging innovations, for example, you can create a SeaPulp™ by extracting cellulose from seaweed. This can be formed into any shape, with the added benefit of avoiding any health issues associated to PFAs.

When you look at our competition, the only consequential one is paper. You’ve got tons of fiber companies on the scene and China has said that their solution to plastic is paper. But, you’re going to start seeing backlash against paper. In some cases, paper has a worse carbon footprint than plastic because of its inputs: Trees have a long lifecycle and often you have to transport them thousands of miles for processing. We are tree-free and rainforest-free, believing that these precious carbon sinks should remain intact versus be used for packaging.

Seaweed is definitely part of the future of replacing plastic. All of our seaweed is sustainably sourced. Our supplier in Europe harvests it in accordance with strict regulations. Right now, less than 1% of it is harvested and, in turn, LOLIWARE only uses a fraction of that.

LOLIWARE has already built a strong and recognizable brand, appealing to consumers who want to avoid plastics, toxins, and GMO products, among other things. How important has branding been for growth?

You have to have a killer technology, but you also have to have a killer brand, especially given the current climate. I got a lot of push back from early-on investors in LOLIWARE. They felt like we were wasting time, asking “Why do you even have a social media presence?” But I always knew they were wrong. We’re B2B2C and we’re a movement to go plastic-free. We’re also a technology to replace plastic. Both of these things come together. That’s the secret sauce. There is no brand of paper straws or corn-based plastics that people identify with, yet people connect with LOLIWARE. It’s important to be clever, to be fun, and to have beauty in sustainability when it comes to branding.

We also really focus on being a women-empowered brand. For the longest time, women’s inventions have been sitting on the sideline – underfunded and underdeveloped. Yet, women have a lot of buying power and care about sustainability. Now is the time to rally them. We need more women in leadership to solve the problems of the ocean and the planet.

And lastly, we can’t ignore the incredible natural environment we’re in right now as we head toward Sitca, Alaska. How do natural backdrops like this help to inspire your work?

When you’re an entrepreneur you can easily sequester yourself in the office and become hermetic. For me, I’m inspired by nature’s vast expanse. I love how Charles Eisenstein expresses the importance of being in places where the dream of the planet still lives. You definitely feel that here. It’s the dream of the planet, a pristine natural environment. You get the visceral sense that you are on the planet versus in a manmade landscape like New York City. Too often we’re in landscapes where everything is made by us and we can quickly become disconnected from the natural world. It’s important to be able to take the mental image of the dream of the planet back to your work. It’s what we’re trying to protect or even recreate in places where the dream of the planet is dead or dying.

The Latest Insights and Analysis from Chris Cui, Director of Asia Programs

The revision of China’s Solid Waste Management and Pollution Prevention Law could have far reaching impact on brands and recyclers.

A proposed revision to the Solid Waste Management and Pollution Prevention Law in China could affect the operations of brands and recyclers. The revised law entered the review phase at the 13th National Congress on June 25, 2019 and is now seeking public opinion. Below are some key implications of the clauses:

Impact on the packaging industry

Clause 2.13: Companies that produce, use, and store solid waste (SW) should publish their waste management information. Publicly listed companies must also publish their preventive measures against SW pollution.

This represents a significant departure from current protocol. Increased transparency and mandatory reporting requirements for public companies will incentivize companies to invest in SW prevention, potentially providing reputational rewards to those best-in-class. This kind of impact oriented investment fits nicely with the growing interest in ESG investing in China.

Clause 3.20: Producers of SW must pay Environmental Protection Tax.

This would add a new expense for manufacturers that could be passed onto consumers too. The commercial real estate sector in China recently had to adjust to the introduction of this, where previously they did not have to worry about their waste management expenses.

Clause 3.21: The design and production of packaging must follow green production standards that will be set up by the State Market Regulation to reduce waste generation. Producers of materials that fall under mandatory recycling categories must be responsible for the recycling of their materials. The list of mandatory recycling materials will be produced by NDRC (National Development and Reform Committee).

Clause 3.22: The government will encourage R&D institutes and producers to develop and use materials that can be easily recycled, safely stored, and that can decompose in a natural environment. Packaging materials that can’t be easily composted will be banned.

Clause 3.21 and 3.22: It’s encouraging to see that the government is not only promoting recycling, but also the reduction of waste through circular design and materials innovation. This will force brands to adopt circular packaging principles, so there will be a lot of room for innovation in eco-friendly packaging.

Clause 3.42: There will be EPR for electric appliances and other products.

Since 2018, this kind of EPR has been in effect for electric vehicle manufacturers, requiring better lifecycle management across the value chain – from product design and consumption to the recycling and waste management related to electronic vehicles at end-of-use.

Impact on the recycling industry:

Clause 3.28: Permits must be required for the transportation of SW across cities.

Demand for distributed, modular recycling units will grow so that waste can be processed more locally. The need for smart logistics will grow in tandem to optimize for more efficient transportation routes, among other things.

Clause 3.29: There should be a complete solid waste import ban by 2020.

While there has been a lot of speculation in the U.S. regarding whether or not China will implement a total waste import ban by late 2020, as declared in 2017, it is clear that the Chinese government plans to move ahead with this.

Clause 3.57: There will be differential charging schemes for residential waste.

The mandatory sorting of residential waste was introduced in certain pilot cities in China on July 1, 2019. In a district in Shanghai, it now costs $17 USD to dispose of 120 liters of food waste. You can read more about this on our blog on Recycling Rises to Power in China.

Although we do not know how likely it is that all of the proposed revisions will pass or when, the fact that there are so many proposed changes to the current law, which came into force in 1995, and that they’ve gone all the way to the desk of the National Congress, is a signal that waste management is a high priority for the central government. By reviewing the proposed changes, companies in China and abroad can better prepare for what’s coming down the line.

Unlike Europe, where the circular economy is championed by investors, the government, and consumers, in China it’s the government taking the driver’s seat. The proposed revisions to the law illustrate the steps the government is willing to take to develop the circular economy in China. In turn, industries are taking note and are seizing the subsequent business opportunities.

I would encourage brands that consider China as one of their key markets to give serious thought on how they can create a circular advantage to meet the growing demand for sustainable products in China before their competitors do. This will be critical in a context where a country is implementing increasingly strict solid waste management laws.

The reform on plastic pollution in China, the next big thing after National Sword?

At the 10th meeting of the Central Committee for Deepening Overall Reform on September 9th, chaired by the Chinese President, plastic waste reform was listed as a key issue. The following was cited:

“Actively responding to plastic pollution by restricting the production, sale, and use of some plastic products, actively promoting recyclable and biodegradable substitute products, and regulating plastic waste.”

We are still waiting for a detailed reform plan, but this is another huge boost for the development of a circular economy in China, supported by the government. Brands and recyclers in China and overseas should start to prepare for the changes brought by a reform like this.

The Key Takeaways from Fortune’s First Global Sustainability Forum:

This September, in Yunnan, China, I attended Fortune’s first Global Sustainability Forum, speaking on a panel on Waste Not. The Forum dived deep into the business opportunities and challenges that arise from the transition from a linear to circular economy, highlighting the following key points:

- There are three key driving forces behind circularity: increasing shareholder activism and interest in public companies’ ESG commitments; public awareness among consumers on the environmental footprint of products and services; and growing regulation in Europe and Asia to tackle waste issues, especially plastic pollution.

- Finance is slowly but surely reckoning with the economic risks posed by climate change and other environmental threats. ICBC, the world’s largest bank by assets, ran a stress test in 2015 and, we learned, issues higher interest loans to firms that are over-exposed to environmental hazards. The stress tests began in 2015, and have changed the way Chinese banks look at the businesses they fund, now reducing their exposure to coal projects and increasing their exposure to renewable energy.

- Building sustainable supply chains is challenging due to limited transparency around data, a lack of focused financing, and water and waste management typically being too cheap to account for negative externalities. Labor specific issues also often take precedence.

How to Use Design Thinking to Advance Systemic Change, One Cup at a Time

August 05, 2019

Amid burbling espresso machines and towering stacks of cups, six teams in the NextGen Circular Business Accelerator are taking waste-free cup solutions to the next level. Venturing back of house at restaurants and into the world of waste management, see how teams use five design thinking practices to advance solutions for a more circular future.

The NextGen Consortium is a global initiative convened by Closed Loop Partners’ Center for the Circular Economy. Starbucks and McDonald’s are founding partners of the Consortium, together with supporting partners The Coca-Cola Company, Yum! Brands, Nestlé and Wendy’s, as well as WWF as an advisory partner. OpenIDEO is the Consortium’s innovation partner.

If you’re looking for a systemic challenge in need of some new thinking, look no further than your morning cup of coffee. Worldwide, 250 billion to-go cups are produced each year, and there’s an increasing need for recoverable alternatives. Most fiber cups have a plastic liner to prevent leaks. The fiber and plastic are recyclable once separated, but limitations and inconsistencies in recycling infrastructure around the world mean that in most markets these materials aren’t easily recovered. The trouble is, as OpenIDEO Circular Program Lead Chris Krohn explains,

“When we have a systems design challenge, we can’t expect to solve it using the same approach that created the problem. It’s essential to understand the issue from perspectives across the entire value chain, and then work across that system to develop a holistic solution.”

In pursuit of some fresh ideas, Closed Loop Partners launched the NextGen Consortium: a multi-year partnership of food and beverage industry leaders that aims to address global single-use food packaging waste. Up first, the ubiquitous hot and cold, fiber-based, to-go cup. The NextGen Cup Challenge identified twelve innovators with the most promising cup solutions – from new cup liners to reusable cup systems. Of those, six winning teams (pictured above) joined the NextGen Circular Business Accelerator, an initiative to help prepare the teams for testing and scaling their solutions to meet the needs of today’s biggest brands and consumers worldwide.

Before rolling out new cup solutions in a real-world setting, it was essential for Accelerator teams to understand the customer needs, business realities, infrastructure challenges, and people at the core of the cup ecosystem. In a week-long design Bootcamp that took us behind counters and across the San Francisco Bay Area, OpenIDEO, with support from Closed Loop Partners, led teams through five design thinking practices to quickly surface new insights and inspiration. Try them out yourself the next time you’re working on a complex problem.

1. Center on a plan for informed, effective research

Design a fresh perspective. An essential part of the design thinking process is design research: exploring what people say, think, do and feel to help build human-centered solutions. This often means getting out into the field to meet people where they are, which helps us understand real needs and imagine what’s next. As Nina Montgomery, an IDEO design researcher, shared with NextGen Accelerator teams at the start of the Bootcamp,

“The power of design research is that—through empathy and inspiration—it is able to surface new thinking.”

Start with what you know. Before jumping into the field, it’s helpful to curate some background knowledge. We worked with each Accelerator team to compile insights from desk research—across internal documents, datasets, and market, competitor and business plan analysis—to get a sense of what was known and what we needed to test. Some teams, like RECUP from Munich, Germany, plan to roll out systems involving reusable cups, while others, like Solublue from London, UK, are building biodegradable cup solutions from new materials. Despite this diversity in business models, every team needed to know how consumers and distributors would respond to their particular cups. We also took into consideration the needs of Consortium Partners like McDonald’s and Starbucks to help identify any gaps and inform the key questions each team had to answer to set themselves up for scale.

NextGen Circular Business Accelerator teams make a plan for their design field research.

Develop a research game plan. With this in mind, we kicked off the Bootcamp by developing a design research plan. This included deciding on research methods, team roles, and questions to ask in the field, and ensuring we were integrating research ethics. Building on background research, we helped Accelerator teams identify and schedule time to visit the kinds of people and places that would surface valuable, diverse insights about the to-go cup ecosystem. Together, we synthesized research questions in a discussion guide that was shared with each team member, ensuring that field research focused on what mattered most. Armed with a plan, a notebook, Sharpies, and lots of Post-Its, we were ready to hit the streets of San Francisco.

Try it:

- Explore a variety of design research methods in Design Kit.

- Focus in on your key research questions using this Design Research Discussion Guide.

2. Gain micro-level insights through observation

Watch and learn. That’s how, on a bright Tuesday morning, a group of IDEO designers and Accelerator entrepreneurs found ourselves attentively watching a stream of cups dance between hands and over counters at a San Francisco McDonald’s. Observation is a key method of design thinking. By taking a step back and looking carefully, we can better understand systems at a micro level.

At McDonald’s, observing employees interact with cups soon surfaced some fresh insights. To keep up with the lunch rush, cups must be easy to grab with one hand, nest well but also release easily from a stack, and communicate branding. Through observation, Accelerator teams quickly built empathy for the employees and identified how their new cups would or would not meet McDonald’s needs. By allowing us to observe their operations, McDonald’s was able to easily communicate their business realities and product requirements in a way that would have been impossible through words alone.

“Everyone knows McDonald’s, but how many people can say they’ve experienced the back of house logistics required to operate one? The Bootcamp provided opportunities like this that startups only dream about, and catapulted our growth potential in ways we’ll still be processing months later.”

Lizzie Horvitz, one of the Accelerator participants

Try it:

- Observation is simple. Grab a notebook, a pen, & scope out a good place to watch & listen.

- Find tips for getting started in this quick Design Research Field Guide from IDEO.

3. Uncover disconnects and trends with interviews and intercepts

Listen for gold. To fully understand what someone is thinking or feeling, we’ve found it’s often best just to ask. Building on our observations, we set up interviews with baristas, managers, and more, asking open-ended “how” and “why” questions that encouraged them to speak freely.

What we heard was a surprising amount of confusion around cup disposal best practices. In one coffee shop, baristas were told to compost cups, while the trash bins in the shop had signs instructing customers to recycle—both instructions contrasting with San Francisco waste management company Recology’s guidelines. User interviews helped teams identify pain points and systemic disconnects which would have been tough to spot without talking to the people on the ground.

Teams gather user feedback on their cup designs and systems during intercepts and interviews.

Intercept for quick insights. The trouble with interviews: they can take time to set up. That’s why we also practiced intercepts— brief moments of connection with users that allowed us to capture impressions and test assumptions in real time. Conducting an intercept is as simple as walking up to a friendly face, introducing yourself, and asking a single important question.

The Footprint team—offering fully formed fiber-based cup solutions—tried out intercepts in a coffee shop, surveying customer opinions on their brown fiber cup vs. their more traditional white cup. The responses were intriguing. In general, millennials seemed to prefer the brown cup, describing it as “natural,” while older generations felt it looked “dirty.” By compiling responses, intercepts helped our teams quickly identify demographic trends and interests that would help define their future product offerings.

“Field research during the bootcamp showed us that there is potential to improve our cups and lids both for convenience and recyclability. We also got better insights into how logistics and incentives around the cup system might need to be adapted for the US market.”

Alexandra Gurstmeier of ReCup

Bring it all together. After every field research session, it’s important to debrief to ensure insights aren’t lost. With each Accelerator team, we’d synthesize—transferring notes from observations and interview guides onto post-its, sticking them up on a board, and grouping where we saw trends. This process helped the teams identify the essential flags, opportunities, and business considerations that surfaced in their research.

Try it:

- Use this Interview Guide to shape consumer conversations and ask strong questions.

- Fill out an Intercept Worksheet to get set up for these quick moments of connection.

4. See a challenge with fresh eyes through analogous experiences

Learn from others. Paradoxically, sometimes the best way to think differently is to seek what’s similar. Analogous research takes a look at different industries to find inspiration in the ways others have tackled similar challenges. During the Accelerator, we paired teams with organizations that have successfully worked through an issue our teams were currently facing. For example, the Solublue team—offering a plant-based, biodegradable cup solution—is currently preparing to ramp up its production. The team toured the Dandelion Chocolate factory for an inside look at how they set up and scaled their manufacturing process.

The Solublue team and IDEO design researchers explore the manufacturing systems of Dandelion Chocolate as analogous research.

Meanwhile, the CupClub team, which creates reusable cups people can pick up in a coffee shop and deposit at dedicated drop points around their city, found inspiration from an unusual source: rentable electric scooters. While cups and scooters may not seem to share much in common, CupClub learned from the Spin team how they managed the “economies” that popped up around their scooters, which provided quick cash for people willing to collect and recharge the scooters at home. This insight led to an interesting question for the CupClub team: how might we build economies of support around a reusable cup model that promote sustainability and job creation?

As the teams found, analogous research is a great way to gain a new perspective, learn from other’s struggles and successes, and help break through entrenched thinking.

Try it:

- Brainstorm: what other industries are tackling problems similar to the ones you are facing? What can you learn from their approach? Use this analogous inspiration exercise as a guide.

5. Map the existing infrastructure to define the path forward

Get real. To design sustainably, it’s essential to understand and integrate into the existing ecosystem that will touch a product over its lifecycle. Mapping how each team’s solution fit within the broader cup recovery infrastructure was crucial to ensure their cups would be fully recoverable down the line.

NextGen Circular Business Accelerator teams tour San Francisco’s waste recovery center, Recology.

Seek an informed perspective. Learning from experts, Accelerator teams toured waste management expert Recology’s facilities to better understand the technological capabilities and market forces affecting the local Bay Area recovery infrastructure. During the visit, teams had the opportunity to run their products through Recology’s recycling lines to gather real-time performance data. Teams also heard from Kate Daly, Managing Director at Closed Loop Partners, who shared a macro-perspective on global trends in recovery and reuse, and helped the teams think big picture—connecting upstream innovation to downstream recovery.

“Alignment between the design of cups and infrastructure is critical for capturing materials at every phase of a cup’s life cycle. It’s also important that as we continue to design for a better, more sustainable future, our infrastructure evolves too.”

Map the journey ahead. With these insights in mind, it was time to pull it all together. To get started, we helped teams consider their product journey, including all the people engaged along the way. The teams created a Post-It to represent every actor—from raw material producers and manufacturing technicians to corporate and distribution partners, consumers, and waste management experts—and made note of their specific needs as identified through research. Between actors, we drew lines to represent relationships: those that already existed, and those that each team needed to build in order to scale their solutions.

Ecosystem mapping with Henrik Björnberg, Chair of Colombier Group. Winning Cup Category: Innovative Cup Liner

The takeaways from the ecosystem mapping process set the Accelerator teams up with an actionable roll-out plan that identified their place within the existing infrastructure and who they needed to build partnerships with in pursuit of a fully circular, sustainable cup system.

Try it:

- Try out this product journey mapping exercise, then imagine new partnerships that could strengthen your network.

All together, these five design thinking practices helped our NextGen Accelerator teams gain a deeper understanding of the complex micro systems and macro infrastructure their products need to serve, while enabling Consortium Partners to quickly surface business realities and sticking points, helping to de-risk and accelerate the roll-out of new cups worldwide.

While not everyone can embark on a research sprint through futuristic waste recovery facilities and McDonald’s back-of-house experiences, anyone can apply design thinking practices to uncover fresh insights.

When addressing a problem that requires systemic change—prep, observe, interview, seek analogous inspiration, and map it out. The result could be some powerful new thinking, or perhaps even the holistic, circular cup of the future.

What’s Going on in China: Recycling’s Rise to Power

Chris Cui, Director of China Programs, builds bridges between the U.S. and Asia in order to advance the circular economy. She brings 13 years of cross-sector experience in financial service and philanthropy sectors in Asia, Europe and the U.S., advising Fortune 500’s emerging market strategies to capture growth potential from Asia.

The U.S. as well as other developed countries were taken by surprise when the Chinese government implemented a ban on the importation of recyclables on January 1, 2018. However, the Chinese government had been sending signals for the past decade of their future plans around both the importation of recyclables and the development of domestic recycling infrastructure.

Eight cities in China were selected as pilot cities for pilot recycling programs as far back as 2000 in order to study the most effective programs. Recycling gained significant attention in June 2019 when Chinese President Xi stressed the importance of cultivating the good habit to improve the living environment and to contribute to green and sustainable development.

“Trash classification is related to the people’s living environment and the economical use of resources. It is also an important embodiment of the level of civic-mindedness. Extensive education and guidance should be carried out to make the people realize the importance and necessity of garbage sorting.”

Chinese President Xi

It’s very rare that the top leader, rather than the Ministries in charge of the industry, make such strong statements about recycling.

Importantly, it demonstrates the priority that China has placed on the development of its own domestic recycling programs and infrastructure, as part of its effort to combat environmental issues that threaten the health of its 1.4 billion citizens. It also explains why China carried out the ban in the first place; they are continuing to shift their focus to developing domestic recycling infrastructure to feed their massive manufacturing base. Xi has made clear that the public sector will support the private sector to develop infrastructure to turn “waste” into opportunity.

So, what does this look like?

The Chinese government aims to increase recycling rates to 35% for residences by 2020, they’re building basic trash sortation systems and starting to charge waste management fees for both residential and commercial waste for 46 major cities by the end of 2020. They’re also expanding their trash classification system to all cities by 2025.

The four new trash sortation categories in China.

Image source here.

Case Study: Shanghai

Shanghai is one of the first cities to start responding to the policies from Central Government. Twenty-three million people must learn to sort their trash according to four labels – recyclables, dangerous goods, kitchen waste and other waste – under a mandatory sorting scheme starting on July 1. Misclassification will result in a fine of up to USD 30 for individuals, USD 7,200 for commercial entities and USD 70,000 for recyclers (and the potential revoking of their licenses). How to sort trash correctly is not just in the news, it’s the talk of the town and it’s even included in exam questions for schools.

For individuals who fail to sort their trash, their social credit rating, which not only determines their mortgage rate and insurance premium, but also their eligibility to purchase flight tickets and even send their kids to public schools, will be lowered.

Unsurprisingly, these new developments in recycling bring challenges, particularly around education and infrastructure. The Shanghai government has hired 1,700 instructors, conducted 13,000 training sessions, and created an app to handle enquiries to help citizens meet the requirements.

Meanwhile, the policy highlights the current lack of infrastructure for this kind of scheme. There needs to be significant investment from both the public sector and private sector to sufficiently grow the collection and sortation capabilities of the country. This especially applies to rural regions, which constitute a large proportion of China and lack the necessary infrastructure to deal with trash, especially tricky waste such as fertilizers and pesticides.

Yet all of these shifts have culminated in, and created, a significant business opportunity. Recycling needs investment now. China’s planned economy means that every five years, the central government will create an economic development plan for the country for the next five years. Key sectors that are targeted in the five-year plan will receive support, from specific policies to financial subsidies, that attract significant interest from the private sector. The recent emphasis on the recycling sector is a good example of this and, importantly, sends a positive signal to the market.

Residents in Shanghai search the internet for guidance on how to sort trash correctly.

Image source here.

The Business Opportunity Is Vast and Growing

At Closed Loop Partners, we know that keeping valuable commodities circulating in supply chains is good business. The current developments in China are spurring interest, excitement and investment in the space, which will continue to grow. There is room for both startups and bigger companies, domestic as well as foreign players, traditional players in the recycling industry and new players from other sectors like tech, marketing or consumer goods companies; all of whom are ready to innovate and embrace the change. We’re seeing a new structure of supply and demand around recyclables worldwide. Shanghai is just the beginning; more cities and business opportunities will arise in the coming years as a result of the combination of favorable factors:

The public markets are all in

With preferential policies and hundreds of billions of dollars to support the campaign, stocks have been rising for companies that supply equipment, chemicals and other services related to recycling.

The private sector is paying attention

More and more startups are emerging to solve the waste management problem in China, with some managing to raise money from mainstream VCs such as Alibaba, Baidu and Tencent. Robots for sortation, like AMP Robotics, or mobile apps for smart recycling stations or second hand mobile phones are just some examples of the innovations applicable in the field.

Demand for recycling related equipment and services is growing

As more cities follow the example of Shanghai and start mandatory urban trash recycling, related sales will jump significantly; sales of the smart trash bin on JD.COM soared by 613% between June 1-13 and it’s estimated that Shanghai residents bought 12% of the smart trash bins sold nationwide.

Sustainable packaging will be encouraged

Innovations in sustainable packaging will be welcomed by brands. Policies have been drafted on EPR in China for the packaging industry.

Opportunities for completely new business models are emerging

Challenges in the enforcement of trash classification means there are opportunities for entirely new business models to solve for the new pain points. For example, startups are offering online booking services for on-demand trash pickers and sorters that will come to your home.

If you’re interested in learning more on this topic, get in touch with Chris Cui and join us at these upcoming events:

- 14th China International Plastic Recycling Conference & Exhibition 2019, Sep 25-27, Shanghai, China. Closed Loop Partners is a co-organizer and will give the keynote.

- The Fortune Global Sustainability Forum 2019, Sep 4-6, Yunnan, China. Closed Loop Partners will be speaking on a panel.

Key Takeaways from the Largest North American Circular Economy Conference

It was a momentous moment in Minneapolis last week as more than 800 people convened for Circularity 19, the largest conference in North America devoted to advancing the circular economy. In acknowledging the world’s finite resources and increasingly volatile supply chains, transitioning to a system that keeps valuable materials in circulation at their best and highest use has become a no brainer. In fact, it’s what many companies have been doing for a long time; Caterpillar has been remanufacturing products since the nineties.

Although not an entirely new concept, supporters of the circular economy are now reaching a critical mass. Consumers and companies alike want a more sustainable economic model. Now we have the appropriate framework: the circular economy. This doesn’t predicate itself on infinite resources; it reduces costs, creates jobs and protects our environment. From large brands like Google and 3M to students, NGOs, financiers and community activists, there was significant momentum behind Circularity 19.

Together, conference attendees watched startups pitch circular solutions such as reusable cup systems, explored the potential of materials marketplaces, and learned about transformational technologies that turn waste plastics back into the building blocks for new materials. All of these examples demonstrated the benefits of keeping valuable materials in circulation.

What was clear was that the circular economy isn’t a nice to have, it’s a need to have. Companies and individuals can’t afford to throw away the valuable rare earth elements in their phones or to ignore the intrinsic value of waste plastics that can reduce our dependence on oil extraction.

An overarching theme of Circularity 19 was around the power and responsibility that inevitably comes with advancing any new system; the importance of making sure the circular economy doesn’t suffer from the same ailments of the past linear “take-make-waste” system. Three areas in particular continued to come up in conversation:

The need for a just and equitable circular economy from the start

There needs to be a greater focus on the social elements of the circular economy; historically underrepresented groups, particularly lower income communities of color, are often disproportionately affected by environmental injustices. In a panel on Power, Privilege and Bias in a Circular Economy, speakers highlighted the importance of including everyone at the table from the very beginning, flagging the need for awareness and intentionality around what signals are being sent when developing a new system. There is also a need for thinking about how the success of circularity is measured from both a business and social standpoint; defining shared metrics for a truly regenerative, healthy, circular society is critical.

The importance of healthy materials and safe chemistry in the circular economy

It’s simple. In a circular economy valuable materials are kept in play, cycling in perpetuity, so the materials of choice must be safe and high quality. What does this really mean? Materials must be evaluated, tested and designed with their next life in mind – what happens when these materials come into contact with your skin? What about with the soil? If something is comprised of mixed materials, for example treated for flammability to serve a particular purpose in their first life, can these materials ever be food grade quality in their second life? These are the kinds of questions that were facilitated and fostered at Circularity 19, helping attendees to think through unintended consequences.

The urgent need for industries to collaborate outside of their comfort zones

A common thread throughout Circularity 19 was the need for unlikely bedfellows in order to achieve systemic, circular change. It takes more than just one industry. For example, the fashion industry can and must learn from the chemicals industry. The technologies emerging from the latter have important applications for the former, including chemical recycling technologies to process polyester garments at the end of their first life. Similarly, the tech industry has spent years investing in the development of RFID technologies and other tracking systems for the digital economy. But not enough organizations are applying these learnings to fashion. There is huge potential for weaving RFID technologies into garments so that stakeholders can keep track of their products’ lifecycles. Scanning tags and seeing that a garment is made of 100% linen and from a certain brand is valuable information that can influence the next life of a product – is it best for resale? Or is it best to recycle the product into fibers to create a new garment?

Throughout Circularity 19, it was encouraging to see how much progress has been made on circularity, as well as important to see how far we still have to go on this journey. By sharing knowledge and continuing to have productive conversations with diverse stakeholders, the conversation can be pushed forward. It was heartwarming to be a part of Circularity 19 this year and we look forward to Circularity 2020 in Georgia.

Investable Opportunities to Stem the Tide of Ocean Plastic Pollution and Build a Circular Economy

With only 9% of the world’s plastics getting recycled and global plastics demand forecasted to triple by 2050, we’re in desperate need for tangible, investable solutions to avert a crisis. Where ten years ago, the urgent need to broach this subject was met with resistance, today the conditions are altogether different.

Across the globe, movements such as Break Free From Plastic and legislation like the EU’s Circular Economy Action Plan have galvanised the public. Shocking images of sea turtles maimed by straws or statistics about there being more plastic than fish in the sea by 2050 have struck a chord.

It’s clear we must rethink our current leaky, linear system and shift to something more circular. We need a system that’s consciously designed to use less materials in the production and delivery of products and that keeps materials in circulation at their highest value for as many generations as possible, if not infinitely. This way we can reduce our waste and our extraction of raw materials.

Sometimes plastic is the most appropriate material to serve a purpose, given its particular properties, other times it’s not. There is no silver bullet approach. We need to invest in both near term solutions and long term solutions with clear paths to scaling to tackle the problem of ocean plastic pollution and reduce overall environmental impacts.

The good news: we’re already seeing clear, investable solutions that can shift us in the right direction.

There are at least 60 technology providers developing transformational technologies that purify, decompose, or convert waste plastics into renewed raw materials in North America, representing a $47 billion opportunity in North America alone. Many of these technologies mean there is no limit to the number of times plastics can be recycled, thereby helping us to shape a more circular economy for plastics.

Other companies are exploring innovative new delivery models or alternative materials science. Their outputs could supersede the need for plastic packaging altogether, whether through vending machines that dispense exact amounts of product into reusable containers like Algramo, new feedstocks replacing styrofoam packaging like TemperPack or through hyper-compostable, edible straws made of sustainably harvested seaweed like Loliware.

Large banks and brands are getting on board too, recognizing the need for change. Institutions like Goldman Sachs, Citi, Comerica Bank and Engie have co-invested in our funds in order to catalyze the development of the circular economy.

If we’re to stem the tide of plastic pollution in our oceans, it’s critical that we invest across the value chain and in companies that are rethinking the system for a more sustainable future. With the current enabling conditions, from policy to consumer engagement, now is the time to do it.

This blog was inspired by the discussion in Confluence Philanthropy‘s webinar on Exploring Investor Solutions to Restore the Ocean, which I participated in with Mark Spalding, President of The Ocean Foundation, Conrad MacKerron, Senior Vice President of As You Sow, and Angela Howe, Legal Director of Surfrider Foundation.