How the Apparel Industry Is Challenging Us to Think Again on Circularity

September 17, 2024

In crowded retail stores, it’s easy to believe that all products on shelves eventually find their forever home in someone’s closet, or at least get re-sold at an off-price retailer at some point. But today’s retail experience––as convenient and on-trend as it is––does not indicate the complexities of operations behind the scenes.

Behind the rapid and improbably simple exchange of products in stores, from cashier to customer (and back, as clothes are often returned), are legacy supply chains struggling to keep up with the speed required of retail today.

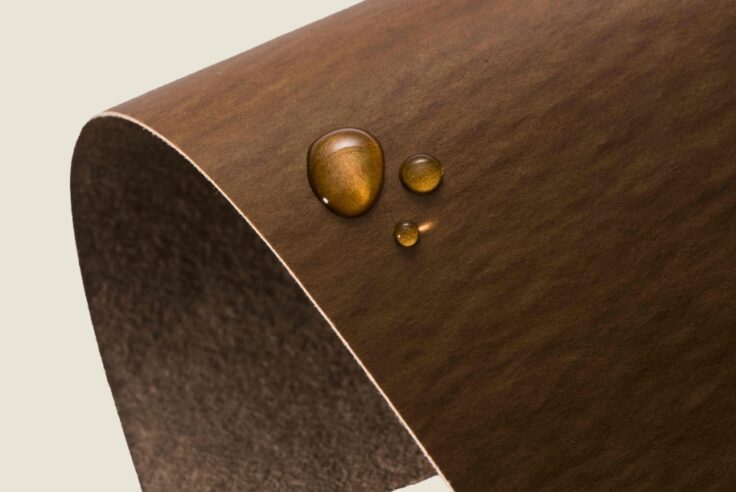

The rapid pace of trends and increasing volume of returns are up against slow supply chain timelines and complex logistics. This translates to a lot of excess clothing––most of it ending up in landfill. Textile recycling and recovery systems are also not yet scaled to recover all these items; often, the best case scenario is items like jeans turning into home insulation. They don’t become new jeans again.

The high cost of waste, to both retailers and consumers, has sparked the need for change, but the apparel industry has ebbed and flowed in its transition to circularity. Yet, in the past six months, the tides have been turning. What makes the next decade the time for the industry to rise to the challenge of an urgent waste crisis?

Retailers are hurting––and change is the only option.

The proliferation of style requirements, and long timelines between a brand placing their order and receiving it, have made it increasingly difficult for retailers to purchase only what they need––and to design in ways that minimize overstock and oversupply. The result is anywhere from 12-40% of clothing is unsold at the end of the season[1]. These are clothes that the brands have already paid their manufacturers for and are now taking losses on through liquidation channels. Even when a product does make it to a consumer, it will likely be worn fewer than seven to 10 times before being discarded,[2] a result of increasing consumer demand for the new and novel and manufacturers’ decisions to prioritize lower cost, lower quality construction to bring products to market quicker.

In parallel, return rates are soaring––up to 20-30% of all products purchased.[3] This costs retailers up to $30 per returned item––or even 2/3 the cost of an item––regardless of whether they’re going to be able to sell that product again.[4] This is made more challenging because a large percentage of returns are damaged on their way back to shelves[5]. Those never make it back on shelf to begin with, even if they were efficiently processed and listed for resale. Every year, more than 9 billion pounds of material end up in landfill from consumer returns.[6] It’s no surprise that historically lenient policies for returns are beginning to fade away[7] as retailers wrestle with finding a balance between top quality customer service and operating a profitable business.

As retailers struggle to right the wrongs of legacy business models, circularity could create opportunities to reduce cost and waste together.

Consumers are aware––and want to see change.

The average consumer purchases 53 new items per person per year––U.S. consumers throw away more than 80 pounds of clothes in the same timeframe.[8] Consumers are increasingly engaging with “returnless refund” models, where retailers offer to refund a consumer a purchase and allow them to keep the product to save shipping and processing costs on returns[9] (which make very clear that the ultimate destination should they have returned the product is landfill), and are asked to engage directly with the disposal themselves. Legacy donation-led systems have also come under increased scrutiny, and it’s become clear just how much business-as-usual results in products being shipped overseas or ultimately landfilled.

In parallel, large retailers are promoting resale and takeback channels at unprecedented levels (see Trashie’s recent announcement with Steve Madden for their takeback recycling program), not to mention the mainstreaming of resale through models like ThredUp, The RealReal and others. Rental is also on the rise again, and it’s creating a sense of community, as our portfolio company, By Rotation, has demonstrated.

In other words, consumers want to be a part of the solution.

High profile “failures” are encouraging all of us to think again

Earlier this year, early innovator in textile recycling, Renew:cell, declared bankruptcy[10]––a sobering moment for all of us who work in this industry. The reality is that less than 1% of textiles are recycled into new fibers annually,[11] and while the necessity of textile recovery is widely recognized, it’s been seen as a Sisyphean task by the industry.

The cost to purchase end-of-life materials is often high. This is driven up by competition with cheaper downcycling options that do not require the same level of stringent sorting as more complex molecular processing technologies. Most of those technologies are currently operating sub-scale, with significant upfront capital requirements to grow to a point where they can produce at parity to virgin fibers.

Where is the opportunity? Necessity is the mother of invention and we’ve seen a remarkable evolution in the willingness of brands and institutional investors to support first-of-a-kind facilities supporting next life textile collection, sorting, processing and recycling in the past twelve months. An evolving capital stack is positioning us to help emerging technologies achieve scale more quickly, as more innovators come into the market to focus on lower cost solutions.

More sophisticated capital partners, and a new crop of innovators––let’s do this!

We’re (finally) all in this together.

In short, if you’ve been an innovator working to advance textile circularity, or a brand responsible for reducing waste in your supply chain, the past decade has been challenging. But in the past two years, the narrative has shifted, and we believe the momentum has returned. Brands, consumers and innovators are coming together with urgency––because the problem of textile waste is not just one for the planet. It is an existential threat––and opportunity––for the industry itself.

At Closed Loop Partners, we’re excited to be on the front lines of this transition. We hope you’ll join us.

If you are interested in continuing to engage on this topic, Closed Loop Ventures will be co-hosting a session during New York Climate Week with the Los Angeles Cleantech Incubator. Please reach out if interested in attending at [email protected].

Note from the Author:

I am lucky to have gotten to evolve my thinking on the apparel industry in real time with a host of industry experts over the past few months. Many thanks to the Circularity24 team from Trellis––and my co-panelists from Eileen Fisher, Fillogic, Debrand and Loop, the team at Home Delivery World, innovators in textile design, reverse logistics, and recycling––including CLVG portfolio companies Browzwear, Hyran, Fillogic and so many others for helping to push my thinking.

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

[1] Source: https://www.theguardian.com/fashion/2024/jan/18/its-the-industrys-dirty-secret-why-fashions-oversupply-problem-is-an-environmental-disaster

[2] https://stateofmatterapparel.com/blogs/som-blog/10-scary-statistics-about-fast-fashion-the-environment

[3] Source: https://3dlook.ai/content-hub/apparel-return-rates-the-stats-retailers-cannot-ignore/; https://coresight.com/research/the-true-cost-of-apparel-returns-alarming-return-rates-require-loss-minimization-solutions/; https://medium.com/@shaku.tech/the-challenge-of-high-return-rates-in-the-fashion-industry-ab51878d0073

[4] Source: https://www.modernretail.co/operations/the-case-for-and-against-return-fees/; Source: https://www.modernretail.co/operations/the-case-for-and-against-return-fees/; https://www.letsbloom.com/blog/true-cost-of-ecommerce-returns/

[5] Source: https://www.cnn.com/2021/01/30/business/online-shopping-returns-liquidators/index.html; https://www.newyorker.com/magazine/2023/08/21/the-hidden-cost-of-free-returns

[6] Source: https://www.fastcompany.com/90756025/product-returns-are-wasteful-for-companies-and-the-planet-heres-how-to-change-that; https://earth911.com/business-policy/rescuing-product-returns/

[7] Source: https://www.cbsnews.com/sacramento/news/more-retailers-doing-away-with-free-returns/; https://retailwire.com/free-returns-are-starting-to-disappear/

[8] Source: https://fashionunited.com/global-fashion-industry-statistics

[9] Source: https://www.cbsnews.com/news/returnless-refunds-retailers/; https://www.gotrg.com/company/news-events/news/this-is-everything-to-know-about-returnless-refunds-and-keep-it-options

[10] Source: https://www.renewcell.com/en/renewcell-decides-to-file-for-bankruptcy/

[11] Source: https://www.mckinsey.com/industries/retail/our-insights/closing-the-loop-increasing-fashion-circularity-in-california

Related posts

Blog Post

The Hidden Value of Scrap Metal: Why Local Recovery...

VALIS discusses circularity of metal processing, and...

Blog Post

How AI Can Reduce Food Waste at Restaurants

Closed Loop Ventures Group led the seed investment...

Blog Post

Why We Invested in Mycocycle: Nature-Inspired Circular...

Closed Loop Partners’ Ventures Group saw a key opportunity...

Press Release

Closed Loop Partners Leads $4M Seed Round for LAIIER,...

Investment in the innovative liquid leak detection...

Blog Post

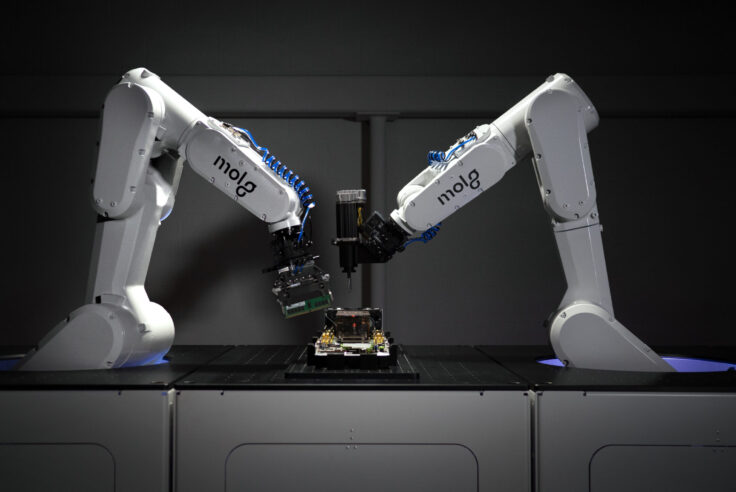

Making Circularity Stick: Electronics

A conversation with Rob Lawson-Shanks, CEO of Molg...

Press Release

Closed Loop Partners Doubles Down on Investment in...

Closed Loop Ventures Group joins Earthodic's $4 million...

Blog Post

Why We Invested in Neutreeno: Engineering Circular...

Neutreeno offers a game-changing solution that seamlessly...

Press Release

Molg Raises $5.5 Million in Seed Funding to Tackle...

Closed Loop Partners' Ventures Group leads seed funding...

Blog Post

Why We Invested in Aerflo: Making Reuse an Everyday...

Closed Loop Ventures Group is thrilled to announce...

Blog Post

Why We Invested in Capra Biosciences: How Microbes...

Today, we are witness to a rapidly changing manufacturing...

Blog Post

Why We Invested in VALIS Insights: Bringing Circularity...

Closed Loop Partners invested in VALIS Insights because...

Blog Post

Why We Invested in Found Energy: The Importance of...

Closed Loop Ventures Group invests in Found Energy,...