Climate

Why Water Needs To Be Part of Circular Economy Investments

October 13, 2022

Amidst a climate crisis and high wastewater treatment costs, water reuse technologies are key to keeping one of the most valuable commodities in circulation

The circular economy is the most significant restructuring of global commerce and supply chains since the industrial revolution. The goal? To produce, consume and manage resources so that valuable materials do not go to waste, and damage communities and ecosystems. Since its founding, Closed Loop Partners has made progress to reach this goal across plastics & packaging, organics, textiles and electronics. However, driven by a range of compounding factors, we are at a point where we need to go deeper, and expand this list of materials to include one that is arguably one of the most valuable: water.

Water is fundamental not only in terms of consumption––human beings cannot survive more than three days without drinking water––but clean water is also essential to production. Most of the groundwater we pump is used by farmers to irrigate agricultural land and industries to manufacture the goods we consume. But with the rates of production and consumption fueling today’s linear economy, wastewater treatment is more important than ever. Groundwater is pumped out of aquifers faster than it can be naturally replenished. Increasing frequency and severity of extreme weather events also mean that long periods of drought are exacerbating already diminishing amounts of water, while periods of excessive rainfall are overwhelming the absorption capacity of soil and water treatment infrastructure, causing overflows in sewage and stormwater systems and massive amounts of consequent damage to ecosystems and infrastructure.

Insufficient supplies of water could reduce production capacity for businesses by 44%, disrupting the availability of essential resources like energy, clothing and food and resulting in millions of dollars’ worth of stranded assets. Earlier this year, droughts in Mexico drove a shortage of chili peppers, threatening the production of Sriracha around the world. Sriracha could just be the tip of the iceberg. Droughts are also exacerbating shortages of staple crops like cotton, wheat and corn, which could drive price increases. On the other hand, increasingly frequent deluges of water threaten the systems our societies run on. For example, the recent floods in Pakistan have already resulted in damages reportedly worth over US$10 billion, affecting millions of people and breaking and overwhelming key infrastructure. Overall, according to a CDP report, 69% of publicly listed companies around the world stated that they are exposed to water risks that could generate a substantive change in their business, with the potential value at risk topping out at US$225 billion.

Consumption patterns coupled with climate change are stressing our water sources and systems, threatening the continuity of those very consumption patterns. Amidst this, the diamond-water paradox is glaring––the availability of water directly affects the longevity and quality of our life yet has been one of the most mispriced assets. While water’s historical undervaluation has made investing in it notoriously difficult, we are now seeing market signals that water pricing and value are changing, and this is creating an opportunity for investors.

A sea change in water investing

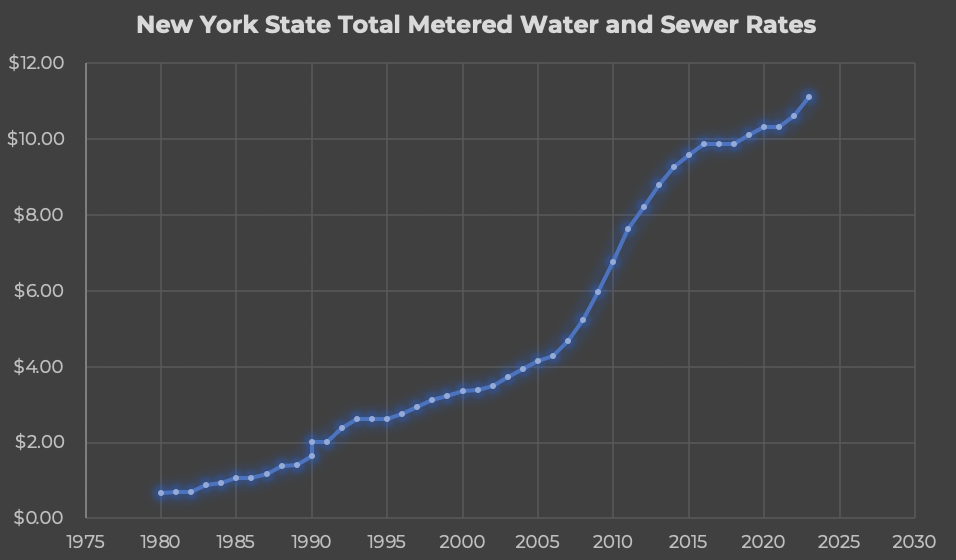

Wastewater treatment has largely improved over the years, driving up water-associated costs in much of the U.S. and Europe. In New York, alone, the price of water and sewer have both increased nearly 5% YoY, and increased over 26% over the last 10 years (over 2x the rate of inflation).

Source: New York City Water Board Rate History Data

The cost to transport heavy wastewater to water treatment facilities, and then transport the leftover sludge to landfill, ensures that operational costs stay high. Sending wastewater sludge to landfills also opens up new environmental and social risks––unleashing a slew of hormones and chemicals from agricultural and industrial waste into the soil. More capacity is needed at treatment plants, but building new water infrastructure requires significant costs: land, new pipes and labor. As it stands, it is more expensive for customers to get rid of water than to buy it. In fact, for anyone hooked up to a municipal water treatment plant, that is often the case. Water disposal in New York City is 159% more expensive than supply (and has been for the last 30 years).

Despite rising costs to treat water, businesses are faced with numerous pressures to keep used water in circulation. Growing policy––including the EPA’s new regulation that holds polluters accountable for cleaning up PFAS contamination, as well as a new plan that reduces water releases from Lake Powell––is raising accountability standards. Industry collaborations––such as Ceres’ Valuing Water Finance Initiative (VWFI), which engages 72 companies with a high water footprint to value and act on water as a financial risk and drive the necessary large-scale change to better protect water systems, and the UN Water Resilience Coalition, a CEO-led initiative committed to reducing water stress by 2050––are driving broader market attention. Water-related public health crises around the U.S.––in Jackson, Las Vegas, Baltimore, Flint and New York––are pushing additional attention onto expanding potable water sources and addressing outdated water infrastructure. With all these forces at play for industries that output water, investing in water management can reduce waste management costs, and provide a consistent and reliable water input stream. If companies can recycle water back into the system and reuse it as an input, they can reduce costs and relieve municipalities of capacity challenges.

A groundswell of new innovations

Across the board, alternative water sources are increasingly interesting––and importantly, increasingly viable from an investment perspective. This includes on-site generation of water, such as SOURCE Water’s technology to produce potable water from sunlight and surrounding air. This also includes on-site filtration technologies that could create potable, grey or functional water, depending on the end user.

Most recently, Closed Loop Partners’ Ventures Group invested in Accelerated Filtration, a water filtration company based in Midland, Michigan that develops industrial water filtration technologies. The company’s technology helps address the pain point of industrial customers, delivering packaged turn-key filtration solutions for the consistent removal of fine suspended solids in variable water streams.

As investable opportunities in the water space continue to grow, Closed Loop Partners’ Ventures Group continues to watch investment opportunities in water filtration technologies that could provide a strong return on investment to commercial and industrial customers, and allow for water reuse. As water becomes increasingly scarce and increasingly valuable, we look forward to seeing the evolution of the space, and championing the integration of water as one of the most important materials to keep within a circular economy.

Interested in learning more about work to keep key materials in circulation? Visit Closed Loop Partners’ website here.