PepsiCo Beverages North America Invests $35 Million to Help Close Gap In Recycling Access through investment in Closed Loop Local Recycling Fund

January 20, 2022

PepsiCo’s investment creates an innovative community-based recycling infrastructure model that aims to reduce waste, increase circularity, and increase availability of recycled plastic to support company’s sustainable packaging goals

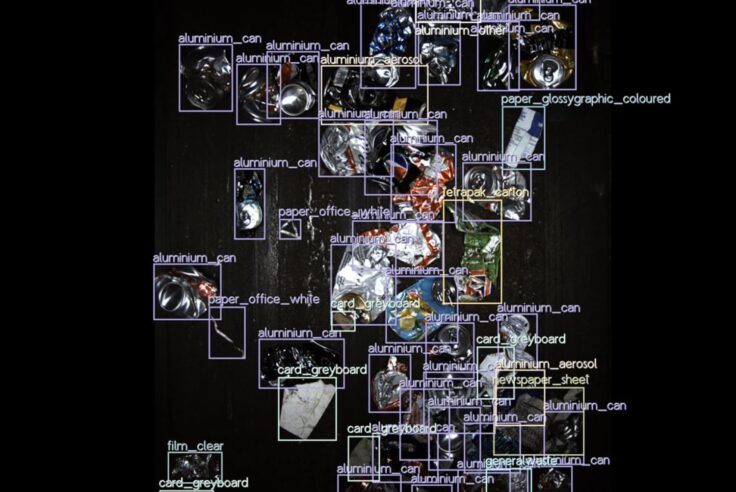

Image: Example of small scale materials recovery facility: Revolution Recycling at Twin, Steamboat Springs, CO

PURCHASE, N.Y., January 20, 2022 – PepsiCo Beverages North America (PBNA) announced today a $35 million investment with Closed Loop Partners that will create the “Closed Loop Local Recycling Fund,” an innovative circular economy initiative to advance new small-scale, modular recycling systems in communities across the U.S. The fund aims to increase recycling in areas with no or limited access to recycling, reducing waste and unlocking a new supply of recycled plastic (rPET), among other valuable materials, to support PepsiCo’s pep+ (PepsiCo Positive) sustainable packaging goals.

“As companies – including PepsiCo – set ambitious goals to use more recycled content in their packaging, there is more need than ever for partnerships and investments to increase recycling in the U.S. We need to develop the infrastructure that makes recycling available to more Americans so we can recover the high-quality material that can be used in our packaging,” said Jason Blake, Chief Sustainability Officer and SVP at PepsiCo Beverages North America. “Through pep+, our end-to-end strategic transformation, sustainability is at the heart of everything we do. As the exclusive investor in the Closed Loop Local Recycling Fund, we are actively driving the changes needed to transform the US recycling system and move towards a circular economy.”

Closed Loop Partners will use the investment to deploy small-scale modular Materials Recovery Facilities (MRFs) in underserved communities that currently lack access to larger municipal MRFs. This gap in access is typically due to a lack of funding or geographic proximity to facilities that process the materials. The smaller, local MRFs lay the groundwork for the future of recycling, introducing a new way to meet and adapt to the various needs of communities across the U.S. These modular recycling systems are smaller and less capital intensive than traditional large-scale recycling facilities, reducing the need for the costly transportation of recycled materials to larger MRFs outside of the area. The small-scale MRFs will help recapture valuable recyclables––paper, plastic, glass, and metals––reducing waste sent to landfill and unlocking a new supply of recycled materials. Each individual system creates the capacity to recycle at least 8,000 tons per year of materials, including keeping 400 tons of rPET in circulation every year. They are also expected to yield higher quality plastic while also reducing the costs and greenhouse gas emissions associated with the longer distance transportation of the materials.

This investment reinforces PepsiCo’s desire to create a world where packaging never becomes waste and to increase recycling rates in the United States. It aims to support PepsiCo’s goal to cut virgin plastic from non-renewable sources across our food and beverage portfolios by 50% by 2030.

“This first-of-a-kind investment from PepsiCo ushers in a new future for local recycling, empowering communities across rural America and small cities to reduce waste and harness the value of their recycled commodities,” says Ron Gonen, Founder & CEO of Closed Loop Partners. “By closing the loop on these commodities, which can then re-enter local manufacturing supply chains, we are better equipping communities with the tools needed for resilience against a globally changing climate, while also creating new revenue opportunities and jobs. We look forward to continuing our long-standing partnership with PepsiCo to build and strengthen circular supply chains.”

This announcement comes on the heels of a $15 million PBNA investment in Closed Loop Partners’ Leadership Fund, a private equity fund that seeks to acquire and grow companies, including those in the packaging value chain, to strengthen recycling infrastructure and build circular supply chains that keep materials out of landfills. These investments are part of a long history of PepsiCo partnering with Closed Loop Partners to make strides on material recovery and infrastructure advancements:

- In 2021, PepsiCo became a founding partner of Closed Loop Partners’ Composting Consortium, managed by their Center for the Circular Economy. The Consortium brings together leading voices in the composting ecosystem in the United States to identify the best path forward and pilot industry-wide solutions to increase the recovery of compostable food packaging and drive toward circular outcomes.

- In 2014, PepsiCo became a founding member of the Closed Loop Infrastructure Fund, which has provided investments that cities, counties, and businesses in the U.S. use to take the steps necessary to move recycling to the next level, including new trucks for pick-up/hauling and cutting-edge technology to make materials recovery facilities work more efficiently.

- Through American Beverage’s Every Bottle Back Initiative, PepsiCo is an investor in Closed Loop Partners’ Beverage Fund, which seeks to improve the collection of the industry’s valuable plastic bottles so they can be made into new bottles using rPET. This fund partners with other beverage companies, as well as nonprofits and NGOs like The Recycling Partnership and WWF to reduce their plastic footprints, improve recycling access, provide education to residents, and modernize recycling infrastructure in communities across the country.

As the Closed Loop Local Recycling Fund begins investing in community recycling, municipalities across the U.S., as well as local haulers, can reach out to Closed Loop Partners if they are interested in exploring a small-scale, modular MRF in their community.

About PepsiCo

PepsiCo products are enjoyed by consumers more than one billion times a day in more than 200 countries and territories around the world. PepsiCo generated more than $70 billion in net revenue in 2020, driven by a complementary food and beverage portfolio that includes Frito-Lay, Gatorade, Pepsi-Cola, Quaker, Tropicana, and SodaStream. PepsiCo’s product portfolio includes a wide range of enjoyable foods and beverages, including 23 brands that generate more than $1 billion each in estimated annual retail sales.

Guiding PepsiCo is our vision to Be the Global Leader in Convenient Foods and Beverages by Winning with Purpose. “Winning with Purpose” reflects our ambition to win sustainably in the marketplace and embed purpose into all aspects of our business strategy and brands. For more information, visit pepsico.com.

About the Closed Loop Local Recycling Fund at Closed Loop Partners

The Closed Loop Local Recycling Fund is a circular economy initiative managed by Closed Loop Partners and funded by PepsiCo, aiming to finance and deploy small-scale, modular Materials Recovery Facilities (MRFs) to increase recycling in communities with no or limited access to recycling, reduce waste and unlock a new supply of recycled plastic. Closed Loop Partners is a New York-based investment firm comprised of venture capital, growth equity, private equity, project-based finance and an innovation center focused on building the circular economy. The firm’s business verticals build upon one another, bridging gaps and fostering synergies to scale the circular economy.

To learn about the Closed Loop Local Recycling Fund, visit Closed Loop Partners’ website.

PepsiCo Cautionary Statement

This release contains statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identified through the inclusion of words such as “aim,” “anticipate,” “believe,” “drive,” “estimate,” “expect,” “goal,” “intend,” “may,” “plan,” “project,” “strategy,” “target” and “will” or similar statements or variations of such terms and other similar expressions. Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from those predicted in such statements, including future demand for PepsiCo’s products; damage to PepsiCo’s reputation or brand image; political or social conditions in the markets where PepsiCo’s products are made, manufactured, distributed or sold; climate change or measures to address climate change; changes in laws and regulations related to the use or disposal of plastics or other packaging of PepsiCo’s products; failure to comply with applicable laws and regulations; and potential liabilities and costs from litigation, claims, legal or regulatory proceedings, inquiries or investigations. For additional information on these and other factors that could cause PepsiCo’s actual results to materially differ from those set forth herein, please see PepsiCo’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made. PepsiCo undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Related posts

Blog Post

Materials Matter: Designing Reuse for the Real World

One of the most important design decisions for reuse...

Press Release

Closed Loop Partners Adds New Private Equity Managing...

Daniel Phan joins the circular economy-focused firm...

Blog Post

The Hidden Value of Scrap Metal: Why Local Recovery...

VALIS discusses circularity of metal processing, and...

Press Release

Closed Loop Partners’ Composting Consortium Launches...

The grant program for composters and communities comes...

Blog Post

How AI Can Reduce Food Waste at Restaurants

Closed Loop Ventures Group led the seed investment...

Press Release

New Data Reveals High Quantities of Food-Grade Polypropylene...

Closed Loop Partners’ Center for the Circular Economy...

Press Release

Closed Loop Partners and U.S. Plastics Pact Identify...

Packaging types primed for reuse lay the groundwork...

Blog Post

Why We Invested in Mycocycle: Nature-Inspired Circular...

Closed Loop Partners’ Ventures Group saw a key opportunity...

Press Release

Groundbreaking Results From Citywide Petaluma Reuse...

The Petaluma Reusable Cup Project from the NextGen...

Press Release

Closed Loop Partners’ Portfolio Company, Sage Sustainable...

The bolt-on acquisition scales Sage’s end-to-end...

Press Release

Closed Loop Partners Unveils Groundbreaking Findings...

Closed Loop Partners’ Center for the Circular Economy...

Press Release

Capricorn Investment Group Backs Closed Loop Partners...

The partnership signals tailwinds behind the circular...