How Closed Loop Partners’ Multi-Million Dollar Investment in LRS Is Expanding Recycling Infrastructure and Access in Chicago

August 16, 2023

This is Closed Loop Partners’ third loan to LRS, which will support the Exchange, its newly constructed materials recovery facility, accelerating materials circularity in the third largest city in the U.S.

When Closed Loop Partners provided its first loan to LRS almost 10 years ago, the leading recycling company was already making waves to advance materials circularity in the Chicagoland area. Operating in the third largest city in the U.S., home to 2.7 million people, LRS has faced significant opportunity to recover valuable materials and expand recycling access at scale, and has been at the forefront of this work, strengthening the recycling infrastructure needed to advance the circular economy. Over the last several years, LRS made critical advancements in its growth, supported by catalytic capital from circular economy investment firm, Closed Loop Partners. Today, LRS, the largest recycling company in the Chicagoland area, has reached another pivotal moment of growth: a newly constructed materials recovery facility (MRF) in the heart of Chicago, the Exchange. Supporting the newly constructed MRF, and the innovative technology housed within it, is a multi-million dollar loan from Closed Loop Partners’ Infrastructure Group.

The Closed Loop Partners team at LRS’s ribbon cutting ceremony; photo credit: Closed Loop Partners

Pictured left to right: Jennifer Louie (CLP), Kate Krebs (CLP), Ray Hugel (CLP)

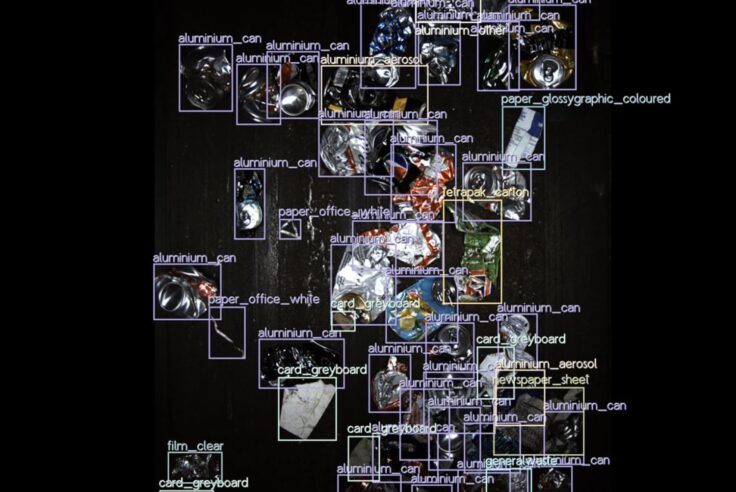

The state-of-the art MRF is now operational and expected to divert 224 million pounds of recycled material per year. It will house cutting-edge system components, including new artificial intelligence (AI)-powered equipment and other technologies to advance efficient materials sortation and recovery in the Chicagoland area. The loan is closing at a critical time, as infrastructure upgrades and innovative technologies are needed to handle an increasingly mixed stream of collected materials, including plastics & packaging, textiles and food scraps. AI and automation play an important role in improving material sortation and reducing contamination across different material streams, enabling the recovery of clean, high-quality materials. The AI-powered sortation technology to be integrated at the Exchange will enable LRS to sort polypropylene (PP) plastic for the first time in the Chicagoland area, including cold to go cups and yogurt containers. The new automated technology is also expected to mitigate labor risks at the facility, as well as add new jobs to manage the new equipment––increasing job quality and safety.

LRS Exchange Facility – LRS employees celebrate the grand opening of The Exchange materials recovery facility, which created 50 new full-time jobs in the city; photo credit: Sean Kennedy/LRS

This is Closed Loop Partners’ third loan to LRS, building on a robust track record between the two entities. The investment firm’s first and second loans to the recycling company contributed to the growth of their operations at a critical moment, helping enable them to win the collection rights of recyclable materials in three additional Chicago Blue Cart recycling zones. This new loan, provided by three catalytic funds within Closed Loop Partners’ Infrastructure Group––the Closed Loop Infrastructure Fund, Closed Loop Circular Plastics Fund and Closed Loop Beverage Fund––helps expand LRS’s capacity, as the Exchange will process recyclable material collected from all six of Chicago’s Blue Cart zones, sorting material for approximately 430,000 households, encompassing over one million people. The Exchange’s expanded capacity will also enable LRS to collect material from other areas surrounding the city, reducing landfilling and providing recycling access for more communities.

“This is a key moment of our expansion, as we extend our reach and impact across the Chicagoland area,” says John Larsen, chief operating officer, LRS. “This loan to support our new facility helps us serve even more households in the area, and sort and process more valuable materials––including polypropylene, for the first time in the region. Closed Loop Partners has been a key part of LRS’s meaningful growth over the years and we are proud to work with their team again in this work to recycle even more valuable materials and reduce waste.”

Ribbon cutting ceremony for LRS’ new $50 million materials recovery facility (MRF) in Chicago, IL; photo credit: Sean Kennedy/LRS

Pictured left to right: Emily Olsen-Torch (LRS), David Fass (Macquarie), Department of Streets and Sanitation Commissioner Cole Stallard, Rich Golf (LRS), Chief Operating Officer John Larsen (LRS), Cook County Commissioner John Daley, Executive Vice President John Silwicki (LRS)

Over the last nearly 10 years, Closed Loop Partners’ Infrastructure Group––the investment firm’s catalytic capital group––has played a key role in identifying and advancing novel technologies and infrastructure development to help private companies and municipalities keep more materials in circulation and out of landfills. Funded by many of the largest consumer goods, technology and material science companies, the catalytic strategy aims to accelerate further investment into materials circularity and drive net positive environmental and social outcomes. To date, the Closed Loop Infrastructure Group has helped keep approximately three million tons of material in circulation across 30 private loans and 15 municipal loans.

The loan to LRS is a milestone for Closed Loop Partners’ catalytic capital funds participating in the financing:

Aligned with the Closed Loop Infrastructure Fund’s goal to improve efficiencies in circular economy infrastructure, the loan to LRS will significantly expand processing capacity in the Chicagoland area;

Further aligned with the Closed Loop Circular Plastics Fund’s goal to advance the recovery and recycling of plastics, the new equipment at the Exchange will capture and separate PP from the stream, with an expected rate of 650 tons of PP collected per year;

Finally, as the Closed Loop Beverage Fund, in partnership with the American Beverage Association, aims to improve the circularity of PET, a critical plastic to the beverage industry, the loan will help reduce LRS’s residue rate in the Chicagoland area, which will enable an increase in other salable commodities annually, including PET for bottle-to-bottle applications. This investment is part of the beverage industry’s Every Bottle Back initiatve, an integrated and comprehensive partnership between America’s leading beverage companies––The Coca-Cola Company, Keurig Dr Pepper and PepsiCo––to reduce the industry’s use of new plastic. The loan is expected to unlock at minimum an additional 150 tons of PET per year.

“One of our industry’s highest priorities is to create a circular economy for our bottles and cans. We are taking action at every step to make sure they are remade as intended,” said Kevin Keane, interim president and chief executive officer of American Beverage. “Chicago is a great and innovative American city. It is exciting to partner on a significant project that will serve to enhance its beauty, environment and quality of life. America’s leading beverage companies are carefully designing our bottles to be 100% recyclable and investing in modern recycling systems to reduce our plastic footprint and keep plastic out of nature. We are excited to continue that work here in Chicago and thank everyone who made this investment a reality.”

“As the circular economy grows across North America, companies that are vital to its development require access to financing to upgrade technology and expand capacity. Closed Loop Partners’ Infrastructure Group is proud to support leading private and public organizations advancing material circularity through upgraded infrastructure and innovative technologies,” says Jennifer Louie, Managing Director of the Closed Loop Infrastructure Group at Closed Loop Partners. “LRS has been a leader in developing the infrastructure needed to accelerate materials circularity in the Chicagoland region. We are thrilled to be working with their team to advance circularity in one of the largest cities in the U.S., keeping more materials in circulation and serving more communities.”

As LRS enters its next phase of growth, Closed Loop Partners will work closely with the LRS team to integrate new technologies into the facility and bolster potential end markets for materials recycled by the facility, helping establish more robust circular systems in the region.

Learn more about Closed Loop Partners’ catalytic capital strategy here.

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

The testimonials provided are from current clients and Limited Partners of Closed Loop Partners. No compensation was provided for the statements, and the statements do not present any material conflicts of interests.

Related posts

Press Release

Beyond the Bag Initiative Releases Its Largest Study...

The Consortium to Reinvent the Retail Bag unveils insights...

Blog Post

For Reuse to Work, Language Matters

A quick guide to messaging for reuse programs and getting...

Press Release

Closed Loop Partners Adds New Private Equity Managing...

Daniel Phan joins the circular economy-focused firm...

Blog Post

The Hidden Value of Scrap Metal: Why Local Recovery...

VALIS discusses circularity of metal processing, and...

Press Release

Closed Loop Partners’ Composting Consortium Launches...

The grant program for composters and communities comes...

Blog Post

How AI Can Reduce Food Waste at Restaurants

Closed Loop Ventures Group led the seed investment...

Press Release

New Data Reveals High Quantities of Food-Grade Polypropylene...

Closed Loop Partners’ Center for the Circular Economy...

Press Release

Closed Loop Partners and U.S. Plastics Pact Identify...

Packaging types primed for reuse lay the groundwork...

Blog Post

Why We Invested in Mycocycle: Nature-Inspired Circular...

Closed Loop Partners’ Ventures Group saw a key opportunity...

Press Release

Groundbreaking Results From Citywide Petaluma Reuse...

The Petaluma Reusable Cup Project from the NextGen...

Press Release

Closed Loop Partners’ Portfolio Company, Sage Sustainable...

The bolt-on acquisition scales Sage’s end-to-end...

Press Release

Closed Loop Partners Unveils Groundbreaking Findings...

Closed Loop Partners’ Center for the Circular Economy...