Closed Loop Partners and the U.S. Plastics Pact Release First-of-Its-Kind Report on Insights from Customers Engaging with Reusable Packaging Systems in the U.S.

January 08, 2024

Key findings support the development of more effective reuse systems that meet customer needs and increase return rates of reusable packaging

NEW YORK – January 9, 2024 – Today, Closed Loop Partners’ Center for the Circular Economy (“the Center”), in collaboration with the U.S. Plastics Pact, published a first-of-its-kind report, Unpacking Customer Perspectives on Reusable Packaging, sharing new insights on customer behavior toward reuse in the U.S. The report seeks to understand customer attitudes, preferences and behaviors around reusable and refillable packaging solutions to help companies, cities and other key stakeholders navigate the current reuse landscape. To effectively address the global plastics waste challenge, we need widespread adoption of reuse systems. Understanding customer preferences is crucial for implementing successful solutions.

Since 2018, the Center for the Circular Economy has been testing diverse reusable packaging solutions in retail stores and restaurants. The Center’s Reuse Insights Lab conducts qualitative and quantitative research and data analytics through in-market testing, focus groups and customer interviews, to identify how to design and build the architecture for a reuse system that brings the circular economy to the forefront in our everyday life. In 2023, the Center’s Reuse Insights Lab collaborated with the U.S. Plastics Pact, engaging the customer bases of 16 innovators participating in the U.S. Plastics Pact’s Reuse Catalyst Program. Based on surveys, interviews and an analysis of hundreds of customers using reusable packaging across the U.S., our methodology focused on early adopter behavior. Rather than asking customers what they would do, we asked them what they already do. This allowed us to avoid the “intention-action gap” that can occur when relying solely on sentiment instead of in-market behavior.

The report shares five key insights distilled from these real-world customer experiences:

- Ongoing education and clear communication are vital to familiarize customers with reuse logistics and enable adoption on a larger scale;

- Technology can simplify reuse tracking—particularly on the backend—but too many tech hurdles on the frontend can overwhelm customers;

- Thoughtful design choices that balance utility, sustainability and appeal are key for reuse systems to achieve their intended impact;

- Choice and availability of reuse options help customers feel empowered to participate; and

- Reuse solutions that meet customers where they are rather than demanding perfection are most likely to support long-term habit formation.

As the Center works to build bridges for reuse systems, we recognize that achieving high return rates for reusable packaging is key to successful adoption. Without high returns, reuse models will struggle to achieve their intended environmental impact. However, with customers at various stages in their reuse journey, building reuse habits takes time. As brands and retailers increasingly look to reuse models as a core sustainability strategy, this timely report provides data-driven guidance on how to successfully scale reusable packaging by understanding customer perspectives and meeting customer needs.

Reuse systems are an essential part of moving away from a linear “take-make-waste” economy towards a system focused on resource circulation. However, to scale reuse sustainably and mitigate unintended consequences of low return rates, solutions must seamlessly integrate into consumer lifestyles and meet customer needs. By reporting on direct feedback from early adopter reusable packaging users, the report provides valuable intelligence on how to optimize participation by assessing real-world experiences, practical applications and perspectives. The insights aim to help both public and private institutions make reuse an accessible, everyday reality.

Kate Daly, Managing Director of Closed Loop Partners’ Center for the Circular Economy notes that, “We’ve reached a crucial moment to make reusable packaging a normal part of everyday life. The research in this report charts a course toward transforming reuse by starting from the customer’s point of view—understanding and overcoming the obstacles people face that stop them from developing a habit of reusing.”

Similarly, Emily Tipaldo, Executive Director of the U.S. Plastics Pact, underscores that, “If businesses and organizations can collaborate to deliver reusable options that truly fit into customers’ lifestyles, reuse can shift from occasional to habitual.”

In the coming year, Closed Loop Partners will release additional insights, building upon this research, as part of an ongoing initiative to accelerate the transition to scalable and durable reusable packaging systems across the U.S. By translating the report’s insights into practical solutions focused on optimizing convenience and value for customers, businesses, advocates and municipalities can propel a culture shift in which reusable packaging models can become the everyday norm.

About the Center for the Circular Economy

The Center for the Circular Economy (‘the Center’) is the innovation arm of Closed Loop Partners, a leading circular economy-focused investment firm in the U.S. The Center executes research and analytics, unites organizations to tackle complex material challenges and implement systemic change that advances the circular economy. The Center for the Circular Economy’s expertise spans circularity across the full lifecycle of materials, connecting upstream innovation to downstream recovery infrastructure and end markets.

The Center’s Circular Insights Lab conducts quantitative and qualitative research and data analytics through in-market pilots, focus groups, iterative testing and consumer interviews, identifying circular trends, challenges and opportunities across multiple sectors and themes, including reuse.

About the U.S. Plastics Pact

The U.S. Plastics Pact is a solutions-driven consortium, launched as part of the Ellen MacArthur Foundation’s global Plastics Pact network. The U.S. Plastics Pact connects diverse public-private stakeholders across the plastics value chain to rethink the way we design, use and reuse plastics, to create a path forward to realize a circular economy for plastic in the United States.

In line with the Ellen MacArthur Foundation’s vision of a circular economy for plastics, which unites more than 850+ organizations, the U.S. Plastics Pact brings together businesses, not-for-profit organizations, research institutions, government agencies and other stakeholders to work toward scalable solutions tailored to the unique needs and challenges within the U.S. landscape, through vital knowledge sharing and coordinated action.

Circular Services Acquires Midwest Fiber Recycling, Expanding Services for Communities in the U.S.

December 18, 2023

The acquisition of a leading Midwest recycling company expands Circular Services’ holistic materials management services to support more communities and companies across the U.S.

December 18, 2023, New York, NY – Circular Services, a leading developer and operator of circular economy infrastructure in the U.S., announced its acquisition of Midwest Fiber Recycling, growing the portfolio of materials recovery facilities under Circular Services’ recycling arm, Balcones Recycling. This marks Circular Services’ expansion into the Midwest of the U.S., to support existing recycling infrastructure and services in the region and increase the recovery of valuable materials into domestic supply chains.

Midwest Fiber began in 1990 when founders Ron and Linda Shumaker purchased the Decatur Recycle Paper Company. Since then, with sons Mike and Todd Shumaker, they have grown the company into one of the largest recycling operations in the Midwest, with facilities in Decatur, Normal, Urbana and Peroria, IL and Terre Haute, IN. Today, Midwest Fiber services residential single-stream and commercial properties via a dedicated collection fleet. In addition, Midwest Fiber provides document destruction and recycling services and has a recycled material brokerage arm that helps generators maximize value by marketing directly to end-users. Following the acquisition, Midwest Fiber’s management team will continue to run the company, partnering with the Circular Services team and leveraging its broader platform to continue its growth trajectory.

“Todd and I waited to find the right partner,” said Mike Shumaker, CEO of Midwest Fiber Recycling. “The singular focus of Circular Services and Balcones Recycling on advancing robust circular materials management, as well as their longstanding experience operating recycling infrastructure, made them a great fit. We look forward to working alongside their team, and leading our family business into the next chapter.”

The acquisition is taking place at a critical time as more cities across the U.S. prioritize zero-waste goals, due to the combined urgency of climate risks and increasing landfill costs. Similarly, many leading corporations in the U.S. are committing to keep more materials in circulation and incorporate more recycled content in their packaging, as part of their larger sustainability and net zero goals. According to the Circularity Gap Reporting Initiative, 70% of all global greenhouse gas (GHG) emissions are related to material handling and use, making circular economy infrastructure a critical part of the solution to the climate crisis. Expanding access to recycling and reuse services will enable cities and businesses to avoid the costs and emissions of landfilling products and packaging and achieve their sustainability goals.

Circular Services operates several companies to offer holistic circular materials management services, helping municipalities and businesses close the loop on valuable materials, including paper, metal, glass, plastics, organics, textiles and electronics. Among these companies is Balcones Recycling, Circular Services’ recycling company. Prior to this acquisiton, Balcones Recycling was already one of the largest independent recycling companies in the country, handling more than 1 million tons of recyclables each year through its operations in New York, New Jersey, Florida, Texas, Arizona and Arkansas. Following this acquisition, Balcones Recycling will operate 18 materials recovery facilities across the U.S., including five from Midwest Fiber.

“The Shumakers have built and led a great company with an excellent reputation as they served their surrounding communities for over 30 years,” said Tom Outerbridge, CEO of Balcones Recycling. “We are proud to join forces with Mike, Todd and their management team and leverage our collective expertise and growing portfolio of facilities to offer custom, effective recycling solutions to more municipalities, counties and small-to-large businesses.”

“We are excited to expand Circular Services and have Midwest Fiber Recycling be a part of our larger portfolio of infrastructure and services keeping materials in circulation—from paper, to plastic, organics, electronics, textiles and more,” said Amy Wagner, CFO & EVP of Business Development & Operations, Circular Services. “We look forward to expanding our services to the Midwest region of the U.S., and into commercial and brokerage services, providing more communities and companies with the infrastructure needed to reduce dependence on extraction and landfill, and advance a circular economy.”

About Balcones Recycling

Balcones Recycling is a Circular Services company. As a pure-play recycling company, Balcones is on a mission to recover all recyclables from the waste stream. As such, we design custom recycling programs focused on keeping resources away from landfills. We are known for building state-of-the-art facilities and fostering great partnerships with small-to-large businesses, counties and municipalities. We don’t stop at processing – we are active in key industry initiatives to increase the circularity of our materials and economy. We prioritize education and outreach initiatives to improve recycling participation. We love what we do and look forward to partnering with you to build a circular economy, one bale at a time. Learn more about Balcones Recycling at https://www.balconesrecycling.com/about/

About Circular Services

Circular Services is the operating group of Closed Loop Partners, a leading investment firm focused on advancing the circular economy. Circular Services provides holistic, circular materials management to close the loop on valuable materials for municipalities and businesses throughout the United States. Employing innovative technology within reuse, recycling, remanufacturing and re-commerce solutions, Circular Services improves regional economic and environmental outcomes by building resilient systems to keep food & organics, textiles, electronics, packaging and more, in circulation and out of landfill or the natural environment. For more information, please visit https://www.closedlooppartners.com/circular-services/

Closed Loop Partners Invests in Circular Manufacturing Company, Minus Works, Accelerating Sustainable Solutions for Cold Chain

December 06, 2023

The loan from Closed Loop Partners’ Infrastructure Group will help the company scale production of sustainable gel packs, reducing waste in the shipping of perishables

December 6, 2023, New York, NY –– Circular economy-focused investment firm Closed Loop Partners announces the closing of its loan to Minus Works, a manufacturing and technology company developing circular solutions for the cold chain. Minus Works builds products to reduce waste in the shipping of perishable products, primarily through sustainable gel packs and freezing process innovations. Financing was deployed through Closed Loop Partners’ catalytic private credit arm, the Closed Loop Infrastructure Group, to support the company’s expansion to meet growing demand for environmentally friendly alternatives to single-use plastic encased gel packs, and create a new end market for recycled paper.

Founded in 2020 and based in Farmingdale, New York, Minus Works is disrupting the cold chain with their BRiQ smarter coolant, a sustainable, high-performance gel pack and freezing process for the shipping of perishables, which aims to reduce single-use plastic waste and avoid greenhouse gas emissions in the supply chain. Made with recycled content paper, as well as a compostable gel interior, BRiQ serves as a non-toxic, circular alternative to single-use plastic wrapped gel packs. With freezing co-located at the gel manufacturing site, Minus Works also reduces required production space by 80%, and reduces costs and emissions associated with transportation.

Today’s standard gel packs are the biggest source of waste in the last mile cold chain, with the vast majority discarded into landfill, or contaminating the recycling stream. Most gel packs are made with single-use, non-curbside recyclable low-density polyethylene (LDPE), and use a petroleum derivative for the gel. Demand for less wasteful alternatives continues to increase as industries that are dependent on the cold chain––such as meal kit delivery services––continue to grow, and perishable packaging materials are expected to shift amidst upcoming Extended Producer Responsibility and “Truth in Labeling” regulations.

The Closed Loop Infrastructure Group has been providing flexible loans to projects that build out circular economy infrastructure and innovation in the United States for nearly 10 years. The loan to Minus Works builds on previous investments in circular economy infrastructure and technologies, including investments in the packaging manufacturing space, such as TemperPack, a leading developer and manufacturer of sustainable packaging materials. The Closed Loop Infrastructure Group aims to advance projects and solutions that keep valuable recyclable materials in circulation for longer, upgrade recycling infrastructure and strengthen end markets for recyclable material.

“Minus Works is accelerating circularity for an industry that has remained largely unchanged for half a century. We are excited about their growth potential, as well as the role that we expect the company to play as a new end market for recycled fiber markets, while reducing waste, emissions and fresh water use in the cold chain industry,” says Jennifer Louie, Managing Director and Head of the Closed Loop Infrastructure Group at Closed Loop Partners. “Closed Loop Partners’ Infrastructure Group is thrilled to partner with Minus Works and to have them as a portfolio company. The company’s values mirror that of other mission-aligned organizations that we have invested in who are committed to advancing innovations and infrastructure to support a circular economy.”

“We at Minus Works see immense opportunity for building new products and introducing new processes that will disrupt the resource-intensive cold chain industry and create more circular supply chains,” says Ben Shore, Founder and CEO of Minus Works. “Since our founding, we have been working on sustainable innovations and have seen demand grow across industries, from the perishable food and meal kit delivery space to life sciences. Our partnership with Closed Loop Partners is a milestone in our continued growth. We look forward to working alongside experts in the circular economy who share our vision for less waste and a positive future for the planet.”

If you are interested in applying for funding from the Closed Loop Infrastructure Group, learn more about Closed Loop Partners’ catalytic capital strategy here.

About Minus Works

Minus Works is an American manufacturing and technology company focused on bringing innovative products to the cold chain industry, including sustainable, high-performance coolant for the shipping of perishables. Learn more about Minus Works here https://minusworks.com/

About Closed Loop Partners

Closed Loop Partners is a leading investment firm advancing the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management; its innovation center, the Center for the Circular Economy; and its operating group, Circular Services. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies. Closed Loop Partners’ catalytic private credit arm, the Closed Loop Infrastructure Group, provides a flexible mix of financing solutions to support a range of circular economy projects, companies, infrastructure and enabling technologies. The Closed Loop Infrastructure Group deploys catalytic capital, which seeks to accelerate and de-risk the development of high-impact projects and companies. Areas of strategic investment include: providing below-market rate loans to finance circular infrastructure, providing catalytic financing to increase recovery of hard-to-recycle plastics and PET bottles, and financing and deploying small-scale, modular materials recovery facilities (MRFs) to increase recycling in communities with no or limited access to recycling. Closed Loop Partners is based in New York City and is a registered B Corp. closedlooppartners.com.

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Closed Loop Partners Invests Nearly $15M in Recycling Infrastructure Upgrades Across Several U.S. Municipalities

November 29, 2023

The investments financed new collection carts and recycling technologies, supporting municipalities in their goals to advance a local circular economy for materials

November 29, New York, NY — Over the last year, Closed Loop Partners provided approximately $15 million in catalytic investments to local municipalities across the country, financing projects to upgrade recycling infrastructure and services across the Midwest and Southeast regions of the U.S. Deployed by funds within the firm’s catalytic private credit arm, the Closed Loop Infrastructure Group, these investments help advance the necessary infrastructure to ensure valuable materials are collected, processed and returned to supply chains at their end-of-life.

As the circular economy grows in North America, the diverse group of stakeholders that are critical to its development, including local municipalities, often lack access to the funding needed to improve recycling services––an important step to achieve zero waste goals and advance a circular economy. The Closed Loop Infrastructure Group’s first fund was created nearly 10 years ago to support these public projects and private companies, and since then has grown with market demand, expanding to four different funds that have invested in over 45 different projects to date––from new recycling carts, to recycling facilities upgrades, to innovative recycling technologies and more––keeping over 3 million materials in circulation and avoiding over 6 million tonnes of greenhouse gas emissions. Across all their investments, the funds have collectively been able to catalyze capital inflow from other sources equivalent to three times what has been deployed, significantly amplifying the impact generated.

Alongside innovative companies advancing new recycling solutions, municipalities have played a key role in accelerating recycling infrastructure improvements across the United States. Often a case study in the success of public-private partnerships, local waste authorities have led the way toward building more robust local circular economies. The infrastructure upgrades financed by the Closed Loop Infrastructure Group have resulted in nearly $40 million in direct savings to municipalities to date, through more materials kept in circulation and out of landfills.

Building on its wide range of investments––encompassing both municipal projects and private companies advancing circular solutions from material collection, to processing and remanufacturing––Closed Loop Partners’ Infrastructure Group provided flexible financing to several municipalities over the past year:

The Central Virginia Waste Management Authority

The Central Virginia Waste Management Authority (CVWMA) is a leading public service authority with a strong track record in the recycling and waste management space, representing counties and localities in the Central Virginia (Richmond) area. Only five of the area’s eight counties participating in the Authority’s recycling program had 95-gallon curbside recycling carts, and CVWMA sought a loan from the Closed Loop Infrastructure Fund to help finance the purchase of over 90,000 95-gallon carts for the three remaining jurisdictions. In July 2023, the Closed Loop Infrastructure Fund provided a loan of over $4 million to fund the new 95-gallon carts provided by Rehrig Pacific, upgrading from 24-gallon bins and enabling a 5,000-7,000 incremental increase in tons of materials collected per year, with the potential to increase to ~8,000 tons per year. This was done in collaboration with The Recycling Partnership, who provided grant funding, technical support, as well as education and outreach for the upgraded recycling program.

The Waste Commission of Scott County

Scott County is the third largest county in Iowa, with the Waste Commission of Scott County serving over 25 counties in Iowa and Illinois and over 185,000 total households. The Commission’s relationship with Closed Loop Partners began nearly 10 years ago, when the Commission was first looking to finance upgrades to their recycling infrastructure services. The Closed Loop Infrastructure Fund provided funding to the Commission in 2015 and 2018 to finance new single-stream recycling carts and infrastructure improvements, respectively. The success of these investments resulted in a follow-on multi-million dollar loan in 2022 from the Closed Loop Infrastructure Fund, alongside the Closed Loop Beverage Fund and Closed Loop Circular Plastics Fund, to finance the purchase of new optical sorters to increase and improve the existing facility’s sorting capacity. The new loan will help grow the processing of valuable recyclable materials throughout the region, including polypropylene. When installed, the equipment upgrades will provide more than 3.5 million pounds of additional capacity and allow for the recovery of an additional 900,000 pounds of materials each year.

Kansas City

Building on long-standing commitments to support recycling efforts, the City of Kansas City, Missouri sought a loan to finance the purchase of 162,000 new curbside recycling carts to increase the City’s material collections services, impacting 380,000 residents. In 2023, the Closed Loop Infrastructure Fund and Closed Loop Beverage Fund provided a loan of over $5 million to the City, financing 162,000 65-gallon carts from Rehrig Pacific––an upgrade from the City’s 20-gallon bins. This upgrade helps enable a 2,000-3,000 incremental increase in tons of material collected per year, with the potential to increase to 10,000 incremental tons per year. This initiative to increase collection access in the City was made possible by a collaboration among private and public partners, including Closed Loop Partners, the American Beverage Association’s Every Bottle Back initiative, Missouri Beverage Association, The Recycling Partnership, Dow and Rehrig Pacific.

The need for investments into recycling infrastructure is critical, given a misalignment between the volume of materials produced––from packaging to consumer products––and the infrastructure available to recover them, process them after use and return them to manufacturing supply chains. Over the last decade, the Closed Loop Infrastructure Fund laid the groundwork to solve this challenge. Moving forward, the four funds within the Closed Loop Infrastructure Group continue to deploy capital into projects that help strengthen the infrastructure needed to recover materials at their end-of-life, and increase the volume of quality recycled material to meet a growing demand for these materials and commitments toward a waste-free world.

If you are interested in applying for funding from the Closed Loop Infrastructure Group, learn more about Closed Loop Partners’ catalytic capital strategy here.

About the Closed Loop Infrastructure Fund at Closed Loop Partners

Established in 2014 and funded by some of the world’s largest retailers, corporate foundations, technology and consumer goods companies, the Closed Loop Infrastructure Fund provides below-market rate loans to finance projects that build out circular economy infrastructure in the United States. Investors include 3M, Amazon, Coca-Cola, Colgate-Palmolive, Johnson & Johnson, BlueTriton, Keurig Dr Pepper, Procter & Gamble, PepsiCo, Danone North America, Danone Waters, Starbucks, Unilever and Walmart Foundation. Learn more about the Fund’s investment criteria and apply for funding here.

About the Closed Loop Circular Plastics Fund at Closed Loop Partners

The Closed Loop Circular Plastics Fund provides catalytic financing to build circular economy infrastructure and improve the recovery of polypropylene and polyethylene plastic in the U.S. & Canada, returning plastics to more sustainable manufacturing supply chains for use as feedstock for future products and packaging. Investors include Dow, LyondellBasell, NOVA Chemicals, Charter Next Generation, Chevron Phillips Chemical, SEE, SK geo centric Co. and SMBC. Learn more about the Fund’s investment criteria and apply for funding here.

About the Closed Loop Local Recycling Fund at Closed Loop Partners

The Closed Loop Local Recycling Fund is a circular economy initiative managed by Closed Loop Partners and funded by PepsiCo, aiming to finance and deploy small-scale, modular materials recovery facilities (MRFs) to increase recycling in communities with no or limited access to recycling, reduce waste and unlock a new supply of recycled plastic. Learn more about the Closed Loop Local Recycling Fund and apply for funding here.

About the Closed Loop Beverage Fund at Closed Loop Partners

In partnership with the American Beverage Association, the Closed Loop Beverage Fund seeks to improve the collection of the industry’s valuable plastic bottles so they can be made into new bottles through investments in recycling and circular economy infrastructure in the United States. Learn more about the Closed Loop Beverage Fund here.

What Brands Need to Know to Increase the Recovery of Compostable Packaging

November 28, 2023

Permitting for composting facilities is complex, but critical. The Composting Consortium breaks it down.

Over the last few years, demand for compostable packaging has grown quickly, as more brands explore alternatives to single-use conventional plastic. Whether in the form of a bowl, fork or a chip bag, compostable packaging is becoming more prevalent each year. At its best, compostable packaging could play an important role in reducing food and packaging waste by helping deliver food scraps within packaging to composting infrastructure, avoiding the greenhouse gases emitted if food were to end up in landfill.

But the reality is that the U.S. composting infrastructure in existence today was predominantly designed to process only yard trimmings––leaves, grass clippings and woody debris––because of a policy trend in the late 80s and early 90s that banned yard waste from landfill in dozens of states. As climate change mitigation and zero-waste goals have emerged, the composting industry is modernizing, diversifying feedstock inputs to include post-consumer food waste and certified compostable packaging. But it is only at the beginning stages of that transition.

The Composting Consortium, a multi-year collaboration across the entire compostable packaging value chain, has been studying composting infrastructure for several years. In the U.S., about 70% of the 200 full-scale composting facilities that process food waste also process some form of compostable packaging. Most of these facilities are located in urban areas. The rest of the over 2,500 composting facilities in the U.S. only process yard waste, meaning most Americans lack convenient options to compost food waste, including food-contact compostable packaging. Creating circular outcomes for compostable packaging hinges on scaling the recovery of food scraps, and brands, packaging manufacturers, industry groups, composters and investors all need to be involved.

What needs to happen so that compostable packaging doesn’t end up as waste?

Several things need to be in place for compostable packaging to operate within a truly circular, waste-free system. Consumer education, supportive policy, and clear and consistent packaging design and labeling all play important roles––and recovery infrastructure is a critical piece to the puzzle.

When envisioning a future system where composting facilities accept not just yard waste, but also food scraps, and the compostable food packaging those scraps often arrive with, the first step is to consider what must be true for facilities to upgrade from yard waste-only composting infrastructure to also recover food.

Only when more food waste is recoverable at composting facilities will it be possible to also see more recovery of food-contact compostable packaging. This infrastructure upgrade is a key steppingstone to reducing packaging waste.

Why do permitting requirements matter?

While there is opportunity to upgrade existing yard trimmings composting facilities to recover food waste––and potentially, also food-contact compostable packaging––it is often difficult to get the necessary permits to do so. In many cases, yard trimmings-only composting facilities are permitted to compost only yard trimmings. To obtain a permit to also compost food waste and make all the necessary upgrades, these facilities would need to go through a lengthy and expensive permitting process.

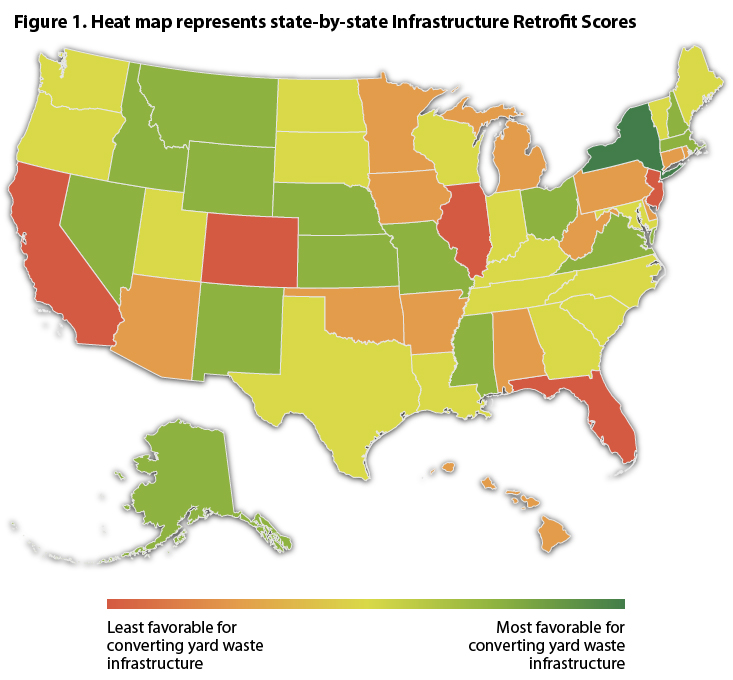

The Composting Consortium, BioCycle and Craig Croker evaluated each of the 50 states’ permitting requirements across five factors to produce a “Composting Infrastructure Retrofit Score” that measures how easy or difficult upgrading existing yard trimmings-only composting facilities would be across different states.

The final Composting Infrastructure Retrofit Score looked across five factors:

- Ease of permitting process: The difficulty of obtaining a permit to compost food waste in a particular state.

- Presence of permitting tier: Whether a state has rules for composting facilities depending on how much and what types of food waste they accept. Some states have stricter rules for facilities that accept large amounts of food waste or food waste that may be contaminated with pathogens.

- Cost to upgrade: The cost of upgrading a yard trimmings-only composting facility to process food waste.

- Time needed to upgrade: The amount of time it takes to upgrade a yard trimmings-only composting facility to process food waste.

- State food waste disposal ban: Whether a state has a ban or mandate that restricts disposal of food waste.

The findings uncovered a patchwork landscape of permitting conditions across the county as shown in BioCycle’s heatmap below. New York state stood out among the 50 states as having a comparatively straightforward process to obtain permits required for infrastructure retrofit, while most states including South Carolina, Rhode Island and California make navigating permitting requirements significantly more costly and time-intensive.

Original Source: BioCycle

In many states, permitting requirements for food waste composting are one of the major factors standing between compostable packaging and the recovery pathways needed to ensure they are a circular alternative to single-use plastic packaging.

What role do brands play in navigating permitting requirements?

CPG brands have a unique opportunity to play a leading role in scaling up a more circular system for food-contact compostable packaging in the U.S.––by investing in recovery solutions for food-contact compostable packaging, advancing consumer education, designing packaging that is compatible with food waste composting infrastructure, and advocating for policies––like extended producer responsibility––that can support the development of food waste composting infrastructure.

To advance the necessary upgrades to composting facilities, brands can be supportive of efforts of composting industry groups like the US Composting Council, who advocates for standardized state regulations for composting. Permitting requirements are a determining factor in creating more opportunities for compostable packaging circularity and navigating them requires the engagement of stakeholders across the value chain.

In 2024 and 2025, the Composting Consortium will continue to connect the dots and work with the compost industry, policymakers, and packaging manufacturers and brands to lower the barriers to scaling food-waste composting infrastructure and unlock value to all stakeholders across the composting value chain. Through this unprecedented collaborative work, the Composting Consortium aims to build a more circular composting system, one that drives values to all stakeholders.

Learn more about the work the Consortium is doing to scale circular outcomes for compostable packaging.

About the Composting Consortium

The Composting Consortium is a multi-year collaboration to pilot industry-wide solutions and build a roadmap for investment in technologies and infrastructure that enable the recovery of compostable food packaging and food scraps. The Composting Consortium is managed by Closed Loop Partners’ Center for the Circular Economy. PepsiCo and the NextGen Consortium are founding partners of the Consortium. Hill’s Pet Nutrition parent company Colgate-Palmolive, Danaher Foundation, Eastman, The Kraft Heinz Company, Mars, Incorporated, and Target Corporation joined as supporting partners, and the Biodegradable Products Institute, the US Composting Council and the U.S. Plastics Pact joined as industry partners. Our advisory partners include 5 Gyres, Foodservice Packaging Institute (FPI), Google, ReFED, Compost Research and Education Foundation (CREF), the Sustainable Packaging Coalition (SPC), TIPA, University College London (UCL), Western Michigan University (WMU), University of Wisconsin-Stevens Point, and World Wildlife Fund (WWF). Learn more about the Consortium at closedlooppartners.com/composting-consortium/

Why We Invested in Found Energy: The Importance of Circular Energy Solutions

November 27, 2023

This blog is part of our “Why We Invested” series, which offers a deep dive into our most recent investments and the growing circularity trends in the space.

At Closed Loop Partners, we focus on investing in the circular economy––advancing solutions that reduce waste through material reduction, alternative materials, reuse and end-of-life solutions like recycling. Through our work, we help reduce the 45% of all emissions derived from the way we make and use products––and where relevant to materials management, we also address the 55% of emissions that are tied to energy production.

Our most recent investment through the Closed Loop Ventures Group in Boston-based company Found Energy embodies this crossover between energy production and materials management. Found Energy upcycles contaminated aluminum into clean hydrogen fuel, while also returning the aluminum to its pre-processing state, creating a fully circular loop for the material. By treating aluminum scrap with a catalyst and then activating it with water, Found Energy creates 1) energy in the form of hydrogen and steam and 2) alumina trihydrate (ATH), a raw material used to manufacture aluminum.

The process unlocks two major benefits:

- Onsite Energy Generation: Any equipment manufacturer, processor or even materials recovery facility can produce their own on-site, clean hydrogen fuel and steam using energy dense aluminum as a means of energy storage. On-site production helps alleviate the challenge of expensive hydrogen transportation and storage.

- Upcycling: Aluminum alloys otherwise destined for downcycling may be reintroduced into the supply chain as alumina trihydrate that can then be processed into virgin-grade aluminum.

Why does aluminum recovery matter?

Aluminum is already one of the most abundantly recycled metals on the planet and can be recycled many times over. More than other classes of recyclables, there is broad consumer participation in aluminum recovery (by recycling cans), and the prevalence of aluminum as a lightweight structural element in manufactured goods (such as automobiles and appliances) means that ample end-of-life aluminum is processed every year. In fact, 75% of all aluminum ever produced is still in use today. Recycled aluminum only takes ~5% of the energy needed to make new aluminum and reduces the need to mine for bauxite––the most common ore needed for aluminum.

However, while recycling rates for aluminum are generally high, they differ substantially by product, alloy and region, ranging from as low as 20% to as high as 80% for some packaging products. We have learned that in the depths of smelters, aluminum recycling is limited to recovery within established alloy classes (meaning two or more metals or a metal with another non-metallic addition). Given that aluminum is 2x more energy dense than diesel and 5x more energy dense than methanol, there is value in finding opportunities to keep more aluminum in circulation as both a material and energy source.

The main challenge with recovering scrap aluminum is removing tramp elements, which cannot be separated easily by current smelting processes given the high melting temperature of aluminum (660° C). This means contaminated aluminum is often downcycled or ends up in landfills.

Found Energy has discovered a clean energy solution for scrap aluminum, working at the intersection of circular economy principles and the clean energy transition. After building this technology for years during his time at MIT and motivated by his work at NASA, co-founder and CEO Peter Godart brought Found Energy to life in 2022.

Unlike other energy solutions we have seen, Found Energy considered end-of-life from the very beginning of their development process, while using scrap aluminum as a wholly recoverable material source for energy generation plus storage. We fully support the transition to renewable feedstocks for clean energy, while recognizing that the structures required to facilitate clean energy transfers, like solar panels and wind turbines, often utilize extractive or single-use resources that frequently end up in landfill after they are decommissioned. We believe that it is better both economically and ecologically to keep these materials in circulation, and up until recently, had yet to find an energy technology that is inherently circular––inclusive of the materials used in the machinery and the renewable feedstock.

We were impressed with the elegance of a solution that uses a ubiquitous metal as a novel hydrogen source, is highly mobile, and can be distributed. Distributed assets will continue to be a priority in places where heavy materials would otherwise be transported long distances, or where permitting and absence of transmission infrastructure can keep manufacturing operations from scaling up their energy loads as needed.

To create a truly waste-free future for renewable energy, we must support the circularity of materials, alongside clean energy innovation. Reducing carbon through circular processes like material recovery and re-manufacturing is critical to reaching our CO2e mitigation goals and living in an ecosystem that is resilient to further climate shocks. Found Energy is helping pave the path forward.

About Closed Loop Partners

Closed Loop Partners is a leading investment firm advancing the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management; its innovation center, the Center for the Circular Economy; and its operating group, Circular Services. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies. The firm’s venture capital group, the Closed Loop Ventures Group, has been investing early-stage capital into companies developing breakthrough solutions for the circular economy since 2016. The Closed Loop Ventures Group’s portfolio includes companies developing leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy. Closed Loop Partners is based in New York City and is a registered B Corp. closedlooppartners.com.

About Found Energy

Found Energy is a Boston-based company building rechargeable aluminum fuel power systems aimed at eliminating carbon emissions from heavy industrial applications ranging from industrial heating (7% of global CO2 emissions) to maritime shipping (3% of global CO2 emissions). Building off technology developed at MIT that enables metallic aluminum to split water, our energy delivery systems safely generate hydrogen and/or industrial heat on-site at >5x the volumetric energy density of liquid hydrogen, >3x that of methanol and ammonia, and >25x that of Li-ion batteries. By integrating storage, transport, and generation into a single package, our technology solves some of the biggest pain points in renewable energy transmission and storage.

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Closed Loop Partners Acquires Majority Stake in Sage Sustainable Electronics, Accelerating IT Asset Management and Disposition Services in North America

November 02, 2023

Amidst the rapid growth of e-waste, Closed Loop Partners acquires majority stake in Midwest-based ITAD provider, Sage Sustainable Electronics, to advance electronics reuse and recovery

COLUMBUS, Ohio, Nov. 1, 2023 /PRNewswire/ — Today, circular economy-focused investment firm Closed Loop Partners joins forces with leading IT Asset Management and Disposition provider, Sage Sustainable Electronics, as a majority shareholder in the company. The investment from Closed Loop Partners’ buyout private equity fund, the Closed Loop Leadership Fund, is taking place at a critical time, amidst the rapid growth of electronic waste, increasing corporate commitments around e-waste management and rising demand for increased transparency and data security in the IT Asset Disposition (ITAD) industry. The strategic partnership aims to accelerate the growth of Sage Sustainable Electronics and strengthen its position as a leading provider of sustainable ITAD services in North America.

Since its founding in 2014 by co-founder Jill Vaské and CEO Bob Houghton, Sage Sustainable Electronics has been at the forefront of advancing a circular economy for electronics, providing reuse and recovery solutions to businesses seeking to sustainably dispose of their IT assets.

Today the company’s clients include Fortune 100 companies across various industries, including finance, healthcare and defense. With Closed Loop Partners as a majority shareholder, Sage will have access to additional resources, a deep ecosystem of companies advancing the circular economy, and expertise to further enhance its services and expand its reach.

Houghton, a leading expert in the ITAD industry said of the partnership, “we’re absolutely thrilled to join forces with Closed Loop Partners. This marks a significant step towards advancing the circular economy within the ITAD industry. First of all, they truly share our commitment to sustainability and reuse. That, of course, is always first on our list. But secondly, this partnership enables us to further expand our reach and increase our impact.”

“Sage Sustainable Electronics’ work to safely increase reuse and proper disposition in the ITAD space is critical to ensuring valuable materials, such as IT assets, do not end up wasted in landfills or the natural environment. E-waste represents a massive loss of value that we can recover through more efficient reuse and recycling,” said Karine Khatcherian, Managing Director and Co-Head of the Closed Loop Leadership Fund at Closed Loop Partners. “We are proud to partner with the Sage team and support their continued growth as one of the leading IT Asset Disposition providers in North America.”

With a differentiated focus on electronics reuse, Sage Sustainable Electronics is committed to achieving the highest possible Reusable Yield® ratio for IT Assets. Coined by Houghton, the ratio determines a company’s IT asset carbon reduction impact. On average, Sage Sustainable Electronics securely refurbishes or ethically recycles nearly one million devices per year on behalf of its clients. Extending the lifespan of electronics not only reduces waste, but addresses climate impact and helps provide access to electronics for more people.

“Reusable Yield is the percentage of everything sent to an ITAD provider that is appropriately triaged, tested, refurbished and securely sent to another user. The higher your Reusable Yield, the higher the financial, environmental and social benefit on your retired assets. It’s what we live by here at Sage,” said Houghton.

In 2022, Sage sent 58% of its total processed devices to a second life, mitigating approximately 300 million pounds of CO2e annually according to the EPA’s Electronic Environmental Benefits Calculator. This is a result of greenhouse gas emissions avoided by preventing the creation of a new device. The impact associated with manufacturing a new device is significant––in fact, approximately 80% of the environmental damage can be done by the time a brand-new device is manufactured.

“An overlooked source of climate risk is the emissions associated with creating a new product. Keeping used materials in circulation to reduce the need for new extraction and new product manufacturing is an important part of mitigating climate impact,” said Jackson Pei, Director at Closed Loop Partners’ Leadership Fund.

According to a 2022 report by McKinsey & Company, the biggest carbon culprit in the IT sector is end-user devices. In fact, the study found end user devices like laptops, smartphones and tablets generate one and a half to two times more carbon than data centers when created. This is exacerbated by the fact that these devices are replaced much more often, with an average refresh cycle by IT departments of two years for smart phones, four years for laptops and five years for printers.

Proactive and sustainability-focused CIOs can decrease their carbon footprints by ensuring their employee devices are destined for a second life. Sage Sustainable Electronics is uniquely positioned to meet this need through their distinct focus on electronics reuse. With a team of industry pioneers who recognize the financial and environmental value of making ITAD programs more sustainable, Sage’s systems ensure that IT assets are efficiently and responsibly kept in circulation.

Today, Sage Sustainable Electronics is well positioned for further growth through their partnership with Closed Loop Partners. “The mission and impact of Sage holds firm from the day we started this work. The tailwinds around e-waste recovery today are only increasing, and this is just the beginning of what is possible,” said Houghton.

About Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments. Closed Loop Capital Management manages venture capital, buyout and catalytic private credit investment strategies on behalf of global corporations, financial institutions and family offices. The Center for the Circular Economy unites competitors and partners to tackle complex material challenges and implement systemic change to advance circularity. Circular Services employs innovative technology within reuse, recycling, remanufacturing and re-commerce solutions to improve regional economic and environmental outcomes, and build resilient systems that keep food & organics, textiles, electronics, packaging and more, in circulation and out of landfill or the natural environment. Closed Loop Partners is based in New York City and is a registered B Corp. For more information, please visit www.closedlooppartners.com.

About Closed Loop Leadership Fund

The Closed Loop Leadership Fund is Closed Loop Partners’ private equity fund, which closed in 2022. The fund focuses on investing in best-in-class circular business models across plastics and packaging, food and organics, technology, textiles, built environment and the energy transition.

To learn about the Closed Loop Leadership Fund, visit Closed Loop Partners’ website.

About Sage Sustainable Electronics

Sage Sustainable Electronics, based in Columbus, Ohio also has a plant in Reno, Nevada. Founded in 2014, co-founders, Bob Houghton and Jill Vaské, are ITAD sustainability pioneers. As founders of Redemtech, their first venture, they defined best practices for the ITAD industry in security, asset management, and responsible recycling—including foundational support for the e-Stewards Certification program, the Microsoft Authorized Refurbisher program, and the Coalition for American Electronics Recycling. When they founded Sage in 2014, their combined ITAD expertise and unwavering commitment to environmental sustainability resulted in an ITAD company designed with sustainability at the forefront. Their mission is to serve the following (and in this order): the planet, customers, colleagues, communities, suppliers, and shareholders.

For interviews contact

Alaina Shearer

[email protected]

614-313-8365

SOURCE SAGE SUSTAINABLE ELECTRONICS LLC

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

New Report from the NextGen Consortium Shares Path Forward for Paper Cup Recycling in the U.S.

November 01, 2023

Insights include solutions for paper mills, materials recovery facilities, brands and communities to increase recovery of paper cups and reduce waste to landfill

Nov. 1, 2023 — Today, the NextGen Consortium, a leading industry collaboration managed by Closed Loop Partners, with partner brands including Starbucks, McDonald’s, The Coca-Cola Company, PepsiCo, JDE Peet’s, The Wendy’s Company and Yum! Brands, released a report with new findings to accelerate paper cup recycling in the U.S. The report, Closing the Loop on Cups: Collective Action to Advance the Recovery of Paper Cups in the U.S., assesses the role of each stakeholder across the paper cup recovery value chain––including paper mills, materials recovery facilities (MRFs), brands, consumers and local communities––and provides recommended actions to increase paper cup recovery opportunities and advance a more circular system.

Every day, millions of people around the world drink from paper cups. They’re safe, functional and convenient–– so much so that globally, more than 250 billion cups are produced each year. But convenience comes with environmental consequences: the majority of cups end up in landfill today. The NextGen Consortium has taken a three-pronged approach to address cup waste holistically: 1) Advancing reusable cup systems that keep materials in circulation for multiple uses, 2) Exploring material science innovation that enhances the sustainability and recoverability of cup materials, and 3) Strengthening materials recovery and recycling infrastructure that recaptures cups after use.

In this report, the NextGen Consortium focuses on the need to strengthen existing materials recovery and recycling infrastructure systems to recapture more paper cups. Recovering and recycling paper cups ensures the value embodied in paper cups—primarily comprised of fiber and a plastic liner—is recovered, rather than wasted in landfill. These cups contain high-quality fiber that is valuable to paper mills as other paper sources like newsprint and office paper decline. While the challenges for paper cup recovery and recycling are significant, collaboration among various stakeholders involved in paper cup recovery can help address its scale and complexity. The report highlights key challenges and opportunities, including:

- Today, only about 11 percent of communities accept cups in their recycling operations. This poses a significant barrier to cup recycling, as residents have few options to properly recycle their used cups.

- While only a handful of cities in the U.S. are officially accepting cups in their recycling programs, the Foodservice Packaging Institute (FPI) identified more than 30 paper mills that accept paper cups in mixed paper bales representing 75 percent of U.S. mixed paper demand, and an additional five mills accepting cups in carton bales. These mills are taking recovered paper materials, including cups, and reprocessing them into new products.

- In 2023, the NextGen Consortium, in collaboration with FPI and Moore & Associates, identified more than 15 additional mills across North America that are interested in testing cup acceptance or that can process cups today. This new interest is a tremendous endorsement for the work that is taking place and can catalyze cup acceptance at MRFs and in new communities in the months and years ahead.

- Each stakeholder in the value chain has an important role to play in improving paper cup recycling. The report outlines key calls to action, including calling on:

- Mills to conduct recycling tests on paper cups to determine if the fiber can be captured without any negative operational impacts at their facilities;

- MRFs to conduct material flow studies to determine where best to site interventions for cup sortation and to collaborate with mills and communities to expand acceptable recycling lists as more mills accept cups;

- Communities to engage with MRFs and mills to evaluate feasibility of adding cups to accepted recyclables list;

- Consumers to bring their own reusable cups when they can and to check local recyclability options and guidance when using disposable cups;

- Brands to source recycled paper content when procuring their cups and other packaging, among other activities.

“The waste generated from to-go paper cups has become a highly visible representation of our disposable, take-make-waste culture. However, these cups also are a valuable resource with growing opportunities for recovery,” says Kate Daly, Managing Director and Head of the Center for the Circular Economy at Closed Loop Partners. “We know that collaboration across stakeholders––from mills and MRFs to brands and cities––is going to be critical to solving this challenge and ensuring paper cups don’t end up in landfill or polluting our environment. The NextGen Consortium plays a key role in advancing the innovation, testing and partnerships needed to make this possible.”

Since its founding in 2018, the NextGen Consortium has taken a holistic and collaborative approach to addressing the challenge of single-use cup waste, advancing reuse models, exploring material science innovations and strengthening materials recovery and recycling infrastructure that recaptures cups after use. While material reduction and reuse are key pathways to reduce reliance on virgin resource extraction, end-of-life recovery pathways are equally critical to ensure that the value embodied in all types of cups, including single-use paper cups, is recovered, rather than wasted in landfill.

As the NextGen Consortium works toward its goal of eliminating foodservice packaging waste, it will continue to work to improve and align recovery and recycling infrastructure across the entire value chain, from collection and sortation to processing and strengthening end markets. Collaborative action, data-driven decision-making and iterative testing continue to be critical to closing the loop on a greater diversity and volume of valuable resources and avoiding unintended consequences. The learnings from this report aim to guide the industry towards a future in which reusing valuable materials in products becomes the commonsense norm, shaping a more circular economy.

About the NextGen Consortium

The NextGen Consortium is a multi-year consortium that addresses single-use foodservice packaging waste globally by advancing the design, commercialization and recovery of foodservice packaging alternatives. The NextGen Consortium is managed by Closed Loop Partners’ Center for the Circular Economy. Starbucks and McDonald’s are the founding partners of the Consortium, with The Coca-Cola Company and PepsiCo as sector lead partners. JDE Peet’s, The Wendy’s Company and Yum! Brands are supporting partners. The World Wildlife Fund (WWF) is the environmental advisory partner. Learn more at www.nextgenconsortium.com.

About the Center for the Circular Economy at Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: Closed Loop Capital Management, the Center for the Circular Economy and Circular Services. In 2018, Closed Loop Partners launched its innovation center, the Center for the Circular Economy, which unites competitors to tackle complex material challenges and to implement systemic change that advances the circular economy. Closed Loop Partners brings together designers, manufacturers, recovery systems operators, trade organizations, municipalities, policymakers and NGOs to create, invest in and support scalable innovations that target big system problems. Learn more about the Center’s work here.

Reuse

Debunking Durability: How Durable Does Reusable Packaging Need to Be?

October 24, 2023

When reuse started regaining popularity in the United States, it was hard to imagine how any version of reuse could be worse for the environment than single-use equivalents. Today, there’s growing awareness of potential unintended consequences of reuse if return rates, and associated packaging use cycles, are not high enough to justify the added durability (and material) that comes with reusable packaging.

With the newest wave of reuse policy discussions and renewed efforts to integrate reuse models into reduction requirements of Extended Producer Responsibility (EPR) bills, there is growing confusion on what defines a “good” reuse system. Although many metrics are cited, use cycles or return rates paint the most robust picture of how well a reuse system is operating in practice. As we build the reuse systems of tomorrow, a universal understanding of such metrics is essential. So, what is a high enough return rate?

The reality of today’s reuse rates

Across different sources, the number of reuses required to offset the added durability and materials needed for reusable packaging (also known as the breakeven point) is said to range from about five to 800 uses. But in today’s reality, reusable packaging is often reused less than five times, based on the results of past and ongoing open-system reuse pilots. For containers to have five uses on average in their lifetime, return rates need to be 80%. For a 90% return rate––which we have yet to see in open systems at scale––containers are used only 10 times on average.

Achieving five to 10 uses is still a dream state for most open-environment reuse systems, yet we see packaging designers choosing and testing packaging materials to withstand dozens, and sometimes hundreds, of uses. Brands and manufacturers designing reusable containers are often reacting to regulations that set up unreasonably high use targets for open-system models. CalRecycle suggests washable as something that lasts 780 cycles. The Choose2Reuse drafted regulation cited a requirement of about 1,000 cycles. These types of requirements force the industry to design packaging for aspirational return rates, making breakeven points even higher.

Why designing for current state matters

To mitigate the environmental impact of reuse, reusable packaging needs to be designed for current return rates. Otherwise, you limit the environmental benefits by potentially generating a higher volume of materials, that are less likely to be recovered.

Additionally, durability will naturally be a function of usage environment; reusables must be appropriately designed for their expected use case. Items made for more closed environments, such as dine-in at a restaurant or for a drink at a venue, may have higher use cycles than open environments, such as takeaway or delivery.

The bottom line: as we transition toward more widespread reuse, we need to design with actual return rates and uses cases in mind. We must also ensure that containers that are not returned for reuse are recycled at their end-of-life (learn more about designing for end-of-life here).

While we work towards building the convenience and incentives needed to increase return rates, we must ask: what’s the least amount of material that we can put in a returnable packaging solution today to make it durable enough to survive five to 10 uses? Will it look sufficiently like a durable reusable to signal returnability? And ultimately, how many cycles does a container need to survive to beat its single-use equivalent? For open reuse systems today, when the answer is less than five or so cycles, the packaging design is going in the right direction.

Reusable packaging is at an important inflection point. New innovations are expanding what is possible, but to ensure that reuse does not generate unintended environmental consequences, reusable packaging needs to be thoughtfully designed with today’s reality in mind. Designing reusable packaging with current return rates, use cases and eventual end-of-life in mind are all critical steps to building a reuse system that truly advances a circular economy and a waste-free future.

Reuse

When Reusable Cups Reach End-of-Life: 5 Tips to Ensure They Don’t Go to Waste

October 18, 2023

We know reuse plays a critical part in reducing foodservice packaging waste. And we’ve seen progress and innovation across all types of packaging and foodservice venues, whether cup share programs, reuse at concerts and events, or even for food delivery services. However, for reuse models to be successful and impactful, they need to check a lot of boxes––they have to fit the lifestyle of customers and align with the reality of retail operations to ensure reusable packaging is sufficiently reused. They also have to be recyclable so that they don’t become waste when they end up somewhere other than the return bin at any point in their lifecycle. Whether a reuse program has a 95 percent (terrific!), 75 percent (needs improvement) or 25 percent (look out!) return rate, designing for recyclability is key, especially as more reusable packaging enters the ecosystem. Appropriate end-of-life management is necessary to maximize the intended environmental benefit that reusable products offer.

Since 2018, the NextGen Consortium has been leading efforts to identify the role reuse can play in addressing foodservice packaging waste, alongside material innovation and recovery [see: Bringing Reusable Packaging Systems to Life: Lessons Learned from Scaling Reusable Cups]. In addition to examining the realities of consumer behavior and retail operations when deploying reuse systems, one critical question we recently investigated is: what happens when a reusable cup ends up in the recycling system?

Reusable foodservice packaging is often designed for durability––both in how long it can be reused and how many times it can be washed––but not always for recyclability. As a result, when reusable cups are decommissioned, or end up anywhere but the reuse bin, they inevitably end up in our waste streams. From NextGen’s consumer research, we know that unless disposal options are convenient, these cups will likely end up as waste. Designing reusable packaging for both consistent reuse and eventual recyclability will help increase recovery opportunities and reduce waste to landfill and the environment.

How do we ensure reusable cups do not become waste when they can no longer be reused or end up in a recycling bin rather than a reuse bin?

Testing is key. There are excellent design guidelines, such as APR’s design for recyclability guidelines, to help suppliers ensure their packaging meets the stated needs of the recycling system today. But reusable cups also need to be tested within the recycling process to see if they can be successfully recovered. There are three critical stages of the recycling process:

- Collection: how recyclable materials are collected in residential or commercial waste streams

- Sortation: how a package will flow at a material recycling facility (MRF)

- Reprocessing: how a package aligns with similar materials to be processed and remanufactured into new materials

In early 2023, the NextGen Consortium collaborated with Van Dyk Technology Center to test how a dozen different reusable polypropylene (PP) cups would sort within a MRF and see if they would end up in the correct material bale, in this case PP.

The test mimicked the flow of a typical MRF, followed APR’s sorting guidance and tested how size, compression, 2D and 3D sortation, and near infrared (NIR) sortation impact how well a cup can be sorted. The results were mixed and provide critical design insights for the companies who are manufacturing and deploying reusable cup formats.

The Results: the good, the bad and the unrecyclable.

When designed with recycling in mind, a reusable PP cup should successfully sort into the correct bale at a MRF. In our tests, the top four best performing cup models were sorted correctly more than 90 percent of the time. The test ran 50 samples of each cup through four separate runs so that each cup model ran through the facility 200 times. The results are no coincidence: successful sortability was driven by specific factors, including color, shape, opacity, thickness and material composition. The highest performing cups were typically opaque, thin and rigid but had some flexibility or bounce, and were all read clearly by the optical sensors of the sortation equipment. Cups that performed poorly, sorting less than 50 percent of the time (or sometimes not at all), often were more translucent than their successful counterparts. Overall, while only four of the cups achieved successful sortation (and a fifth cup was borderline), simple design corrections can improve the fate of the others.

Design Tips: Making recyclability a priority for reusable PP cups.

The Van Dyk sortation test gave a window into what happens to various types of reusable PP cups traveling through a MRF. However, this only assessed one step in the recycling process––sortation––and does not confirm compatibility with reclamation systems nor prove that the cup can be recycled effectively into a new package. Additional testing is needed to confirm assumptions that reusable PP cups are truly circular. For now, reusable foodservice packaging companies and suppliers can design with sortation in mind and improve end-of-life outcomes by considering the following:

- Follow the design guidelines created by APR and other groups: There are many resources available online to help packaging designers/suppliers ensure greater compatibility with the recycling system. For plastic packaging, the APR Design® Guide is a great place to start.

- Avoid all black plastics: While there have been technological advancements to help sort black plastics, most MRFs do not possess that technology. Both opaque and translucent black packaging is problematic and reusable cup manufacturers should design cups with today’s system in mind. If black is absolutely required, use an NIR sortable black colorant. Colorants that have passed APR testing can be found on APR’s website here.

- Not all polypropylene is equal: PP is a wide class of material. PP sorters in the recycling process are designed to detect and separate PP that is common to single-use plastic such as tubs and lids; however, other PP grades may not be as easily identified.It is critical to engage with your cup suppliers and test if needed to confirm compatibility.

- Mono materials (cups made of just one material) are best: A reusable cup that is multi-material (i.e., part plastic, part fiber, part silicone, etc.) is simply not compatible with today’s recycling system. Cups designed to be in a high-volume sharing system should be made of a singular material and avoid too many add-ons. Cups with ridges (i.e., a built-in sleeve) may also impede sortation; however, it does not appear that those design features are overly detrimental.

- Think twice before adding tech: Tracking systems are typically needed to assess the impact of a reuse system and enable traceability, but features such as Radio Frequency Identification (RFID) tags need to be evaluated further for their impact on the recycling system. While an RFID tag is unlikely to hinder a package’s sortability, it might impact whether a material can be reclaimed or recycled. APR’s guidance lists RFID tags as “detrimental,” and the NextGen team is investigating the impact this technology has on the system.

When in doubt, TEST.

Despite widely available design guidance, reusable packaging that is not compatible with today’s recycling system continues to be manufactured. The conversation needs to be more nuanced and shift from only discussing designing for durability and the number of washes a package can withstand, to the realities of how the packaging will actually be used and travel through a system. Most reusable wares in an open system would be lucky to hit 40 reuses (which would assume a >95% return rate)! Sortation and recovery testing can help provide reusable foodservice packaging companies with additional peace of mind and ensure that their packaging has a better chance of staying out of landfill.

The NextGen team looks forward to continuing this journey to study and test optimal conditions for reusable packaging to succeed and achieve a positive environmental impact within a circular economy.