SOLARCYCLE Raises $6.6 Million Seed Round to Rapidly Accelerate Buildout of Advanced Recycling Platform for the Solar Industry

June 01, 2022

OAKLAND, CA, JUNE 1, 2022 – SOLARCYCLE, a tech-driven solar system recycling platform, today announced that the company has raised $6.6 million in growth funding from leading renewable energy and circular economy investors – including SolarCity founders Peter and Lyndon Rive, former CEO/CTO of Sunpower Corporation Systems Tom Dinwoodie, Urban Innovation Fund, and Closed Loop Partners.

“At SOLARCYCLE we are driven by the urgent challenge to maximize the sustainability of the raw minerals needed to power the clean energy revolution,” said SOLARCYCLE CEO Suvi Sharma. “It is exciting to have the financial backing of investors who helped launch and scale the solar industry, as well as venture funds specializing in creating the needed infrastructure for the circular economy. This funding will allow us to scale our advanced recycling operations in North America, enabling us to start handling the millions of solar systems that will be retiring in the coming years.”

“Solar energy is the fastest-growing energy source in the U.S.,” said Julie Lein of Urban Innovation Fund. “But with more solar panels comes more waste. SOLARCYCLE has an exciting vision to transform the way we recycle and re-use solar panels – and they have the right team to pull it off. The Urban Innovation Fund is thrilled to back SOLARCYCLE.”

“Increasing amounts of solar panels are being replaced with newer versions. The older panels have high value metals like silver, aluminum, and high-grade silicon,” said Peter Rive, Co-founder and CTO of SolarCity. “I invested because SOLARCYCLE has a recycling system that could enable high volume, cost-effective recycling of solar panels at scale.”

“I was involved with commissioning the first wave of large and utility-scale solar installations, and I am excited to be involved with SOLARCYCLE,” stated Tom Dinwoodie, co-founder of Sunpower. “I firmly believe the transition to a renewable economy must be coupled with full attention to developing a circular economy for addressing the mineral scarcity and looming waste problem coming our way. The team at SOLARCYCLE is well positioned to turn this emerging problem into an opportunity, and I welcome them bringing their technical insight and innovation to address the recycling needs of the industry. I am confident that their success will ensure a better world for us all.”

“We are thrilled to invest in the visionary and accomplished team at SOLARCYCLE as they help build out circular economy infrastructure for the solar industry,” said Danielle Joseph of Closed Loop Partners. “As the demand for solar energy grows with an increasingly urgent climate crisis, it is critical that materials used for solar panels do not go to waste in landfills. SOLARCYCLE has the technology, operational experience and mission-driven passion to help address this emerging and pivotally important challenge at scale. We look forward to seeing them advance their climate-friendly and cost-effective platform to return more than 95% of all the valuable materials back into the solar supply chain.”

About SOLARCYCLE

SOLARCYCLE, Inc (www.SOLARCYCLE.us) is a technology-driven platform designed to maximize solar sustainability by offering solar asset owners a low-cost, eco-friendly, comprehensive process for recycling retiring solar panels and technologies and repurposing them for new uses. The company’s proprietary technology allows it to extract valuable metals such as silver, silicon, copper and aluminum and to recycle or repurpose 95% of panels currently in use. SOLARCYCLE was founded in 2022 by experts in solar technology, recycling and sustainability to accelerate build-out of the circular economy for solar and renewables.

Contact: Susan DeVico ([email protected] | +1 415 235-8758)

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Related posts

Blog Post

The Hidden Value of Scrap Metal: Why Local Recovery...

VALIS discusses circularity of metal processing, and...

Blog Post

How AI Can Reduce Food Waste at Restaurants

Closed Loop Ventures Group led the seed investment...

Blog Post

Why We Invested in Mycocycle: Nature-Inspired Circular...

Closed Loop Partners’ Ventures Group saw a key opportunity...

Press Release

Closed Loop Partners Leads $4M Seed Round for LAIIER,...

Investment in the innovative liquid leak detection...

Blog Post

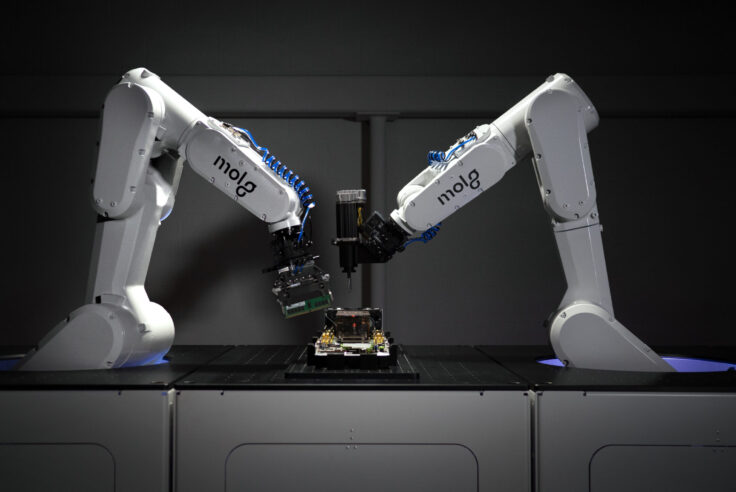

Making Circularity Stick: Electronics

A conversation with Rob Lawson-Shanks, CEO of Molg...

Press Release

Closed Loop Partners Doubles Down on Investment in...

Closed Loop Ventures Group joins Earthodic's $4 million...

Blog Post

Why We Invested in Neutreeno: Engineering Circular...

Neutreeno offers a game-changing solution that seamlessly...

Press Release

Molg Raises $5.5 Million in Seed Funding to Tackle...

Closed Loop Partners' Ventures Group leads seed funding...

Blog Post

How the Apparel Industry Is Challenging Us to Think...

The high cost of textile waste has sparked the need...

Blog Post

Why We Invested in Aerflo: Making Reuse an Everyday...

Closed Loop Ventures Group is thrilled to announce...

Blog Post

Why We Invested in Capra Biosciences: How Microbes...

Today, we are witness to a rapidly changing manufacturing...

Blog Post

Why We Invested in VALIS Insights: Bringing Circularity...

Closed Loop Partners invested in VALIS Insights because...